Broadcom Inc. (NASDAQ:AVGO) is the latest addition to the elite club of trillion-dollar companies. The announcement that the company could generate revenues of between $60 billion and $90 billion from artificial intelligence by 2027 underlines why it remains the center of attention on Wall Street. The stock is up more than 30% in the past month as investors react to AI revenues growing from just $3 billion to more than $12 billion in one year.

Upside momentum has almost begun as guidance indicates Broadcom (NASDAQ:AVGO) will be the biggest beneficiary as tech giants look for low-cost alternatives away from Nvidia’s pricey processors. Analysts at Bank of America are already calling Broadcom a growing AI opportunity for good reason.

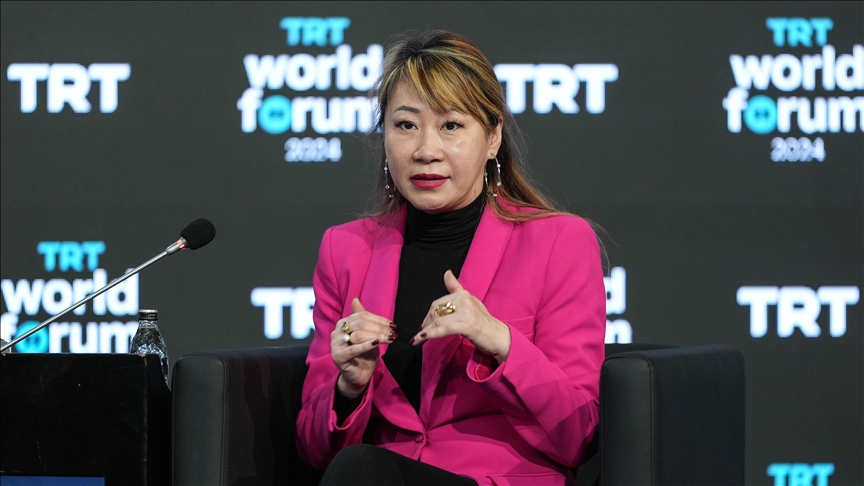

While Broadcom (NASDAQ:AVGO) is a growing AI name, Alex Coffey, manager of trading services at Charles Schwab, doesn’t believe it’s still an AI opportunity after rising more than 30%. The analyst insists that most analysts touting the company as an opportunity have been sleeping on the wheel as the company has always been a winner.

According to Coffey, Broadcom is evolving from a “value-consistent” company to a name with hyper-growth potential that requires a new multiple.

“This has clearly been one of the winners of AI all along. It was a bit of a stealth mover. It’s been a little bit more in the background, and I think what you’re seeing now is that it has risen to the surface very publicly in terms of forcing the recognition that it’s a winner, Coffey said in an interview with Schwab Network.

While Broadcom (NASDAQ:AVGO) has always been a winner in semiconductors, it’s only now starting to see an astronomical increase in growth rates. That was clearly visible in the fourth quarter of the fiscal year, when revenue rose 51% year over year to $14.05 billion, and full-year revenue rose 44% to $51 billion. In contrast, the company’s revenues rose just 4% in the fourth quarter of fiscal 2023. The fourth quarter results confirm Broadcom’s transition from a value investment to a fast-growing company with tremendous upside potential.

A scientist at a computer station, surrounded by a neural network of artificial intelligence code.

The robust growth comes from the fact that Broadcom (NASDAQ:AVGO) has a stable core business that revolves around selling chips. While the company has always relied on Apple to sell its chips, its generative AI chips are drawing interest from meta-platforms Amazon, Microsoft and Alibaba.

Likewise, Broadcom (NASDAQ:AVGO) is increasingly diversifying its revenue base beyond hardware sales. The $69 billion acquisition of VMware strengthens prospects on the software side of the business. Successful integration of VMware was the catalyst behind the company bringing in $21.5 billion in software revenue, accounting for 44% of total revenue by 2024.