Oui, le Rwanda est officiellement bilingue — français et anglais — et bien qu’il soit souvent associé à l’Afrique de l’Est anglophone, son héritage francophone reste fort et sa dynamique entrepreneuriale est incontestable.

Le Rwanda se classe au 2ᵉ rang africain pour la facilité de faire des affaires et au 38ᵉ rang mondial selon le rapport Doing Business 2020 de la Banque mondiale. Ce classement résulte de réformes telles que l’enregistrement d’une société en 6 heures, les licences commerciales gratuites pour les nouvelles PME, l’accélération des permis de construire, ainsi que des procédures simplifiées pour les raccordements à l’eau et à l’électricité. En 2024, le pays a été reconnu comme le 3ᵉ au monde pour la facilité de création d’entreprise, grâce au dialogue actif entre gouvernement et secteur privé.

Outre les exonérations de TVA et l’amortissement accéléré, le Rwanda propose :

● visa entrepreneuriat de deux ans et visas pour talents-clés.

Un cluster technologique mixte de 60 hectares, doté de 2 milliards $, destiné à devenir un hub panafricain de l’innovation, regroupant CMU-Africa, incubateurs, centres de recherche, bureaux, logements étudiants et hôtels, au sein de la zone économique spéciale de Kigali.

La quasi-totalité des services publics est accessible en ligne via Irembo et les portails e-gouvernementaux.

La Banque nationale du Rwanda a lancé une stratégie fintech sur 5 ans (2024-2029) visant 300 entreprises fintech, 7 500 emplois et 200 M$ d’investissements, soutenue par un bac à sable réglementaire adopté par plusieurs cohortes. Kigali se classe aussi 67ᵉ au monde et 2ᵉ en Afrique subsaharienne pour la compétitivité fintech.

● Agri-tech : 50 M$ pour réduire les pertes post-récolte (AgriGo, GreenHarvest…)

Westerwelle Startup Haus et CMU-Africa. Plus de 7 000 km de fibre optique, déploiement 4G/5G et l’une des vitesses Internet les plus rapides d’Afrique.

En 2024, plus de 10 000 emplois créés dans les startups.

Le programme Inkomoko accompagne plus de 100 000 micro-entrepreneurs dont de nombreux réfugiés (24 M$ de prêts, plus de 60 000 emplois créés). 61 % des sièges parlementaires sont occupés par des femmes.

Le Rwanda est un modèle de ce qui est possible lorsque politique, exécution et ambitions’alignent. Mais le marché intérieur reste petit, le capital de croissance limité, et l’intégration rurale en retrait.

GOZEM

Le 25 février 2025, Gozem a bouclé une levée de fonds Série B de 30 M$ (15 M$ en actions, 15 M$ en dette), menée par SAS Shipping Agencies Services (filiale de MSC) et Al Mada Ventures. Total levé depuis 2018 : ≈ 45 M$. L’entreprise opère au Togo, Bénin, Gabon et Cameroun (près de 10 000 chauffeurs inscrits, +1 M d’utilisateurs) et prévoit de s’étendre au Sénégal, en Côte d’Ivoire, au Nigéria et en RDC d’ici 2026.

Enjeux clés de la levée :

1. Capacité à grande échelle – Renforcement du programme de financement de véhicules neufs, avec remboursement flexible via les revenus quotidiens.

2. Accélération fintech – Soutenue par l’expertise logistique de MSC et le capital africain d’Al Mada, Gozem développe Gozem Money (virements, paiement de factures, e-commerce…), intégré à son super-app.

3. Ambition régionale – Devenir la super-app dominante mobilité + fintech en Afrique francophone de l’Ouest et centrale.

4. Confiance des investisseurs & impact écosystème – Contribution à placer le Togo dans le Top 5 africain du financement startup au T1 2025.

