President Donald Trump’s 180 on Intel Corp. is at least directionally correct, certainly more so than calling for the ouster of Lip-Bu Tan, Intel’s CEO. But a contemplated investment by the U.S. in Intel, as reported by Bloomberg and the Wall Street Journal, without a significant restructuring of Intel’s entire business, is a recipe for failure in our view.

Specifically, we continue to urge Intel’s board to spin out its foundry business. Every day it waits further decreases foundry’s value. Moreover, we call on the U.S. government to use money from the CHIPS Act and its influence on large U.S. chip designers, and Taiwan Semiconductor Manufacturing Co., to secure a position for a U.S.-domiciled company in advanced semiconductor manufacturing.

In this Breaking Analysis, we explain how an investment by U.S. taxpayers, if structured properly, could work. We update our previous bold plan to spin out foundry and set expectations for why an investment in Intel will take many years and more likely a decade to break even — and why that still may make sense.

Trump does a 180 on LBT

Intel shares are up around 12% after reports that the Trump administration is exploring a potential U.S. government stake in the company. Trump discussed the idea with Lip-Bu Tan at the White House, with the caveat that talks are early and may not proceed. In an interview with Andrew Ross Sorkin and Joe Kernen on CNBC, analyst Gil Luria of D.A. Davidson called intervention “essential” and compared the importance to the nuclear arms race in the 1940s. We agree with Luria that the current situation is “untenable” and requires immediate action.

But like most discussions around Intel, the conversation dances around the most fundamental issues and the root cause of Intel’s troubles: lack of volume compared with TSMC.

Cash may be king but folume is a ruthless dictator

The chart below shows our estimates of wafer volumes from 2014 through 2024 with an estimate in 2025. When PC volumes peaked in 2014, it signaled the beginning of Intel’s problems.

As we’ve reported time and time again, Wright’s Law, also known as the experience curve effect, describes the dynamic where the cost of producing a unit decreases as the cumulative number of units produced increases. This principle suggests that the more something is produced, the more efficient and cost-effective production becomes, often by a predictable percentage with each doubling of cumulative output.

This is especially important in semiconductor manufacturing where the time to go from breaking ground on a manufacturing facility to quality chip yields takes the better part of a decade. And because jumping S-curves to a new process is expensive, the volume leader increases its advantage relative to the competition with each subsequent cycle.

Wright’s Law explains why Intel’s x86 architecture beat out RISC chips in the 1990s and it explains why Arm volumes have propelled TSMC into its current leadership position, as shown in this chart. TSMC holds more than 50% of the market thanks to Arm and volume wafer customers such as Apple Inc., Qualcomm Inc., Nvidia Corp. and others. Intel is trying to catch up, but relative to TSMC, its costs are 35% higher and it takes more than a year longer to get to quality yields on advanced semis. Intel is cutting costs and scaling down the fab investments promised under former CEO Pat Gelsinger. Meanwhile, TSMC continues to expand its lead. This has put Intel foundry into a death spiral.

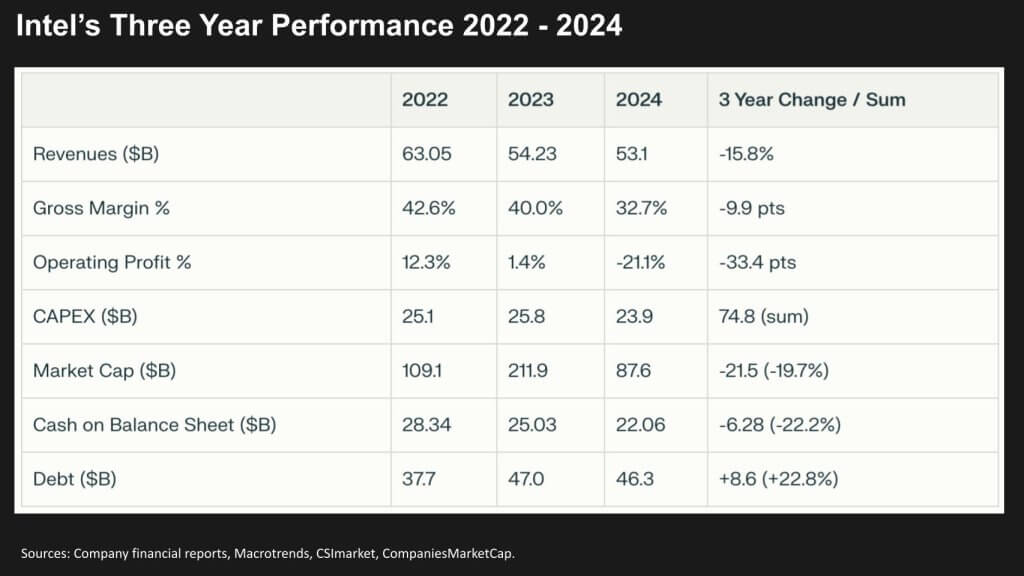

Intel’s numbers tell a bleak story

Here’s a three-year look at Intel’s business from 2022 to 2024.

