Cryptocurrency exchange Kraken has entered an agreement to acquire NinjaTrader Group LLC, a leading U.S. retail futures trading platform provider, for $1.5 billion, subject to certain purchase price agreements.

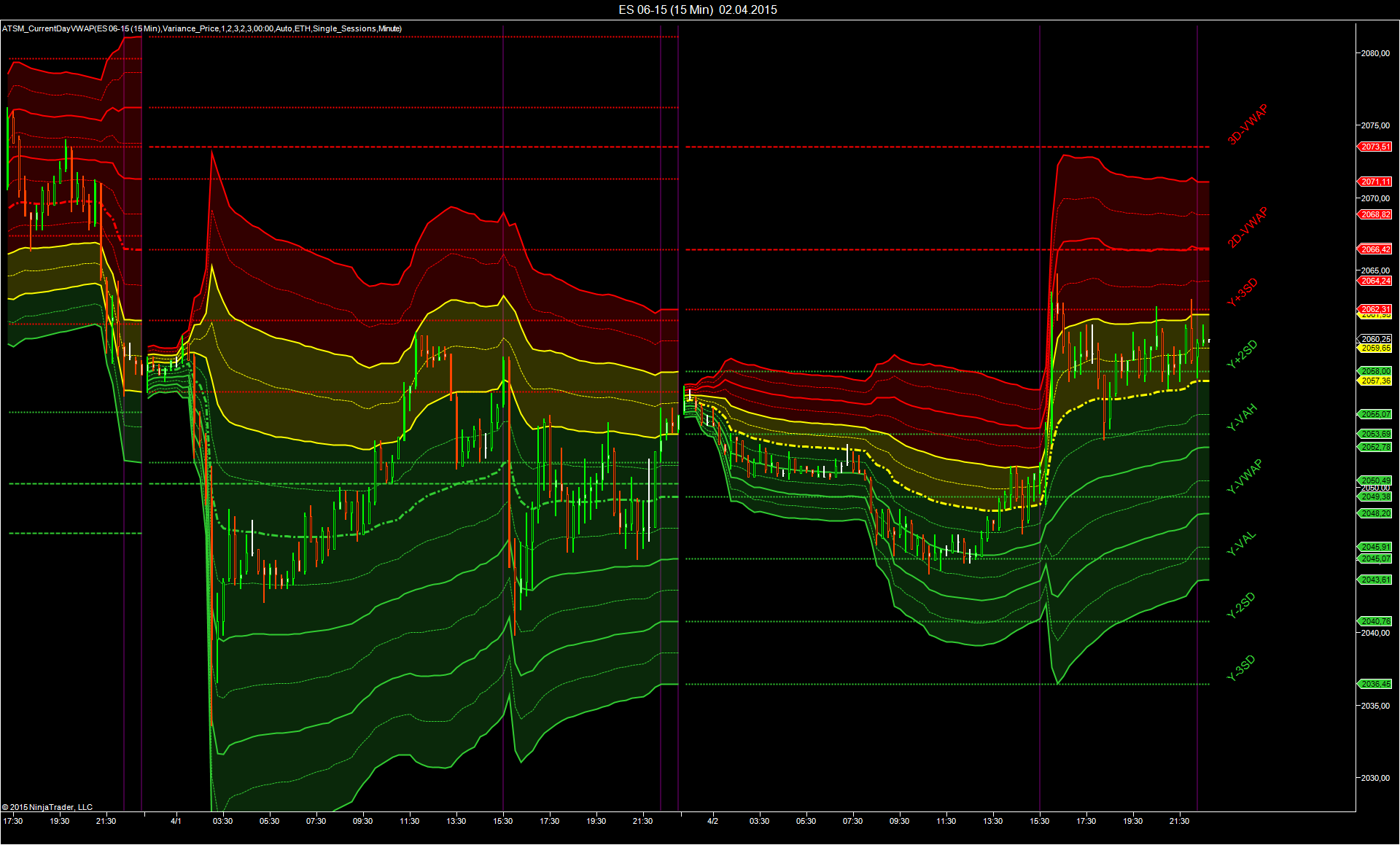

Founded in 2023, NinjaTrader offers trading technology and brokerage services with a platform that supports futures and forex trading. The platform features advanced charting, market analytics, trade simulation and trading system development, among other features.

Based in Chicago, Illinois, NinjaTrader has a community of over 1.8 million users, with its platform catering to both novice and experienced traders with tools that facilitate in-depth market analysis and strategy development.

NinjaTrader’s brokerage services offer access to major futures markets with competitive pricing, such as $50 margins and commissions starting at $0.09 per contract. The company’s platform also supports trading across desktop, web and mobile apps to ensure that traders can monitor and execute trades from anywhere.

In addition to its trading platform, NinjaTrader also provides a range of educational resources. These include daily live streams, platform training and tutorials on technical analysis, all aimed at enhancing traders’ skills and knowledge.

Post acquisition, NinjaTrader will continue to operate as a standalone platform under the Kraken suite of trading and payments applications, with its clients gaining access to an expanded array of trading opportunities in the future.

“NinjaTrader’s mission has been to redefine retail futures trading, making it more accessible, cost-effective and trader-friendly,” said Marty Franchi, chief executive officer of NinjaTrader. “Joining forces with Kraken allows us to take this vision to a global scale, expanding our reach and unlocking innovative new use cases.”

The acquisition will also strengthen Kraken’s position as a technology platform built for professional traders by making it a leader in U.S. futures for both traditional and crypto markets. It also accelerates Kraken’s multi-asset-class ambitions — which also include plans for equities trading and payments.

“This transaction is the first step in our vision of an institutional-grade trading platform where any asset can be traded anytime,” said Arjun Sethi, CEO of Kraken.

Coming into its acquisition, NinjaTrader had raised external funding once in January 2020, when it received a majority growth investment led by Long Ridge Equity Partners, with participation from DRW Venture Capital. The sum raised by NinjaTrader, according to PitchBook, was $87 million, although that is not confirmed by other sources, likely due to the funds being raised occurring 25 years ago.

Image: NinjaTrader

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU