The investment and accounting software firm Clearwater Analytics Holdings Inc. said today it will be taken private by the private equity firms Permira Holdings Ltd. and Warburg Pincus LLC in a deal valued at $8.4 billion.

The private equity firms said they have agreed to buy Clearwater at a price of $24.55 per share in cash, representing a 47% premium on the firm’s share price of $16.69 on Nov. 10, before the first news reports on the possibility of a deal emerged. A number of minority investors, including Francisco Partners Management LP and the Singaporean investment firm Temasek, are also participating in the deal.

Clearwater Chief Executive Sandeep Sahai told media that the deal represents a “great outcome” for the company and its shareholders. “Both firms understand our business and the technology industry and have proven track records fostering growth for some of the largest and fastest-growing technology businesses globally,” he added.

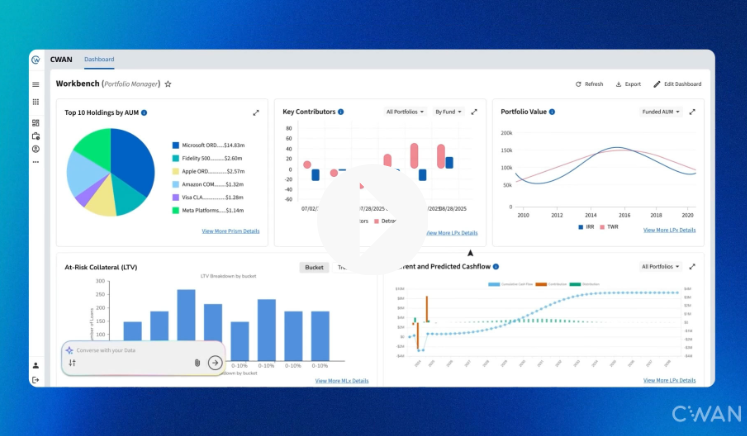

Boise, Idaho-based Clearwater develops analytics software for automated investment accounting, performance, compliance, and risk reporting, helping organizations manage their investment data efficiently and accurately across various asset classes. The structure of its software makes it possible for investors to integrate various artificial intelligence tools to derive more precise, clear-cut insights into their portfolios on-demand, which can improve their investment strategies.

Although the rise of AI has been highlighted as a possible threat to Clearwater, one source familiar with the deal told Reuters that Permira and Warburg Pincus see the deal as an opportunity for the company to expand its own AI capabilities. The private equity firms first submitted an offer to take the company private last month, about four years after they initially helped the software maker to enter the stock market through an initial public offering.

Clearwater’s stock never really set the world alight, though, and it has lost more than 19% of its value in the year-to-date. All told, it’s down 6% from its original IPO price. Last week, the activist investor Starboard Value LLC divulged that it had taken a 5% stake in the company, saying it believes the stock is undervalued and has concern over the integration of recent acquisitions it has made, such as its $1.5 billion deal in January to buy the fellow financial software firm Enfusion Inc.

Permira and Warburg Pincus are acutely familiar with Clearwater. Following the company’s 2021 IPO, they remained its majority shareholders for some time, before slowly reducing their stakes by selling certain share classes.

There is still time for the deal to be derailed, however, for the agreement includes a “go-shop” period that runs until Jan. 23 next year, during which time Clearwater is allowed to solicit alternative offers and evaluate them. It can extend that window for up to 10 days for certain bidders.

However, if no other bidders emerge, the private equity firms say they expect the transaction to close during the first half of next year, at which point Clearwater will be delisted and return to privately held status.

Image: Clearwater Analytics

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About News Media

Founded by tech visionaries John Furrier and Dave Vellante, News Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.