Dubai, UAE, March 28th, 2025/Chainwire/–Crypto exchange Coincall has officially entered the Top 5 global crypto options exchanges by trading volume, marking a major milestone just 18 months after its founding. The achievement highlights the platform’s rapid growth in a sector that’s increasingly drawing both institutional and retail interest.

The surge in performance, according to internal data and third-party analytics, is linked to a successful Q1 strategy that included high-impact marketing campaigns and new product rollouts, in collaboration with notable crypto partners such as SignalPlus, DWF, and Big Candle Capital.

Crypto Options: From Niche Strategy to Core Market Structure

Once reserved for quants and hedge funds, options are now becoming a go-to instrument for crypto-native investors. These contracts give traders the right, but not the obligation, to buy or sell assets at a set price — enabling sophisticated hedging, volatility plays, and directional speculation.

As the broader digital asset market matures, crypto options are increasingly viewed as a critical building block of the financial stack. That narrative hit the mainstream this month when reports emerged of

Youngest in the Top 5 — and Fastest Rising

Coincall’s breakout is notable not just for its velocity, but for the company’s relative youth. Founded in late 2023, Coincall now ranks among the top exchanges in the space, with it currently 9-10% the size of Deribit.

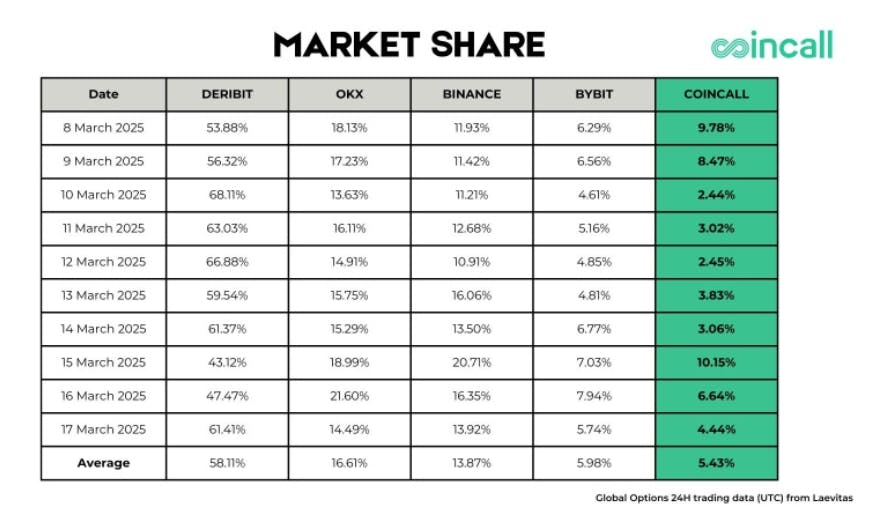

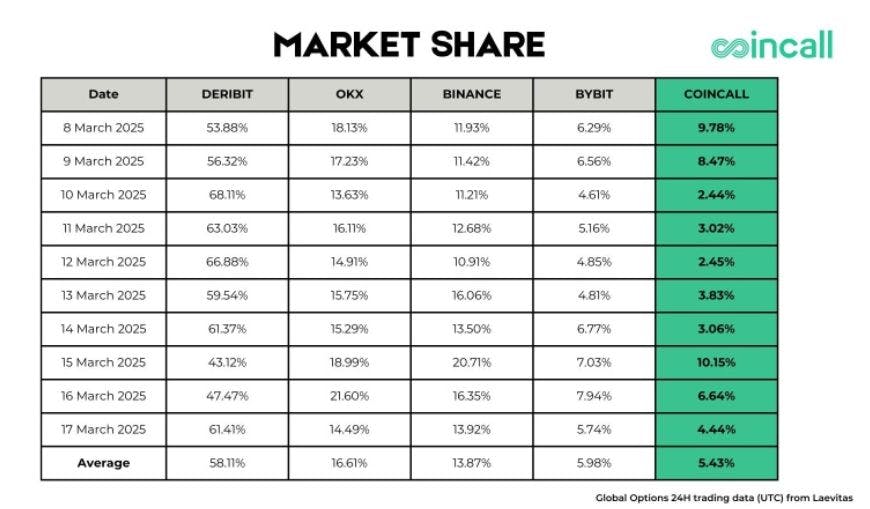

According to data from Laevitas, Coincall captured an average market share of 5.43% between March 8 and 17, 2025, with a notable peak at 10.15% on March 15. The exchange also saw strong volume days with 9.78% share on March 8 and 6.64% on March 16 — signaling rising momentum and growing competitiveness in the global crypto options landscape.

Coincall’s comparative market share and growth trajectory make it the youngest exchange ever to break into the Top 5, and potentially one of the most viable candidates for acquisition or institutional partnership among rising players.

As attention shifts from mature giants to agile challengers, Coincall has positioned itself at the center of that conversation, growing into almost the same market share as industry giant ByBit.

Leadership Backed by Vision

In January, Coincall appointed

“We’re witnessing crypto achieve consensus-level legitimacy as a store of value,” Teo said. “Options are the next wave — they provide leverage, flexibility, and strategy. Our mission at Coincall is simple: make investing quick, intuitive, and safe — for everyone.”

“Earn While You Trade” feature: Unlocking Yield + Capital Efficiency

Coincall’s latest innovation, Earn While You Trade (EWYT), is designed to eliminate the traditional tradeoff between yield farming and active trading. With EWYT, users can:

- Earn up to 6.4% APR on USDT holdings

- Access 90% of staked funds as trading margin

- Withdraw funds at any time — no lock-ups

- Increased capital efficiency for active traders

The feature enables users to earn yield on idle capital without forgoing trading activity, offering an alternative approach to capital utilization.

Users can explore the product

Macro Momentum: Crypto Infrastructure Is Back

Coincall’s rise reflects broader tailwinds in crypto infrastructure. According to

“The next phase of crypto will be defined by real infrastructure,” said Teo. “The platforms building with intention, with capital efficiency and user accessibility in mind, will shape the decade ahead.”

About Coincall

Contacts

Daryl Teo

Coincall

[email protected]

Marketing Lead

Vera K.

Coincall

[email protected]

This story was distributed as a release by Chainwire under HackerNoon’s Business Blogging Program. Learn more about the program