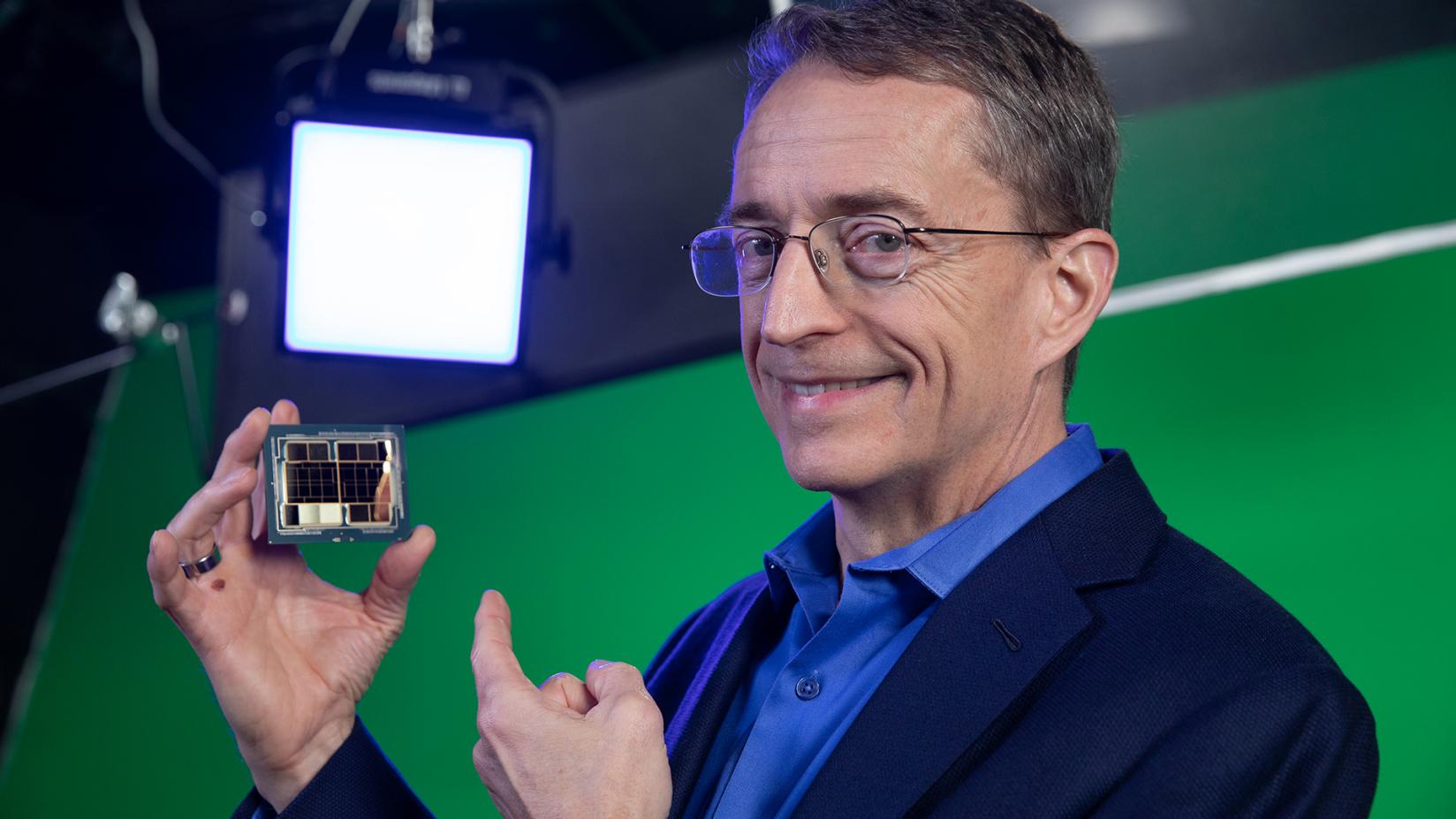

Pat Gelsinger, the CEO of Intel, has just announced his resignation after being pushed out by the company’s board of directors. He leaves behind a disastrous record, and will remain the emblem of an era during which the blue team saw its technological leadership collapse at the same rate as its stock market performance.

However, it would be unfair to attribute all of Intel’s woes to it. When he took over the company in 2021, the giant that once ruled the hardware world head and shoulders was already a shadow of its former self. Due to major logistical problems and a significant brain drain, the company had already produced several generations of disappointing products which allowed the competition to regain momentum, particularly from AMD. . Bob Swan, the CEO at the time, was therefore pushed out to make way for Gelsinger, a veteran of the house who had already served there as technical director.

Eyes bigger than your stomach

Trying to redress the situation, he came up with an extremely ambitious plan, called IDM 2.0, which aimed to revitalize the company through a radical transformation. His vision was to strengthen the firm’s production capabilities through massive investments in next-generation factories, but also to expand Intel’s foundry services to manufacture chips for third-party customers.

A risky approach, since it involved stepping on the toes of manufacturing titans like TSMC. But the bet seemed justified, because the company benefited from unconditional government support through the CHIPS and Science Act — an immense investment plan worth 280 billion supposed to revitalize American industry in the face of the rise of China.

Unfortunately, nothing went as planned. Substantial delays in implementing this plan undermined the firm’s financial results, while the company’s diversification prevented it from focusing on its core business — chip design. Result: during the Gelsinger era, the new generations of Intel processors were all disappointing, in particular because of recurring thermal and energy problems which continued to cause its technological leadership to waver.

A delay in AI with serious consequences

The board also criticized Gelsinger for failing to anticipate the tsunami of artificial intelligence, which began sweeping the industry a year into his tenure. Unlike Nvidia, which was able to ride this wave brilliantly to become a true economic titan, Intel has never firmly positioned itself in this incredibly profitable segment.

Result: within three years, Intel’s stock therefore fell by 61% while that of AMD increased by more than 50%… and that of Nvidia increased tenfold. ! The situation had even become so dramatic that rumors of a takeover by Qualcomm began to rear their heads.

A duo of new CEOs

Following his departure, Gelseinger was temporarily replaced by not one, but two co-CEOs: CFO David Zinsner and Managing Director Michelle Johnston Holthaus. And the least we can say is that they will have a lot to do during this interim period. It will therefore be appropriate to keep an eye on Intel’s activities to see if the duo will succeed in breathing new life into this titan.

🟣 To not miss any news on the WorldOfSoftware, , .

/cdn.vox-cdn.com/uploads/chorus_asset/file/25771475/FORD_2024_PUMA_GEN_E_10.jpg)