The cryptocurrency infrastructure landscape is experiencing significant market fatigue. After years of explosive growth, infrastructure project valuations are now shrinking as investors grow more selective. This trend reflects a maturing market where mere technical innovation is no longer sufficient to command premium valuations.

The Innovation Problem

Today’s infrastructure projects face a critical dilemma: most offer similar capabilities with minimal differentiation. Despite technical advancements, we haven’t seen breakthrough use cases that enable entirely new classes of applications. The ecosystem struggles to demonstrate compelling value propositions for established Web2 platforms like X or Instagram to migrate to blockchain. Without clear advantages beyond decentralization, these platforms see little incentive to uproot their existing operations. This fundamental adoption gap leaves trading and speculation as the dominant applications across most infrastructure layers, limiting the sector’s transformative potential.

The Empty Infrastructure Dilemma

The proliferation of infrastructure projects has created a paradoxical situation – too many platforms competing for too few compelling applications. This imbalance has resulted in numerous “ghost chains” with minimal real-world usage and negligible revenue generation, creating unsustainable economic models that rely primarily on token appreciation rather than genuine utility.

Breaking the Feedback Loop

A healthy crypto ecosystem requires a productive feedback loop between application developers and infrastructure builders. Currently, this cycle is fractured – application developers struggle with infrastructure limitations, while infrastructure teams lack clear signals about which capabilities would drive actual usage. Restoring this feedback mechanism is essential for sustainable growth.

Despite these challenges, infrastructure development remains lucrative, with 35 of the top 50 cryptocurrencies by market capitalization maintaining their own infrastructure layers. However, the bar for success has risen dramatically – new infrastructure projects must simultaneously demonstrate concrete use cases, substantial user traction, and compelling narratives to achieve meaningful valuations.

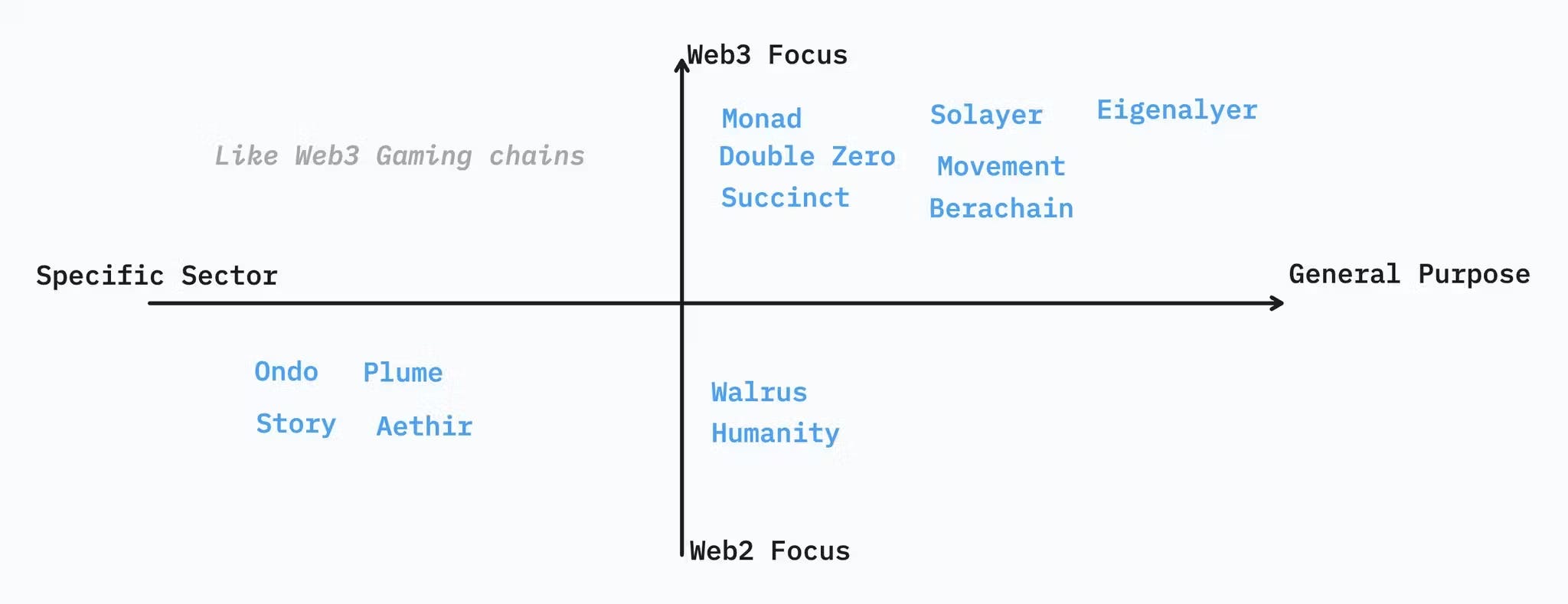

Most successful new infra in the past year

Evolution of Blockchain Infrastructure

Previous cycles of blockchain infrastructure primarily focused on solving Ethereum’s limitations, with projects positioning themselves as “faster and cheaper” alternatives while offering few truly novel capabilities. The landscape has shifted dramatically, with recent successful projects introducing more diverse and specialized infrastructure solutions.

