Welcome to our new series, The Circuit. Meet our next interviewee:

KPMG’s global Emerging Giants programme supports fast-growth and scaling businesses, working across a variety of sectors to provide support to companies navigating the complex, and often overwhelming, early stages.

In this exclusive interview with UKTN, Lowe explains what makes the ultimate Emerging Giant, the special qualities that founding teams need to progress beyond the early stages and the current investing landscape.

What key indicators or traits do you look for when identifying a business with the potential to scale successfully?

There are several indicators we look for, and these change over time. We need to ensure that we understand a product and explore how the product fits within its selected market. We always look at how we can pique an audience’s interest, not just domestically but on a global scale.

From an accounting perspective, we have a team that complements early-stage businesses. We consider the financial model, which is vital to determine how a product will be commercialised. We work with businesses to create a financial plan that outlines how their business will create sustainable, recurring year-on-year revenue growth so investors are clear on the path to profitability.

“We have a team that complements early-stage businesses”

Fast-growth businesses often face difficulty scaling. What are the most common challenges you see startups encounter, and how do you proactively help them overcome these hurdles?

Our team operates across the UK, and a universal challenge we encounter when working with scaling companies is access to finance.

We work directly with founders on their funding pathway either through our Access programme – an investor readiness initiative – or working with them on a one-to-one basis. We provide guidance for businesses to prepare for a series funding round; understanding the requirements a venture capitalist will be looking for and the conversations they should be having.

Access to new markets is another key challenge. KPMG is obviously a global firm, so we are happy to work with our colleagues around the world to build connections, but we also work with businesses to understand what international expansion might mean for them.

With the businesses you work with during their most critical phase, how do you advise that they stay financially sound without slowing their momentum?

During this phase, businesses are often moving from MVP (minimum viable product) to scale, which requires both forward planning and flexibility. Founders may be experts in their niche, but by this point they need to shift their focus toward broader business areas, especially financials.

