Here’s what your typical “productive” financial research session actually looks like:

Open Bloomberg Terminal ($24,000/year) → Export data to Excel → Search for industry reports → Read through 50+ pages of PDFs → Cross-reference competitor filings → Build models manually → Still unsure if you caught everything important → Repeat for every analysis.

The dirty secret: Legacy financial platforms make billions keeping you clicking through interfaces. Your fragmented workflow is their business model.

But here’s what changed: Perplexity Pro transforms a simple prompt into comprehensive market analysis, competitive intelligence reports, and revenue forecasting models—all with live data, interactive charts, and working calculations. In about 10 minutes.

What Perplexity Pro Actually Is (And Why It Matters for Finance) 💡

After 8 months of daily use, here’s my take: Perplexity Pro isn’t just another AI chatbot. It’s a financial research-first AI that combines web search with large language models to deliver what Bloomberg, FactSet, and traditional tools should have built years ago.

The fundamental difference:

Traditional tools: You navigate → They display data → You do all the analytical work

Perplexity Pro: You ask → It researches → It synthesizes → Analysis delivered with citations

What Makes Perplexity Different

Unlike Google, which forces you to sift through countless results, Perplexity’s answer engine:

- Actively searches the web and cites sources in real time

- Connects directly to real-time market data, earnings reports, and SEC filings

- Synthesizes information from multiple sources into concise answers

- Allows natural follow-up questions without losing context

- Provides inline citations so you can verify every claim

The Finance section specifically provides structured insights without toggling between multiple tabs—displaying live stock quotes, earnings summaries, peer comparisons, and SEC filings with contextual summaries and source links.

Perplexity Pro Pricing: Built for Financial Professionals 💰

Understanding the investment is crucial for finance teams:

Professional Plan ($20/month or $200/year)

- 300+ Pro Searches Daily – Perfect for intensive analysis

- Access to multiple latest AI models

- Reasoning models

- Unlimited file uploads for financial documents

- $5/month in API credits included

- Ad-free experience with priority processing

Max Plan ($200/month or $2,000/year)

- Unlimited access to latest AI models

- Unlimited Labs usage for dashboard creation

- Early access to new features

- Priority support for critical analysis

Enterprise Pro ($40/month per seat)

- Team collaboration features

- Advanced security and compliance

- Centralized billing and admin controls

- SOC 2 Type II compliance

For most financial analysts, the Pro plan delivers exceptional ROI—replacing multiple expensive subscriptions while providing superior analytical capabilities.

ROI Calculation: 95%+ cost savings vs. traditional stack ($57,000/year → $240-2,400/year)

Perplexity Finance: Core Capabilities 🚀

1. Real-Time Market Analysis

Ask about drivers behind price moves or commodity swings and get concise, cited answers. The platform excels at pulling live stock quotes, earnings summaries, peer comparisons, and SEC filings—providing a clean snapshot of any company with price, P/E ratio, market cap, dividend yield, and contextual summaries.

2. Earnings Summarization

Feed a 30-page earnings call into Perplexity and receive bullet-point highlights in seconds. Users can ask follow-up questions like “What caused revenue to decline?” and receive context-aware answers that cite credible sources.

3. Sector-Specific Research

Whether forecasting semiconductor demand or analyzing biotech TAM, Perplexity pulls recent news, whitepapers, and industry reports without paywalls. The platform balances speed and accuracy—excelling at quick snapshots while acknowledging that deep quantitative analysis requires complementary tools.

4. Follow-Up Threads

Ask follow-up questions without repeating context—Perplexity remembers and adapts throughout the conversation, building on previous queries naturally.

5. Data Integrations

Leverage Financial Modeling Prep (FMP) API data, Google Finance, and Yahoo Finance for metrics. Pair Perplexity’s narrative output with Excel or FMP for raw numbers.

