To wrap up the second quarter results, we look at the numbers and key takeaways for HR software stocks including Paylocity (NASDAQ:PCTY) and peers.

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses of all sizes prefer the flexibility of cloud-based, web-based, subscription-based software delivered through a web browser, rather than the hassle and complexity of buying and managing on-premise enterprise software. In terms of usability, the consumerization of enterprise software creates seamless experiences that consolidate multiple disparate processes like payroll and compliance into a single, easy-to-use platform.

The 6 HR software stocks we track reported a slower second quarter. As a group, revenues beat analysts’ consensus estimates by 0.7%, while next-quarter revenue forecasts came in 2.1% lower.

Inflation has recently moved toward the Fed’s 2% target, prompting the central bank to cut its policy rate by 50 bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) numbers have been supportive recently, employment measures have bordered on worrying. Markets will judge whether this rate cut (and more potential cuts in 2024 and 2025) is the ideal time to support the economy or too late for a macro that has already cooled too much.

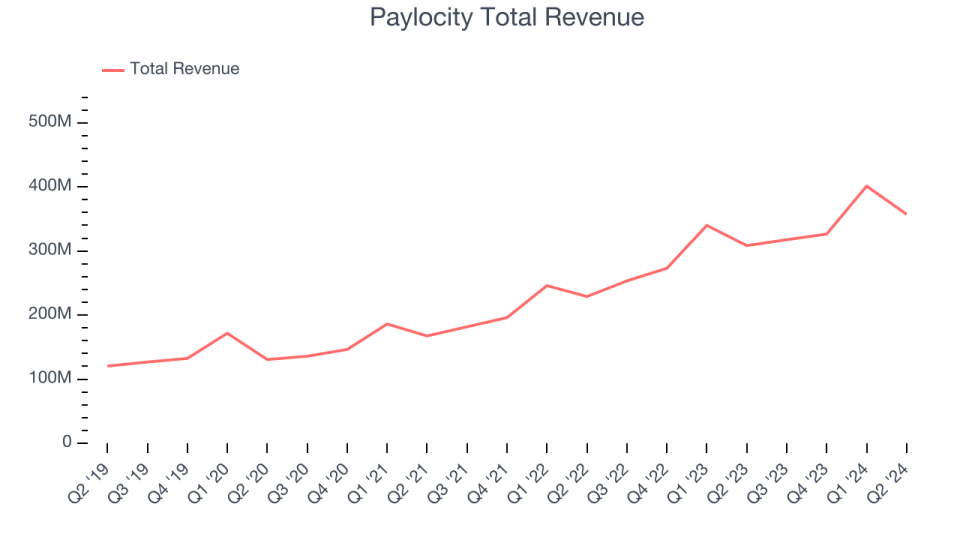

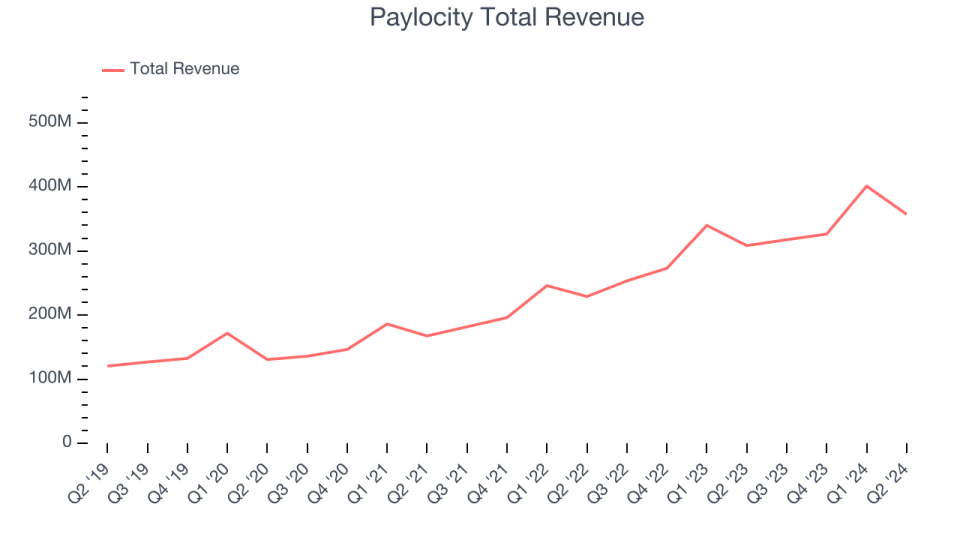

Paylocity (NASDAQ:PCTY)

Founded in 1997 by payroll software veteran Steve Sarowitz, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software to small and medium-sized businesses.

Paylocity reported revenue of $357.3 million, up 15.8% year-over-year. The print topped analysts’ expectations by 2.1%. Despite the top-line beat, it was still a softer quarter for the company, with management predicting slowing growth and disappointing revenue guidance for the next quarter.

“Our position as the most modern HCM provider drove strong financial results in fiscal year 24, as we ended the year with total revenue growth of 19%, recurring and other revenue growth of 17%, and significant increases in profitability. Our financial performance in fiscal year 24 was supported by year-over-year client growth of 8% to 39,050 clients and average revenue growth of 8% per client, while also focusing on efficiency and productivity across our organization,” said Toby Williams, President and Co-Chief Executive Officer of Paylocity.

Paylocity delivered the weakest full-year guidance update of the group. Interestingly, the stock is up 8.4% since the report and currently trades at $160.76.

Read our full report on Paylocity here, it’s free.