High-Valuation Newcomers

The past year has witnessed the emergence of several infrastructure projects that have achieved remarkable valuations through token generation events (TGEs) or significant funding rounds. According to Cryptorank data, these projects represent the most impactful new infrastructure in both primary and secondary markets:

Ultra-High Valuation ($4B+ FDV)

- Ondo ($8B FDV) – RWA tokenization platform

- Story ($5B FDV) – IP programmability for AI

- Movement ($4B FDV) – MoveVM on Ethereum

- Berachain ($4B FDV) – Liquidity EVM layer1

High Valuation ($1-4B FDV/Valuation)

- Walrus ($2.6B FDV) – Blob storage

- Plume ($1.7B FDV) – RWA blockchain

- Eigenlayer ($1.6B FDV) – Restaking protocol

- Solayer ($1.4B FDV) – Solana restaking, Ultra fast SVM blockchain

- Aethir ($1.3B FDV) – On-demand GPU compute network

- Monad (>$1B valuation) – High-performance EVM

- Humanity ($1.1B valuation) – Digital identity protocol

Emerging Contenders (Under $1B)

- Succinct ($500M-1B valuation) – ZK proof generation network, ZKVM

- Double Zero ($400M valuation) – Decetralized physical fiber network

Key Observation

0. The Unsustainability of High FDV, Low MC, Low Volume Projects

When analyzing projects with high FDV, low MC, and minimal trading volume, a concerning pattern emerges:

- Token Inflation: The large gap between FDV and market cap indicates future token unlocks that will create sustained selling pressure.

- Persistent Price Decline: Despite technical progress or partnership announcements, continuous token dilution typically leads to price drops.

- Eroding User Confidence: When prices fall despite positive developments, community sentiment deteriorates, making it increasingly difficult to attract developers, users, and additional investment.

This dynamic creates a negative feedback loop: diminished confidence reduces adoption, further suppressing trading volume and accelerating price decline. Infrastructure projects must carefully balance tokenomics to avoid this unsustainable pattern, as technical advantages alone cannot overcome fundamentally flawed token economic models.

1. Crypto-Native Infrastructure Maintains Strong Relevance

Projects focused on core blockchain infrastructure continue to capture significant value:

- Enhanced Layer 1/2 Platforms: Monad, Movement, Berachain, and Solayer have achieved $1B+ valuations by offering a faster blockchain leverage existing developer community (EVM, MoveVM, SVM) rather than introducing entirely new programming languages. This suggests VM innovation may plateau temporarily while optimization takes precedence.

- Network Layer Optimization: Double Zero ($400M valuation) demonstrates the value of new specialized infrastructure focused on reducing latency and increasing bandwidth for validators.

- Security Enhancement: Succinct provide critical proof generation capabilities that strengthen blockchain security, while Eigenlayer’s restaking protocol offers novel security models for emerging blockchains.

2. Valuation Ceiling Presents Exit Challenges

None of these projects exceed $10B valuation, indicating a potential ceiling in the current market. This suggests that achieving outsized returns (100x) would require early entry at sub-$50M valuations, making timing critical for investors.

3. Web2-Focused Projects Command Premium Valuations

Projects explicitly bridging Web2 and Web3 demonstrate exceptional market traction:

- Ondo ($8B FDV) and Story ($5B FDV), and Plume ($1.7B valuation) all focus on making blockchain relevant to mainstream applications.

- These successful projects build accessible global marketplaces around already-adopted Web2 concepts

4. Finance and AI Dominate Use Cases

Examining the target use cases reveals finance and AI applications represent the most valued infrastructure categories, with projects like Ondo, Movement, Berachain (finance), and Eigenlayer, Aethir (AI) achieving significant valuations.

5. Ecosystem Composability Drives Valuation

Nearly every project valued above $1B FDV has established a dedicated ecosystem. The data indicates that ecosystems featuring multiple composable projects create exponentially more value than isolated solutions, highlighting the network effect in blockchain infrastructure.

6. First-Mover Advantage Is Not Deterministic

Only three projects (Double Zero, Story, Eigenlayer) pioneered their respective narratives, yet many followers have achieved comparable or higher valuations. This suggests execution quality and market timing often outweigh first-mover status.

7. Notable Narrative Gaps

Several infrastructure narratives failed to produce billion-dollar projects during this period, including gaming-specific chains, RaaS (Research as a Service), verification layers, multi-VM platforms, agent-oriented blockchains, DePIN-specific chains, and decentralized science infrastructure.

Future Investment Opportunities in Blockchain Infrastructure

Targeting Untapped Web2 Markets

The most promising infrastructure opportunities will target substantial Web2 markets that remain underserved by blockchain solutions. These projects can create globally accessible marketplaces while introducing improved financilization mechanisms

Creating Novel Infrastructure Categories

Rather than incrementally improving existing infrastructure, significant value will emerge from entirely new infrastructure categories:

- Intent-Based Infrastructure: Protocols enabling users to express desired outcomes rather than specific transactions, with execution optimization handled automatically.

Enabling Web2 Integration Patterns

Creating revolutionary applications from scratch requires significant time and resources. A more efficient approach mirrors the recent AI revolution: integrating blockchain functionality directly into existing Web2 applications. The remarkable speed of AI adoption wasn’t primarily driven by standalone AI applications, but by thousands of established platforms incorporating AI capabilities into their existing user experiences.

Blockchain infrastructure must therefore prioritize seamless integration pathways that allow Web2 applications to progressively implement blockchain features without disrupting their core user experience. The most successful infrastructure will enable familiar applications to offer ownership, trading, and financial capabilities without requiring users to understand complex blockchain concepts or navigate entirely new interfaces.

Financial incentives will likely drive this integration wave. Just as AI features helped Web2 companies create premium tiers and new revenue streams, blockchain integration can unlock new monetization models through tokenization, fractional ownership, and programmable royalties. Infrastructure that makes these benefits accessible while minimizing technical complexity will catalyze the next phase of blockchain adoption across mainstream applications.