Table of Links

Abstract and 1. Introduction

-

Background

2.1 Rollup

2.2 EIP-4844

2.3 VAR(Vector Autoregression)

-

Data

3.1 Consensus security data

3.2 Ethereum usage data

3.3 Rollup Transactions Data

3.4 Blob gas fee data

-

Empirical Results

4.1 Consensus security

4.2 Ethereum usage

4.3 Rollup transactions

4.4 Blob gas fee market

-

Conclusion and References

A. Consensus Security Data

B. Rollup Data Collection

C. Detailed Var Model Results for Blob Gas Base Fee and Gas Fee

D. Detailed Var Model Results for Blob Gas Base Fee and Blob Gas Priority Fee

E. Rollup Transaction Dynamics

4.4 Blob gas fee market

Understanding the blob gas fee market dynamics is essential for enhancing market predictability, enabling DApps and rollups to optimize data posting and fees. This predictability reduces variability in Ethereum transaction settlement times and minimizes costs. Previous research, such as [9, 10], has investigated optimal strategies in multidimensional markets, providing practical insights that complement theoretical models.

Additionally, insights from this analysis could contribute to improvements in the blob gas fee market. Extensive studies on gas fee markets [5, 29, 39] have explored how fee update rules might better capture user demands and reduce variability. Extending these studies to multidimensional fee markets could deepen our understanding.

This section presents an analysis of the newly emerged blob gas fee market and outlines the following key findings:

(1) The VAR model indicates that the gas base fee has a small, yet statistically significant influence on the blob gas base fee. Initially, this impact is positive but tends to diminish over time.

(2) We introduced a metric for ‘blob gas priority fee’ to represent the priority demand for blob gas. The validity of this proxy was established by demonstrating its utility in enhancing the explainability of blob gas base fees.

(3) The blob gas fee market exhibits higher volatility compared to the gas fee market, indicating potential challenges in predictability and stability. Despite its volatility, the lower ratio of priority fee to base fee in the blob gas market suggests it captures market demands more effectively than the gas market.

4.4.1 Inter relationships between gas and blob gas market. To investigate the dynamic interactions between the gas and blob gas markets, we employed a VAR model analyzing the base fees for both types of gas. The significant effects detected in the model are outlined in Table 4. For the gas base fee, positive effects are noted at lags 1 and 4, with a negative effect at lag 3, indicating oscillating impacts that diminish over time. In contrast, the equation for the blob gas base fee showed no significant effects. The near-zero correlation of residuals (-0.027446) suggests minimal unforeseen shared variations between these markets.