Revenues is down 15%, gross margins down 10%, operating profit down 33 points, $75 billion shelled out in capital expenditures, market cap down 20%, cash down 22%, debt up 23%.

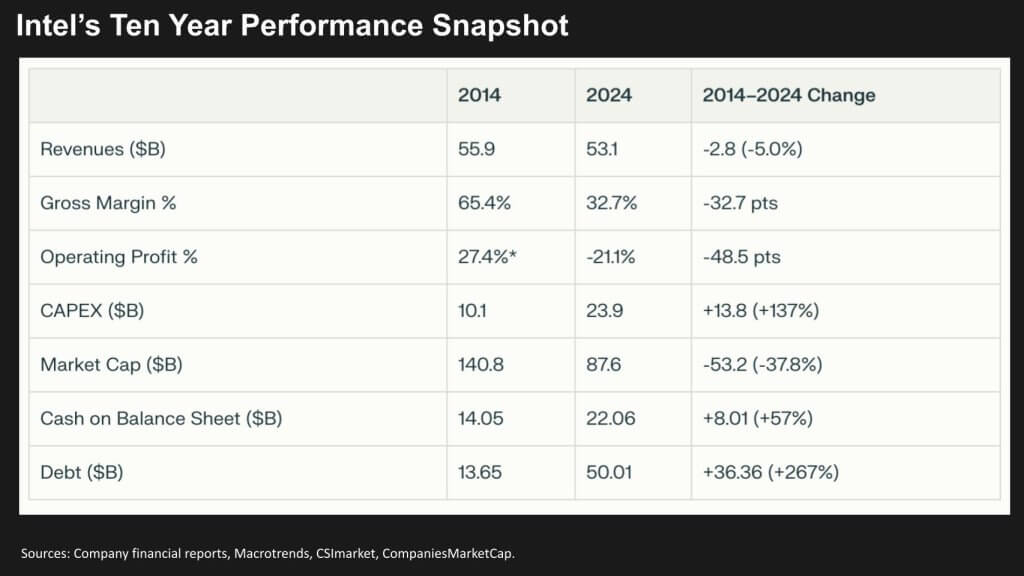

A 10-year view of Intel’s fall from dominance

But a longe- term look at Intel going back to when PC volumes peaked in 2014 is even more telling, as shown in this chart below.

- Revenue has contracted during one of the greatest 10 years in tech

- Gross margin has more than halved in a decade from its mid-60s perch

- Operating profit swung from strong positive to a huge loss.

- Capex and debt have both more than doubled.

- Market cap dropped by over one-third.

- Cash on hand rose modestly – around $8 billion — but debt increased by roughly $36 billion.

This highlights how Intel has shifted to an asset-heavy, lower-margin model with much higher leverage over the last decade. The company took advantage of near-zero interest rates and, in the process, lost its paranoia.

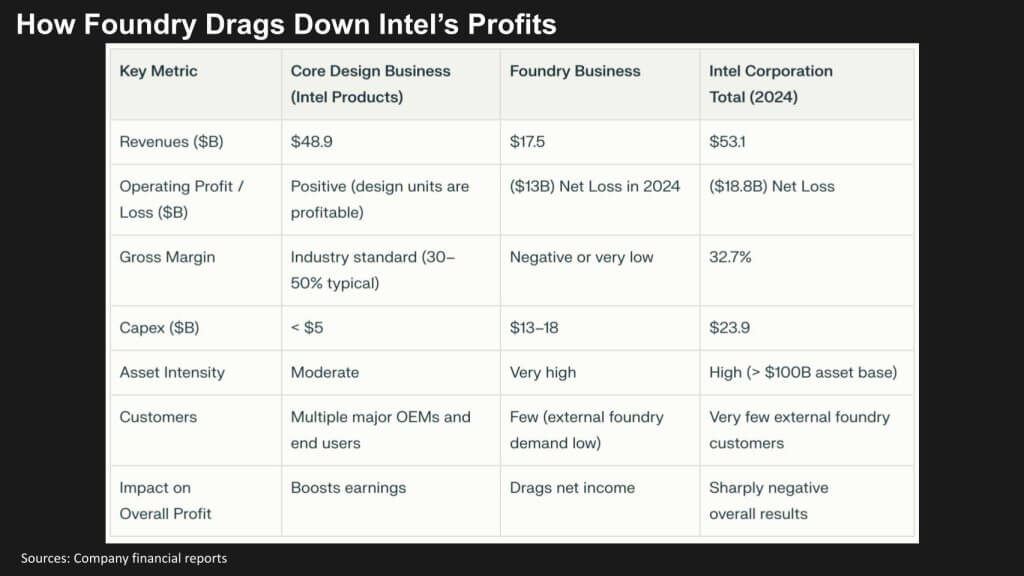

Foundry is the culprit

And in case you’re not getting our premise – the problem is foundry, as shown below.

Intel’s core design and product businesses – such as Client Computing and Data Center – continue to serve as the primary engines of both revenue and profitability. These segments remain the company’s competitive and financial backbone, generating the bulk of sales and sustaining margins despite broader industry headwinds.

In contrast, the foundry business, now reported as a separate segment, delivers far less revenue, most of it derived from internal customers, while consuming the lion’s share of Intel’s capital investment. This capital-heavy operation posts substantial operating losses, $13 billion last year, making it a structural drag on the company’s financial performance.

The combination of persistent operating losses, high asset intensity, limited external customer adoption and outsized capital expenditures in the foundry business materially depresses Intel’s overall margins and returns to shareholders. This dynamic underscores the challenge of balancing long-term manufacturing ambitions with near-term profitability goals.

Intel’s move to a split financial model has further illuminated the disparity between its two main businesses. The disclosure makes clear that the foundry segment is absorbing disproportionate resources relative to its revenue contribution, and that it remains meaningfully unprofitable when compared to the company’s core design operations.

The solution is to spin out the foundry business and allow the products group to flourish.

A simplified cap table for the Foundry of America

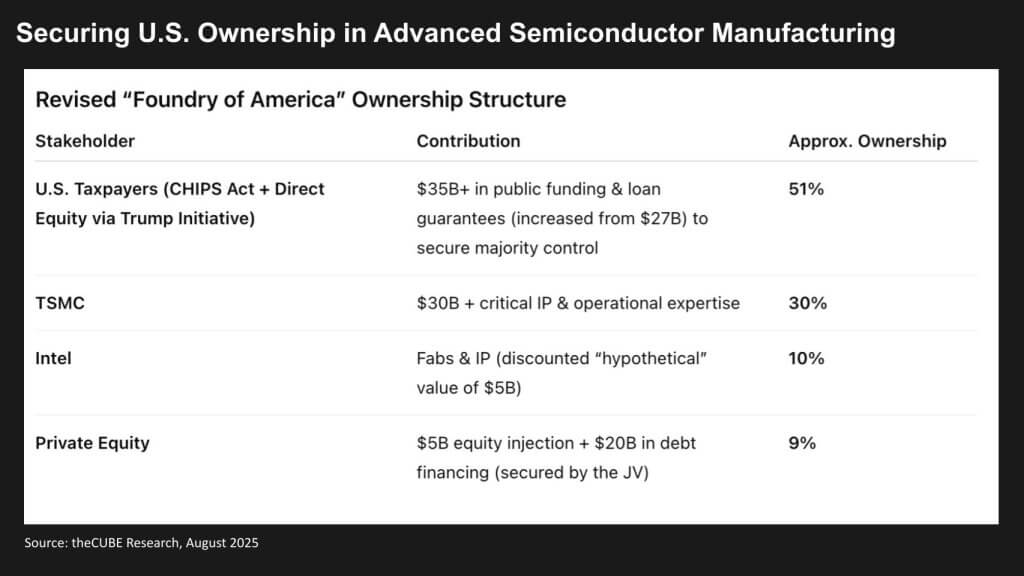

The question is how to do this. This chart updates our original bold plan by simplifying the cap table and making some adjustments to secure U.S. majority control.

Our original plan called for more participation from chip designers such as Apple, Nvidia and the hypersca cloud providers. And that could still happen. We’ll get to that momentarily, but to simplify the argument, we’ve created the cap table shown above.

The proposed structure for spinning out Intel’s foundry operations into a new “Foundry of America” entity underscores the scale, complexity and geopolitical weight of this initiative. Under the structure shown here, U.S. taxpayers — via a combination of CHIPS Act funding and direct equity injections under the Trump administration’s manufacturing push — would take a controlling 51% stake. That majority position is designed not just to inject capital, but to guarantee U.S. leverage over advanced semiconductor manufacturing capacity at a time when supply chain security is a national priority.

