China has had a remarkably good month.

While US President Donald Trump’s first weeks in office have his allies reeling and Americans uncertain as they sort out his torrent of executive orders, Beijing is orchestrating a masterclass of reinvention and resolve.

It all began in late January with artificial intelligence (AI) startup DeepSeek’s surprising debut, which jolted US stock markets. That was followed this past week by Chinese President Xi Jinping’s public mending of fences with his country’s sidelined business elites, and an ongoing surge in Chinese capital-market prices, driven by tech stocks. And that has been accompanied by a surprisingly cordial beginning with the new Trump administration despite Beijing’s unsettling military assertiveness.

To be sure, none of China’s underlying problems have vanished. Its economy is growing too slowly, and its debt issues continue to cast a cloud over the property sector. Few serious experts think that the Chinese economy will reach its 5 percent growth target this year. In addition, Beijing’s demographic problems are a generational challenge. And Xi’s insistence on strict Chinese Communist Party control remains a disincentive for investment.

At this moment, two stories are being told about China, RAND researcher Gerard DiPippo pointed out in a recent analysis. China is racing ahead as an economic and technological powerhouse, and China’s economy is slowing under the weight of its mounting problems. “Although these narratives appear contradictory, both are true,” DiPippo argues.

Seek the limelight

No development marked a more powerful shift in the global mood toward China than the release and immediate success of DeepSeek’s reasoning model. Once shrouded in mystery, the breakthrough is now the symbol of China’s potential to rival the United States at less cost and despite export controls on the most advanced US microchips.

In areas where many have assumed that US companies are in the lead—AI, data analytics, quantum computing—Beijing has declared “game on.” Countries that have been betting tens of billions of dollars on the United States’ technological edge are now left wondering just how quickly China will be able to close any technological gap.