Programme V+ (2024)

● 1 000 chauffeurs devenus propriétaires via financement échelonné (2 ans motos, 4 ans voitures)

● Ligne de crédit IFC de 10 M$ pour financer 6 000 chauffeurs supplémentaires au Togo et au Bénin, avec projet pilote de motos électriques et stations d’échange de batteries

● Aucun dépôt initial requis ; remboursement via recettes journalières.

Forces et faiblesses de Gozem en Afrique francophone :

| Catégorie | Forces | Faiblesses |

|---|---|---|

| Adéquation au marché local | Solide compréhension des cultures locales, du transport informel et de la réglementation | Faible visibilité de la marque sur les grands marchés comme le Sénégal et la Côte d’Ivoire |

| Stratégie produit | Super-app combinant transport, livraison, fintech et assurance | Technologie/UX moins raffinées que celles des acteurs mondiaux comme Yango ou Uber |

| Écosystème chauffeurs | Propose le financement de véhicules, des avances carburant et une assurance — fidélisation forte | Modèle à forte intensité capitalistique, risque de crédit élevé en cas d’augmentation des défauts |

| Innovation mobilité | Pionnier des motos électriques avec recharge solaire | Réseaux électriques et infrastructures pour véhicules électriques encore sous-développés dans de nombreux marchés |

| Financement & partenaires | Plus de 30 M$ levés ; soutenu par MSC et Al Mada (fort appui financier/logistique) | Moins capitalisé que Yango ou d’autres concurrents mondiaux |

| Modèle de croissance | Expansion ciblée et durable à travers l’Afrique francophone | Forte dépendance à de petits marchés comme le Togo et le Bénin |

| Position réglementaire | Coopératif et conforme ; aucun bannissement ou perturbation dans les marchés | Vitesse d’expansion plus lente que celle des entrants internationaux agressifs |

| Capacité opérationnelle | Structure légère favorisant l’agilité | Risque de surextension avec l’élargissement simultané des produits et des marchés |

Gozem transforme les chauffeurs informels en propriétaires d’actifs grâce à des modèles de crédit accessibles, tout en intégrant mobilité, services financiers et logistique dans un écosystème complet.

Conclusion

Yango et Gozem transforment le paysage numérique francophone :

● Atouts : montée en compétence locale, accès au marché pour les PME, maturation de l’usage digital

● Risques : dépendance à un acteur dominant, éviction de startups locales, précarisation du travail

Gozem réinvente les règles de la mobilité en Afrique francophone — opportunités et fragilités se côtoient.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! Get your tickets

Revue des principaux titres

Hello👋,

Welcome to the third edition of the The Next Wave Francophone Africa newsletter where we share the biggest insider insights and analysis of the region’s technology landscape. This is twice-monthly newsletter, expect the next dispatch on August 26th. Sign up here and be the first to know.

In our last dispatch, we explored how Benin’s ambition and Morocco’s maturity are driving the next wave of Francophone African innovation.

Today’s edition continues on that wave with one ecosystem pitching itself as Africa’s next innovation hub, and the first part of our analysis on how two companies are recording fast notable growth and success in markets often described as too small to matter.

Let’s get into today’s dispatch!