TSMC’s participation at 30% brings not only a massive $30 billion commitment, but also the critical intellectual property and operational expertise required to make the venture globally competitive. This reflects a pragmatic recognition that U.S. fabs alone cannot quickly replicate the scale and technical leadership TSMC commands. And it inherently creates a hedge for TSMC and its suppliers in the event China takes over Taiwan.

Intel itself would hold a 10% stake through the contribution of fabs (which as we’ve said are basically of negative value without this type of venture) and intellectual property, assigned here a discounted hypothetical value of $5 billion. Though small in percentage terms, Intel’s role would be foundational, as the venture would be seeded with its existing manufacturing footprint and engineering talent.

Private equity kicks in with 9% ownership, achieved through a $5 billion equity injection and $20 billion in debt financing secured by the joint venture. This capital structure signals that private markets will still have a role in funding and driving efficiency, but because the breakeven for this venture is so long (a decade or more), we need to give private equity yield over the period and that’s where the debt instrument comes in.

In our view, this mix of public capital, TSMC expertise, domestic assets and private funding could give the U.S. its most credible shot in decades at not only re-shoring, but controlling a meaningful share of advanced semiconductor production. It admittedly bakes in governance complexity — balancing national security interests, global partnerships and the commercial realities of a capital-intensive, fiercely competitive industry.

Now, we’re working backwards from the cap table, but this is only a starting point. There are still some necessary conditions for this to succeed, namely cash and wafer volume commitments. Which brings us to the hyperscalers and other tech companies that are committing hundreds of billions of dollars in an effort to placate Trump. Why the administration hasn’t connected the dots between these massive investments in artificial intelligence and the need for an American foundry is beyond explanation.

AI investments must support US semiconductor manufacturing

Let’s look at what that looks like.

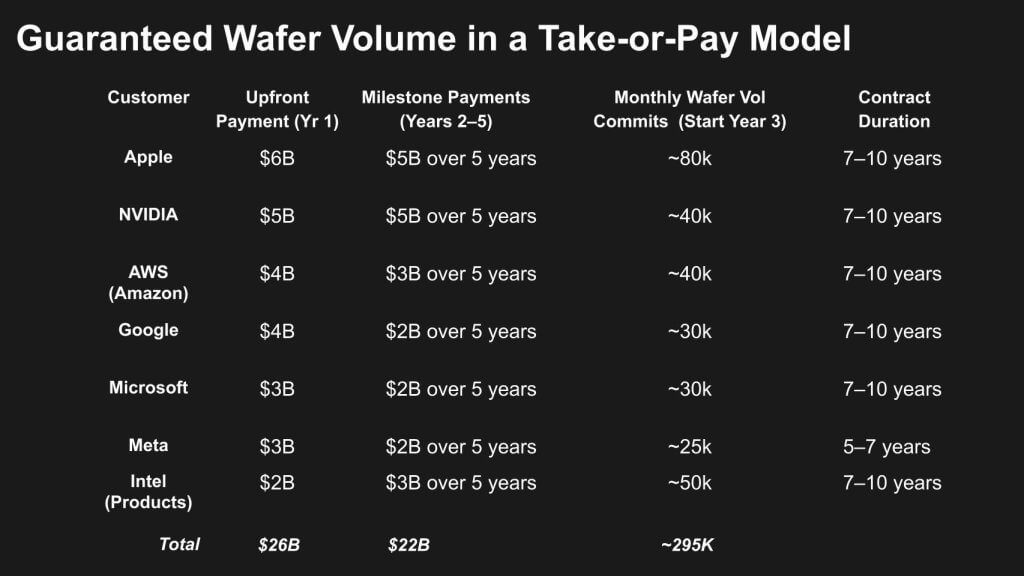

The Foundry of America will only achieve long-term viability if it can secure both sustained wafer-scale volume and substantial upfront and milestone cash commitments from anchor customers. The take-or-pay model outlined here is designed to provide exactly that — locking in predictable demand from the largest semiconductor consumers in the world while de-risking capital-intensive buildouts.

Under this structure, leading technology companies — including Apple, Nvidia, Amazon Web Services Inc., Google LLC, Microsoft Corp., Meta Platforms Inc. and Intel’s own product divisions — commit a combined $26 billion in upfront payments and $22 billion in milestone payments over the first five years. These funds provide essential working capital and help offset the massive upfront capex required to build and equip advanced fabs. In parallel, the contracts secure a baseline of nearly 295,000 wafers per month starting in year three, giving the foundry the scale needed to get on the Wright’s Law learning curve, crossing into 10 million-plus annual wafer volume territory.

