AMD seems to be gaining ground on Nvidia.

The debate of AMD (AMD +0.00%) in return for Nvidia (NVDA 1.55%) hardware for tasks like gaming or PCs is one that can last forever. But the debate between Nvidia and AMD artificial intelligence (AI) processing hardware is short: Nvidia beats AMD all day long. However, that is an older idea that is starting to shift.

AMD is starting to see real momentum in its product offerings and could compete with Nvidia on a more level playing field in the near future. A shift in the landscape could make AMD a better investment than Nvidia in 2026.

So, which one do I choose for 2026? Let’s find out.

Image source: Getty Images.

AMD’s main weakness is starting to improve

From a product offering perspective, Nvidia has owned the data center space since its artificial intelligence (AI) buildout began in 2023. Nvidia’s technology stack, plus its industry-leading software, made it a natural choice to train AI models on, but AMD has improved its offering.

Thanks to a handful of acquisitions and partnerships, AMD’s ROCm software has improved and become a more competitive offering with CUDA (Nvidia’s software). At its recent Financial Analyst Day, AMD noted that ROCm downloads have increased tenfold year over year, showing that this software may be gaining popularity in the AI community.

If AMD can offer a similar level of performance to Nvidia, Nvidia may be in trouble. It’s no secret that Nvidia’s hardware is much more expensive than AMD’s, and this is reflected in the two companies’ margins.

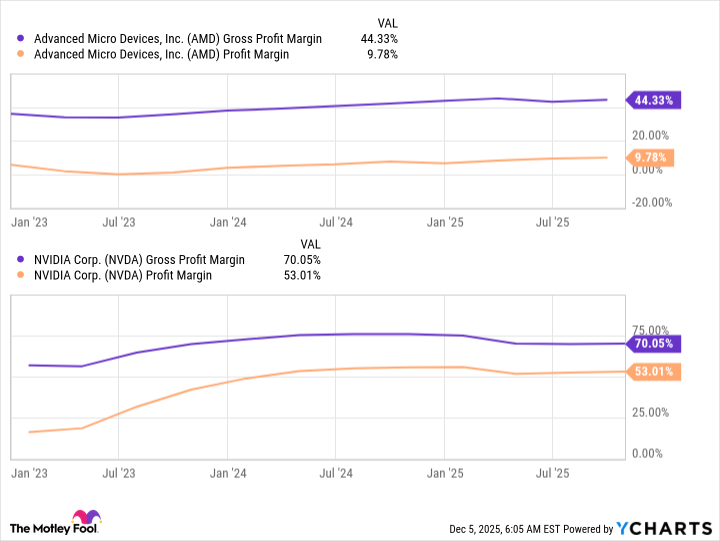

AMD gross profit margin data according to YCharts

Nvidia’s gross margin and net revenue margin are much larger than AMD’s, showing that a large portion of the cost of Nvidia GPUs goes towards paying for profits. With more attention being paid to how much money AI hyperscalers are spending on their data center capital expenditures, switching to cheaper alternatives like AMD in exchange for some performance penalty may be a smart move.

At this point I doubt this will happen. Companies are fairly locked into the Nvidia ecosystem, with Nvidia CEO Jensen Huang noting that the company is currently “sold out” in cloud GPUs. This wouldn’t be the case if Nvidia were to lose market share to cheaper alternatives, but this could open the door for AMD.

If potential customers are trying to get more computing power in a short time and Nvidia doesn’t have the capacity, those companies can turn to AMD to meet their needs. If these customers discover that AMD’s hardware is comparable, they can move more business from Nvidia to AMD.

We’ll see if this statement comes true, but the reality is that there is plenty of room for both companies to thrive.

The AI computing market is huge

Nvidia believes that global capital expenditure on data centers will increase from $600 billion by 2030 to $3 trillion to $4 trillion by 2025. AMD is also bullish on this topic and believes there will be a $1 trillion computing market by 2030. These two projections are quite similar, as are Nvidia’s projections all data center costs, while AMD focuses on computing power alone.

If both companies are right on the market opportunity, there is a huge growth runway. That’s why AMD told investors to expect a compound annual growth rate (CAGR) of 60% in its data center division. Nvidia likely expects a similar growth rate, making both stocks genius investments for 2026 if each company’s 2030 forecasts come true.

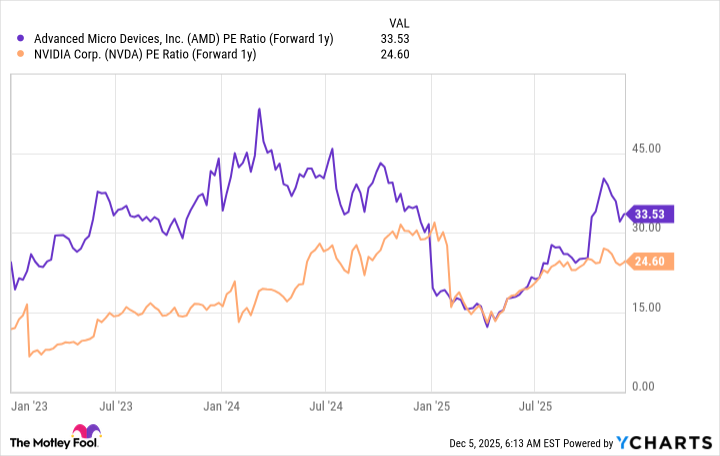

Currently, Nvidia is the much cheaper stock, trading at 25 times next year’s earnings, compared to 34 times for AMD.

AMD PE ratio data (1 year forward) according to YCharts

That’s a significant premium for investors to pay to own AMD, which hasn’t been as successful in its AI efforts.

As a result, I think Nvidia is the better stock pick than AMD because it has less expectations priced in. However, if AMD starts to deliver on its growth expectations, don’t be surprised if AMD outperforms Nvidia in 2026. Both companies are valid investments, and I wouldn’t be surprised if either one beats the market in 2026.