Stash Financial Inc., a startup with a popular subscription-based investing platform, today announced that it has raised $146 million in funding.

Goodwater Capital led the Series H round. It was joined by Union Square Ventures, StepStone Group, Serengeti, the University of Illinois Foundation and T. Rowe Price. The investment brings Stash’s total funding to more than $550 million.

The round comes less than a year after co-founders Brandon Krieg and Ed Robinson returned as co-chief executives. Stash has since become profitable and grown its installed base to more than 1.3 million subscribers. The company claims that it’s managing more than $4 billion worth of assets for those customers.

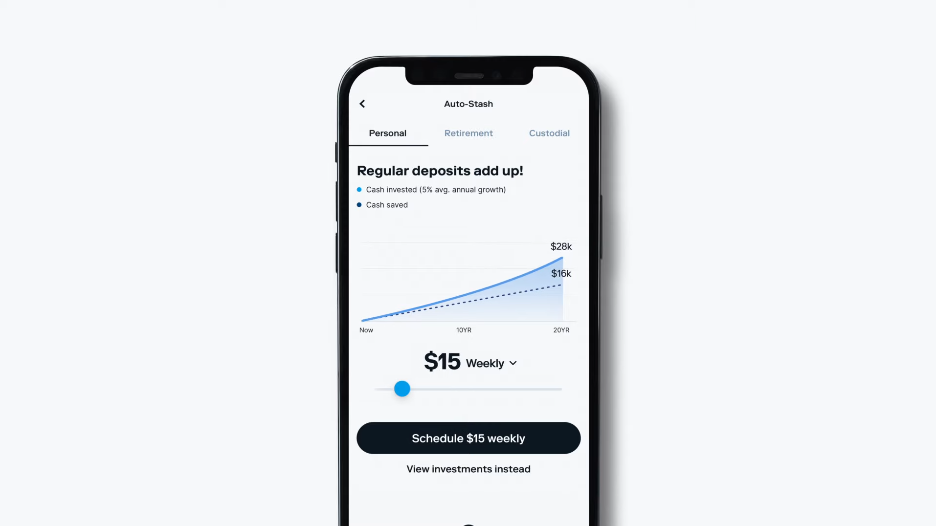

Stash’s investing platform allows users to purchase shares through a mobile app. Customers can configure it to deposit a fixed sum in a stock portfolio daily, weekly or monthly. Stash reinvents the dividends that those stocks generate and can automatically rebalance a portfolio to avoid overdependence on a single asset.

Last year, the company launched an investing service called StashWorks that is geared toward the enterprise. It allows organizations to provide a stock-based savings program to their employees. According to Stash, workers can earn cash rewards for making recurring deposits and reaching savings milestones.

Both StashWorks and the standard consumer edition offer access to a feature called Smart Portfolio. To activate it, subscribers must specify how much investing experience they have and their savings goals. Smart Portfolio reviews those parameters to automatically recommend a set of stocks in which users should invest.

Subscribers can also invest manually. Stash provides a fractional share feature, which allows users to buy a portion of a share, and offers access to ETFs. Those are publicly traded funds that each invest in a basket of stocks. Investing in ETFs is considered to be less risky than owning stocks directly.

Alongside its core investing features, Stash offers a mobile banking service. Customers who sign up receive a payment card that provides up to 5% back on purchases in the form of shares. Often, those shares are in the companies with which users place their orders.

“By leveraging the power of AI, Stash is helping people take control of their money, understand their options, build real wealth, and secure their financial future, no matter where they’re starting from,” said Krieg.

Stash will use the funding round announced today to add more users and enhance its feature set. The engineering effort will focus on Money Coach AI, a set of artificial intelligence capabilities the company introduced earlier this year. It provides users with advice on decisions such as the first stock in which they should invest and the optimal way of reducing portfolio risk.

Image: Stash

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU