Can a decentralized exchange really offer 1000x leverage while maintaining security and capital efficiency?

That’s the question Moonlander aims to answer, and it just secured an undisclosed amount of funding from one of crypto’s major players to prove it can.

Crypto.com Capital announced its strategic investment in Moonlander on September 22, 2025, marking a significant vote of confidence in the decentralized perpetual exchange built on Cronos EVM and zkEVM. While the investment amount remains confidential, it comes from Crypto.com Capital’s $500 million fund dedicated to Web3 ventures, at a time when decentralized finance continues to search for solutions that can match the trading experience of centralized exchanges without sacrificing the core principles of blockchain technology.

The Numbers Behind the Investment

Moonlander has already built considerable momentum before this investment. The platform reports a Total Value Locked exceeding $33 million and cumulative trading volume surpassing $2 billion. These metrics suggest real user adoption rather than speculative interest, particularly notable in a market where many DeFi protocols struggle to maintain consistent activity.

The investment from Crypto.com Capital, drawn from its $500 million fund dedicated to Web3 companies, will fuel team expansion, feature development, and marketing initiatives. While the exact investment amount remains undisclosed, the strategic nature of the partnership suggests more than just capital injection. Crypto.com’s ecosystem, which includes millions of app users globally, provides Moonlander with potential distribution channels that many DeFi projects lack.

For context, TVL represents the total amount of cryptocurrency locked in a protocol’s smart contracts. Think of it as the amount of money sitting in a digital vault that enables the platform to function. A higher TVL typically indicates greater user trust and more liquidity for traders.

At its core, Moonlander operates through what it calls the Moonlander Liquidity Pool, or MLP. This shared pool functions as the counterparty to all trades on the platform. When a trader opens a position, they’re essentially betting against this pool rather than another individual trader. This model, while not unique to Moonlander, aims to solve the liquidity fragmentation that plagues many decentralized exchanges. The platform integrates PYTH oracle for price feeds, a critical component for any derivatives exchange. Oracles act as bridges between blockchain networks and real-world data. Without reliable price information, traders could face unfair liquidations or price manipulation. PYTH, developed by major financial institutions and trading firms, provides high-frequency price updates that help maintain market integrity.

Leverage, in simple terms, allows traders to control a larger position than their initial capital would normally permit. If you have $100 and use 10x leverage, you can control a $1,000 position. The promise of 1000x leverage means a trader could theoretically control $100,000 with just $100. While this amplifies potential profits, it equally magnifies losses, making risk management crucial.