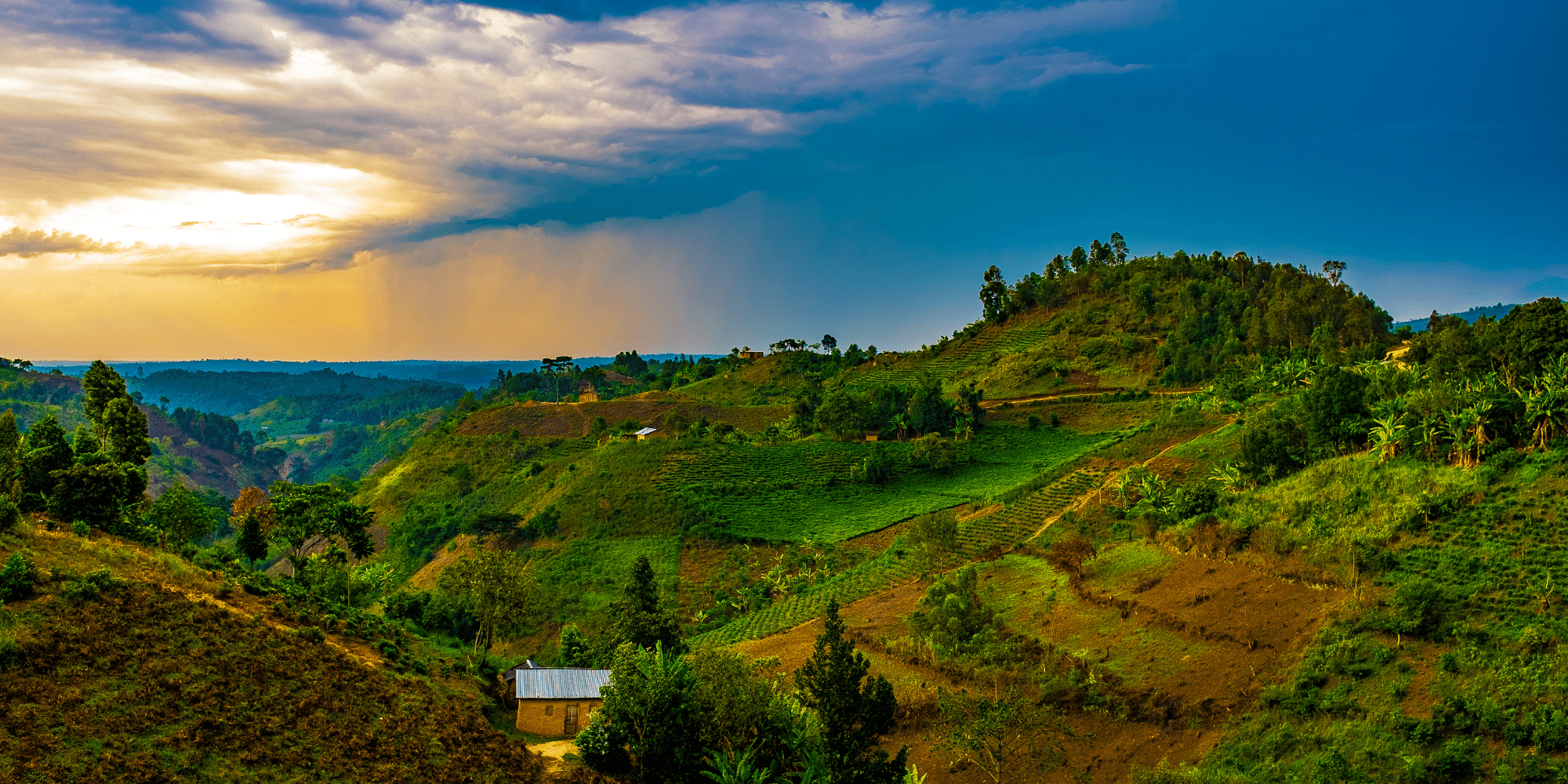

Rwanda: The Francophone Outlier That Got It Right

Yes, Rwanda is officially bilingual — French and English—and while it is often associated with Anglophone East Africa, its Francophone heritage is strong and its startup momentum is undeniable.

Here’s why you should watch out for Rwanda:

Pro-entrepreneurship policy: Rwanda ranks second in Africa for ease of doing business and was listed 38th globally in the 2020 World Bank Doing Business report.

This achievement is driven by reforms like 6-hour company registration, free trading licenses for new SMEs, faster construction permits, and streamlined power and water connections. In 2024, Rwanda was also recognized as the third easiest country in the world to start a business, supported by active dialogue between government and private sector.

