Many of us intend to tackle household expense tracking (with the best intentions!) but frequently put it off. Starting from scratch can be daunting, leaving you staring at a blank file and wondering where to begin.

Free templates from Google Sheets provide a framework for you to easily input your financial data and gain insights into your spending habits.

Here is a list of the best free household budget tracking tool templates on Google Sheets, plus some great alternatives from .

These templates help you manage your income, save time, monitor your expenses, and pave the way for a more financially secure future.

🔍 Did You Know: 55% of Americans are uncertain about their financial decisions, especially when managing income, debt, savings, and retirement plans.

Free Household Budget Templates for Google Sheets

What Makes a Good Household Budget Template?

A well-designed household budget template in Google Sheets helps individuals and families manage their finances, track spending, and plan.

Here are the key features an ideal household budget template should include:

- Income and expense tracking: Select a template that provides for clear sections to log monthly income sources and categorized expenses (e.g., rent, groceries, utilities, savings) ✅

- Pre-built formulas: Look for a Google Sheets budget template that automates calculations for totals, differences, and savings with built-in formulas, reducing manual work and errors ✅

- Customizable categories: Search templates allowing users to add or modify spending categories with a clear cost breakdown structure to reflect on their unique financial situations ✅

- Visual summaries: Pick Google Sheets budget templates that include charts, graphs, or color-coded indicators to offer quick insights into spending patterns and savings ✅

- Monthly and yearly views: Opt for a template providing both short- and long-term overviews to help with consistent budgeting and organize your finances effectively ✅

- Savings and debt tracking: Choose a comprehensive template where users get to allocate funds for savings goals or track outstanding debts alongside budgeting data ✅

🧠 Fun Fact: The most common priorities for saving are for emergency funds (48%), investments (36%), retirement planning (35%), and travel savings (34%).

Top 4 Household Budget Template Google Sheets

If you want to simplify your budget and expense management, Google Sheets templates are a great place to start.

These templates come pre-built with categories for personal expenses, bills, savings goals, and more, making it easier to monitor your financial health.

Here’s a handpicked list of the top Google Sheets templates for monthly and annual budget planning:

1. Google Sheets Family Monthly Budget Template by GooDocs

A growing family juggling school expenses, groceries, and weekend activities often struggles to track where the money goes. The Google Sheets Family Monthly Budget Template by GooDocs uses a structured grid to document income sources and expenses.

Color-coded sections separate essentials like housing and utilities from discretionary spending, helping families maintain better awareness and control over monthly cash flow. Whether you’re budgeting for groceries, school supplies, or emergency funds, everything is laid out so you can track how every dollar is spent.

💜 Why you’ll like it:

- Organize expenses by category across a familiar spreadsheet format

- Edit directly in Google Sheets without downloading extra tools

- Collaborate easily with household members or partners

- Access the ability to track monthly income and expenses with clarity

Ideal for: Families who want to build smarter money habits, stay on top of monthly bills, and save more together.

💡 Pro Tip: Dreaming of crushing your short- and long-term goals? Check out these 1-5-10 year goal examples to map your personal and professional journey! It’s a simple way to set clear milestones and stay focused through every phase of life.

2. Simple Household Monthly Budget Spreadsheet Template by Template.Net

The Simple Household Monthly Budget Spreadsheet Template by Template.Net simplifies budgeting by focusing on the essentials without compromising clarity. Its minimal design is perfect for users who want to focus on the numbers without getting lost in cluttered layouts.

Rows for income and major expenses are pre-labeled, making data entry fast and repeatable month after month. The template also includes sections for savings and debt repayment, making it easy to get a complete view of your financial health at a glance. It is a helpful solution for beginners.

💜 Why you’ll like it:

- Focus on essential categories like rent, food, and transportation

- Simplify monthly budgeting and avoid clutter with a no-frills layout

- Monitor financial health with built-in monthly summaries

- Update figures in real time to reflect your current financial situation

Ideal for: Individuals or households who want a clean, distraction-free budget planner to manage everyday expenses easily.

🧠 Fun Fact: Nearly 54% of people track their expenses manually, while only about 21% use budgeting apps. Additionally, 24.4% utilize other digital tools, such as calculators or spreadsheets, for their household budgeting.

3. Google Sheets Household Expense Budget Template by Template.Net

Unexpected utility hikes or one-off repair bills often throw household finances off balance. The Google Sheets Household Expense Budget Template by Template.Net offers detailed tracking for recurring and surprise expenses—from fixed expenses like rent and insurance to variable costs such as entertainment or groceries.

It auto-calculates totals and gives a quick visual snapshot of your financial position month-to-month, reducing the guesswork in budgeting. Budget categories come pre-filled, and the layout supports dynamic adjustments across weeks and months.