Understanding The Social First Approach

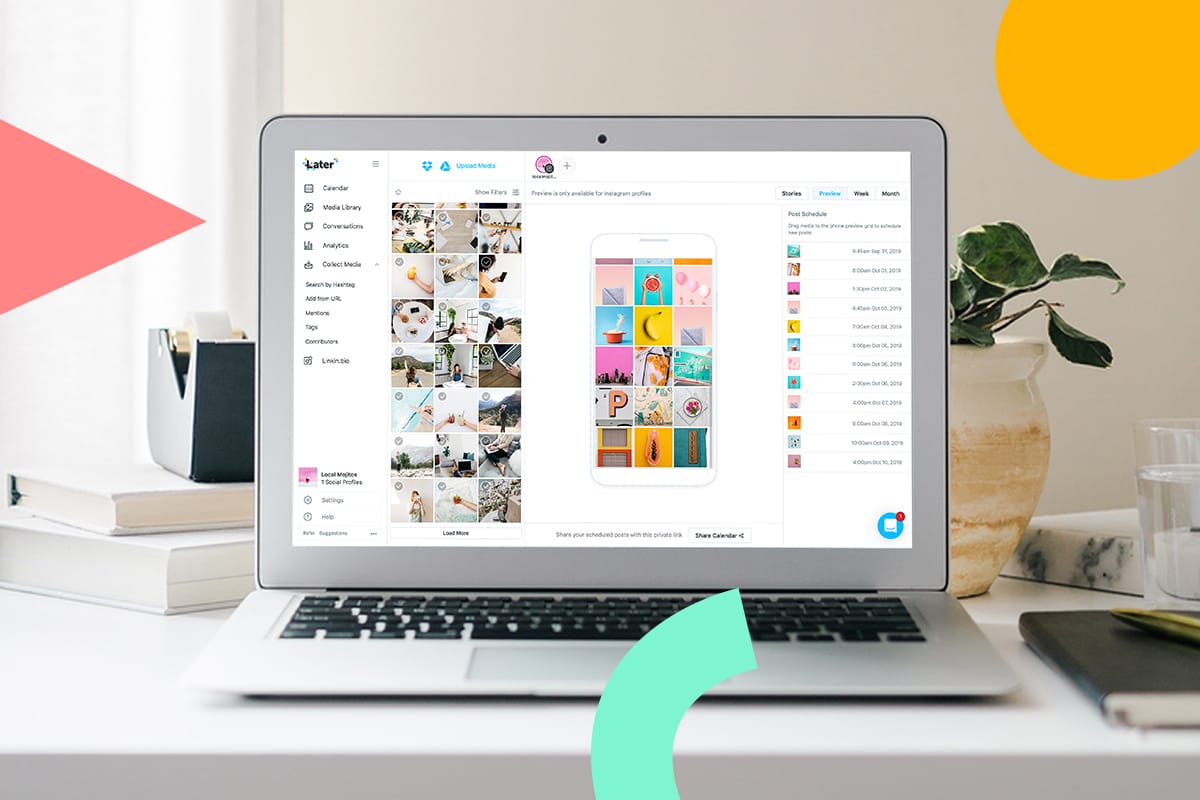

Moonlander differentiates itself through what it calls a “social-first approach.” The platform includes token-specific chat rooms, real-time leaderboards, and markets tied to political events and internet culture. This strategy acknowledges that trading, particularly in crypto, has become as much about community and narrative as it is about technical analysis.

“Trading is Social,” as the platform puts it, reflects a broader trend in financial markets where retail traders coordinate through social media and messaging platforms. The GameStop saga of 2021 demonstrated the power of coordinated retail trading, and Moonlander appears to be building infrastructure to facilitate similar community-driven speculation within its ecosystem. These social features could serve a dual purpose. They might increase user engagement and retention while also creating information networks that could improve price discovery and market efficiency. However, they also raise questions about market manipulation and the spread of misinformation, challenges that all social trading platforms must navigate.

Risk and Reward in DeFi Derivatives

The promise of 1000x leverage raises immediate questions about risk management and platform sustainability. Traditional finance typically caps leverage at much lower levels, with forex brokers offering 50x to 100x for retail traders. The higher the leverage, the smaller the price movement needed to liquidate a position.

For liquidity providers who deposit assets into the MLP, the model presents different risks. They earn yields from trading fees, paid in CRO and other tokens, but they also bear the risk of trader profits. If traders collectively win against the pool, liquidity providers could see their deposits decrease in value. This model has been tested in other protocols with mixed results, depending on market conditions and trader behavior.

Tommy Chan, Head of DeFi Investment at Crypto.com Capital, expressed confidence in the team’s technical capabilities,

“Moonlander’s team has demonstrated exceptional technical vision and the ability to execute on a sophisticated product that we believe can become a cornerstone of the DeFi ecosystem on Cronos.”

We need to note that Moonlander enters a competitive landscape dominated by established players like dYdX, GMX, and Synthetix. Each offers different approaches to decentralized derivatives trading, from order book models to synthetic assets. The key differentiator often comes down to execution, user experience, and liquidity depth rather than just feature sets. The timing of this investment coincides with renewed interest in DeFi following regulatory clarity in major markets and improved blockchain infrastructure. However, the sector still faces challenges including regulatory uncertainty, smart contract risks and the complexity barrier for mainstream users.

The integration with Crypto.com’s ecosystem could provide Moonlander with a bridge to retail users who might otherwise find DeFi protocols intimidating. The platform’s social features might also lower the learning curve by allowing new users to observe and learn from experienced traders.

Final Thoughts

Moonlander represents both the promise and peril of DeFi innovation. The platform’s technical architecture appears sound, with established components like PYTH oracles and proven liquidity pool models. The backing from Crypto.com Capital provides not just funding but also ecosystem access that could accelerate user adoption. However, the 1000x leverage headline feature feels more like marketing than a sustainable trading tool. Few traders can effectively manage such extreme leverage, and the feature might attract gamblers rather than serious traders. The platform’s long-term success will likely depend more on its ability to build liquid markets, maintain security, and create genuine community value rather than extreme leverage offerings.

The social trading elements present an interesting evolution in DeFi, acknowledging that financial markets are inherently social constructs. If Moonlander can balance community engagement with market integrity, it might carve out a unique position in the crowded derivatives landscape.

What remains to be seen is whether Moonlander can deliver on its ambitious vision while navigating the technical, regulatory, and market risks inherent in offering leveraged derivatives trading. The Crypto.com Capital investment suggests confidence in the team’s ability to execute, but in DeFi, execution is everything, and the market will ultimately judge whether Moonlander’s approach resonates with traders seeking alternatives to centralized exchanges.

Don’t forget to like and share the story!

:::tip

This author is an independent contributor publishing via our business blogging program. HackerNoon has reviewed the report for quality, but the claims herein belong to the author. #DYO

:::