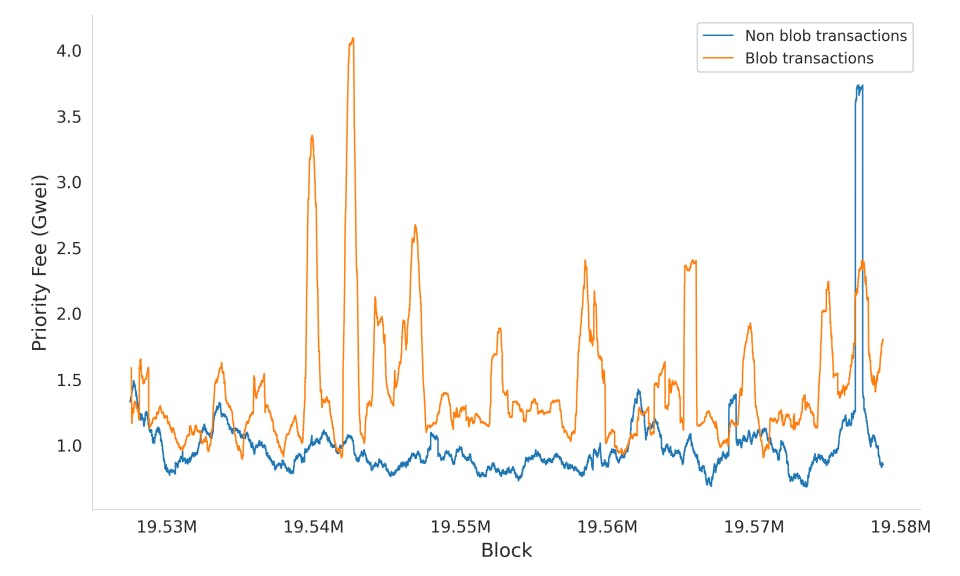

4.4.2 Blob gas priority fee. We analyzed the economic implications of blob transactions by examining priority fees—calculated as the difference between the effective gas fee and the base fee. Median priority fees for blob and non-blob transactions were compared across various blocks. As shown in Figure 15, blob transactions have a higher average median priority fee of 1.43 Gwei, which is 45.2% greater than the 0.99 Gwei for non-blob transactions.

This notable difference implies that blob transactions are typically assigned a higher priority due to the need to handle additional blob data. Consequently, we have defined the priority fee for blobs, termed ‘blob gas priority fee,’ using the following formula, as detailed in Section 3.4:

The median gas priority fee from other transactions within the same block serves as the baseline. This baseline is subtracted from the total priority fee to isolate the component attributable to blob gas. This method underscores the additional costs imposed on blob transactions.

Validating blob gas priority fee. The priority fee can act as a leading indicator of the base fee when the latter does not promptly reflect demand spikes. Conversely, a rising base fee, signaling increased demand, typically causes the priority fee to decrease. We validated the blob gas priority fee as a proxy for unmet demand using a Vector Autoregression (VAR) analysis, with findings detailed in Table 5 showing statistically significant interactions.

Panel A of the table illustrates the persistence of the blob gas priority fee across all time lags, indicating that these fees are applied consistently and reflect strategic adjustments within the network. Notably, a negative coefficient for the blob gas base fee at lag 1 suggests that a higher initial base fee might reduce subsequent priority fees, better aligning with market demands.

Panel B demonstrates a positive influence of the blob gas priority fee on the blob gas base fee, confirming that increases in the priority fee are promptly followed by rises in the base fee.

These results confirm the interrelationship between the priority and base fees, justifying the use of the blob gas priority fee metric. This metric provides essential insights into fee dynamics within the blob market, aiding developers and users in optimizing network interactions.

4.4.3 Disscussion of Blob Gas Fee Mechanisms. The blob gas base fee update rule’s design is crucial for ensuring predictability for users. Previous studies often evaluate the gas base fee update rule based on two criteria: its volatility and how well it reflects actual demand, inferred from indirect metrics such as the effective gas fee [9, 14, 39].

In our analysis, the blob gas priority fee served as a proxy to gauge the deviation from actual demand within the blob gas market. We employed the ratio of the base fee to the priority fee as a critical metric, reflecting the proportion of unmatched user demands. Figure 16 illustrates significant differences between the gas and blob gas markets. The ratio in the gas market stands at 0.037, markedly higher than the blob gas market’s 0.004. This disparity indicates that the blob gas market aligns more closely with user demand, despite its higher volatility, as detailed in Table 6.

These observations indicate that the blob gas base fee generally aligns well with user demands, suggesting that the underlying mechanisms are effective. However, its heightened volatility poses challenges for the predictability and stability of transaction costs, which are critical for user strategies and overall market dynamics. This variability requires careful consideration; protocol designers must weigh trade-offs between market responsiveness and fee stability to improve the ecosystem’s operational efficiency

5 CONCLUSION

We have conducted a comprehensive analysis of EIP-4844 across four key dimensions: consensus security, Ethereum usage, rollup transactions, and user delays, and the blob gas fee market. Our analysis of the impact of EIP-4844 on the increase in fork rates and block delays provides essential insights into the security implications of the protocol update, addressing concerns within the Ethereum community. Our empirical findings demonstrate the changes in Ethereum and rollup ecosystem dynamics, highlighting the effectiveness of the upgrade and introducing new considerations for user security due to increased posting delays. Furthermore, our exploration of the blob gas fee market unveils new possibilities for evaluating fee structures and optimizing strategies for decentralized applications.

REFERENCES

[1] [n. d.]. L2 Fees Info. https://l2fees.info/. Accessed: 2024-04-30.

[2] 2021. Proposer LMD Score Boosting. Accessed: 2024-04-26.

[3] 2024. Ethernow: Ethereum Data Analysis Tool. https://ethernow.xyz. Accessed: 2024-04-25.

[4] 2024. Etherscan: The Ethereum Blockchain Explorer. https://etherscan.io. Accessed: 2024-04-25.

[5] Sarah Azouvi, Guy Goren, Lioba Heimbach, and Alexander Hicks. 2023. Base Fee Manipulation In Ethereum’s EIP-1559 Transaction Fee Mechanism. arXiv preprint arXiv:2304.11478 (2023).

[6] Mirko Bez, Giacomo Fornari, and Tullio Vardanega. 2019. The scalability challenge of ethereum: An initial quantitative analysis. In 2019 IEEE International Conference on Service-Oriented System Engineering (SOSE). IEEE, 167–176.

[7] Vitalik Buterin. 2022. EIP-4844 spec. https://eips.ethereum.org/EIPS/eip-4844. Accessed: 2024-04-25.

[8] Vitalik Buterin. 2024. Proto-Danksharding FAQ. https://notes.ethereum.org/ @vbuterin/proto_danksharding_faq. Accessed: 2024-04-25.

[9] Davide Crapis, Ciamac C Moallemi, and Shouqiao Wang. 2023. Optimal dynamic fees for blockchain resources. arXiv preprint arXiv:2309.12735 (2023).

[10] Theo Diamandis, Alex Evans, Tarun Chitra, and Guillermo Angeris. 2023. Designing Multidimensional Blockchain Fee Markets. In 5th Conference on Advances in Financial Technologies (AFT 2023). Schloss Dagstuhl-Leibniz-Zentrum für Informatik.

[11] Stefan Dziembowski, Sebastian Faust, and Kristina Hostáková. 2018. General state channel networks. In Proceedings of the 2018 ACM SIGSAC Conference on Computer and Communications Security. 949–966.

[12] Dankrad Feist. 2024. New Sharding Proposal. https://notes.ethereum.org/ @dankrad/new_sharding Accessed: 2024-04-15.

[13] Rex Fernando and Arnab Roy. 2023. Poster: WIP: Account ZK-Rollups from Sumcheck Arguments. In Proceedings of the 2023 ACM SIGSAC Conference on Computer and Communications Security. 3594–3596.

[14] Matheus VX Ferreira, Daniel J Moroz, David C Parkes, and Mitchell Stern. 2021. Dynamic posted-price mechanisms for the blockchain transaction-fee market. In Proceedings of the 3rd ACM Conference on Advances in Financial Technologies. 86–99.

[15] Ethereum Foundation. 2024. Ethereum Consensus Specifications. https://github. com/ethereum/consensus-specs. Accessed: 2024-04-25.

[16] Péter Garamvölgyi, Yuxi Liu, Dong Zhou, Fan Long, and Ming Wu. 2022. Utilizing parallelism in smart contracts on decentralized blockchains by taming application-inherent conflicts. In Proceedings of the 44th International Conference on Software Engineering. 2315–2326.

[17] Rati Gelashvili, Alexander Spiegelman, Zhuolun Xiang, George Danezis, Zekun Li, Dahlia Malkhi, Yu Xia, and Runtian Zhou. 2023. Block-stm: Scaling blockchain execution by turning ordering curse to a performance blessing. In Proceedings of the 28th ACM SIGPLAN Annual Symposium on Principles and Practice of Parallel Programming. 232–244.

[18] Mathias Hall-Andersen, Mark Simkin, and Benedikt Wagner. 2023. Foundations of data availability sampling. Cryptology ePrint Archive (2023).

[19] James D Hamilton. 2020. Time series analysis. Princeton university press.

