The financial markets are inherently volatile, and hedge funds operate in an environment where risk and reward are two sides of the same coin. To navigate this complexity, hedge fund managers are increasingly turning to advanced risk management software. These tools not only help mitigate potential losses but also enhance decision-making, ensuring compliance and optimizing returns.

The Growing Importance of Risk Management in Hedge Funds

Hedge funds face unique challenges, from market volatility and regulatory scrutiny to liquidity constraints and operational inefficiencies. Traditional risk management methods, such as manual data analysis or spreadsheet-based tracking, are no longer sufficient. Instead, modern software solutions offer real-time insights, predictive analytics, and automated workflows.

For instance, consider the 2008 financial crisis. Many firms that relied on outdated systems struggled to identify exposure to subprime mortgages, leading to catastrophic losses. Today, risk management software can flag similar risks early, allowing managers to adjust strategies proactively. Moreover, as investors demand greater transparency, these tools provide detailed reporting capabilities that build trust and accountability.

Key Features of Advanced Risk Management Software

Not all risk management platforms are created equal. To maximize value, hedge funds must prioritize solutions with the following features:

Real-Time Data Analytics

Markets move fast, and delays in data processing can be costly. Leading software aggregates data from multiple sources—such as exchanges, news feeds, and internal systems—to deliver up-to-the-second insights. This enables managers to spot trends, assess portfolio performance, and respond to market shifts instantly.

Stress Testing and Scenario Analysis

What if interest rates spike? How would a geopolitical crisis impact investments? Advanced tools simulate hundreds of scenarios, quantifying potential losses under different conditions. By stress-testing portfolios, managers can identify vulnerabilities and diversify assets more effectively.

Compliance Automation

Regulatory requirements, like SEC guidelines or GDPR, are constantly evolving. Risk management software automates compliance checks, ensuring adherence to laws while reducing manual errors. This not only minimizes legal risks but also frees up teams to focus on strategic tasks.