Tax breaks for startups: Beyond VAT exemptions and accelerated depreciation, Rwanda offers 7-year tax holidays for investment in innovation parks, 0 % corporate tax for regional HQs, and preferential 15 % rates in sectors like ICT and e-mobility, plus a two-year entrepreneurship visa and talent visas for key staff .

Kigali Innovation City: This $2 billion, 60-hectare mixed-use tech cluster is being built as a pan-African innovation hub, hosting CMU-Africa, incubators, research centers, offices, student housing, and hospitality, all within Kigali’s special economic zone (SEZ).

Digital governance: Nearly every public service can be accessed online via Irembo and e-government portals. The National Bank of Rwanda launched a 5-year FinTech strategy (2024-2029) aiming for 300 fintech firms, 7,500 jobs, and $200 million investment, supported by a regulatory sandbox that’s already drawn multiple cohorts. Kigali also ranks 67th globally in the Global Financial Centres Index and< second in sub-Saharan Africa in fintech competitiveness.

Ecosystem traction & sectoral growth: In 2024 alone, fintech startups raised $60M, with firms like Mobicash and Zedya leading the charge. Startups raised $50M to boost productivity and reduce post-harvest losses, with notable names like AgriGo and GreenHarvest emerging. Solar and microgrid startups raised $20M leveraging Rwanda Energy Group’s support, while tourism tech startup raised just $10 million in 2024

Infrastructure & talent: Kigali hosts hubs like KLab, Impact Hub, Fablab, Westerwelle Startup Haus, and the Carnegie Mellon campus. Rwanda’s ICT backbone includes 7,000+ km of fiber, 4G/5G expansion, and one of Africa’s fastest average internet speeds. National initiatives like Smart Kigali and AI hackathons via Irembo further build skills and civic-tech capacity.

Social impact & inclusion: Over 10,000 jobs created in startups in 2024; Programs like Inkomoko support over 100,000 micro-entrepreneurs (many refugees), with $24 M loaned and 60,000+ jobs created; Women’s empowerment is embedded in policy, 61% of parliamentary seats are held by women .

Summary

Rwanda is a blueprint for what’s possible when policy, execution, and ambition align. Its government doesn’t just talk innovation, it structures for it, builds for it, and measures it. From digital governance and tech-enabled public services to Kigali Innovation City and strong regulatory frameworks, Rwanda has laid the foundations of a modern startup state. It’s compact, efficient, and deliberately designed for experimentation.

But this isn’t a utopia. The domestic market is small, growth-stage capital remains hard to come by, and rural inclusion still lags behind Kigali’s progress. Some policies work better on paper than in practice, and the ecosystem’s global visibility often outpaces its depth. Still, Rwanda’s discipline and intent are undeniable, and in a region where follow-through is often the missing piece, that alone makes it a

standout.

GOZEM

On February 25, 2025, Gozem closed a $30 million Series B financing round,comprised of $15 million equity and $15 million debt, led by SAS Shipping Agencies Services (a subsidiary of MSC) and Al Mada Ventures. This round brings Gozem’s total capital raised to ≈ $45 million since 2018.

It currently serves nearly 10,000 registered drivers and over 1 million users across Togo, Benin, Gabon, and Cameroon. The startup plans to expand into Senegal, Ivory Coast, Nigeria, and DRC over the 2025–2026 period, leveraging new capital and operational experience. This new round is significant for Gozem for multiple reasons:

1. Capacities at Scale: This substantial injection empowers Gozem to deepen its vehicle financing programs, enabling drivers to transition from used to new vehicles with flexible repayment via daily earnings.