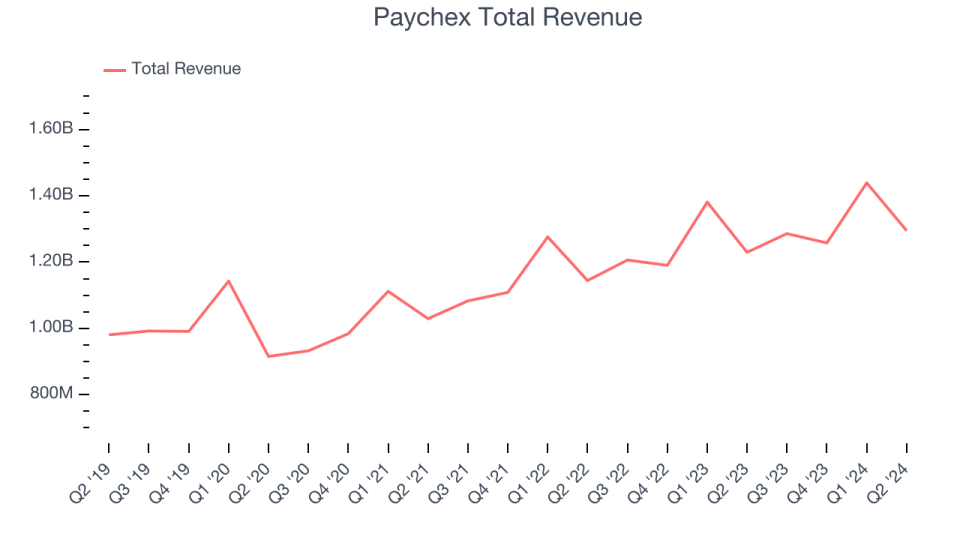

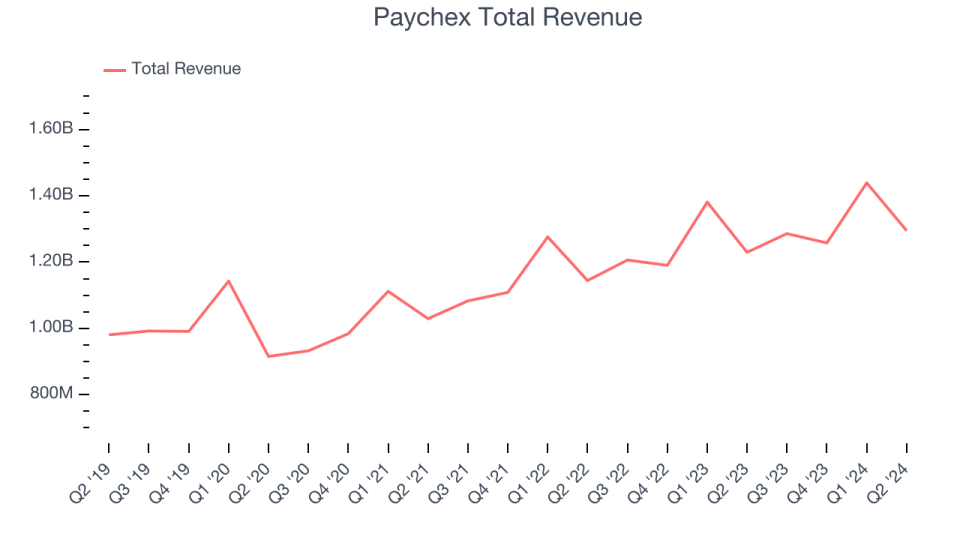

Best Q2: Paychex (NASDAQ:PAYX)

Paychex (NASDAQ:PAYX), one of the industry’s oldest service providers, provides payroll and HR software solutions to its customers.

Paychex reported revenue of $1.30 billion, up 5.3% year-over-year, in line with analyst expectations. The company outperformed its peers, but overall it was a mixed quarter with gross margins down.

The market seems pleased with the results, as the stock is up 6.5% since the report. It is currently trading at $132.98.

Is now the time to buy Paychex? Check out our full earnings analysis here, it’s free.

Asure (NASDAQ:ASUR)

Asure (NASDAQ:ASUR) was formed in 2007 through the merger of two small workforce management companies and provides cloud-based payroll and HR software to small and mid-sized businesses (SMBs).

Asure reported revenue of $28.04 million, down 7.8% year-over-year, 2% below analyst expectations. It was a softer quarter, as it reported a decline in gross margin and a full-year revenue forecast that missed analysts’ expectations.

Asure delivered the weakest performance against analyst estimates and the slowest revenue growth in the group. As expected, the stock has fallen 13.3% since the results and is currently trading at $8.66.

Read our full analysis of Asure’s results here.

Paycom (NYSE:PAYC)

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and mid-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Paycom reported revenue of $437.5 million, up 9.1% year-over-year. The print was in line with analysts’ expectations. However, it was a softer quarter, as it posted a decline in gross margin and a full-year revenue forecast that missed analysts’ expectations.

The stock has risen 3.3% since the report and is currently trading at $172.20.

Read our full, actionable report on Paycom here. It’s free.

Dayforce (NYSE:DAY)

Dayforce (NYSE:DAY) was founded in 1992 as Ceridian, an outsourced payroll processing company, and transformed following the acquisition of Dayforce in 2012. It is a provider of cloud-based payroll and HR software focused on mid-market companies.

Dayforce reported revenue of $423.3 million, up 15.7% year-over-year. The result beat analysts’ expectations by 1.4%. Taking a step back, it was a softer quarter, as it recorded a decline in gross margin and slowing customer growth.

Dayforce scored the highest full-year guidance increase among its peers, adding 82 customers for a total of 6,657. The stock is up 10.2% since the report and is currently trading at $59.18.

Read our full, actionable report on Dayforce here. It’s free.

Join Paid Stock Investor Research

Help us make StockStory more useful to investors like you. Join our paid user research session and receive a $50 Amazon gift card for your opinion. Sign up here.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25803800/hero_adjustment.jpg)