Table of Links

Abstract and 1. Introduction

-

Background

2.1 Layer-2 Blockchains

2.2 Project Mariana

-

Related Work and Contribution

-

System Architecture

-

Model

5.1 Automated Market Makers

5.2 Price Impact

-

Simulation

6.1 Data and Parameters

6.2 Results

-

Discussion

-

Conclusions, Acknowledgements, and References

Graphs and Tables

4 System Architecture

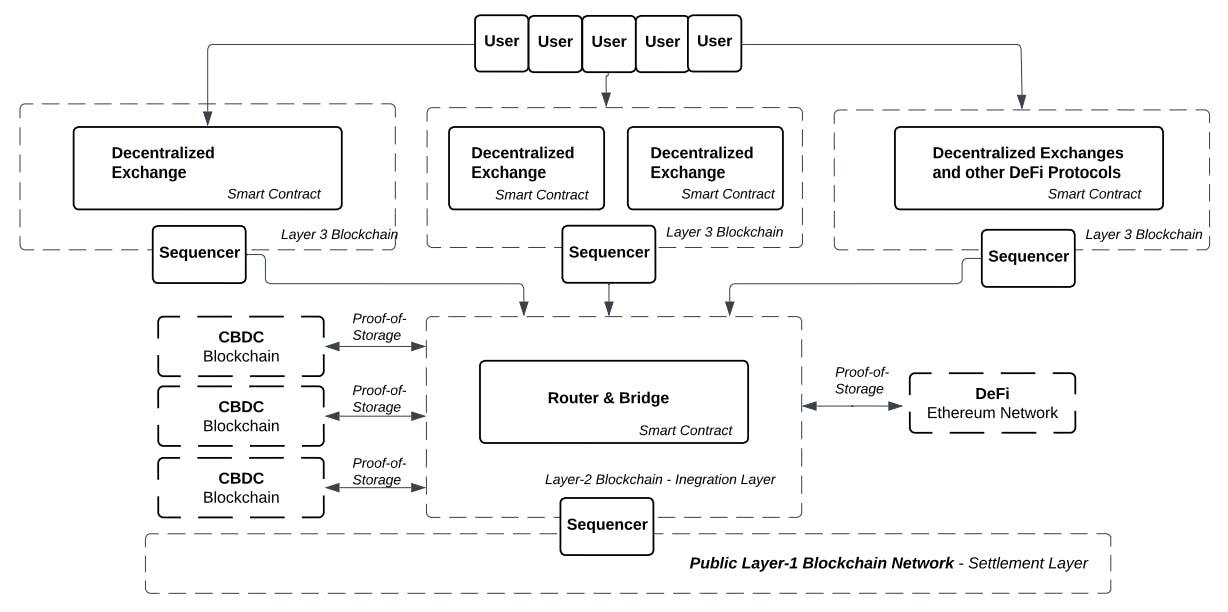

This paper proposes a novel approach for facilitating cross-border CBDCs exchange through a rollup (a form of L2 blockchain) on the public Layer-1 network, further enhanced with a Layer-3 (L3), as illustrated in Fig. 3.

Blockchain and VM Type. The system operates as a L2 blockchain on the public L1 network, benefiting from the inherent security and infrastructure of the L1, including consensus mechanisms and miners/validators. Bitcoin, Ethereum or other L1 networks can be the underlying L1. The system also incorporates Virtual Machines (VMs) to execute smart contracts, with the Ethereum Virtual

Machine (EVM) being our chosen VM due to its compatibility with most DeFi protocols.

L2 and L3s Responsibilities. L2 is the data integration layer and its operations are managed by central institutions like BIS, focusing on interoperability with other CBDC blockchains and facilitating communication between L2 and L3s. The system supports multiple independent L3 blockchains, each with the authority to determine the deployment of decentralized exchanges (DEX) and Automated Market Makers (AMM). Furthermore, the deployment of other DeFi protocols is feasible within this framework. AMM and exchange logic of L3s is moved to the external entities that compete with each other.

Transaction Privacy and Compliance. The L2 and L3 blockchains are private (permissioned networks). All participants must undergo KYC [24] procedures before entering the system. This ensures the system can maintain full transaction privacy, e.g. by leveraging zero-knowledge proofs technology [15], while adhering to regulatory requirements.

Proof-of-storage. We propose utilizing proof of storage protocols to enhance the security, instead of bridges. Unlike bridges that often involve trust assumptions and centralization, the system employs a proof-of-storage approach. CBDC tokens are directly minted on L2, and proof-of-storage protocols rely on corresponding token reserves within country-specific CBDC blockchains.

Rule-based router to L3s. At the core of the system is a Rule-based router hosted on L2. This router employs rules to select the optimal AMM-DEX and L3 for traders at any given moment. Trading fees are dependent on gas costs and trade expenses, and the router optimizes these parameters for each trade.

Integration with DeFi on Ethereum. To ensure compatibility with regulations, the system integrates with DeFi through the privacy pools on the Ethereum blockchain, proposed by Buterin et al.[11]. Only profiles and users validated through these pools are permitted to trade CBDCs, with no additional restrictions or limitations imposed.

Comparison to Mariana Project. A key distinction is its flexibility regarding AMMs, allowing external operators to make decisions about the types of AMMs or central limit order books they wish to operate on L3. Operators of L3s retain control over actions and DeFi protocols within their respective layers. Another advantage of the L2-based system with L3 enhancements is cost optimization and resistance to network congestion. The L2 router automatically directs traders to the L3 AMM-DEX with the lowest trade and gas fees.

Authors:

(1) Krzysztof Gogol, University of Zurich ([email protected]);

(2) Johnnatan Messias, Matter Labs;

(3) Malte Schlosser, University of Zurich;

(4) Benjamin Kraner, University of Zurich;

(5) Claudio Tessone, University of Zurich.