2. Fintech Momentum: Backed by MSC’s logistics expertise and Al Mada Ventures’ African capital, Gozem will expand Gozem Money, enhancing its competitive edge in digital payments, banking, and commerce within its super app. Gozem unveiled Gozem Money, its mobile-money service, in Q4 2024 in Togo, in partnership with NSIA Banque, following the 2023 acquisition of fintech firm Moneex. Core offerings include: person-to-person money transfers, bill payments, mobile purchases and merchant payments,financial tracking tools for everyday budgeting. It is seamlessly embedded within the Gozem Super App, enabling drivers and consumers to manage transport, deliveries, commerce, and finance in one place,

3. Path to regional leadership: The move reinforces Gozem’s ambition to become the dominant mobility + fintech super app across Francophone West and Central Africa, challenging global entrants and building on its local-first credibility.

4. Investor confidence & ecosystem Impact: By largely driving Togo into Africa’s Top-5 for startup funding in Q1 2025, Gozem not only benefits itself, but also elevates the broader ecosystem’s visibility

In 2024, Gozem launched a successful program: the V+ Program :

● Helped about 1,000 drivers become vehicle owners (motorcycles, cars,through installment plans (typically 2 years for motos, 4 years for cars)

● With a $10M credit line from IFC, Gozem targeted financing 6,000 more drivers across Togo and Benin, significantly expanding access to affordable, formal mobility assets. IFC investment includes a pilot for electric motorbike leasing and battery swapping stations in Togo and Benin, allocating ~10% of capital toward EV infrastructure.

● Drivers repay via deductions from daily earnings, no upfront deposit required, creating accessible capital for low-income, informal-sector workers.

Let’s have an overview of Gozem’s strengths and weaknesses in Francophone Africa:

Strengths & Weaknesses:

| Category | Strengths | Weaknesses |

|---|---|---|

| Local Market Fit | Deep understanding of cultures, transport, regulation | Low visibility in big markets |

| Product Strategy | Super app combining mobility & fintech | Less refined UX vs Yango/Uber |

| Driver Ecosystem | Financing, fuel advances, insurance | Capital-intensive, credit risk |

| Mobility Innovation | EV motorcycles, solar charging | Underdeveloped EV infrastructure |

| Funding & Partners | Strong backers (MSC, Al Mada) | Less capital than global rivals |

| Growth Model | Focused Francophone Africa expansion | Heavy reliance on small markets |

| Regulatory Standing | No bans/disruptions | Slow expansion speed |

| Operational Capacity | Lean and agile | Risk of overstretch |

Ultimately, Gozem transitions drivers from informal earners into asset owners through scalable financing and tailored credit models. It embeds financial services

into everyday mobility use cases, boosting inclusion in underbanked regions. By integrating mobility, financial services, and logistics, Gozem is setting itself up as a holistic ecosystem player, competing with global entrants but built locally.

CONCLUSION

The likes of Yango and Gozem also have notable implications for the Francophone African tech ecosystem. The upside includes:

● Talent development: Yango Fellowship (pan-African extension) builds local tech skills, boosting future entrepreneurs.

● Marketplace for scale: Small digital businesses (restaurants, couriers, stores) get access to technology and consumer reach.

● Digital ecosystem maturation: Users get used to combining ride-hail, delivery, finance, pay, all within one app, raising expectations for other services.

On the other hand, the potential downsides are:

● Consolidation around a single foreign-owned platform risks creating dependency.

● Crowding out local players before they reach scale, making late-stage innovation difficult.

● Labor market pressure: Drivers pushed to exhaustion or mis‐aligned incentives if Yango doesn’t manage welfare issues.

Gozem is rewriting the playbook for what’s possible in Francophone Africa’s mobility and logistics sector. Its rapid growth and ambitious strategies expose both the opportunity and the fragility of digital ecosystems in the region.

On one hand, the startup unlock new jobs, elevate tech adoption, and force long-overdue upgrades in service delivery. On the other hand, it introduces complex risks, from regulatory gaps and labor precarity to the displacement of local innovation.

In the next newsletter we’ll dissect Yango, another pivotal startup in the Francophone region. We’ll also talk about how governments, local startups, investors, and communities engagement with these players—Yango and Gozem—will define the region’s digital future.