Editor’s Note: Wall Street wants you to believe the market is unbeatable. That outperformance is just luck, a statistical fluke.

But history and logic suggest otherwise. In 1984, Warren Buffett famously proved that disciplined, value-driven investing could consistently beat the odds. Skill and discipline matter.

Today, AI and advanced math are taking that principle further, turning data into actionable insights and creating a system capable of extraordinary, consistent returns. And our partners at TradeSmith have paired AI and cutting-edge math to build a system that doesn’t just aim to match the market, but crush it.

On Wednesday, October 15, at 10 a.m. Eastern time, TradeSmith CEO Keith Kaplan will show you how to take AI-powered investing to the next level at his Super AI Trading event. You can reserve your spot for that event here.

Today, Keith is joining us to share how AI is turning long-standing market math on its head, giving investors a real edge in today’s volatile market.

Take it away…

It was billed as an academic debate, but it felt more like a heavyweight bout.

On May 17, 1984, Columbia University marked the 50th anniversary of Security Analysis by Benjamin Graham and David Dodd – the Bible of value investing.

At one podium stood Michael Jensen, a rising star from the University of Rochester. He carried the weight of a near-unanimous academic consensus: the Efficient Market Hypothesis (EMH).

It claimed markets were unbeatable. What looked like investor outperformance was nothing more than statistical noise.

On the other side was one of the world’s most successful investors, Warren Buffett.

Nineteen years earlier, he’d taken over a failing New England textile mill called Berkshire Hathaway. By applying Graham and Dodd’s principles, he transformed it into one of the world’s most successful investment firms.

Jensen spoke first. He cited studies showing that, taken as a whole, the pros weren’t beating the market.

He compared it with a national coin-flipping contest. If 225 million people flipped coins, he argued, a few would rack up 20 wins in a row. No skill required — just the law of large numbers at work.

Then it was Buffett’s turn.

“Let’s accept Professor Jensen’s coin-flipping contest,” he began. He walked through the same logic: millions flipping coins, losers dropping out, a tiny remnant surviving 20 rounds.

Then he reframed the question.

“But what if those survivors all came from the same place?” He let the pause hang… “Graham-and-Doddsville.”

Buffett wasn’t talking about a place – but a school of thought. He showed slides of nine funds, each run by Graham disciples, all with years of outperformance. You can dismiss one streak among this group as chance… but not nine.

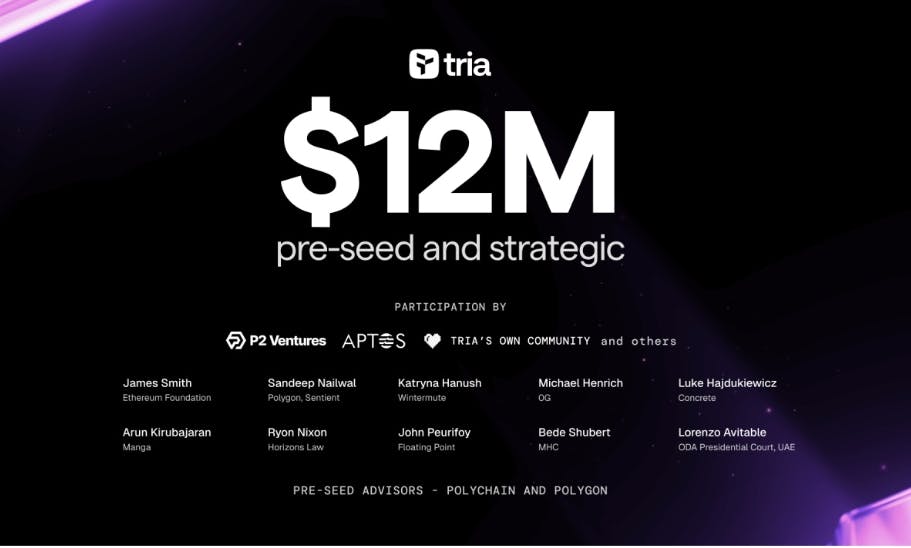

For decades, academics like Jensen told investors that beating the market was impossible. At TradeSmith, we set out to prove otherwise — not with luck, but with discipline, data, and world-class software tools.

Our latest breakthrough takes the core math behind the EMH and turns it on its head — creating a system with a real, lasting edge.

In backtests, it delivered an average annual return of 374% over five years — through the Covid Pandemic, the 2022 crash, the 2025 tariff shock, two wars, and wild swings in interest rates.

And it’s powered by something investors in 1984 could only imagine in science fiction: artificial intelligence.

Surprisingly Consistent Results

You’re probably familiar with ChatGPT, Gemini, and Copilot. They’re called large language models because they’re trained on massive datasets of words.

Think of our AI-powered trading system as a “large numbers model.”

We trained it on more than 100 billion stock market data points – including odd jumps and volatility spikes. It learns patterns hidden in the noise, then projects where stocks are likely to move next.

You may be wondering how accurate these projections are. We monitor it daily and see surprisingly consistent results.

Some stocks hit their price projection more than 90% of the time. That covers more than 700,000 projections a month since we introduced the model in 2023.

And we consistently see 70% accuracy or higher. That’s even more impressive than residents of “Graham-and-Doddsville.”

For instance, on July 27, 2023, our model predicted Opendoor (OPEN) would soon hit $4.87 a share.

Twenty-four hours later, the stock hit that price. My team booked a 9.4% gain. That’s like growing your money 34 times in a year.

And you could have boosted that gain to 244% in just 24 hours with a special kind of trade.

Another example is restaurant chain Wingstop (WING). On June 4, our AI projected a 74% chance of it rising over the next 21 days to hit $384.87.

Wingstop reached that price within 24 hours. You could have booked a 3.6% gain… and boosted it to 156%.

Or take Tesla (TSLA). In May, our model projected it would hit $302.89 in 21 trading days.

It reached that price even faster than expected. We booked a 5.2% gain in 24 hours, which you could have boosted to 310%.

These gains are great. But my team and I wanted to make this technology even more accessible to everyday investors and even more powerful. That’s where our EMH math breakthrough comes in.

A Simple Portfolio With Superhuman Results

It turns the core mathematical concepts of EMH against itself.

The math is called Mean Variance Optimization (MVO). It’s mostly used to minimize risk while holding a broad, market-based portfolio.

But our research team used the same formula not to spread bets, but to concentrate capital into a handful of stocks with the highest potential payoff.

The chart below shows what happens when we applied our MVO model to the tech-heavy Nasdaq 100 (QQQ) ETF.

The blue line shows $10,000 invested in QQQ since January 2018. The orange line shows $10,000 put into the top five QQQ stocks selected by our MVO model on the same date.

The MVO-selected five stocks outperformed the QQQ by four-to-one.

But our team is never satisfied. And impressive as this was, it still wasn’t good enough. We then found a way to apply our MVO model to the stock projections our AI makes. The result is our AI Super Portfolio.

As I mentioned, it returned 374% a year on average in a five-year back test. But that’s just an average.

Last year, it returned 602%.

That’s more than 30x the return you’d have gotten holding the S&P 500 stocks for the year. And it’s more than 3x the return of Nvidia (NVDA) over the same time.

Even better, our system is easy to follow. You hold the five top stocks based on our AI’s projections. Then you rotate into a new set of five stocks when the AI says it’s time to sell.

That’s it… there’s nothing more to it. It takes no more than a few minutes, on average, once a week to maintain.

On Oct. 16, just three days from now, we’ll launch our first-ever live five-stock portfolio. Charter members will be the first to see which first stocks to buy. We’ll also give them instructions on when to sell and what to buy next.

I’d love you to join us. It never sat right with me that Wall Street and the index fund industry peddle the myth that the market is unbeatable.

But the sad truth is that millions of regular investors are happy to settle for average returns. This allows fund managers to sit on their hands and get rich on fees.

That’s great news for folks on Wall Street. It’s also one of the biggest scams in the market today – one that my team and I at TradeSmith are on a mission to expose.

So I hope you’ll clear some time in your schedule for my Super AI Trading Event. It kicks off one day before our charter intake, on Wednesday, Oct. 15, at 10 a.m. Eastern Time.

I’ll also show you how the system works, reveal one of its top trades, and get into how you can build your own AI-powered portfolio to potentially quadruple your money.

The markets aren’t unbeatable. You just need the right tools. That’s what next Wednesday’s event is all about.

Go here to claim your spot, and I’ll see you on Oct. 15.

Sincerely,

Keith Kaplan

CEO, TradeSmith