Share

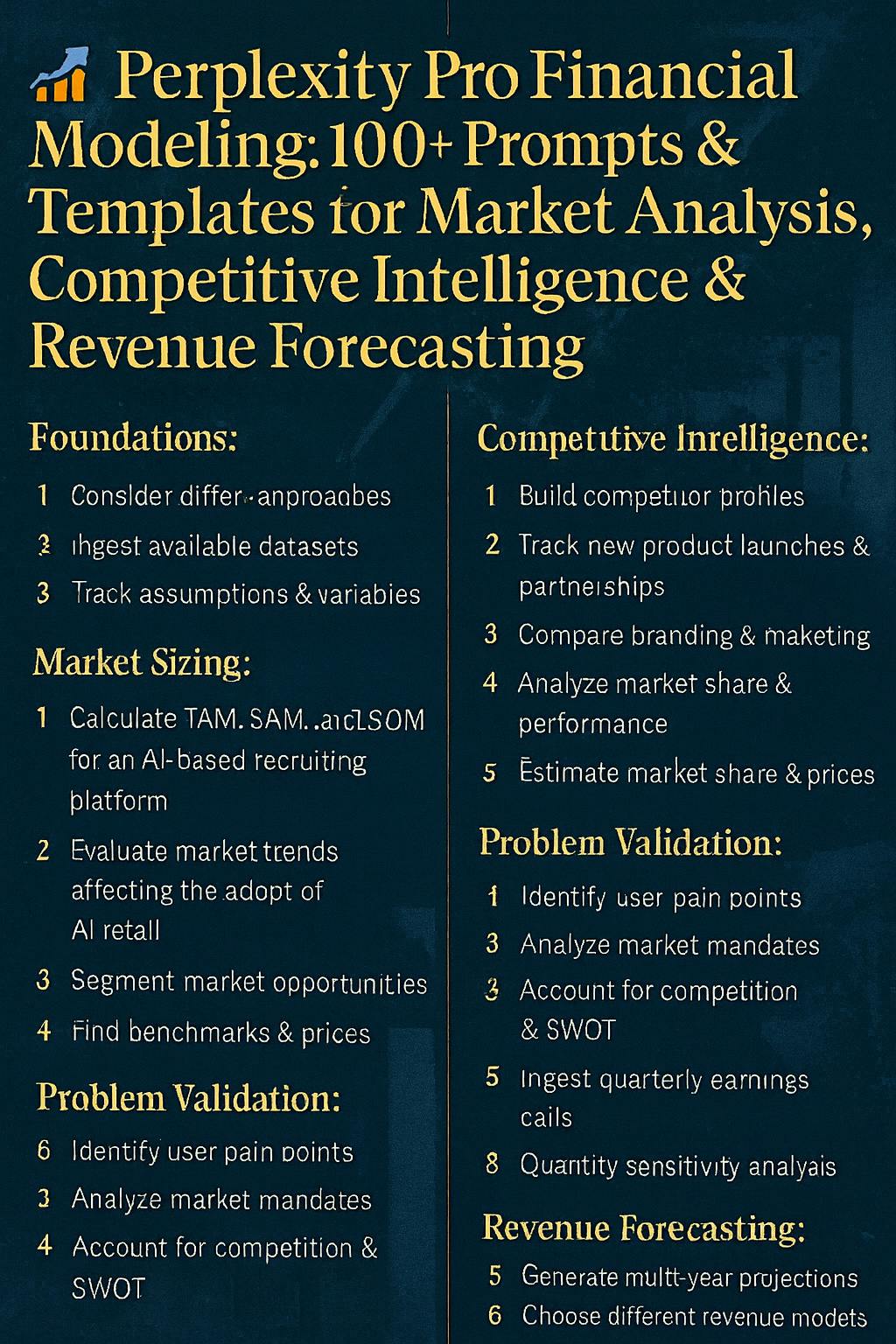

100+ Prompts for Market Analysis, Competitive Intelligence & Revenue Forecasting

Foundations: Assumptions, Definitions, Sources (12 Prompts)

1. Business Terms Glossary

“Define all business terms used in this analysis (ARPU, churn, net revenue retention, CAC payback, contribution margin). Return a glossary with formulas.”

2. Data Source Validation

“List credible data sources for [industry] demand, pricing, and adoption (government, trade groups, top research firms). Rank by reliability.”

3. Missing Data Checklist

“Given this data room (paste bullets/links), map what’s missing to build a defensible forecast. Output a ‘Missing Data’ checklist.”

4. Variable Sheet Creation

“Create a clean variable sheet for a revenue model. Include units, typical ranges, and sensitivity bounds for each variable.”

5. Scenario Assumptions

“Draft assumptions for base/bull/bear scenarios with rationale and sources.”

6. Data Dictionary

“Convert messy CSV headers into modeling-friendly names + a data dictionary.”

7. Assumption Tracking Template

“Build a template to log every assumption, the source, last updated date, and owner.”

8. Circular Reference Detection

“Flag any circular references in my current logic (paste formulas/code). Suggest fixes.”

9. Peer Set Selection

“Suggest peer sets (public + private) that match our business model and stage. Explain inclusion criteria.”

10. Audit Trail Format

“Create an audit trail format for every chart (source, query, extraction method, timestamp).”

11. Unit Economics Validation

“Validate my unit economics assumptions (CAC, LTV, payback period) against [industry] benchmarks. Flag any outliers.”

12. Assumption Sensitivity Matrix

“Build a sensitivity matrix showing how changes in key assumptions (growth rate, margin, discount rate) impact valuation. Rank assumptions by materiality.”

Share

Market Sizing & Macro Analysis (Top-Down) (35 Prompts)

Sector Overview & Macro Analysis

13. Comprehensive Market Overview

“Provide a current overview of the [industry] sector. Include market size, CAGR, top players and recent regulatory changes. Present the data in bullet points with citations.”

14. Growth Drivers & Headwinds

“Identify the primary growth drivers and risks facing the [industry] sector in the next 3 years. Summarize macroeconomic, technological and regulatory factors.”

15. Porter’s Five Forces Analysis

“Conduct a Porter’s Five Forces analysis for the [industry] sector, highlighting the bargaining power of suppliers and buyers, threat of substitutes, threat of new entrants and competitive rivalry.”

16. PESTEL Analysis

“Perform a PESTEL analysis for [industry] in the United States. List key political, economic, social, technological, environmental and legal factors.”

17. Cross-Sector Comparison

“Compare the performance of [industry A] vs [industry B] over the last 12 months using revenue growth, profitability and valuation multiples.”

18. Economic Impact Assessment

“Explain how rising interest rates are affecting [industry] companies’ margins and capital expenditures. Include examples from recent earnings calls.”

19. Geographic Trends

“Describe regional differences in [industry] growth across North America, Europe and Asia. Include market size and growth forecasts for each region.”

20. Emerging Markets Identification

“Identify emerging markets within [industry] that are poised for rapid growth. Provide supporting statistics and recent investment activity.”

21. Technology Disruption Analysis

“Analyze how [technology] is disrupting the [industry] sector. Discuss current use cases, adoption rate and future outlook.”

22. Consumer Sentiment Tracking

“Summarize recent consumer sentiment trends affecting [industry]. Include data from surveys, social media and spending patterns.”

- Commodity Impact Assessment

“Explain how changes in [commodity] prices impact companies in [industry]. Include sensitivity of margins and historical correlation.”

- FX Exposure Analysis

“Assess the foreign-exchange risk for [industry] companies with significant revenue outside the U.S. Highlight currency pairs and hedging practices.”

- Regulatory Watch

“What pending regulations or policy changes could materially impact the [industry] sector in the next 12 months? Summarize proposed laws and potential effects.”

- ESG Considerations

“Evaluate ESG considerations within the [industry] sector. Identify environmental risks, social issues and governance trends investors should watch.”

- Labor & Talent Dynamics

“Analyze talent shortages or labor cost pressures impacting [industry] companies. Provide data on wage trends, union activity and hiring challenges.”

- Capital Allocation Trends

“How are companies in [industry] allocating capital (R&D, dividends, share buybacks, M&A)? Provide examples and ratios.”

- Seasonality Analysis

“Describe seasonal patterns that influence revenue or demand in [industry]. Provide historical data and reasons behind the seasonality.”

- Demand Elasticity

“Assess the price elasticity of demand for major products in [industry]. Discuss how consumers respond to price changes.”

- Innovation Landscape

“List major innovations or breakthroughs expected in [industry] over the next 5 years and discuss potential market impact.”

- Investment Themes

“Identify top investment themes within [industry] (e.g., automation, sustainability). Provide examples of companies positioned to benefit.”