[20] Chengpeng Huang, Rui Song, Shang Gao, Yu Guo, and Bin Xiao. 2024. Data Availability and Decentralization: New Techniques for zk-Rollups in Layer 2 Blockchain Networks. arXiv preprint arXiv:2403.10828 (2024).

[21] Ben Henry Hunter. 2024. Title of the Gist. https://gist.github.com/ benhenryhunter/687299bcfe064674537dc9348d771e83. Accessed: 2024-04-28.

[22] Mubashar Iqbal and Raimundas Matulevičius. 2021. Exploring sybil and doublespending risks in blockchain systems. IEEE Access 9 (2021), 76153–76177.

[23] Uri Klarman, Soumya Basu, Aleksandar Kuzmanovic, and Emin Gün Sirer. 2018. bloxroute: A scalable trustless blockchain distribution network whitepaper. IEEE Internet of Things Journal (2018).

[24] Arad Kotzer, Daniel Gandelman, and Ori Rottenstreich. 2024. SoK: Applications of Sketches and Rollups in Blockchain Networks. IEEE Transactions on Network and Service Management (2024).

[25] Michał Król, Onur Ascigil, Sergi Rene, Etienne Rivière, Matthieu Pigaglio, Kaleem Peeroo, Vladimir Stankovic, Ramin Sadre, and Felix Lange. 2023. Data Availability Sampling in Ethereum: Analysis of P2P Networking Requirements. arXiv preprint arXiv:2306.11456 (2023).

[26] L2BEAT. [n. d.]. Layer 2 Scaling Projects Summary. https://l2beat.com/scaling/ summary. Accessed: 2024-04-15.

[27] Prysmatic Labs. 2024. Prysm: Ethereum Consensus Layer Client. https://github. com/prysmaticlabs/prysm. Accessed: 2024-04-29.

[28] Ledgerwatch and other contributors. 2024. Erigon: Ethereum implementation on the efficiency frontier. https://github.com/ledgerwatch/erigon. Accessed: 2024-04-28.

[29] Stefanos Leonardos, Daniël Reijsbergen, Barnabé Monnot, and Georgios Piliouras. 2023. Optimality despite chaos in fee markets. In International Conference on Financial Cryptography and Data Security. Springer, 346–362.

[30] Yulin Liu, Yuxuan Lu, Kartik Nayak, Fan Zhang, Luyao Zhang, and Yinhong Zhao. 2022. Empirical analysis of eip-1559: Transaction fees, waiting times, and consensus security. In Proceedings of the 2022 ACM SIGSAC Conference on Computer and Communications Security. 2099–2113.

[31] Akaki Mamageishvili and Edward W Felten. 2023. Efficient rollup batch posting strategy on base layer. In International Conference on Financial Cryptography and Data Security. Springer, 355–366.

[32] Mahen Mandal, Mohd Sameen Chishti, and Amit Banerjee. 2023. Investigating Layer-2 Scalability Solutions for Blockchain Applications. In 2023 IEEE International Conference on High Performance Computing & Communications, Data Science & Systems, Smart City & Dependability in Sensor, Cloud & Big Data Systems & Application (HPCC/DSS/SmartCity/DependSys). IEEE, 710–717.

[33] Author’s Name. 2018. Roll-up roll back SNARK side-chain: 17000 TPS. https: //ethresear.ch/t/roll-up-roll-back-snark-side-chain-17000-tps/3675. Accessed: 2024-04-25.

[34] Kamilla Nazirkhanova, Joachim Neu, and David Tse. 2022. Information dispersal with provable retrievability for rollups. In Proceedings of the 4th ACM Conference on Advances in Financial Technologies. 180–197.

[35] Ray Neiheiser, Gustavo Inácio, Luciana Rech, Carlos Montez, Miguel Matos, and Luís Rodrigues. 2023. Practical Limitations of Ethereum’s Layer-2. IEEE Access 11 (2023), 8651–8662.

[36] Joachim Neu, Ertem Nusret Tas, and David Tse. 2021. Ebb-and-flow protocols: A resolution of the availability-finality dilemma. In 2021 IEEE Symposium on Security and Privacy (SP). IEEE, 446–465.

[37] Optimism. 2024. Span Batches. https://specs.optimism.io/protocol/span-batches. html. Accessed: 2024-04-18.

[38] Joseph Poon and Vitalik Buterin. 2017. Plasma: Scalable autonomous smart contracts. White paper (2017), 1–47.

[39] Daniël Reijsbergen, Shyam Sridhar, Barnabé Monnot, Stefanos Leonardos, Stratis Skoulakis, and Georgios Piliouras. 2021. Transaction fees on a honeymoon: Ethereum’s EIP-1559 one month later. In 2021 IEEE International Conference on Blockchain (Blockchain). IEEE, 196–204.

[40] Tim Roughgarden. 2021. Transaction fee mechanism design. ACM SIGecom Exchanges 19, 1 (2021), 52–55.

[41] Caspar Schwarz-Schilling, Joachim Neu, Barnabé Monnot, Aditya Asgaonkar, Ertem Nusret Tas, and David Tse. 2022. Three attacks on proof-of-stake ethereum. In International Conference on Financial Cryptography and Data Security. Springer, 560–576.

[42] Cosimo Sguanci, Roberto Spatafora, and Andrea Mario Vergani. 2021. Layer 2 blockchain scaling: A survey. arXiv preprint arXiv:2107.10881 (2021).

[43] Peiyao Sheng, Bowen Xue, Sreeram Kannan, and Pramod Viswanath. 2021. ACeD: Scalable data availability oracle. In Financial Cryptography and Data Security: 25th International Conference, FC 2021, Virtual Event, March 1–5, 2021, Revised Selected Papers, Part II 25. Springer, 299–318.

[44] Ertem Nusret Tas, John Adler, Mustafa Al-Bassam, Ismail Khoffi, David Tse, and Nima Vaziri. 2022. Accountable safety for rollups. arXiv preprint arXiv:2210.15017 (2022).

[45] Ethereum Team. 2024. go-ethereum: Official Go implementation of the Ethereum protocol. https://github.com/ethereum/go-ethereum. Accessed: 2024-04-28.

[46] Louis Tremblay Thibault, Tom Sarry, and Abdelhakim Senhaji Hafid. 2022. Blockchain scaling using rollups: A comprehensive survey. IEEE Access 10 (2022), 93039–93054.

[47] Leon Visscher, Mohammed Alghazwi, Dimka Karastoyanova, and Fatih Turkmen. 2022. Poster: Privacy-preserving genome analysis using verifiable off-chain computation. In Proceedings of the 2022 ACM SIGSAC Conference on Computer and Communications Security. 3475–3477.

[48] Toni Wahrstätter. 2024. On Increasing the Block Gas Limit. https://ethresear.ch/ t/on-increasing-the-block-gas-limit/18567. Accessed: 2024-04-15.

[49] Gavin Wood et al. 2014. Ethereum: A secure decentralised generalised transaction ledger. Ethereum project yellow paper 151, 2014 (2014), 1–32.

[50] Yang Xiao, Ning Zhang, Wenjing Lou, and Y Thomas Hou. 2020. Modeling the impact of network connectivity on consensus security of proof-of-work blockchain. In IEEE INFOCOM 2020-IEEE Conference on Computer Communications. IEEE, 1648–1657.

Authors:

(1) Seongwan Park, this author contributed equally to the paper from Seoul National University, Seoul, Republic of Korea ([email protected]);

(2) Bosul Mun, this author contributed equally to the paper from Seoul National University, Seoul, Republic of Korea ([email protected]);

(3) Seungyun Lee, Seoul National University, Seoul, Repulic of Korea;

(4) Woojin Jeong, Seoul National University, Seoul, Repulic of Korea;

(5) Jaewook Lee, Seoul National University, Seoul, Repulic of Korea;

(6) Hyeonsang Eom, Seoul National University, Seoul, Repulic of Korea;

(7) Huisu Jang (Corresponding author), Soongsil University, Seoul, Republic of Korea.

This paper is