This is Follow the Money, our weekly series that unpacks the earnings, business, and scaling strategies of African fintechs and financial institutions. A new edition drops every Monday.

For years, USSD (Unstructured Supplementary Service Data) was the poster child of financial inclusion; every digital payment solution ultimately got a USSD code. The low-tech bridge brought millions without smartphones or internet access into the digital payment net. However, its relevance is now fading as mobile apps take over.

GTCO’s *737#—which helped popularise USSD—processed ₦987 billion ($676.97 million) in H1 2024. One year later, that figure dropped to ₦499 billion ($342.26 million), with transaction volumes crashing 64% from 137 million to 49 million.

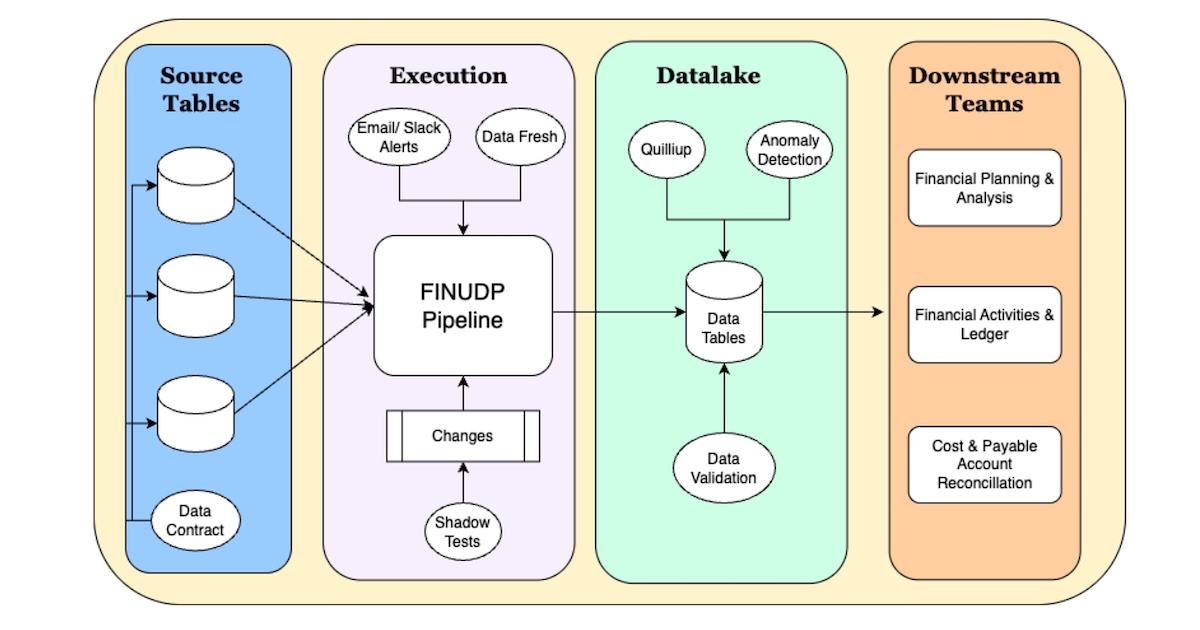

Visualising GTCO’s Pivot: The Shift from USSD to Apps

Between H1 2024 and H1 2025, GTCO’s data captures a dramatic digital

migration. Hover or tap each bar to see the change in transaction

value.

*737# (USSD)

H1 2024

₦987B

H1 2025

₦499B

▼ 49.4% Value

Mobile Apps

H1 2024

₦30T

H1 2025

₦35.8T

▲ 19.3% Value

Note: Chart shows change in transaction value. The article notes a

64% drop in transaction volume for USSD.

Source: GTCO H1 2025 Report, as cited by .

Industry-wide, USSD transactions fell to ₦2.19 trillion ($1.50 billion) in H1 2024 from ₦4.84 trillion ($3.32 billion) in the previous year, according to the Central Bank of Nigeria. Transaction volume dropped by more than half, from 630.6 million to 252.06 million.

Nigeria’s ₦100 Trillion+ Payment Shift

The move from USSD to apps is the entire industry. See the opposing

year-on-year trends for transaction values across Nigeria.

USSD Transactions

H1 2023

₦4.84T

H1 2024

₦2.19T

-54.8% Value

Mobile App Payments

Q1 2024

₦77.9T

Q1 2025

₦104.1T

+33.65% Value

Note: Timeframes differ (H1 vs Q1) but show year-on-year trends.

Source: Central Bank of Nigeria, as cited by .