Market Sizing & Forecasting 33. Bottom-Up TAM Calculation

“Build TAM/SAM/SOM for [market], triangulating 3 methods (spend-based, incidence-based, proxy-based). Show math and citations.”

- Revenue Segmentation

“Break down [company]’s revenue by segment, geography and customer type. Highlight which segments are growing fastest.”

- Historical Growth Analysis

“Plot [industry] revenue growth over the past 10 years and identify inflection points. Explain drivers behind each trend.”

- 5-Year Forecast

“Forecast [industry] revenue through 2030 under base, optimistic and pessimistic scenarios. Outline assumptions and key variables.”

- Sensitivity Analysis

“Create a sensitivity analysis showing how [variable] (e.g., interest rates, demand growth) affects [industry]’s market size over 5 years.”

- Market Share Shift Modeling

“Estimate potential market share shifts among top [industry] players if [event] occurs (e.g., regulatory change, new technology). Present results in a table.”

- Cost Structure Benchmarking

“Compare cost structures (COGS, SG&A, R&D) of leading [industry] companies. Highlight reasons for differences.”

- Pricing Strategy Research

“Research pricing strategies used in [industry] (subscription, freemium, tiered). Analyze pros and cons and cite examples.”

- Customer Acquisition Costs

“What are typical customer acquisition costs (CAC) in [industry]? Compare CAC vs lifetime value (LTV) across companies.”

- Distribution Channel Analysis

“Identify primary distribution channels for [product] in [region]. Discuss margins and growth outlook for each channel.”

- M&A Landscape Review

“Summarize notable M&A transactions in [industry] over the last 3 years. Include deal size, rationale and market reaction.”

- Fundraising Environment

“Analyze venture capital funding trends in [industry]. Provide data on deal count, average round size and active investors.”

- Valuation Multiples Comparison

“Compare valuation multiples (EV/EBITDA, P/E, P/S) across top [industry] companies and discuss reasons for differences.”

- Supply Chain Analysis

“Identify key suppliers and bottlenecks for [industry]. Discuss how supply constraints have affected revenue and margins.”

- Global Peer Benchmarking

“Benchmark [company] against international peers in [industry] using profitability, leverage and growth metrics.”

Competitive Intelligence & Strategic Positioning (40 Prompts) Competitor Profiling 48. Company Snapshot

“Create a concise profile for [competitor]. Include products/services, total revenue, growth rate, geographic footprint and recent strategic moves.”

- SWOT Analysis

“Conduct a SWOT analysis for [competitor] relative to [your company]. Focus on technology, market positioning and financial strength.”

- Product Portfolio Mapping

“List [competitor]’s products by category and compare them with [your company]. Highlight gaps, overlaps and pricing differences.”

- Leadership Review

“Profile [competitor]’s executive team. Include background, tenure and notable strategic decisions.”

- Financial Health Check

“Summarize [competitor]’s financial health—revenue growth, profitability, leverage and liquidity metrics—over the last 3 years.”

- Funding History

“Describe [competitor]’s funding rounds (VC investments, debt issuance). Include amounts, investors and valuations where available.”

- Talent Trends

“Compare workforce size, headcount growth and Glassdoor ratings for [competitor] vs [your company]. Identify hiring advantages.”

- Patents & IP Assessment

“Identify major patents or intellectual property held by [competitor] and assess how they create competitive moats.”

- Channel Strategy Analysis

“Analyze [competitor]’s distribution channels (direct sales, partners, e-commerce) and compare efficiency and margins to [your company].”

- Brand Perception Evaluation

“Evaluate brand perception of [competitor] via customer reviews, NPS scores and social-media sentiment. Compare with [your company].”

Strategic Moves & Innovation 58. New Product Launch Analysis

“Assess the potential impact of [competitor]’s new [product/service] on your market share. Include target audience, pricing and early adoption signals.”

- M&A Strategy Review

“List recent acquisitions by [competitor] and analyze how each deal fits into its long-term strategy. Discuss integration challenges.”

- Partnership Ecosystem

“Identify key partnerships formed by [competitor] (technology alliances, distribution deals). Evaluate strategic benefits and risks.”

- R&D Investment Analysis

“Compare [competitor]’s R&D spend (as % of revenue) with industry averages. Discuss how this influences innovation pipeline.”

- Patent Filing Trends

“Analyze [competitor]’s patent filings over the past five years. Identify technology areas with increased focus.”

- Customer Acquisition Strategy

“How does [competitor] acquire customers (paid media, referral programs, product-led growth)? Estimate CAC and retention rates.”

- Pricing War Assessment

“Assess the likelihood of a price war between [competitor] and [your company]. Model the impact on margins and market share.”

- Product Roadmap Inference

“Infer [competitor]’s product roadmap based on recent announcements, job postings and partnerships.”

- International Expansion Analysis

“Evaluate [competitor]’s international expansion plans. Identify priority markets, entry strategies and local partnerships.”

- Supply Chain Resilience

“Compare supply-chain diversification and resilience for [competitor] vs [your company]. Identify vulnerabilities.”

- Sales Organization Structure

“Describe [competitor]’s sales organization (inside vs field, vertical teams, channel partners). Contrast with your approach.”

- Customer Churn Analysis

“Estimate [competitor]’s customer churn rate and reasons for attrition based on reviews, case studies and market chatter.”

Benchmarking & Performance Tracking 70. Competitive Benchmarking Table

“Create a benchmarking table comparing [company], [competitor 1], [competitor 2] across KPIs such as revenue growth, gross margin, R&D ratio, and NPS.”

- Feature Gap Analysis

“Identify feature gaps in [company]’s product versus [competitor]. Recommend features to close the gaps.”

- Pricing Comparison Matrix

“Build a pricing comparison matrix for [company] and [competitors]. Include plan tiers, pricing and key features.”

- Market Share Trends

“Visualize market-share trends of [company] vs [competitor] over the last five years. Discuss reasons for gains or losses.”

- Profitability Comparison

“Compare EBITDA margins of [company] and [competitor]. Analyze cost structures and economies of scale.”

- ESG Performance Benchmark

“Evaluate ESG ratings and sustainability initiatives for [company] vs [competitor]. Highlight differences and investor sentiment.”

- NPS & Customer Loyalty

“Compare Net Promoter Scores (NPS) and retention rates across [company] and its main competitors.”

- User Experience Review

“Conduct a user-experience analysis of [company] and [competitor] by aggregating app store reviews and UX critiques.”

