Companies that use Nvidia and Palantir products can benefit even more in the long term.

Few companies have seen their value increase as much as Nvidia (NVDA 0.34%)) or Palantir Technologies (Funger 3.08%)) In the midst of artificial intelligence (AI) tree.

Since OpenAI has released its advanced AI Chatbot Chatgpt at the end of 2022, the market capitalization of Nvidia has increased ten times to become the world’s first $ 4 trillion company. Palantir shares have performed even better and climb more than 22 times in the same period.

And there is a good reason for that profit. Both companies have seen their income and profit rise in the midst of an increased demand for their products. The GPUs of NVIDIA are essential infrastructure for AI training and conclusion, while Palantir’s software is a critical low, so that companies can use the power of AI.

Although both companies have been big winners, in my opinion there can be an even greater chance for long -term investors, especially those who want to work new capital today.

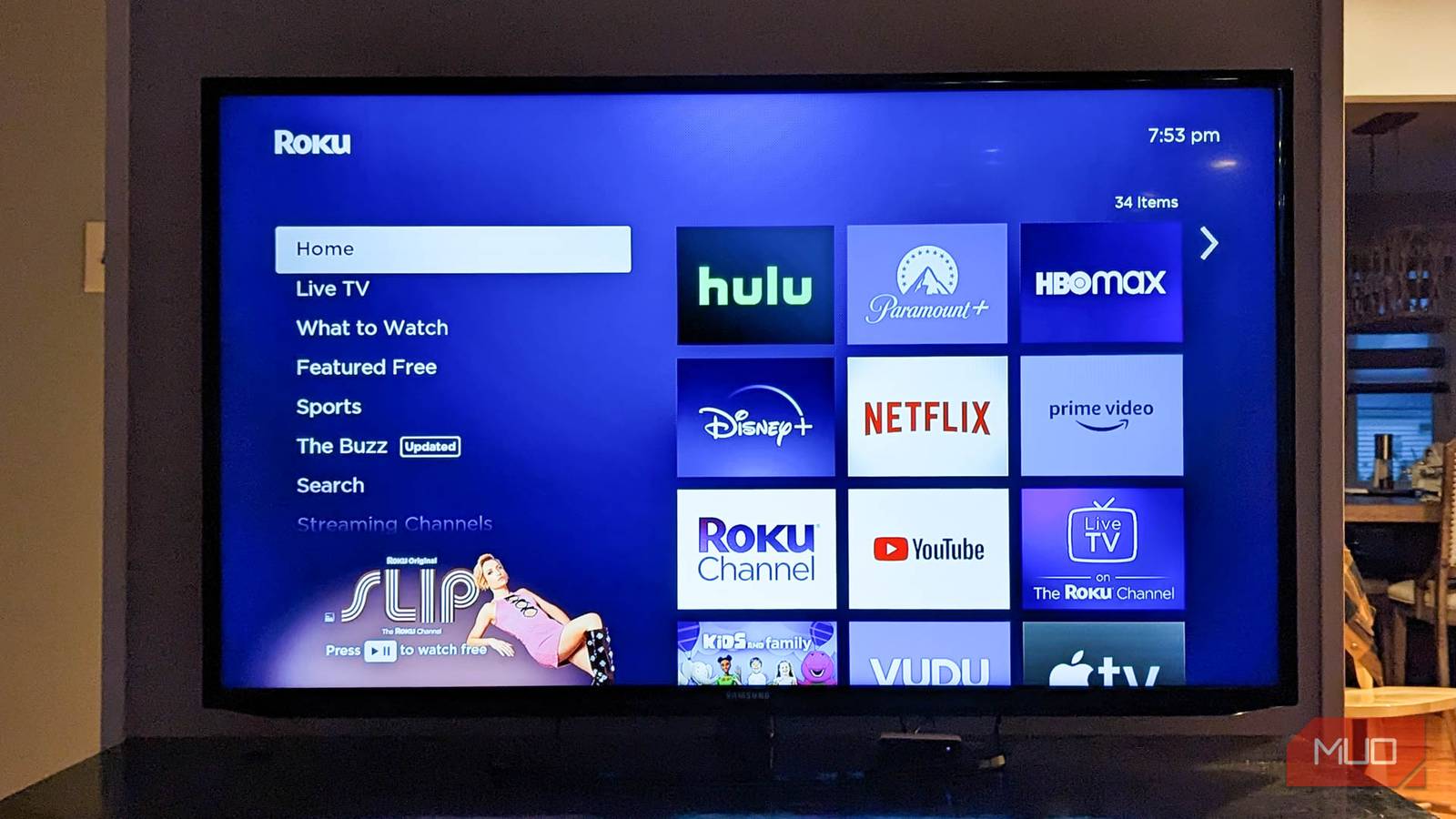

Image source: Getty images.

Looking beyond the winners of the first order of artificial intelligence

It is easy to determine who can benefit from increased expenses for AI development in the short term. It is there in the quarterly win reports and financial prospects. NVIDIA cannot be denied almost its turnover between 2022 and 2025 as a result of building more data centers full of GPUs.

Even Palantir can be considered a first -order winner. The sale received a huge boost from his development of his artificial intelligence platform (AIP), which uses large language models to make its software more powerful and accessible.

But the Palantir product is still a facilitator for companies to use AI more effectively in their activities. And those are the second-order winners of the artificial intelligence tree.

Companies that can get the most operational leverage of generative AI can see their income grow much faster in the coming decade. And if history is something to enter into, the biggest winners of a technological revolution are usually smaller companies, not just technology companies. This is why investors should pay more attention to smaller companies that benefit from AI.

The Dot-Com bubble completely again?

The widespread acceptance of the World Wide Web led to the creation of many new internet companies. Many of those companies received extremely high ratings based on expectations for the future of the web, which led to the DOT-Com Bubble. OpenAI CEO Sam Altman thinks we are now in another bubble – an AI bubble.

Whether you think that the AI industry is in a bubble as Altman claims, it is not to be denied that the technological progress that AI companies have made in recent years. Even if this stock market is not immediately comparable to the DOT-Com Bubble, the AI revolution is demonstrably comparable to the internet revolution.

The internet was a blessing for small companies. When Wall Street Journal Columnist Jason Zweig points out: “Most beneficiaries of the internet tree were not the online providers, but rather consumers: manufacturers, health care, service and material companies that used the emerging technology to streamline their own activities.”

The Internet enabled smaller companies to expand their addressable market and to lower costs. You can have 24-hour customer service via e-mail. You can put your company on the market with a simple website, an e -mill list and Alphabet‘s Google Advertising or SEO. You could build an e-commerce site or use an external market place to sell items all over the world instead of opening hundreds of stores.

In other words, the internet brought the playing field and small companies eventually saw enormous benefits of moving online.

Image source: Getty images.

Generative AI offers comparable promises for small companies. It can make more attentive customer service and in any language possible. It can make full marketing campaigns for social media for a certain business objective. And it can manage inventory – predicting the question and placing orders – ensure that a company never misses a sale.

The operational profit can be much greater for smaller companies versus larger companies, because they benefit from both cost reduction and market expansion. The impact may not be that big on an absolute scale, because few companies will see dozens of billions of new sales as Nvidia will see. But on a relative basis, the impact of AI can considerably stimulate profit for smaller companies that learn how to use the technology to effectively reduce the costs and increase sales.

Will history repeat itself?

The S&P 600 Small-Cap Index usually kept pace with the large cap S&P 500 (^GSPC 0.49%)) In the mid-90s. Only in the late 90s large hoods separated when the investor kapital continued to stack in DOT-COM treasures. That led to a historical valuation gap between large caps and small caps.

As a result, small CAP shares stopped much better in the 2000s, because they saw improved financial results in the midst of growing internet acceptance. The S&P 600 returned 85% in the 2000s compared to a negative total return of 9% for the S&P 500.

History can repeat itself. Small-Cap shares look particularly attractive in today’s valuations, especially with regard to the high prices of shares with a large cap and in particular AI-related shares. If they can achieve operational profit from AI, they should be able to grow much faster than in the recent past, which increases their stock prices for higher income and potential multiple expansion.

Investors who want to dive into the details of small CAP companies may be able to identify unique opportunities, whereby the AI potential is undervalued by the market. Collecting information about smaller companies, however, can still be a challenge (perhaps AI can help).

Another option is to buy an index fund in the small cap. I prefer small companies that are already profitable. An S&P 600 index fund fits in with the bill, but the Avantis US Small Cap Value ETF (AVUV -1.38%)) Holds more shares and uses stricter criteria for profitability for inclusion. That makes it my favorite way to invest in Small-Cap shares and to take advantage of the opportunities for us.