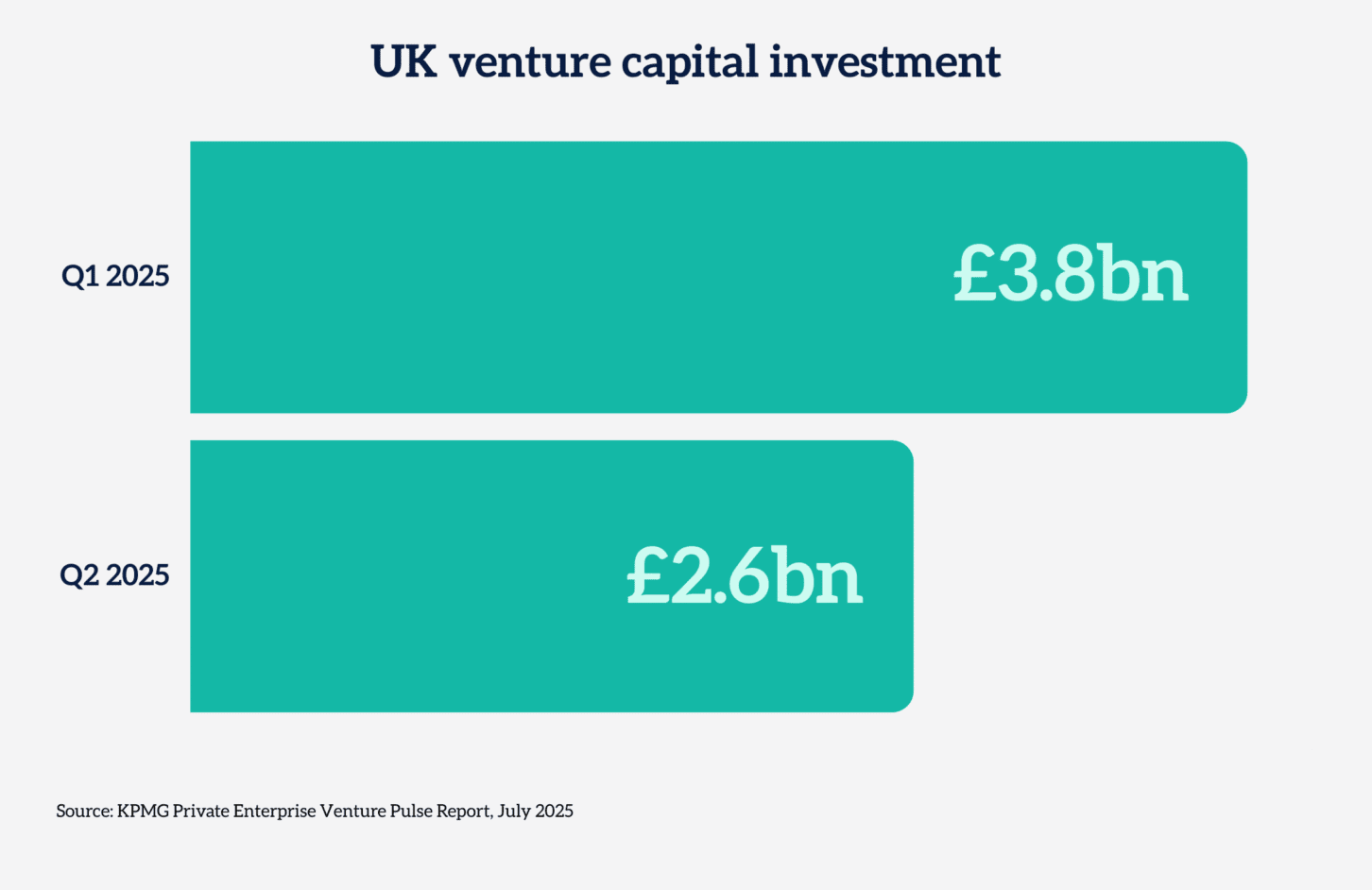

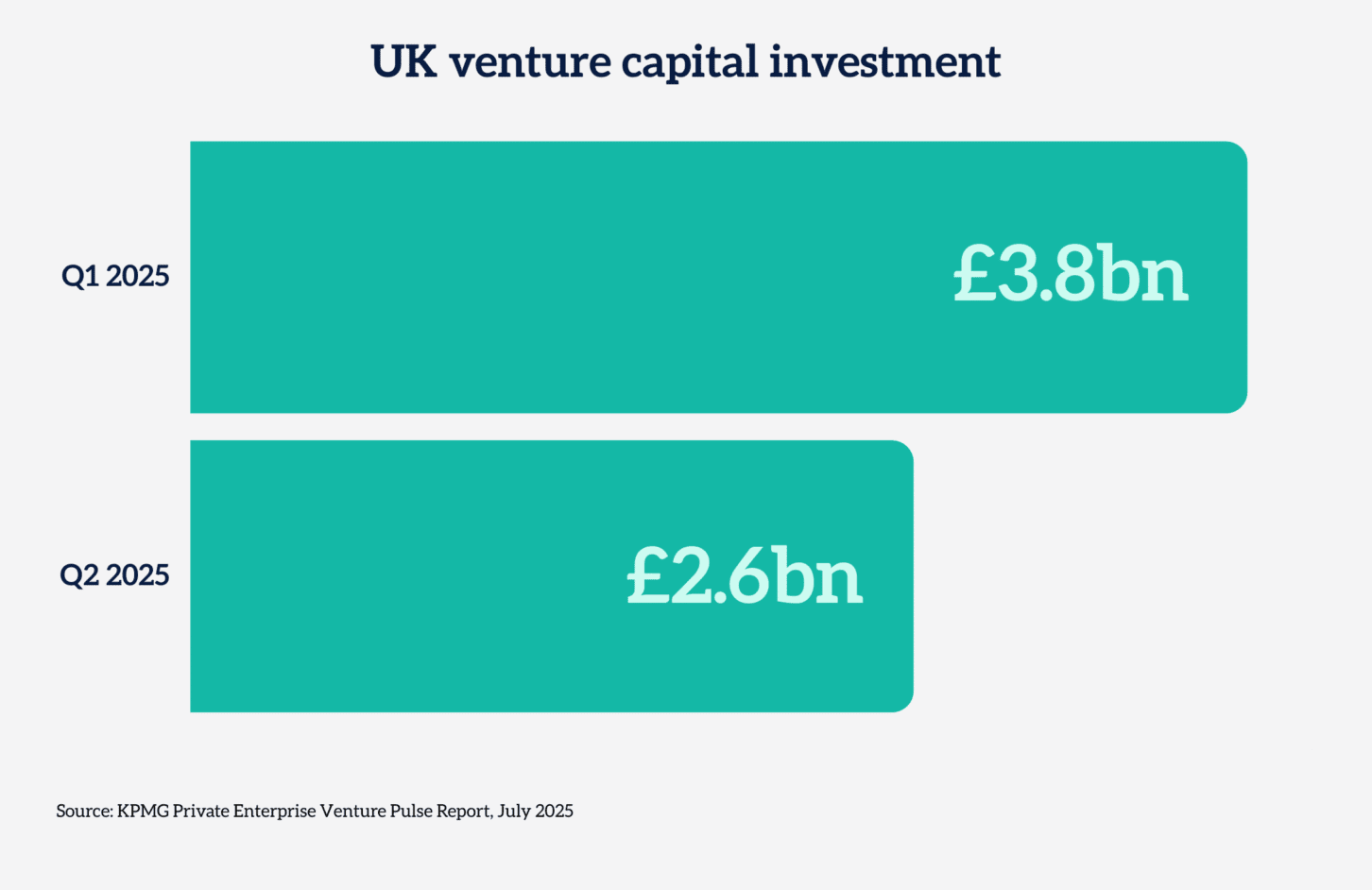

Being realistic is key – particularly around timelines and funding. With VC investment recently hitting a five-year low, founders must consider whether to pursue investment now or delay. Funding timelines are also extending; where a Series A used to take four- to six months, it is now more like six to 12 and this needs to be a key consideration for businesses embarking on their scaling journey.

To maintain momentum, it is important to assess gaps in the team. This may mean hiring more experienced people outside the founding group to own specific areas, allowing founders to focus on where they add the most value during a pivotal time.

The winning formula

Every year, we hold our KPMG’s 2025 Global Tech Innovator competition to find the most innovative and exciting businesses in different regions.

From its humble beginnings 12 years ago, when selected companies would pitch over pizza and beer, it has since grown to become a highly regarded initiative that attracts hundreds of applications every year.

For the UK competition, we had eight heats where around 80 of the businesses that applied pitched in front of an independent judging panel for each region. This panel consisted of an investor, an entrepreneur and someone who is either a leader within a local ecosystem or part of a university incubator programme. This panel then selected the finalists.

This year, we had eight finalists who pitched in front of an esteemed panel of venture capitalists. We brought everyone together for a celebratory dinner to announce the winner – Rachel Curtis at fintech business Inicio.ai (pictured).

As part of our Circuit interview series, we speak to execs from some of the most exciting companies on the UK tech scene. These interviews offer insight about a company’s journey, the sector in which it operates and the people behind the job titles.

Visit The Circuit page to read all interviews in the series and stay tuned for future conversations.