As second-quarter earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the design software industry, including Autodesk (NASDAQ:ADSK) and its peers.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse may still be more of a buzzword than a real thing, the demand for the tools to create these experiences is real. are games, 3D tours or interactive films.

The seven design software stocks we track reported a slower second quarter. As a group, revenues exceeded analyst consensus expectations by 1.9%, while revenue expectations for the next quarter were in line.

Inflation has recently risen toward the Fed’s 2% target, prompting the Fed to cut its policy rate by 50 basis points (half a percent or 0.5%) in September 2024. This is the first reduction in four years. While the CPI (inflation) numbers have been supportive lately, the employment measures have turned out to be almost worrisome. Markets will debate whether the timing of this rate cut (and more potential ones in 2024 and 2025) is ideal to support the economy, or whether it is a bit too late for a macro that has already cooled too much.

In light of this news, design software stocks have held steady, with share prices up an average of 3.6% since the last earnings results.

Autodesk (NASDAQ:ADSK)

Autodesk (NASDAQ:ADSK), founded in 1982 by John Walker and becoming one of the industry’s behemoths, makes computer-aided design (CAD) software for engineering, construction and architecture companies.

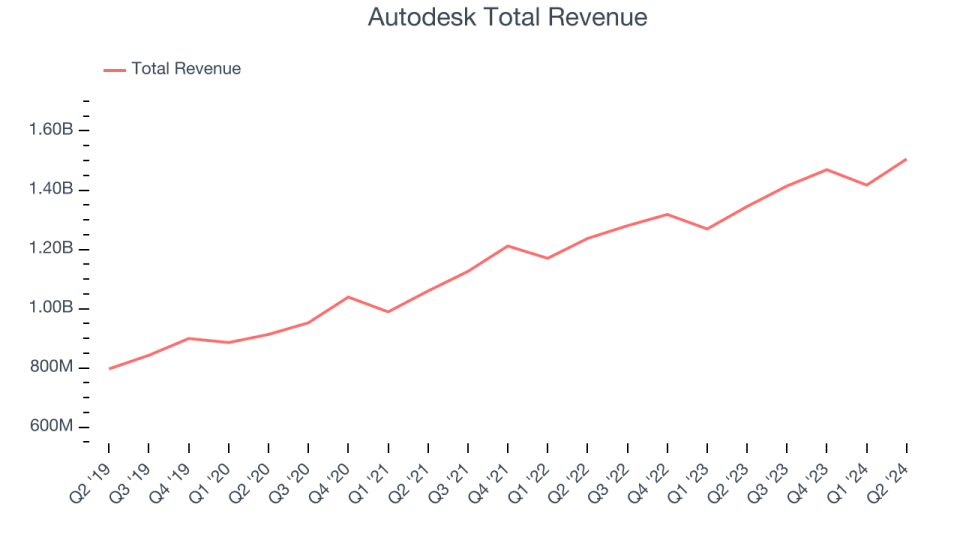

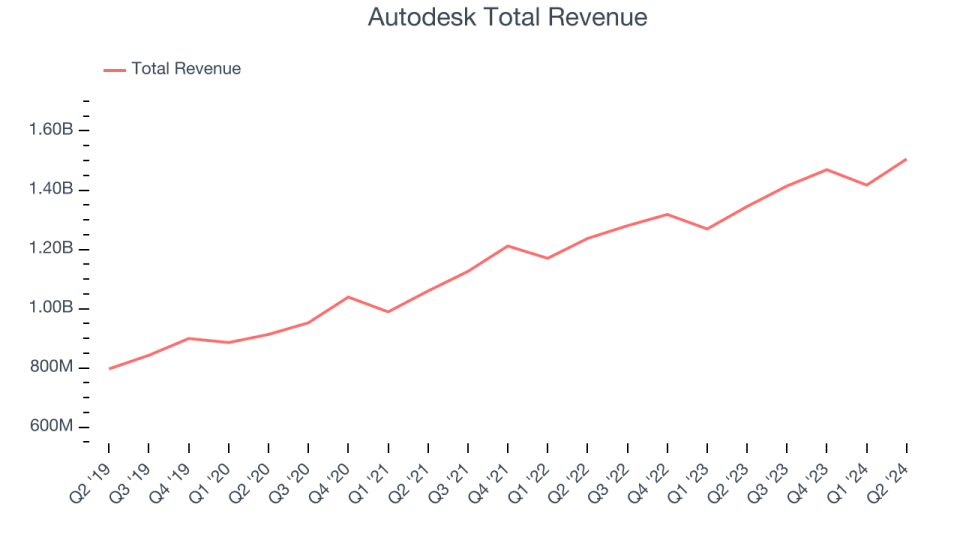

Autodesk reported revenue of $1.51 billion, up 11.9% year over year. This print exceeded analyst expectations by 1.5%. Despite the revenue increase, it was still a slower quarter for the company, missing analyst billings and annual recurring revenue (ARR) estimates.

“Autodesk continues to generate strong and sustained momentum, both in absolute terms and compared to peers. Our success is fueled by our ability to capitalize on the attractive long-term growth trends we see, including increases in global reconstruction and infrastructure. This is supported by our focused strategy to deliver more valuable and connected solutions for our customers, and by the proven sustainability of our business,” said Andrew Anagnost, president and CEO of Autodesk.

Autodesk scored the highest full-year guidance increase of the entire group. Unsurprisingly, the stock is up 5.1% since reporting and is currently trading at $271.16.

Is Now the Time to Buy Autodesk? See our full analysis of earnings results here. It’s free.

Best Q2: Cadence (NASDAQ:CDNS)

