Can a decentralized protocol settle derivatives faster, cheaper, and more transparently than a centralized exchange, without sacrificing execution quality?

That question has haunted onchain derivatives for years. Perpetual futures, the contracts that let traders take leveraged positions without expiry dates, have exploded in demand. Decentralized perpetual exchanges processed $7.9 trillion in trading volume in 2025 alone, according to DefiLlama data reported by Cointelegraph. Monthly volumes crossed $1 trillion for the first time in October 2025, and December sustained that pace. Yet despite this growth, onchain derivatives still capture only a fraction of the total derivatives market. Most volume remains locked inside centralized venues like Binance, Bybit, and OKX.

MYX thinks the bottleneck is not demand. It is infrastructure. And with Consensys now its largest investor, the protocol is betting that modular settlement, not another exchange interface, is what the market actually needs.

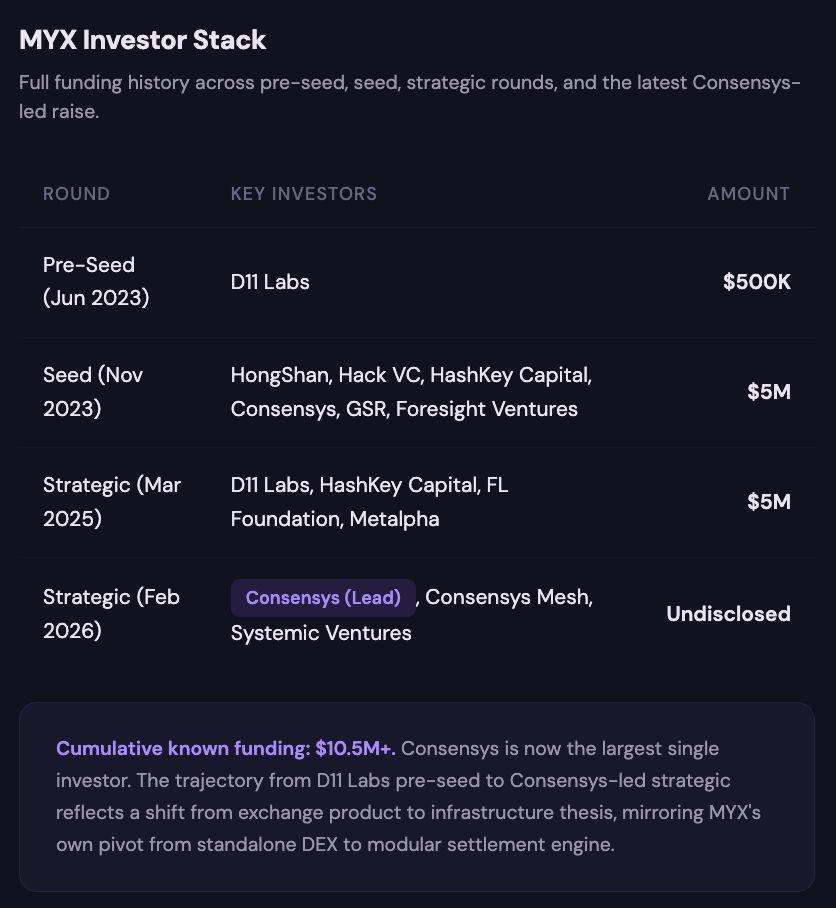

The Funding and What It Means

Consensys led the strategic round, with participation from Consensys Mesh, the Ethereum ecosystem incubator and investment arm founded by Ethereum co-founder Joseph Lubin in 2015, and Systemic Ventures. The round makes Consensys the single largest investor in MYX, a notable signal given that Consensys builds core Ethereum infrastructure including MetaMask, Linea, and Infura.

Ray Hernandez, Senior VP of Corporate Development at Consensys, explains,

As onchain markets mature, derivatives infrastructure needs to evolve beyond siloed venues toward modular, shared settlement layers. We believe that resilient, capital-efficient settlement infrastructure is foundational to the long-term health and scalability of Ethereum’s financial ecosystem. MYX’s approach reflects this shift, prioritizing composability and transparent settlement at the infrastructure layer.

The framing here matters. Consensys is not positioning this as a bet on another trading venue. It is positioning it as an investment in financial infrastructure, the plumbing layer that other products, protocols, and institutions build upon. Consensys Mesh’s portfolio of over 138 positions spans the entire Ethereum stack, and MYX now sits within that infrastructure thesis alongside projects like Gnosis, Gitcoin, and Aztec.