- Support Quality Comparison

“Compare customer support response times, channels (chat, phone) and satisfaction scores for [company] and [competitor].”

- Emerging Players Assessment

“Identify emerging startups challenging [company]. Compare their offerings, pricing and funding traction.”

Advanced Competitive Intelligence 80. Comprehensive Financial Analysis

“Conduct a detailed financial analysis of [Competitor] including: 5-year revenue and profitability trends, cash flow analysis, balance sheet strength, debt structure, working capital management, return on invested capital, and compare against industry benchmarks. Identify financial strengths and vulnerabilities.”

- Market Share Evolution

“Track [Competitor]’s market share evolution in [Market] over the past 5 years including: share gains/losses by segment, competitive responses, pricing strategy impact, and forecast future share trajectory based on current strategies.”

- Strategic Direction Assessment

“Analyze [Competitor]’s strategic initiatives over the past 2 years including: new market entries, product launches, partnership agreements, organizational changes, and evaluate success rates and strategic coherence.”

- Innovation Capability Evaluation

“Evaluate [Competitor]’s innovation capabilities including: R&D spending levels and trends, patent portfolio strength, product pipeline analysis, technology partnerships, and time-to-market performance compared to industry standards.”

- Digital Transformation Progress

“Assess [Competitor]’s digital transformation progress including: technology investments, digital revenue streams, operational digitization, customer experience improvements, and compare digital maturity to industry leaders.”

- Management Quality Assessment

“Evaluate [Competitor]’s management team including: leadership track record, strategic execution capability, communication effectiveness, governance practices, and compare to industry leadership standards.”

- Competitive Response Analysis

“Analyze how [Competitor] responds to competitive threats including: response speed, strategic flexibility, defensive capabilities, and historical effectiveness of competitive responses.”

- Customer Base Deep Dive

“Assess [Competitor]’s customer base including: customer concentration risk, retention rates, lifetime value trends, acquisition costs, and customer satisfaction metrics. Compare customer economics to industry benchmarks.”

Revenue Forecasting & Financial Modeling (40 Prompts) Revenue & Margin Forecasting 88. 5-Year Revenue Forecast Model

“Create a 5-year revenue forecast for [company] using historical growth rates and market trends. Provide base, bear and bull cases.”

- Segment-Level Forecast

“Project revenue for [company] by product segment and region. Identify segments with accelerating growth.”

- Driver-Based Revenue Model

“Build a driver-based revenue model for [company]. Identify key drivers (ARPU, customer count) and show sensitivity tables.”

- Seasonality Adjustment

“Adjust [company]’s revenue forecast for seasonal patterns. Explain methodology and underlying factors.”

- Gross Margin Forecast

“Forecast gross margin for [company] over the next 3 years. Include cost-inflation assumptions and potential productivity gains.”

- Operating Expense Projection

“Project SG&A and R&D expenses for [company] as a percentage of revenue over five years. Discuss scaling effects.”

- Projected Income Statement

“Construct a 5-year projected income statement for [company] including revenue, COGS, gross profit, operating expenses, EBIT and net income. Present base and alternative scenarios.”

- Cash Flow Forecast

“Develop a free cash-flow (FCF) forecast for [company]. Include working-capital changes, capex and depreciation assumptions.”

- EBITDA Bridge

“Create an EBITDA bridge from current year to forecast year showing contributions from revenue growth, cost savings and mix changes.”

- Break-Even Analysis

“Perform a break-even analysis for [new product] at different price points and unit volumes. Plot results.”

- Unit Economics Model

“Calculate unit economics (CAC, lifetime value, gross margin) for [company]’s subscription product. Model payback periods.”

- Pricing Elasticity Model

“Build a model showing how revenue for [product] changes under different price points. Discuss elasticity and optimal price.”

- Upsell & Churn Projections

“Forecast upsell revenue and churn impact on total revenue for [company] over three years. Provide assumptions.”

- ARPU Evolution

“Analyze average revenue per user (ARPU) trends for [company] and forecast ARPU over the next two years.”

- Revenue Mix Analysis

“Break down [company]’s revenue into recurring and one-time streams. Forecast the mix change over five years.”

- Cost of Capital Sensitivity

“Evaluate how changes in weighted average cost of capital (WACC) affect [company]’s net present value. Provide a sensitivity table.”

- FX Impact Modeling

“Model the effect of a ±10% change in [currency] on [company]’s revenue. Include hedging strategies.”

Cohort Analysis & Customer Economics 105. Cohort Table Construction

“Construct cohort tables by signup month with gross churn, net churn, expansion.”

- LTV Calculation (Three Methods)

“Estimate LTV using 3 methods (simple, cohort survival, contribution margin).”

- Churn Driver Attribution

“Break down churn drivers (product, price, support) with attribution bounds.”

- CAC by Channel Analysis

“Model CAC by channel with decay curves and saturation points.”

- CAC Payback & Rule of 40

“Compute CAC payback and Rule of 40; benchmark vs peers.”

- NRR Driver Forecast

“Forecast NRR drivers (seats, usage, add-ons); show waterfall.”

- Early Warning Churn Signals

“Build early-warning churn signals (usage downshift, ticket spikes).”

- Onboarding Impact on Retention

“Quantify impact of onboarding time on 6-month retention.”

- Trial Conversion Simulation

“Simulate trial length and PQL thresholds on conversion.”

- Partner Pipeline Quality

“Estimate partner-sourced pipeline quality vs direct.”

- Renewal Playbook by Segment

“Create a renewal playbook by segment risk score.”

- Referral Loop Modeling

“Model referral loop effects on blended CAC.”

- Cohort-Normalized ARPU

“Cohort-normalize ARPU and expansion to avoid Simpson’s paradox.”

Scenario Analysis & Valuation 118. Macro Scenario Analysis

“Create scenarios for [company]’s revenue based on high-inflation, recession and recovery macro environments. Summarize key impacts.”

- Competitive Shock Scenario

“Model how [company]’s revenue would change if [competitor] cuts prices by 20%. Show market-share effects.”

- Regulatory Change Scenario

“Assess revenue impact if a new regulation limits [company]’s ability to sell [product] in [region].”

- Technological Disruption Scenario

“Model revenue changes for [company] if [technology] becomes mainstream and replaces current offerings.”

- Market Downturn Stress Test

“Stress test [company]’s revenue and margins under a market downturn similar to the 2008 recession.”

- DCF Valuation

“Perform a discounted cash-flow valuation for [company] using your FCF forecast. Provide assumptions for WACC and terminal growth.”

- Relative Valuation

“Calculate valuation multiples (EV/EBITDA, P/E) for [company] and compare them to peer averages. Discuss whether the stock is over- or undervalued.”

- Comparable Company Analysis

“Identify a peer set for [company], compile trading multiples and compute an implied valuation range.”

- LBO Model Outline

“Outline a simplified LBO model for acquiring [company]. Include purchase price, leverage assumptions, exit multiple and IRR estimation.”

- Real Options Valuation

“Use a real-options approach to value [project] for [company]. Explain factors like volatility and time to expiration.”

Risk, Compliance & Advanced Analysis (Additional Prompts) 128. Risk Factor Analysis

“List the major risk factors disclosed by [company] in its latest 10-K or annual report. Summarize how each risk could impact revenue.”

- Inflation Impact Assessment

“Analyze how inflation trends are affecting input costs and pricing power for [industry] companies. Provide examples from earnings calls.”

- Interest Rate Sensitivity

“Assess how different interest-rate scenarios (e.g., +50 bps, +100 bps) would affect [industry]’s cost of capital and profitability.”

- Demographic Trends Analysis

“Examine demographic shifts influencing [industry] demand (ageing population, Gen Z preferences). Provide data and projections.”

- Historical Returns Distribution

“Calculate the historical distribution of returns for [industry] stocks over 10 years. Identify periods of high volatility and their causes.”

- Social Media Sentiment

“Analyze social-media sentiment for [company] over the past month. Include key themes, influencer commentary and sentiment scores.”

- News Impact Summary

“Summarize the most significant news stories impacting [industry] this week and analyze their effect on stock performance.”

- Analyst Consensus Compilation

“Compile analyst consensus on [company]’s revenue and EPS forecasts for the next 4 quarters. Highlight any diverging opinions.”

- Earnings Preview

“Provide a pre-earnings analysis for [company]’s upcoming quarter. Include whisper numbers, recent guidance and market expectations.”

- Whisper vs. Actual Analysis

“Compare [company]’s actual earnings results to whisper numbers and analyst expectations over the last 4 quarters. Discuss market reaction.”

- Trading Volume Anomalies

“Identify abnormal trading volume in [industry] stocks over the past month and hypothesize reasons for the spikes.”

- Insider Transaction Analysis

“List recent insider buying or selling activity for [company]. Discuss whether transactions signal confidence or concern.”

- Short Interest Assessment

“Assess the short interest ratio for [company] and analyze trends over the last year. Discuss what it indicates about investor sentiment.”

- Sentiment vs. Fundamentals

“Evaluate whether current sentiment around [company] aligns with underlying financial performance. Provide evidence.”

- News-Price Correlation

“Perform a correlation analysis between news sentiment scores and [company]’s stock price changes over the last 6 months.”

- Policy Impact Evaluation

“Summarize the SEC’s new [regulation] and its impact on [industry]. Provide compliance deadlines and potential penalties.”

- Geopolitical Risk Analysis

“Analyze how current geopolitical tensions (e.g., U.S.–China relations, Russia sanctions) affect [industry] supply chains and exports.”

- Tax Policy Impact

“Explain how proposed tax reforms would affect capital structure and after-tax earnings for [industry] companies.”

- Climate Regulation Assessment

“Assess the impact of climate disclosure rules on [industry]. Highlight additional reporting requirements and associated costs.”

- Labor Legislation Impact

“How might new labor laws (minimum-wage changes, gig-economy rules) influence the profitability of [industry] firms?”

Mastering Perplexity Labs & Templates: Your Financial Dashboard Factory 🎯 If Deep Search is your supersmart research assistant, Perplexity Labs is your full-blown automated research workshop. Labs allow you to chain together searches, data processing, code execution, and content generation into one cohesive project.

What Perplexity Labs Really Is Perplexity Labs is an automated research engine and app studio in one. Instead of answering a single question, a Lab can produce an entire multi-component project for you.

A single Lab can:

Fetch the latest data from the web

Run Python code to crunch numbers

Generate charts and visualizations

Compile everything into an HTML report

Prepare a shareable interactive dashboard

All outputs are packaged in an Assets folder ready to download or share—no more scattered files.

Core Labs Features 🚀

- Multi-Asset Generation A single Labs session can output multiple files—PDF reports, CSV data exports, interactive HTML dashboards, or code notebooks. All accessible in the Labs Assets tab.

Example: Generate a neatly formatted PDF report AND supporting CSV data exports from one run.

- Deep Toolset Integration Labs combines natural language queries with actual coding and web scraping:

Retrieve live stock data via API

Run calculations (CAGR, NPV, IRR) in Python

Generate Matplotlib or Plotly charts

Have the language model write executive summaries

All chained together automatically.

- Full Traceability

Every piece of content is traceable with cited sources

All code can be inspected

Underlying data for charts is visible

Perfect for auditing: “where did this number come from?”

Core Template Features 📑

- Curated Prompt Library Perplexity’s team and community have contributed dozens of ready-made Templates:

Market Overview Report

Competitor SWOT Comparison

Product Launch Analysis

Investor Relations Q&A prep

Financial Dashboard Builder

- One-Click Duplication See a template you like? Click Duplicate and it’s now in your account, fully editable. Never start from scratch if a similar project exists.

- Cross-Model Flexibility Templates are model-agnostic. Whether you use GPT-5, Claude, or Sonar, the template’s logic adjusts. You choose which model handles each step.

Why Labs + Templates Matter for Finance The Old Routine:

Google searches

CSV downloads

Manual Excel manipulation

Slide deck tweaking

Rinse and repeat for every project

With Labs:

Define what you need upfront

Let AI assemble it

Spend time interpreting results and formulating strategy

Benefits:

Time savings: Multi-hour research → minutes

Consistency: Every report follows the same high-quality structure

Focus: Eliminate low-level busywork, concentrate on insights

Signal over noise: Get exactly what you ask for, skip the fluff

23 Real-World Labs Use Cases for Financial Professionals Investment Analysis & Research

- Company Profile Builder

“Generate comprehensive profile for [Target Company] including: financial highlights from last 3 years, management team backgrounds, market position analysis, recent strategic moves, competitive advantages, and key risk factors. Include charts for revenue trends and margin evolution. Provide downloadable PDF and supporting CSV data.”

