- Key insight: It’s unclear how hard a downturn in the software sector would hit banks’ balance sheets, but for now, their relative dependability is buoying their stock prices.

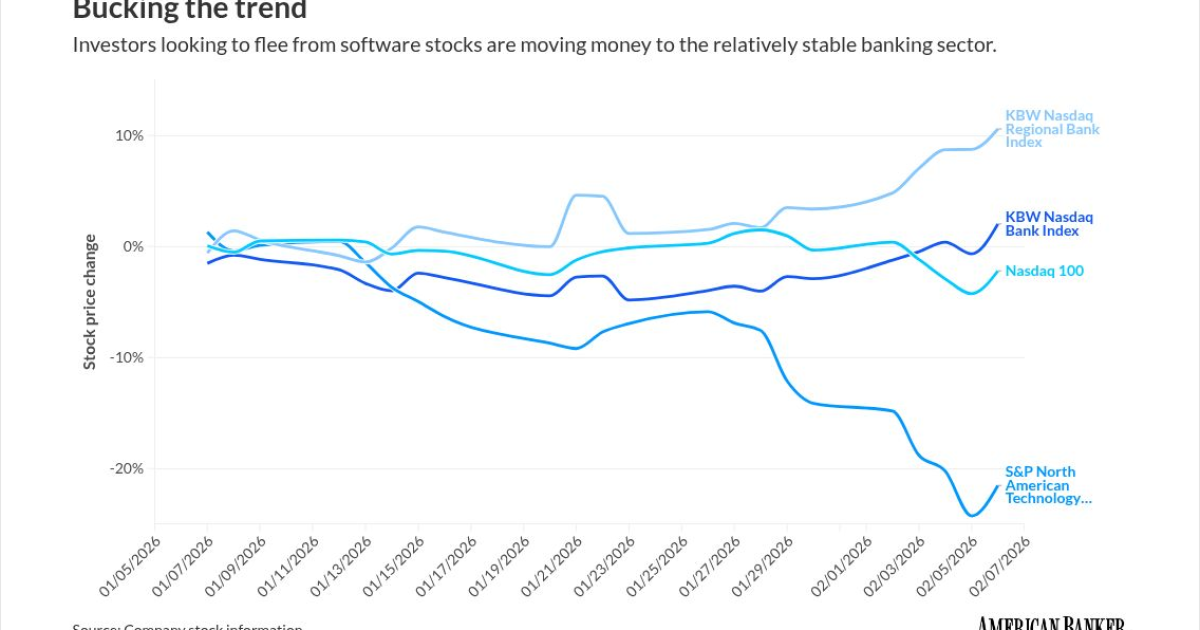

- Supporting data: Large and regional bank stocks are up over the last month, on average, while the S&P Software Index has plunged more than 20%.

- What’s at stake: Banks outperformed after the dot-com bubble burst in 2000, despite some credit losses tied to the tech sector.

Wall Street’s recent flight from software stocks has started to stir up concern about banks’ exposures to possible losses, but that isn’t stopping the banking sector from outperforming the market at large by a mile.

Investors have been worrying that recent developments in artificial intelligence could pose a threat to some technology companies. The sell-off is tied to AI developments that could make coders, if not obsolete, then fewer and further behind. If software developers go belly-up, so too could their loans.

Processing Content

But the market has so far judged banks to be a safe way to insulate from software troubles. While tech stocks have been bleeding value in recent days, traditional financial institutions have seen steady gains.

What is there to lose?

It’s difficult to gauge how big a hit banks could take if tech companies go bust en masse.

Many banks don’t break down their loan portfolios by sector. Among those that do, software exposure is just a piece of “tech,” “information services” or the “technology, media and telecom” category. Additionally, some companies that may be classified in one sector, like consumer services, could be heavily impacted by a contraction in software.

Bank of America, the only major bank that

Truist Securities analyst Brian Foran estimates that across the banking industry, tech makes up less than 3% of total loan books.

“But 3% is still big enough that if it really deepens and turns into a full cycle, it can move the needle,” Foran said.

He pointed to credit blows from

There’s also the fact that software is an asset-light sector, which could limit banks’ recoveries during a sector-wide downturn, per an analyst note from BNP Paribas.

Still, Foran said that even if software companies do start going out of business, he thinks it will be a slow-moving disruption.

The banking sector’s relatively light exposure to the tech industry is likely due, in part, to post-2008 financial crisis rules that reined in banks’ leveraged lending capabilities.

The tech sector is less averse than other industries to limited cash flow or high multiples of debt to earnings before interest, taxes, depreciation and amortization — qualities that regulators long cautioned banks to avoid. (The Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp.

That regulatory dynamic drove many tech borrowers to asset management firms, private equity firms and business development companies, or BDCs.

Analysts estimate that tech makes up between 25% and 35% of BDC loan portfolios.

Banks have some indirect exposure to software companies through their loans to BDCs, but it’s unclear how much, or how potential losses would land. Foran said he thinks that banks will likely offer more information about their software concentrations in the coming weeks.

Boring is back

Despite the lack of clarity around banks’ connection to the software sector, investors looking to escape the volatility of the market at large are funneling money into asset classes that can provide some respite — like the relatively boring banking sector.

The KBW Nasdaq Bank Index is up more than 2% over the last month, while the S&P North American Technology Software Index has plunged nearly 22% in the same period, and the Nasdaq 100 is down more than 2%. The KBW Nasdaq Regional Bank Index, which includes lenders even less likely to have direct or indirect tech exposure, is up nearly 11%.

“You took a bank that, three months ago, it’s like, ‘Why would I ever buy this? It’s boring. It’s like watching paint dry,'” Foran said. “Now, for a generalist, that’s amazing. It’s predictable. There’s no immediate disruption risk, and the multiple is not crazy.”

The result is similar to what happened during the dot-com bust of 2001 and 2002, Foran said. When many tech companies crashed following years of massive overvaluation, banks largely came out unruffled, Foran said.

Banks did see some loan hits at the time, mainly concentrated in tech. Credit card losses rose slightly, and loan growth slowed down, too. But Foran said the banking industry’s roughly 20% decline in earnings from 2000 to 2002 was temporary and manageable.

He added that the sector’s current strength is probably buoyed by an influx of new investors.

“A big part of the bank outperformance over the past month has just been money flowing out of all these other asset classes,” Foran said. “It’s got to go somewhere. And people are looking at banks, especially regional banks, and being like, ‘Well, not much has changed for them.”