What MYX V2 Actually Changes

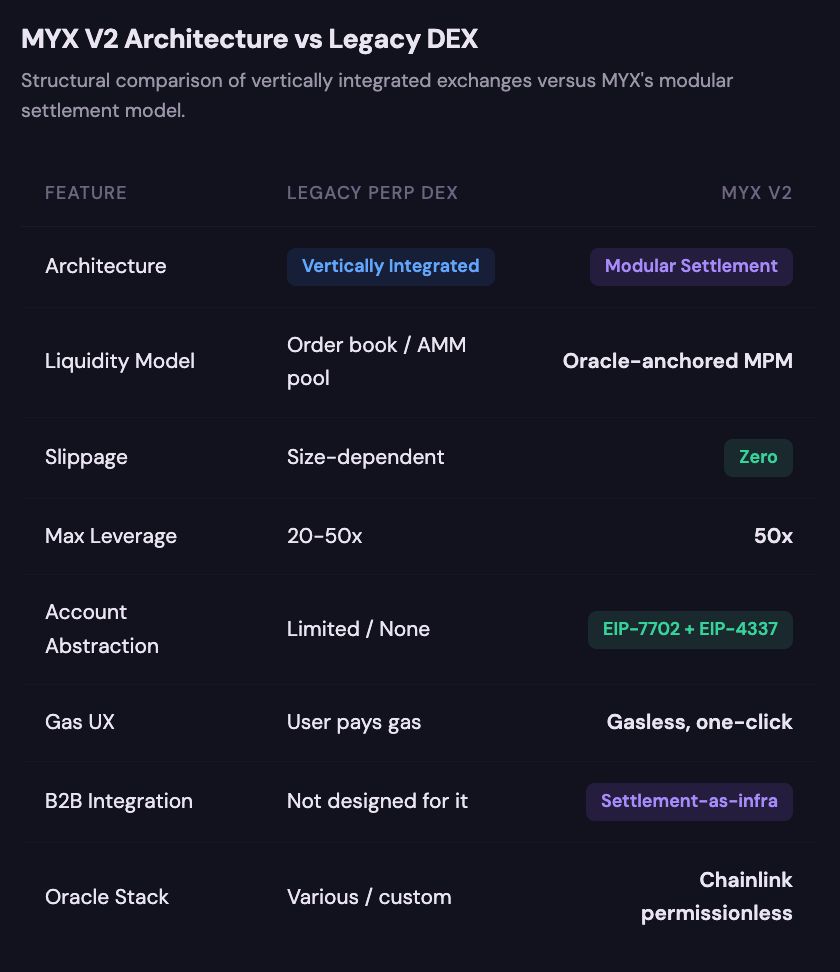

To understand why this matters, you need to understand how most decentralized perpetual exchanges work today. Platforms like Hyperliquid, dYdX, and GMX are vertically integrated. That means the matching engine, liquidity pools, settlement logic, and user interface all live within a single application. If you want to trade on Hyperliquid, you use Hyperliquid. The liquidity there does not transfer anywhere else.