- M&A Case Study Generator

“Create M&A precedent analysis for [Industry/Target Type]. Research transactions from past 3 years, compile deal metrics (EV/Revenue, EV/EBITDA multiples), analyze strategic rationale, and assess post-merger performance. Output: comparison table, valuation range analysis, and executive summary report.”

- Earnings Analysis Dashboard

“Build interactive earnings analysis dashboard for [Company]. Include: historical EPS trends, revenue growth by segment, margin evolution, consensus vs. actual performance, and forward guidance tracking. Generate with downloadable Excel model and presentation-ready charts.”

- Sector Rotation Tracker

“Create sector rotation analysis dashboard showing: performance of 11 S&P sectors over past 6 months, factor attribution (growth vs value), correlation with economic indicators, and forward-looking positioning recommendations. Include interactive charts and export capability.”

- DCF Valuation Model Builder

“Build comprehensive DCF valuation model for [Company] including: 10-year revenue projections, margin assumptions, working capital calculations, capex forecasting, terminal value computation, WACC calculation with supporting schedules, and sensitivity analysis. Output: Excel model + executive summary.”

Competitive Intelligence 6. Competitive Landscape Dashboard

“Design competitive intelligence dashboard for [Industry] showing: market share evolution over time, financial performance comparisons (revenue, margins, growth), valuation multiple trends, M&A activity tracker, product launch timeline, and sentiment analysis from earnings calls. Make it interactive with drill-down capabilities.”

- Product Feature Comparison Matrix

“Create detailed product comparison for [Product Category] analyzing [Company A, B, C, D]. Build matrix covering: feature set, pricing tiers, target customers, integration capabilities, user ratings, and market positioning. Include visual comparison charts and downloadable spreadsheet.”

- Pricing Strategy Analyzer

“Analyze pricing strategies across [Industry] competitors. Research pricing models (subscription, usage-based, tiered), compare pricing levels, assess value metrics, and identify pricing power indicators. Output: pricing comparison table, strategic recommendations, and trend analysis.”

Portfolio & Risk Management 9. Portfolio Performance Dashboard

“Build portfolio performance dashboard that tracks: individual stock performance vs. benchmarks, sector allocation and attribution, risk metrics (VaR, beta, Sharpe ratio), dividend yield tracking, ESG scoring for holdings, and performance attribution analysis. Include rebalancing recommendations and export to PDF.”

- Risk Monitoring System

“Create comprehensive risk dashboard including: portfolio VaR calculations, stress testing results under multiple scenarios, correlation breakdown analysis, concentration risk assessment, factor exposure analysis, and early warning indicators. Generate with real-time data refresh capability.”

- ESG Investment Tracker

“Build ESG investment analysis dashboard for portfolio holdings including: ESG ratings by company, sustainable investing trend analysis, regulatory compliance tracking, performance impact of ESG factors, carbon footprint analysis, and improvement recommendations with peer comparisons.”

Market Research & Analysis 12. Industry Deep Dive Report

“Create comprehensive industry research report on [Industry] including: market size and growth projections, competitive landscape with market shares, key trends and drivers, regulatory environment, technology disruptions, M&A activity, valuation analysis, and investment implications. Output: 20-page report + supporting data files.”

- Economic Indicators Dashboard

“Design interactive dashboard monitoring global economic indicators including: GDP growth by country/region, inflation rates, unemployment, central bank rates, manufacturing PMI, consumer confidence. Allow comparison across countries, trend analysis over 5 years, and correlation with market performance.”

- Sentiment Analysis Tracker

“Build real-time sentiment analysis tool for [Company/Sector] aggregating: social media sentiment, news article tone, analyst report sentiment, earnings call transcripts, and insider trading patterns. Visualize sentiment trends and correlate with stock price movements.”

- M&A Deal Tracker

“Create M&A activity dashboard for [Industry] tracking: announced and completed deals, deal values and multiples, strategic rationale categorization, acquirer/target profiles, financing structures, and post-deal performance analysis. Include filters by deal size, geography, and timeframe.”

Financial Modeling & Forecasting 16. Revenue Forecasting Model

“Build driver-based revenue forecasting model for [Company] including: historical trend analysis, key driver identification (units, pricing, market share), scenario modeling (base/bull/bear), seasonality adjustments, and sensitivity analysis. Output: Excel model with charts and assumptions documentation.”

- LBO Analysis Model

“Create leveraged buyout analysis for [Target Company] including: entry valuation, optimal capital structure, debt capacity analysis, operational improvement opportunities, exit scenarios, IRR sensitivity to key variables, and sources & uses table. Generate complete LBO model with returns analysis.”

- Trading Strategy Backtester

“Model trading strategy performance for [Strategy Description]. Build backtesting framework including: entry/exit rules, position sizing, risk management, historical performance across market regimes, drawdown analysis, and comparison to buy-and-hold. Include interactive charts and performance statistics.”

Client Reporting & Presentations 19. Investment Committee Deck Generator

“Prepare Investment Committee presentation for [Investment Opportunity] including: investment thesis, market opportunity analysis, competitive positioning, financial projections, valuation analysis, risk assessment, and recommendation. Output: PowerPoint deck with supporting appendix and data room.”

- Quarterly Investor Update

“Create quarterly investor update for [Fund/Portfolio] including: performance summary vs. benchmarks, top contributors/detractors analysis, portfolio positioning changes, market outlook, notable investments/exits, and forward strategy. Generate professional presentation deck with charts.”

- Client Portfolio Review

“Build client portfolio review report including: performance attribution, holdings analysis, risk metrics, ESG profile, tax efficiency analysis, rebalancing recommendations, and market outlook. Create presentation-ready deck with executive summary and detailed appendix.”

Data Analysis & Visualization 22. Financial Statement Analyzer

“Analyze uploaded 10-K filing and create: summary of key financial highlights, year-over-year changes dashboard, segment performance breakdown, cash flow analysis, balance sheet strength assessment, management discussion insights extraction, and risk factor identification. Output: interactive dashboard + PDF report.”

- Earnings Call Transcript Synthesizer

“Process earnings call transcript and extract: key financial metrics mentioned with YoY comparisons, management guidance updates, analyst question themes, competitive commentary, strategic initiative updates, and sentiment analysis of management tone. Create structured summary with key quotes and supporting data.”

Automating Your Financial Intelligence: Perplexity Tasks 🔔 Perplexity Tasks turn one-time analyses into recurring automated intelligence. Set research to run on your schedule and receive distilled insights automatically.

My Daily Finance Update System 📈 Morning Market Brief (6:00 AM daily)

“Summarize market-moving news from the last 16 hours including: major earnings releases with surprise analysis, significant M&A announcements, regulatory developments affecting financials, central bank communications, commodity price movements, and sector rotation activity. Focus on actionable insights for equity portfolio management.”

Market Open Pulse (9:30 AM)

“Check $[WATCHLIST] opening prices and pre-market trading. If any stock moved >3%, explain why (earnings, news, analyst changes). Note major index futures movement and any 8:30 AM economic data releases. Format as 5-7 bullets with source links.”

Competitor Watch (Weekly – Fridays 3:00 PM)

“Check [Competitor 1, 2, 3] for: new features/products launched, pricing changes, notable social media complaints, executive changes, partnerships announced. Summarize 3-5 key findings per company with source links and strategic implications.”

Earnings Season Tracker (During earnings season – Daily)

“List companies reporting earnings tomorrow from my watchlist. Provide: consensus estimates, whisper numbers, historical beat/miss patterns, options positioning, key topics to watch. Flag highest impact releases.”

Economic Data Alerts (Weekdays 8:35 AM)

“Check if major economic data was released (jobs report, CPI, GDP, Fed decision). If yes, summarize the numbers, compare to expectations, note immediate market reaction. If none, confirm ‘No major releases today.’”

20 Essential Financial Tasks to Automate Daily Market Intelligence

- Tech Sector Brief

“Every morning at 7 AM, search for significant movements in mega-cap tech stocks (AAPL, MSFT, GOOGL, META, NVDA, TSLA). If any moved >2% overnight, explain why with news/earnings context. Include Bitcoin/Ethereum price action.”

- Fixed Income Update

“Daily at 8 AM, summarize: 10-year Treasury yield changes, credit spread movements (IG, HY), any Fed speaker comments, and implications for equity valuations. Keep to 5 bullets.”

- Commodity Monitor

“Each morning, track: crude oil, gold, copper prices. If any moved >1.5%, explain drivers (supply, demand, geopolitics). Include dollar index movement.”

- Crypto Market Pulse

“At 9 AM and 5 PM, track Bitcoin, Ethereum, and top 10 altcoins. Note: 24-hour price changes, any regulatory news, major exchange flows, and significant liquidations.”

- Pre-Market Mover Analysis

“At 9:15 AM, identify top 10 pre-market gainers/losers in S&P 500. For each, provide one-line explanation with news/earnings catalyst.”

Weekly Strategic Analysis 6. Sector Rotation Digest

“Every Monday at 9 AM, analyze prior week’s sector performance. Include: best/worst performers, factor attribution (growth/value, size), economic sensitivity analysis, and positioning recommendations for the week ahead.”

- Earnings Calendar Preview

“Each Sunday evening, preview the upcoming week’s major earnings releases. Include: company names, expected report dates, consensus estimates, key metrics to watch, and potential market impact.”

- Options Flow Analysis

“Every Friday at 3 PM, summarize unusual options activity for the week in mega-cap tech. Include: volume spikes, put/call ratio shifts, large block trades, and institutional positioning signals.”

- Insider Trading Report

“Weekly on Thursday, compile insider transactions >$1M for S&P 500 companies. Categorize by: buying vs. selling, C-suite vs. board, and cluster analysis by sector.”

- Analyst Rating Changes

“Every Monday, summarize all analyst upgrades/downgrades from prior week for coverage universe. Include: rating changes, price target adjustments, and rationale highlights.”

Monthly Deep Dives 11. Portfolio Performance Review

“First Monday of each month, analyze portfolio performance: returns vs. benchmarks, attribution by position and sector, top contributors/detractors, and rebalancing recommendations.”

- Valuation Monitor

“Monthly, update valuation multiples for coverage universe. Track: P/E, EV/EBITDA, P/S trends. Flag stocks trading at historical extremes (>2 std dev).”

- Economic Indicators Dashboard

“First of each month, compile: prior month’s key economic data (jobs, inflation, manufacturing, consumer confidence), compare to forecasts, and assess implications for Fed policy and markets.”

- Short Interest Analysis

“Mid-month, analyze short interest changes for watchlist. Flag: new heavily shorted names (>20% SI), significant changes (>5pp), and potential squeeze candidates.”

Competitive Intelligence 15. Product Launch Monitor

“Weekly on Tuesday, scan for product launches, updates, or announcements from key competitors. Include: feature highlights, pricing, target market, and competitive positioning implications.”

- Patent Filing Tracker

“Monthly, check patent filings from competitors in key technology areas. Summarize: new applications, granted patents, and strategic technology focus areas.”

- Executive Movement Alert

“Weekly, track C-suite and senior executive changes at competitors and within industry. Include: new hires, departures, promotions, and strategic implications.”

Risk Monitoring 18. Geopolitical Risk Scan

“Daily at 6 PM, summarize: major geopolitical developments, trade policy changes, sanctions updates, and potential market impacts. Focus on: US-China, Russia-Ukraine, Middle East.”

- Regulatory Alert System

“Weekly on Wednesday, monitor: new SEC filings/rules, Congressional financial legislation, industry-specific regulatory changes. Summarize impact on coverage sectors.”

- Credit Market Watch

“Daily at 4 PM, track credit market indicators: HY spreads, default rates, distressed debt levels, covenant-lite issuance. Alert if any metric crosses threshold.”

Advanced Perplexity Pro Features for Financial Modeling 🚀 File Upload and Analysis Capabilities Perplexity Pro’s ability to analyze uploaded financial documents revolutionizes how analysts process information:

10-K/10-Q Deep Analysis

“Analyze the uploaded 10-K filing and provide: summary of key financial highlights, year-over-year changes in major line items, management discussion insights, risk factor changes compared to prior year, segment performance analysis, and identify potential red flags or opportunities. Create comparison table and executive summary.”