💜 Why you’ll like it:

- Break down expenses into fixed, variable, and unexpected costs

- Monitor budget fluctuations across different timeframes

- Visualize your spending patterns with auto-calculated summaries

- Manage recurring bills and one-off purchases effortlessly

Ideal for: Families and individuals who want a more detailed, category-specific view of their household spending habits.

💡 Pro Tip: If you need help getting started on your financial plans, you can ask Brain, an AI personal assistant. Here’s how:

4. Google Sheets Household Budget Planner Template by Template.Net

Many families like to review where the extra funds could come from—the Google Sheets Household Budget Planner Template by Template.Net supports forward-thinking financial decisions. It balances planning and tracking by combining projected income, anticipated spending, and savings goals into one cohesive dashboard.

The template also lets you log various sources of income alongside recurring and variable expenses. It then calculates your monthly savings automatically, providing instant insights into your financial health.

💜 Why you’ll like it:

- Align short-term spending with upcoming goals or events

- Identify areas to reduce or reallocate funds for better fund planning

- Download, print, and use directly within Google Drive

- Adjust values and categories to suit your budgeting style

Ideal for: Families creating proactive financial plans around upcoming life events or seasonal expenses.

Limitations of Using Google Sheets Household Budget Templates

While Google Sheets offers a flexible and accessible platform for creating and managing household budgets, it’s important to acknowledge its limitations compared to dedicated budgeting software.

Some of these limitations include:

- Manual updates: Google Sheets requires you to update income and expenses manually. Unlike some specialized budgeting software, there is no automatic syncing with bank accounts, which leads to extra time spent on data entry

- Limited analytics: Although there are formulas and charts, Google Sheets lacks the in-depth financial analysis tools in dedicated budgeting apps. For users who require detailed insights or projections, this feels limiting

- Complex for beginners: While the templates are easy to use, creating and modifying custom sheets or troubleshooting errors in formulas might be daunting for those unfamiliar with spreadsheets

- Data security: Google Sheets may not be ideal for users with strict data security or privacy concerns. If the link is shared with third-party apps, the sensitive financial data might be leaked

7 Alternative Household Budget Templates

If you’re looking for additional household budget template options beyond Google Sheets, there are several excellent alternatives from , the everything app for work.

These budgeting spreadsheet templates help you streamline your budgeting and household management in just a few minutes:

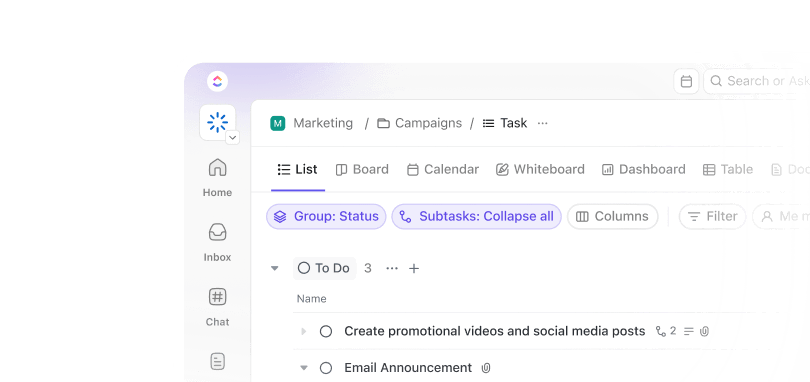

1. Simple Budget Template

The Simple Budget Template makes it easy to manage your day-to-day finances. With a clean layout and intuitive setup, you can quickly track income, expenses, and savings all in one place—perfect for individuals and families who want a straightforward budgeting solution.

Instead of getting lost in complicated spreadsheets, this template keeps your financial data clear and organized. With this budgeting tool, you’ll be able to visualize spending patterns, identify areas to cut costs, and confidently plan for future financial goals—all without the hassle.

💜 Why you’ll love it:

- Organize your finances with simple categories for a clear overview

- Track income and expenses easily to ensure you stay within budget

- Customize categories based on your unique spending habits

- Track savings goals alongside everyday spending for a complete financial picture

Ideal for: Anyone looking for a straightforward, easy-to-use template to manage household expenses and savings goals.