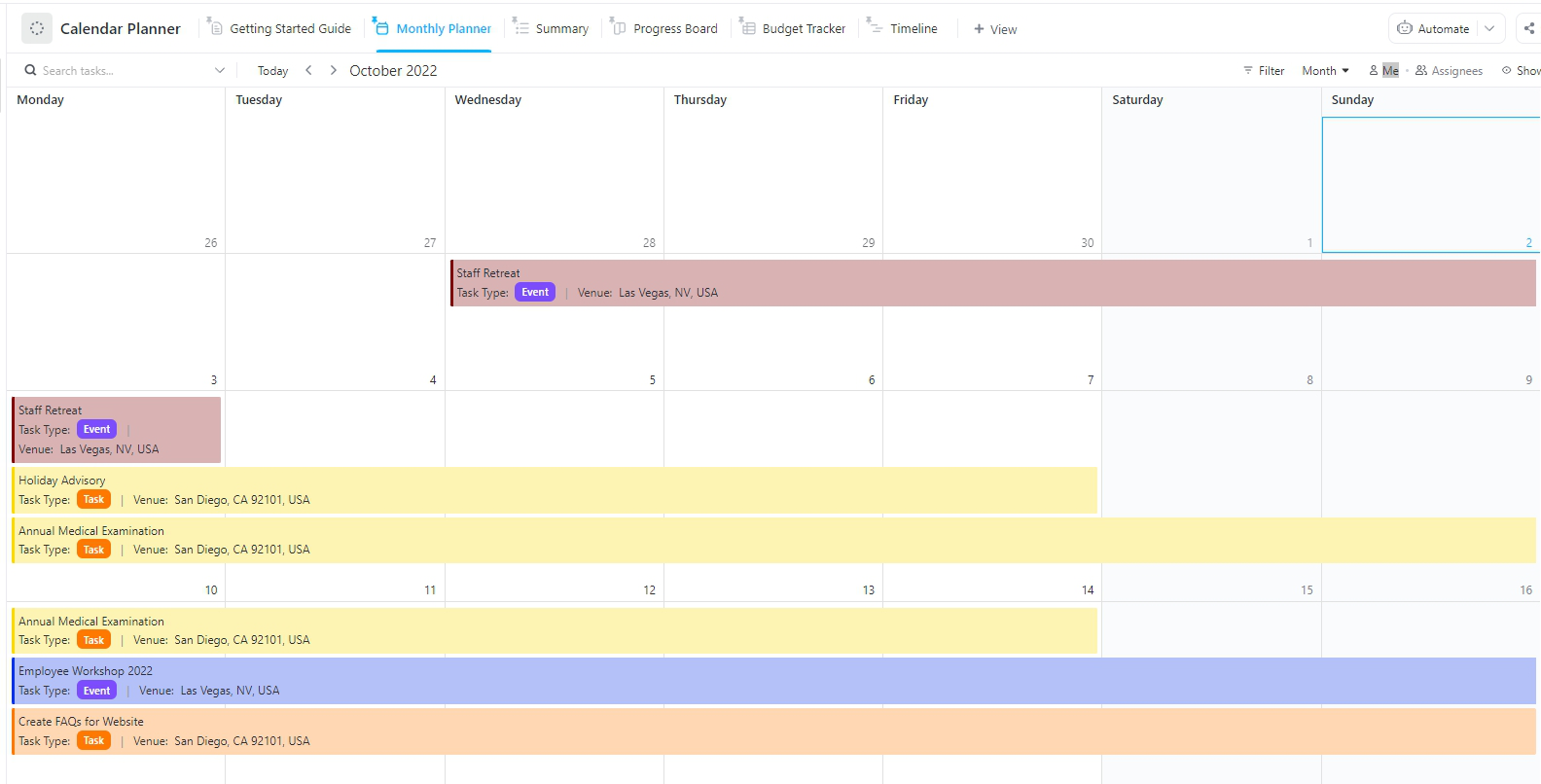

Integration with Existing Systems

Seamless integration with trading platforms, accounting software, and CRM systems is critical. Disconnected tools create data silos, whereas integrated solutions provide a unified view of operations, enhancing collaboration and efficiency.

Benefits Beyond Risk Mitigation

While the primary goal of risk management software is to reduce exposure, its benefits extend far beyond loss prevention. For example, these platforms often include portfolio optimization features that suggest asset allocations based on risk tolerance and market conditions. Additionally, machine learning algorithms can uncover hidden patterns in historical data, offering actionable insights for future investments.

Another advantage is scalability. As hedge funds grow, manual processes become unsustainable. Automated software scales effortlessly, handling larger datasets and more complex strategies without compromising speed or accuracy. Furthermore, robust reporting tools simplify communication with stakeholders, providing clear visuals and summaries that align with investor expectations.

Overcoming Implementation Challenges

Adopting new technology is not without hurdles. Resistance to change, high upfront costs, and data migration complexities are common concerns. However, these challenges can be mitigated with a phased approach. Start by identifying pain points—such as inefficient reporting or compliance gaps—and select software that addresses these issues first.

Training is equally critical. Ensure teams understand how to use the software’s features, from generating reports to interpreting analytics. Many providers offer onboarding support and ongoing training, which can smooth the transition. Lastly, prioritize vendors with strong customer service and regular software updates to stay ahead of industry changes.

The Future of Hedge Fund Risk Management

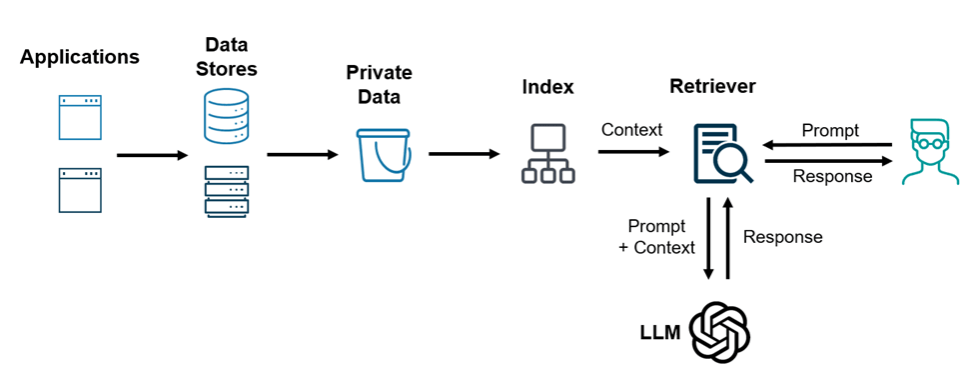

As technology change, so too will risk management tools. Artificial intelligence (AI) and blockchain are poised to revolutionize the sector. AI-powered platforms, for instance, can predict market movements with greater accuracy by analyzing vast datasets, including non-traditional sources like social media sentiment. Blockchain, meanwhile, enhances transparency and security, reducing fraud risks in transactions.

Moreover, environmental, social, and governance (ESG) factors are becoming integral to investment strategies. Future software will likely include ESG scoring systems, helping managers align portfolios with sustainability goals while assessing associated risks.

Conclusion

Hedge funds cannot afford to rely on outdated methods. Risk management software is no longer a luxury but a necessity, offering unparalleled advantages in efficiency, compliance, and strategic decision-making. By investing in the right tools, hedge funds can not only survive market turbulence but thrive in it.

The key lies in choosing scalable, intuitive platforms that align with organizational goals. As the financial landscape continues to evolve, those who leverage technology today will be best positioned to lead tomorrow.