With the name chosen to capture the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenue of $1.06 billion, up 8.6% year over year, beating analyst expectations by 1.7%. The company outperformed its peers, but unfortunately it was a mixed quarter with a solid improvement in analyst expectations but a decline in gross margin.

Although it has had a good quarter compared to its peers, the market seems unhappy with the results as the stock is down 7.2% since reporting. It is currently trading at $266.76.

Is Now the Time to Buy Cadence? See our full analysis of earnings results here. It’s free.

Weakest Quarter 2: PTC (NASDAQ:PTC)

PTC’s (NASDAQ:PTC) software-as-service platform, used in the design of the Airbus A380 and Boeing 787 Dreamliner commercial aircraft, helps engineers and designers create and test products before they go into production.

PTC reported revenue of $518.6 million, down 4.4% year over year, falling 2.8% short of analyst expectations. It was a weaker quarter as analyst expectations were not met and gross margin fell.

PTC delivered the weakest performance against analyst estimates and the weakest full-year forecast update in the group. The stock is flat since the results and is currently trading at $178.80.

Read our full analysis of PTC’s results here.

Unit (NYSE:U)

Founded as a game studio by three friends in an apartment in Copenhagen, Unity (NYSE:U) is a software-as-a-service platform that makes it easier to develop and monetize new games and other visual digital experiences. generate.

Unity reported revenue of $449.3 million, down 15.8% year over year. This result exceeded analyst expectations by 1.7%. More generally, it was a slower quarter as analyst expectations were missed.

Unity had the slowest revenue growth among its peers. The stock is up 51% since reporting and is currently trading at $21.69.

Read our full, actionable report on Unity here. It’s free.

ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) provides a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenue of $594.1 million, up 19.6% year over year. This figure exceeded analyst expectations by 6.9%. Zooming out, it was a slower quarter as the average contract value of analysts was not met and the gross margin fell.

ANSYS achieved the highest expectations from analysts among its peers. The stock is flat since reporting and is currently trading at $314.68.

Read our full, actionable report on ANSYS here. It’s free.

Participate in paid stock investor research

Help us make StockStory more useful to investors like you. Participate in our paid user research session and receive a $50 Amazon gift card for your opinion. Sign up here.