Here’s what Philip Storry, Senior System Administrator at SYZYGY, had to say about using :

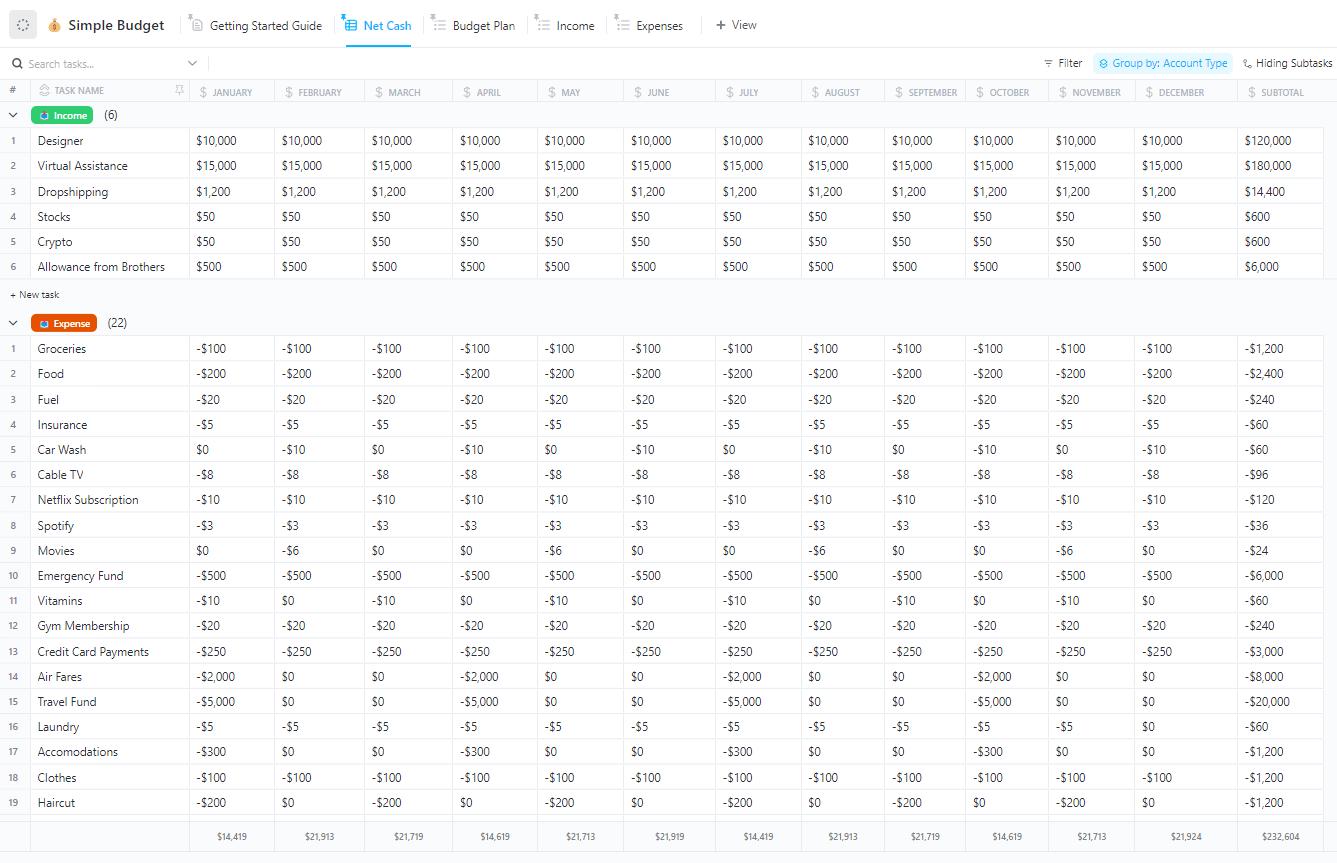

2. Personal Budget Template

The Personal Budget Template helps you take full control of your finances with a personalized touch. Easily categorize your expenses, set custom savings goals, and monitor cash flow so you can stay on top of your financial wellness every month.

This template provides a structured, easy-to-use space where you can adjust your budget as your life evolves, helping you build a strong financial foundation.

Moreover, this template uses Tasks instead of relying on formulas to connect money management with everyday planning.

💜 Why you’ll love it:

- Track both fixed expenses and variable spending in one place

- Analyze spending patterns without switching between tabs

- Set and track savings goals to make sure you’re putting money aside for the future

- Automate monthly reminders for bills and payments to avoid missed deadlines

Ideal for: Individuals or families who want a detailed yet simple way to track their monthly spending and savings goals while maintaining financial discipline.

🎥 Learn how to keep track of personal tasks with this video rundown:

3. Personal Budget Plan Template

The Personal Budget Plan Template empowers you to create a realistic, actionable financial strategy tailored to your lifestyle. With a flexible system that grows with you, plan monthly budgets, monitor spending habits, and set achievable savings targets.

Instead of waiting for a financial wake-up call, use this template to take proactive control. You’ll have a clear roadmap to manage debt, build emergency funds, and meet long-term money goals while maintaining complete visibility of your financial journey.