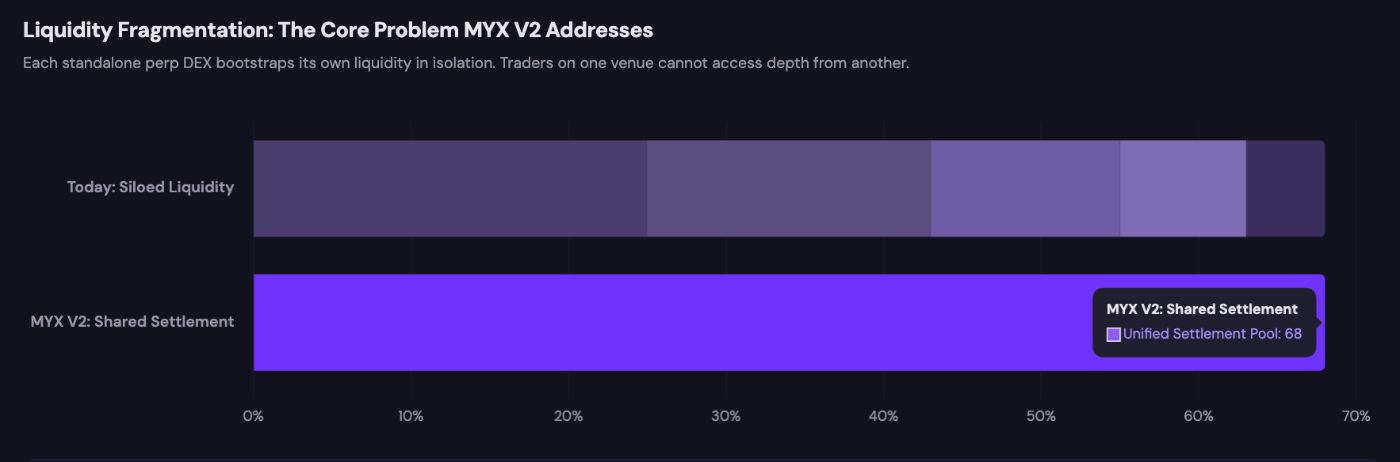

This creates a structural problem called liquidity fragmentation. Every new chain, every new DEX, every new trading app has to bootstrap its own liquidity from scratch. Traders on one platform cannot access depth from another. This is the equivalent of every stock exchange in the world refusing to share order flow with any other.

MYX V2 takes a different approach. Instead of operating as a standalone exchange, it repositions as a modular settlement engine, a shared layer that other products can plug into. Think of it like the difference between building a restaurant and building a commercial kitchen that multiple restaurants can use. Trading apps, automation platforms, and institutional desks can integrate with MYX’s settlement rails without building their own clearing and margin infrastructure.

MYX CEO Ryan explains,

MYX V2 is more than just an exchange, it’s an engine. Integrating EIP-7702 and permissionless oracles means we can make onchain perps trading seamless while preserving decentralized sovereignty. We’re grateful to all our investors for aligning with our vision to redefine perpetual settlement standards.

At the technical level, V2 integrates two significant Ethereum standards. EIP-7702, which was introduced in Ethereum’s Pectra upgrade on May 7, 2025, allows regular wallets (called externally owned accounts or EOAs) to temporarily function like smart contracts. In practice, this means users can batch multiple actions into a single transaction, have gas fees sponsored by the platform, and trade without the typical friction of approving each step separately. Alongside EIP-4337 account abstraction, this enables gasless, one-click trading while the user retains full custody of their funds.

The second component is Chainlink’s permissionless oracle stack, which anchors prices directly to external data feeds rather than relying on order book depth. This is what enables MYX’s zero-slippage execution model. A trader placing a large position does not push the price against themselves because pricing is derived from oracle feeds, not from the orders currently sitting in the book. MYX calls this its Dynamic Margin system, which supports up to 50x leverage.

The $7.9 Trillion Context

The timing of this raise matters. Onchain perpetual futures had a breakout 2025. According to Cointelegraph’s reporting on DefiLlama data, cumulative perpetual DEX volume reached $12.09 trillion by year end, with $7.9 trillion, representing 65% of all lifetime volume, generated in 2025 alone. Hyperliquid dominated with roughly 80% market share at its peak, processing over $357 billion in monthly volume by August 2025.

But dominance by a single platform is itself a risk. Coinbase researcher David Duong noted in late 2025 that the surge was driven partly by the absence of a traditional altcoin season, pushing traders toward leverage as a substitute for spot gains. If that leverage demand becomes structural rather than cyclical, the infrastructure beneath it needs to scale accordingly.

This is where the modular thesis comes in. MYX’s bet is that the next phase of growth will not come from building more standalone exchanges, but from building settlement primitives that multiple front-ends, strategies, and institutions can share. The parallel in traditional finance would be clearinghouses like the DTCC or LCH, entities that sit beneath exchanges and ensure trades settle correctly across multiple venues.

MYX itself already has traction. According to DefiLlama and CoinMarketCap data, the protocol has processed significant volume across Linea, Arbitrum, and BNB Chain, with over 200,000 cumulative trading addresses prior to the V2 launch. Previous funding rounds included backing from HongShan (formerly Sequoia China), Hack VC, HashKey Capital, and Foresight Ventures.

Final Thoughts

Consensys becoming the largest investor in MYX is not a casual allocation. It reflects a thesis that onchain derivatives are graduating from standalone exchanges into composable infrastructure, and that settlement is the layer where long-term value will accrue. The integration of EIP-7702 and permissionless oracles directly addresses the two issues that have historically kept institutional capital on centralized venues: execution friction and slippage risk.

Whether MYX captures meaningful market share depends on execution and ecosystem adoption. But the structural logic is sound. The derivatives market is moving onchain at an accelerating pace, and the protocols that become embedded infrastructure, not just trading interfaces, will likely define how that market operates for the next decade.

Don’t forget to like and share the story!