Earnings Call Transcript Synthesis

“Process this earnings call transcript and extract: key financial metrics mentioned with historical context, management guidance updates and changes, analyst concerns and management responses, competitive commentary, strategic initiative updates, and sentiment analysis of management tone. Provide structured summary with key quotes.”

Financial Model Review & Enhancement

“Review this uploaded financial model and provide: assumption reasonableness assessment, calculation accuracy check, circular reference identification, sensitivity analysis recommendations, scenario modeling suggestions, and benchmark comparisons with industry standards. Suggest improvements and flag risks.”

Excel Formula Generation

“Generate Excel formulas and VBA code to: automate data pulls from public APIs, create dynamic charts for financial presentations, build sensitivity analysis tables, implement Monte Carlo simulations for risk modeling, and create scenario switchers for dashboard presentations.”

Real-World Implementation Strategies Morning Market Briefing Automation Daily Workflow (15 minutes total):

6:00 AM – Morning Brief

“Search financial markets news from last 16 hours globally. Focus on:

Major index movements (US, Europe, Asia) with explanations

Significant earnings beats/misses with market reactions

Economic data releases and central bank comments

Sector rotation and factor performance

Material corporate actions (M&A, buybacks, dividends)

Present 7-10 bullets with context and source links. Skip minor noise.”

9:30 AM – Portfolio Risk Check

“Analyze risk factors affecting portfolio holdings [LIST]:

Overnight news impact

Analyst recommendation changes

Technical indicator warnings

Sector headwind developments

Correlation breakdown risks

Flag high-priority items requiring action.”

4:00 PM – Market Close Summary

“Summarize today’s market action:

Index performance with attribution

Unusual volume or price movements

Earnings reaction analysis

Economic data impact

Key themes for tomorrow

Format as 5-7 actionable bullets.”

Investment Committee Preparation Use Perplexity Pro to streamline IC prep:

Research Phase:

Update financial models with latest data

Generate competitive positioning updates

Create scenario analysis for key decisions

Build risk assessment framework

Deliverable Creation:

Investment memo with thesis (Claude)

Financial model and scenarios (GPT-4)

Competitive analysis dashboard (Labs)

Risk assessment summary (Multi-model)

Q&A Preparation:

“Based on this investment proposal for [Company], generate 15 tough questions an Investment Committee would ask covering: valuation methodology, competitive risks, market assumptions, management quality, downside scenarios, and exit strategy. Provide strong answers with supporting data.”

Client Presentation Automation Leverage Labs for client-ready materials:

Automated Quarterly Review:

“Create comprehensive quarterly portfolio review including:

Performance vs. benchmarks with attribution

Holdings analysis with position changes

Risk metrics and ESG profile

Market outlook and positioning

Rebalancing recommendations

Generate: PowerPoint presentation + supporting data appendix + executive summary memo.”

Custom Research Reports:

“Build custom research report on [Topic] for client including:

Executive summary (1 page)

Market analysis (3-5 pages)

Competitive landscape (2-3 pages)

Investment implications (1-2 pages)

Supporting charts and data tables

Output: PDF report + editable PowerPoint + raw data CSV.”

The Honest Final Take 💭 After daily Perplexity Pro use for financial modeling, here’s what I know for sure:

Perplexity Pro isn’t perfect.

It occasionally makes calculation errors

Complex models require verification

Industry-specific nuances need validation

Not a complete replacement for specialized tools

But it’s also transformative.

95%+ cost savings vs. traditional stack

10+ hours weekly time reclaimed

Higher quality, more comprehensive analysis

Better decisions from deeper insights

Implementation Challenge: Prove the Value This Week 🎯 Don’t just read this—actually implement it.

Your Weekly Challenge: Pick ONE high-impact use case:

- [ ] Earnings analysis automation

- [ ] Competitor intelligence dashboard

- [ ] Client portfolio review

- [ ] Investment memo generation

- [ ] Market research report

Execute it with Perplexity Pro:

Use prompts from this guide

Build with Labs if needed

Set up Task automation

Compare to traditional method

Measure concrete results:

Time saved (hours)

Quality improvement (1-10 rating)

Comprehensiveness (sources used)

Cost savings (tools replaced)

Success Metrics:

✅ Save >2 hours on chosen task

✅ Match or exceed traditional quality

✅ Identify 2+ workflow improvements

✅ Document ROI for team presentation

Starter Prompts for Each Challenge: Earnings Analysis:

“Analyze [Company] Q[X] [Year] earnings including: results vs. consensus, key metric performance, segment analysis, guidance changes, management commentary themes, analyst Q&A insights, and forward implications. Compare to prior 4 quarters and provide investment perspective.”

Competitor Intelligence:

“Build competitive intelligence dashboard for [Your Company] vs [Competitor 1, 2, 3] including: product comparison matrix, pricing analysis, recent strategic moves, market share trends, financial performance comparison, and SWOT assessment. Output: interactive dashboard + summary report.”

Portfolio Review:

“Create quarterly portfolio review for [Client Portfolio] including: performance attribution vs. benchmark, top contributors/detractors, sector allocation analysis, risk metrics update, ESG profile, and rebalancing recommendations. Generate client-ready presentation.”

Investment Memo:

“Draft investment memo for [Company] including: investment thesis, business model analysis, competitive advantages, financial projections, valuation analysis (DCF + comps), key risks, and recommendation. Support with data and multiple scenarios.”

Market Research:

“Conduct comprehensive market research on [Industry/Topic] including: market size and growth, competitive landscape, key trends and drivers, regulatory environment, technology disruptions, and investment implications. Output: 15-page report with charts and data appendix.”

Final Thoughts: The Mindset Shift The biggest change isn’t the tool—it’s realizing you don’t have to do everything manually anymore.

Old Mindset: “I need to personally review every source, build every model, write every report to ensure quality.”

New Mindset: “AI handles research and synthesis. I focus on judgment, strategy, and client relationships.”

This isn’t about replacing analysts—it’s about amplifying them.

The analysts who thrive will be those who:

Master AI tools as force multipliers

Focus on high-value strategic work

Build on AI-generated insights

Validate and enhance AI output

Use freed time for relationship building

The question isn’t “Can AI do my job?”

The question is “How can I use AI to do my job 10x better?”