💜 Why you’ll love it:

- Build in savings or emergency funds as part of your core budget

- Plan monthly, quarterly, and yearly budgets for a comprehensive view of your finances

- Use timeline views to visualize money goals against real-life dates

- Track debt repayment and allocate money towards paying off loans and credit cards

Ideal for: Anyone looking for an exhaustive budget planning tool that offers long-term financial tracking while keeping monthly and yearly goals in focus.

📮 Insight: 78% of our survey respondents make detailed plans as part of their goal-setting processes. However, a surprising 50% don’t track those plans with dedicated tools. 👀

With , you seamlessly convert goals into actionable tasks, allowing you to conquer them step by step. Plus, our no-code Dashboards provide clear visual representations of your progress, showcasing your progress and giving you more control and visibility over your work. Because “hoping for the best” isn’t a reliable strategy.

💫 Real Results: users say they can take on ~10% more work without burning out.

4. Budget Report Template

The Budget Report Template makes financial reporting easy and transparent. With structured sections for planned vs. actual expenses, revenue breakdowns, and variance tracking, you’ll always know where your money is going—and where you need to optimize.

This annual budget template provides a centralized hub for creating detailed business budget reports, allowing you to manage all your financial activities in one simple transaction tracker.

💜 Why you’ll love it:

- Generate detailed budget reports to track income and expenses effectively

- Highlight over- and under-spending with easy visuals

- Integrate reporting directly into your financial planning workflow

- Summarize monthly and quarterly budgets to keep a clear financial overview

Ideal for: Individuals, families, or small business owners who need to generate clear, actionable budget reports with visual tracking.

5. Finance Management Template

The Finance Management Template is your go-to tool for organizing every aspect of your financial life. Manage budgets, track invoices, monitor expenses, and oversee investments within one easy-to-navigate workspace.

This template optimizes financial operations, helping you get the complete picture of your financial health. Additionally, it goes beyond monthly budgeting to provide a command center for household finances, with each financial responsibility becoming a trackable, time-sensitive task.

💜 Why you’ll love it:

- Create a digital finance hub for everything from bills to savings

- Schedule recurring reminders for payment due dates

- Review overall financial health through automated dashboards

- Organize expenses by type for more granular control over your budget

Ideal for: Households, freelancers, and businesses that manage multiple financial accounts, services, and savings priorities and want a clear, comprehensive view of their finances at all times.

6. College Budget Template

Students moving out for the first time often underestimate how fast small expenses add up. The College Budget Template introduces structure to help students manage rent, books, transport, and daily costs.

This template makes budgeting simple and intuitive for students, helping them focus more on studying and less on stretching their next meal budget. It also combines budgeting with time management, so financial tracking fits into a student’s academic workflow.

💜 Why you’ll love it:

- Link budgeting tasks to academic deadlines and calendar events

- Categorize expenses for tuition, rent, groceries, and other essential costs

- Set savings goals to prepare for unexpected expenses or future semesters

- Track income sources like part-time jobs, scholarships, or allowances

Ideal for: College students looking for a simple yet effective way to manage their finances and avoid financial stress.

🎥 Here’s a quick video guide to healthy work habits for a successful career:

7. Monthly Expense Report Template

The Monthly Expense Report Template helps you easily track and organize your monthly spending. From fixed expenses like rent to variable costs like groceries and entertainment, you’ll have a clear snapshot of your financial habits.

Forget trying to remember where your money went at the end of the month. This template gives you a simple, structured way to monitor expenses and spot trends—empowering you to budget smarter and save more.

💜 Why you’ll love it:

- Track monthly expenses with ease by categorizing them into customizable groups

- Record daily costs and review them in monthly summaries

- Stay on top of budget limits by setting up alerts and notifications

- Spot repeat overspending trends and adjust plans accordingly

Ideal for: Individuals or businesses seeking full control over their monthly expenses and making data-driven financial decisions.

Streamline Your Household Budgeting with

Choosing the right Google Sheets budget template is crucial to helping you take the first step towards achieving your financial goals.

The templates we’ve highlighted offer various options for different needs, whether you want to start tracking spending, manage an annual budget, or plan for the future. However, if you’re looking for more advanced features, automated tracking, or enhanced collaboration, is your go-to option.

1000+ library templates designed to help you manage your budgets, allow you to fetch data from multiple sources automatically, analyze it in a broader view, and understand exactly where you are spending your money.

also doubles down as a comprehensive tool for managing household and personal finances, business budgets, and more in a single platform.

Sign up for free on today and ace your financial goals! 🚀

Everything you need to stay organized and get work done.