If you live in Kenya, chances are that you use M-Pesa every day, or you are thinking of starting to consider the possibilities of taking advantage of the e-payment app to send money, pay bills, buy airtime, or receive payments. But how much do you really pay for these services in 2025?

Let’s break it down in the simplest way possible so you can save more and spend smartly.

Sending money on M-Pesa (2025 rates):

Sending money is the most used M-Pesa transaction— good thing some transfers are still free, especially for small amounts.

Here is how it works:

- Ksh 1-49: Free

- Ksh 50-100: Free

- Ksh 101-500: Ksh 7

- Ksh 501-50,00: Ksh 13-108

- 50,001-250,000: Ksh 108

The charges are the same you’re sending to another M-Pesa user, Pochi La Biashara, or a Business Till (Buy Goods) number. This means paying a local business or sending money to a friend costs the same.

Saving tip: Transferring smaller amounts or using “send to bank” – instead of withdrawing from an agent and depositing in a bank- can help save money in the long run.

Withdrawing money— agent and ATM fees:

To withdraw cash, M-Pesa agents are a good go-to option. However, ATM withdrawals are also an option. Charges for both agents and ATM withdrawals vary according to the amount.

M-Pesa withdrawal agent’s fee breakdown:

- Ksh 101-2500: Ksh 29

- Ksh 2,501-3,500: Ksh 52

- Ksh 3,501-10,000: Ksh 69-115

- Ksh 10,001-35,000: Ksh 167-197

- Ksh 35,001-250,000: Ksh 278-309

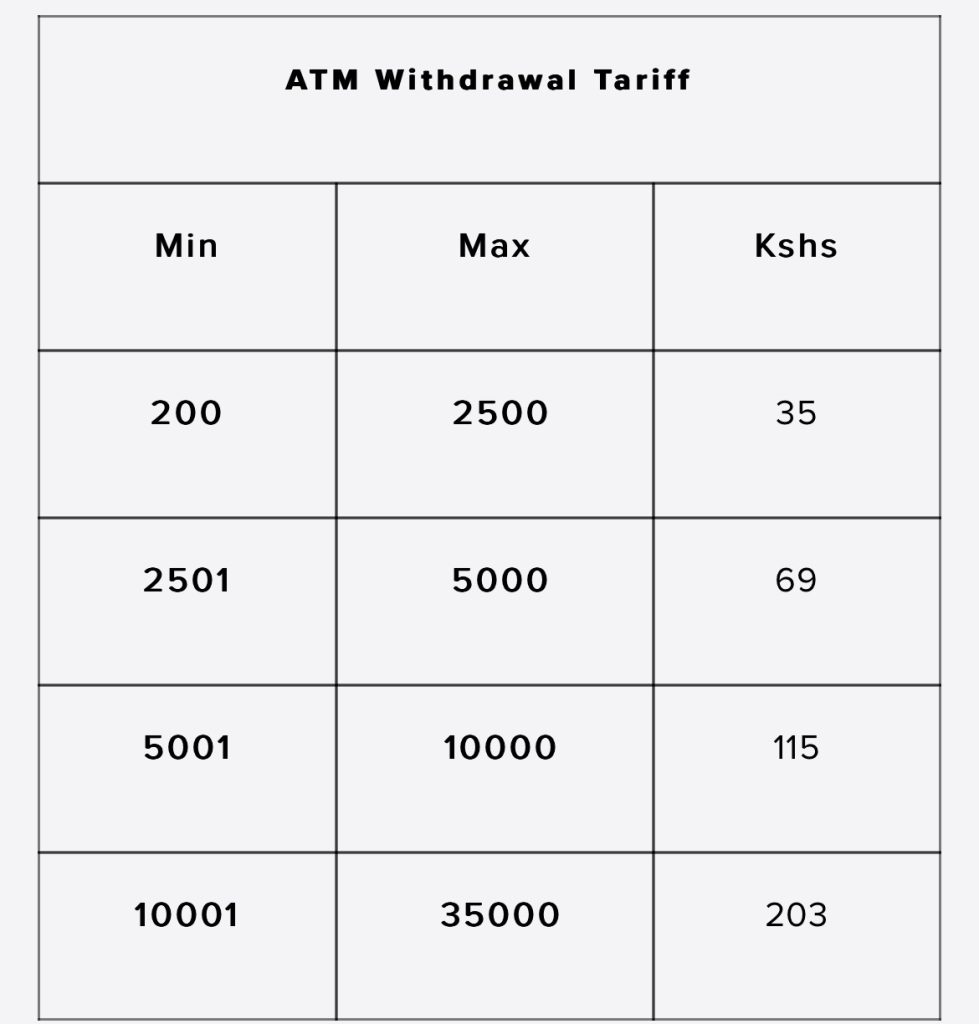

M-Pesa ATM withdrawal tariff:

- Ksh 200-2500: Ksh 35

- Ksh 2,501-5,000: Ksh 69

- Ksh 5,001-10,000: Ksh 115

- Ksh 10,001-35,000: Ksh 203

While convenient, ATM withdrawals cost slightly more in some cases, especially for amounts between Ksh 2,500 and Ksh 35,000.

Saving tip: Withdraw in larger sums when possible. Multiple withdrawals will result in higher cumulative fees.

Other M-Pesa services and what they cost:

M-Pesa keeps most of its basic services free, which is welcome news to everyday users. Here is a quick summary:

- Deposits: Free

- Registration: Free

- Checking balance: Free

- Buying airtime: Free

- Changing pins: Free

This means the only times you’re charged for fees are when you’re sending or withdrawing.

Saving tip. Everything here is free; we can all skip this part.

M-Pesa limits you should know (2025 update)

With Safaricom’s 2025 update, here are the official transaction and account limits:

- The maximum account balance is Ksh 500,000

- The maximum daily transaction value is Ksh 500,000

- The maximum amount per transaction is KSh 250,000

- Minimum amount to withdraw at an agent outlet is Ksh 50

5 tips to save on M-Pesa charges:

If you’re tired of those small fees eating into your money, you should try these tricks:

- Instead of splitting payments and paying multiple fees, send larger sums at once.

- Use Paybill or Buy Goods for business payments. Some merchants absorb fees.

- Avoid unnecessary withdrawals.

- Use the M-Pesa mobile app or USSD 234# for self-service— it’s free to check balance or reverse errors.

- Move money from M-Pesa to bank accounts; it’s often cheaper than cashing out through agent outlets.

M-Pesa in 2025

M-Pesa continues to hold a considerable market share in Kenya’s digital payment space, making banking easier for millions across cities, towns, and rural areas every single day.

Safaricom, the parent company, has worked to make the platform transparent, secure, and user-friendly by introducing clear tariffs and higher transaction limits that support Kenya’s growing economy.