The durability of these agreements — most spanning seven to 10 years — ensures predictable cash flow, supply stability for customers, and operational visibility for the foundry. Importantly, these volumes and cash flows also underpin financing for further capacity expansions and technology node transitions, both of which are necessary to remain competitive with TSMC and Samsung. Without this combination of committed volume and upfront capital, the Foundry of America risks falling into the same trap that has historically plagued new entrants: underutilized capacity, weak returns and an inability to keep pace with the industry’s relentless capital and R&D requirements.

In our view, locking in these contracts is as important as the ownership structure itself — because without guaranteed demand and a robust cash buffer, even majority U.S. control would not be enough to secure a sustainable domestic alternative in advanced semiconductor manufacturing.

This structure assures $138 billion in funding over a decade, which we believe will be required. And it will still take a decade for the new venture to be competitive in our view. In a previous post, we laid out the motivation for these chip designers and TSMC to play ball. The short answer is Trump will make them. The fact is, they’re already committing hundreds of billions combined to fund AI. So we have confidence the current administration could make it happen.

Time is running out

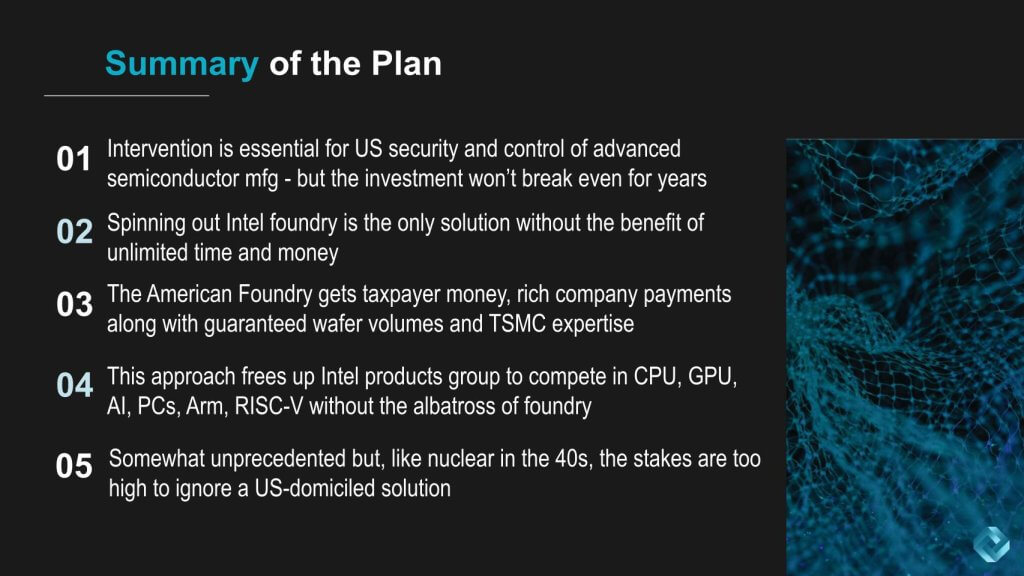

The bottom line is that this plan represents a bold, high-stakes intervention aimed at securing U.S. leadership in advanced semiconductor manufacturing. Though the economics will be challenging and breakeven is years away, the strategic rationale is sound, in our view. Spinning out Intel’s foundry operations into a standalone “American Foundry” creates a vehicle that can absorb significant public and private investment, attract world-class expertise and lock in long-term demand through guaranteed wafer contracts.

By separating manufacturing from Intel’s product group, the company can focus its energy on competing in central processing units, graphics processing units, AI accelerators, personal computers and emerging architectures such as Arm and RISC-V — free from the operational and financial drag of running a capital-intensive foundry. Meanwhile, the foundry benefits from taxpayer backing, corporate anchor tenants and TSMC’s operational know-how, giving it a credible path to global relevance.

This approach is without identical precedent in modern tech policy, but it echoes moments in history — like the nuclear race of the 1940s — when national imperatives demanded extraordinary measures. The stakes in semiconductor sovereignty are simply too high to ignore and, in our view, the Foundry of America could become the cornerstone of a resilient, U.S.-controlled supply chain for decades to come.

Disclaimer: All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by News Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Image: theCUBE Research/Reve

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About News Media

Founded by tech visionaries John Furrier and Dave Vellante, News Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.