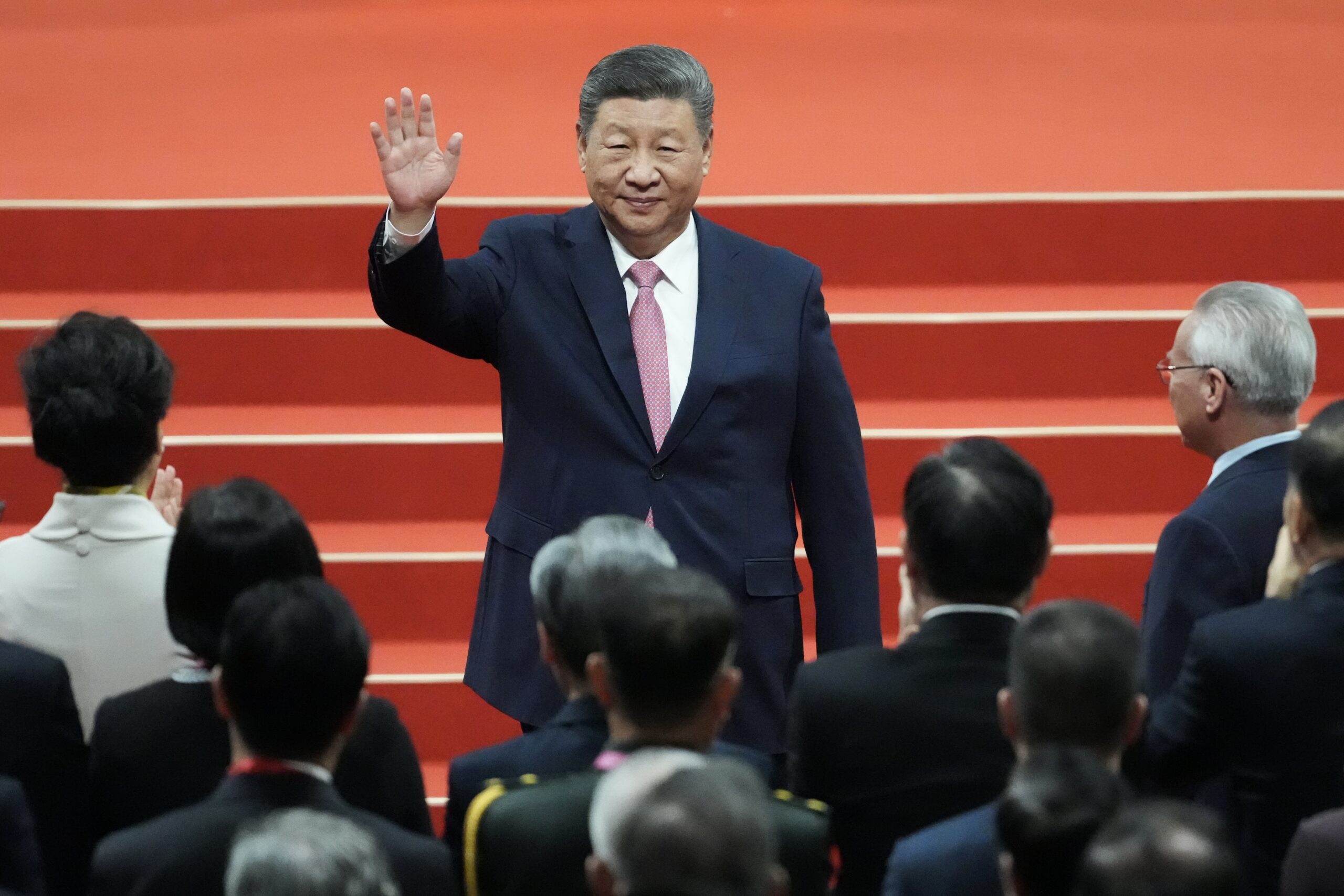

If DeepSeek caught investors off guard about Chinese capability to compete on AI, Xi surprised them again on February 17 with a high-profile, deeply choreographed meeting with Chinese business leaders. It was a shift by Xi, who had sidelined some of these leaders in recent years as he consolidated power, sensing that their growing success might be a threat to party and state control.

The most unexpected attendee at Xi’s meeting was Alibaba co-founder Jack Ma, who had fallen afoul of the party after he publicly complained about overregulation in October 2020. It remains a safe bet that Xi doesn’t intend to cede state control to the private sector, but his urgent need for economic growth means that he must provide it more leash. At the same time, he is sending a message to markets.

Take the lead

Global investors have responded with one of the biggest market surprises of 2025: the comeback of the Chinese tech sector, which many global investors had abandoned in recent years due to Xi’s regulatory crackdown.

The Hang Seng Tech Index, which tracks Chinese stocks traded in Hong Kong, surged 6.5 percent alone this past Friday. Shares of Alibaba, now with more official blessing, rose 15 percent that same day after robust sales growth. Since the beginning of the year, Chinese stocks have outperformed many of their US counterparts.

Many global investors are now willing to place bets on Beijing’s new direction, even as they begin to hedge on uncertainties related to the Trump administration’s actions and potential US inflation.

Washington’s recalibration

Trump himself is fueling this change of mood regarding China. Having threatened tariffs as high as 60 percent against China during his presidential campaign, his softening of tone as president has soothed Chinese nerves. Trump’s gestures have included an invitation to Xi to attend his inauguration, an executive order that has brought a reprieve to the banning of TikTok, and an imposition of a relatively modest 10 percent tariff on China that Chinese leaders seem to have received with more relief than disdain.

If relations between China and the United States in recent months seemed to be a powder keg ready to ignite, then Trump appears to have pulled the fuse. He has done this through his willingness to engage with Beijing and his apparent lack of concern for Xi’s gathering autocratic challenge to US global leadership, including China increasingly acting in concert with Russia, Iran, and North Korea.

Trump’s dramatic recalibration this past week regarding Russian President Vladimir Putin further boosted Xi—someone whom Trump, only days earlier in Davos, had blamed for complicity in Russia’s war against Ukraine. While the Biden administration often warned that losing Ukraine would only encourage China in its aspirations to gain control of Taiwan, the Trump administration appears less convinced of the connection.

China also rightly senses a potential opening among Washington’s European allies and even with Ukraine. Despite China’s support for Putin’s war, Ukrainian President Volodymyr Zelenskyy has been careful not to close the door to engaging with Beijing. China has even signaled its willingness to provide troops for a peacekeeping role in Ukraine, while Trump has ruled out the use of US soldiers for such purposes.

Beijing’s maneuvers

China may sense another opening, as well. Beijing’s military moves in the past month underscore that Xi sees little downside to greater military assertiveness in the first days of the new Trump administration.

Last week, New Zealand’s government said that the Chinese navy held live-fire drills in international waters off its coast. This came just a day after Chinese vessels staged a similar drill off Australia’s southwestern coast that forced some commercial airlines to divert their flights.

During the recent Lunar New Year celebrations, China’s People’s Liberation Army increased military maneuvers around Taiwan. And on February 18, a Chinese navy helicopter flew within ten feet of a Philippine patrol plane in an effort to force it out of disputed skies.

“You are flying too close, you are very dangerous,” the Philippine pilot warned by radio.

It adds up to a remarkable start of the year for China. The emergence of DeepSeek, Xi’s olive branch to Ma and others, an ongoing market rally led by tech stocks, Trump’s conciliatory approach amid Beijing’s muscular military posturing—all contribute to increased Chinese confidence in 2025, which is the Year of the Snake, symbolizing transformation and the shedding of negativity.

Frederick Kempe is president and chief executive officer of the . You can follow him on X: @FredKempe.

This edition is part of Frederick Kempe’s Inflection Points newsletter, a column of dispatches from a world in transition. To receive this newsletter throughout the week, sign up here.

Tue, Feb 4, 2025

Where do the Trump tariffs go from here?

Fast Thinking

By

US tariffs on China went into effect today, while President Donald Trump paused levies on Mexico and Canada. Our experts explain who and what could be next.

Image: President Xi Jinping waves to the crowd at the inauguration ceremony held at Macao East Asian Games Dome, as this year marks the 25th anniversary of the city’s return to Chinese administration. 20DEC24. SCMP / Eugene Lee