Model ML Inc., a provider of artificial intelligence software for investment professionals, has raised $75 million in funding to support its growth efforts.

The startup disclosed today that investment bank FT Partners led the Series A raise. It was joined by QED, 13Books, Latitude, Y Combinator and LocalGlobe. The latter two firms previously led a $12 million seed round for Model ML in February.

Investment professionals spend a significant percentage of their time creating documents such as due diligence reports. New York-based Model ML has developed a platform that promises to speed up the documentation creation workflow. According to the company, its software can complete tasks that usually take days in a few hours.

Model ML generates documents and spreadsheets using a financial services firm’s internal data. It can retrieve that data from Salesforce, Google Workspace and other software-as-a-service applications. When needed, the platform is capable of combining internal records with external information such as third-party market intelligence.

Users can query the data that Model ML retrieves with natural language prompts. If a financial dataset isn’t easily usable in its original form, the platform generates the scripts necessary to simplify the information. Those scripts automate tasks such as changing file formats and extracting key details from a lengthy spreadsheet.

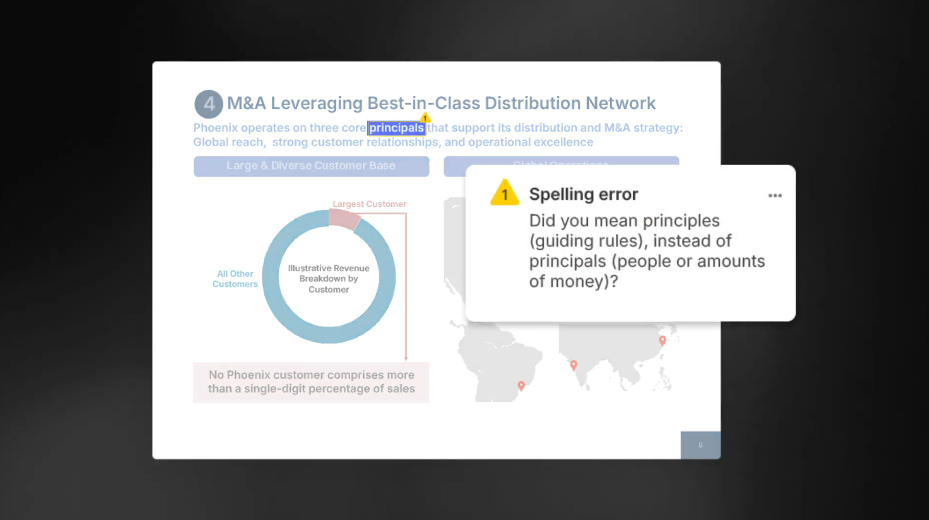

According to Model ML, its platform can not only generate document drafts but also scan existing files for errors. A tool called AutoCheck can detect paragraphs and charts that contain inconsistent financial information. It also spots other issues such as formatting errors that may reduce a PowerPoint presentation’s visual fidelity.

In an internal test, Model ML had AutoCheck and two of its employees check the accuracy of a financial presentation. The tool completed the task in under three minutes while the two staffers took over an one hour. Model ML says that AutoCheck also caught more errors.

In June, the company disclosed that its platform is powered by AI agents based on OpenAI Group PBC’s reasoning models. Model ML’s platform also uses Agents SDK, an open-source tool that the ChatGPT developer released in March to ease tasks such as coordinating the work of AI agents.

“This financing enables us to accelerate global expansion and advance our AI capabilities across key financial hubs as we scale to meet rapidly growing enterprise demand,” said Chief Executive Officer Chaz Englander.

The growth initiative will see the company expand its go-to-market, AI engineering and infrastructure teams. The new hires will help Model ML build new workflow automation features for finance professionals.

The company faces competition from Anthropic PBC, which offers a growing list of financial features as part of its Claude chatbot. Last month, the company introduced tools that ease tasks such as benchmarking a company’s valuation against competitors. OpenAI, whose algorithms Model ML uses to power its platform, is reportedly also developing automation features for investment professionals.

Image: Model ML

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About News Media

Founded by tech visionaries John Furrier and Dave Vellante, News Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.