We’d like to think that crypto is completely independent from traditional money, but that’s not the case yet. Case in point, every time the Federal Reserve (Fed) decides to alter their interest rates, most financial markets react —and that includes cryptocurrencies. Central banks still have enough power to heavily influence global money conditions, and how investors behave based on that.

You see, we all use loans, and loans often come with interest rates attached. That’s why when borrowing is cheap (because of low rates), money flows with confidence. Now, when borrowing gets expensive, investors turn cautious. Crypto is just another asset in this financial ocean, and it moves with the tide. Let’s see more of how this works.

The Fed and Its Rates

The Federal Reserve is the central bank of the United States, which means it’s the one and only institution in charge to mint and manage the supply of US Dollars (USD). It also supervises the financial firms that use this asset, and tries to keep their economy steady. One of its main tools is the Federal funds rate, which dictates how expensive it’s for banks to borrow reserves from each other overnight.

When that rate goes up, borrowing feels (for everyone using dollars) like climbing a hill with extra weight. When it goes down, the load eases, and credit moves with more comfort. We may like it or not, but the USD is still the most used currency worldwide. Therefore, changes on its interest rates are never limited to the United States. They have international consequences, shaping costs for companies, investors, and governments alike. Once the Fed sends a signal, money shifts position like a flock of birds changing direction mid-flight.

Of course, crypto traders are also affected. In periods of low rates, investors feel bolder and lean toward riskier assets (like cryptos, yes). On the contrary, when rates go up, people seek safer assets. Prices quickly reflect this scenario: a chain reaction that starts with central banks and travels through global markets until it reaches every portfolio, including those filled with tokens.

Crypto Markets & Rate Changes

Risk assets like cryptocurrencies tend to react fast to any shift in global liquidity. That’s why we see prices going up and down almost immediately after every announcement. For instance, when the Fed pushed rates higher throughout 2022, there was a chill in the markets. A study by Yale University found a clear correlation between US monetary policies and digital asset volatility, indeed.

We saw a concrete example in December 2022, when the Fed raised its interest rates. Bitcoin and Ethereum values plummeted in a matter of hours after the announcement, while the uncertainty of tighter conditions in global markets spread throughout the investment community.

The opposite case came in July 2024: The Fed hinted that it might hold off on further increases, and global traders welcomed the shift instantly. Crypto prices brightened as confidence returned.

But wait there, this isn’t just about the US Fed. Crossing the ocean, when the European Central Bank (ECB) adjusts its policies, crypto might feel it, too.

This region is also an important financial center globally, so, when credit conditions here change, investors react. Low rates mean more investments and potential bullish markets. High rates mean the opposite. In the end, crypto is also part of the global economy, and it can move in tandem with it.

Crypto Needs Independence

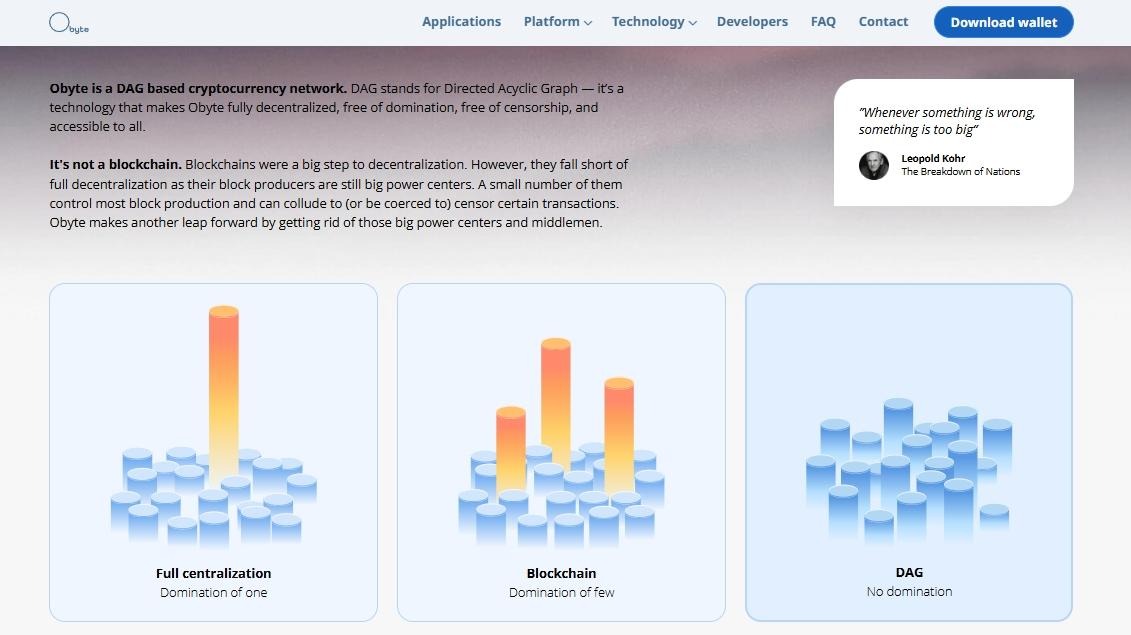

Remember: central bank rates are temporary, but crypto was built to outlast them. To outlast the fragile fiat system, indeed. These distributed networks were born with the goal to create a method for the transfer of value from one individual to another without the need for a central authority, with neither permission nor censorship by external parties or traditional monetary policies.

Bitcoin has provided a medium of exchange that’s decentralized, transparent, censorship-resistant, and open to everyone. Networks like Obyte have taken this one step further by eliminating all intermediaries (miners and “validators”), so no one can be an obstacle for their payments and transactions.

With the increasing acceptance of digital currencies worldwide, we can say there will be less reliance on interest rate announcements over time. Knowing how today’s central banking operations can affect crypto markets can be useful to avoid panic. However, the long game belongs to the technology, not bank announcements. Prices will always swing, for one reason or another. The noise will fade, and the stronger system will prevail.

Featured Vector Image by pinnacleanimates / Freepik