In contrast, mobile app payments have picked up. Transaction values jumped 33.65% to ₦104.07 trillion ($71.38 billion) in Q1 2025 from ₦77.87 trillion ($53.41 billion) a year earlier. GTCO’s own apps—GTWorld and GAPS/GAPSLite—handled ₦35.8 trillion ($24.56 billion) in H1 2025, a 19.33% jump from the previous year.

This shows that as smartphones become cheaper and mobile banking apps more stable, Nigerians are quietly trading short codes for full digital experiences, as the financial system matures. The rails that once powered inclusion through telcos are giving way to bank-owned ecosystems built for scale, data, and recurring revenue.

The code that changed banking

Around 2016, Guaranty Trust Bank, Nigeria’s most cost-efficient bank, launched *737#, allowing customers to transfer money without a smartphone or app. It became the face of a fast and simple movement that was built on the back of telecom expansion.

“The introduction of USSD changed everything. Without telecoms infrastructure, there is no USSD code,” said Zenith Bank’s Group Managing Director, Ebenezer Onyeagwu, during the 20th anniversary of Nigeria’s telecoms revolution in 2021.

By 2020, over 762 million transactions were carried out via USSD, according to the Nigeria Inter-Bank Settlement System (NIBSS). At its peak, telcos said 90% of USSD traffic was driven by financial transactions.

More smartphones, more mobile transactions

USSD was built for a 2G world that Nigeria is fast leaving behind. Basic phone connections (2G) have dropped from 60.85% in July 2023 to 38.38% in August 2025. Smartphone connections now exceed 60%, fuelled by Chinese phone makers like Transsion and Xiaomi, which have driven affordability and access.

The Great Phone Crossover: Nigeria’s Shift to Smartphones

The decline of USSD is directly linked to the technology in people’s hands.

See how phone connections in Nigeria changed in just two years.

Basic Phones (2G)

Smartphones

This shift is the engine driving users from USSD codes to mobile banking

apps.

Source: , based on NCC’s data.

“Smartphone penetration is increasing, and without USSD, people will probably be fine,” said Adedeji Olowe, founder of Lendsqr, a lending-as-a-service platform.

Despite this, six in ten Nigerians remain offline, especially in rural areas. Only 39% of people in rural areas had smartphones compared to 73% in urban areas in 2024. This gap suggests USSD’s obituary might still be premature.

Biggest losers

USSD opened the door to inclusion, but its infrastructure—and economics—were owned by telcos.

Since 2019, both sides have been locked in a dispute over payment terms, with bank debts to telcos crossing ₦200 billion by 2024. A 2025 compromise allowed telcos to deduct ₦6.98 per 120 seconds directly from customers. But by then, the market had already moved on.

For banks, the math is simple: apps make money; USSD doesn’t. GTCO made ₦28.61 billion ($19.62 million) in e-banking income in H1 2025, while Access Bank made ₦101.65 billion ($69.72 million). None of that came from USSD.

As Segun Agbaje, GTCO’s CEO, once put it,” It is not state-of-the-art. The best way to have financial inclusion is to crash the cost of data so that data becomes more affordable. Then we can use what is a superior technology.”

Banks’ tech bet pays off

Banks did not get here in one day, as they have been making strategic investments in their tech capacity. Six of Nigeria’s biggest banks increased their combined tech spend by 74.5% to ₦268.7 billion ($184.29 million) in 2024 to fund upgrades to core banking systems, digital channels, ATM networks, databases, and fraud detection.

GTCO alone grew its tech budget by more than 450% since 2021 to ₦37.76 billion ($25.89 million) in H1 2025 from ₦6.85 billion ($4.67 million).

These investments have helped banks absorb the surge in instant payments, which jumped by 78.3% to ₦1.07 quadrillion ($733.90 billion) in 2024 from ₦600 trillion ($411.53 billion) in 2023, and already at ₦284.99 trillion ($195.47 billion) in Q1 2025.

They also coincide with the decline of cash transactions in the country. Between 2014 and 2024, the country saw a 59% drop in cash use. This combination of stable apps and reduced cash handling means banks are now more fully incentivised to invest in their digital channels.

Not dead, yet

GTCO still counts 3.1 million USSD users—a 6.06% drop from H1 2024—but nearly 3 million now use its apps, up from 2.5 million. This implies that while the old bridge (USSD) still stands, the traffic has shifted.

USSD walked so mobile apps could run and fly. But for the millions still offline, it will continue serving as their doorway into cashless transactions. However, it is now clear that Nigeria’s transfer culture has shifted.

Note: exchange rate used: ₦1,457.96/$