MiCA officially went live in 2025, introducing the first EU-wide licensing and compliance framework for crypto assets. While much has already been said in the community about its implications for exchanges and stablecoins, here is a quick recap of key changes.

For a deep dive into how the USDT ban specifically affects EU crypto casino players, check out the USDT ban guide by Casinos Blockchain.

What MiCA Changed in 2025 (In Brief):

- Requires crypto platforms to register in the EU and obtain a license

- Introduces strict KYC/AML obligations for all crypto asset service providers (CASPs)

- Sets transparency and reserve standards for stablecoins (especially USDT, USDC, EURC)

- Bans the use of non-compliant stablecoins (e.g., USDT) by EU-regulated platforms

- Forces centralized and decentralized platforms to follow the same legal rules

Now let’s dive deeper into how MiCA affects crypto gambling platforms and players across the EU, with hard numbers and behavior shifts observed in 2025.

How MiCA Is Reshaping Crypto Gambling Operators

Crypto gambling has exploded into a multi-billion-dollar industry, generating $81.4 billion in global gross gaming revenue (GGR) in 2024, rivaling traditional online casinos.

Average deposit amounts in crypto casinos are growing by an impressive 340% in global markets than on fiat-based platforms, reflecting a high-spending, engaged user base, especially among high-rollers and crypto-wealthy players.

With MiCA kicking in, crypto casinos operating in or targeting the EU are being forced to adjust their operations.

Key Developments in 2025:

- Only 17 CASP licenses granted across the EU by April 2025 – none to crypto casinos

- Up to 75% of crypto service providers in the EU expected to exit or be denied licenses

- Most major crypto exchanges delisted USDT, pushing players toward compliant tokens like USDC

Some casinos have stronger KYC checks, especially for bigger deposits or unusual activity. However, many platforms still allow players to gamble without sharing personal information, especially those that are not fully regulated or operate from other countries.

“MiCA 2025 is reshaping the landscape for anyone promoting crypto-related projects in the EU. While the regulation does not directly apply to gambling platforms for now, it significantly affects the infrastructure they rely on, including stablecoins, payment gateways, and advertising channels.” – Yaroslav Kalynychenko, CMO at Generis Web3 Agency.

KYC and User Onboarding: The New Normal

As a result of MiCA and tightening AML directives, Know Your Customer (KYC) procedures have become standard at most crypto casinos. The depth and timing of these checks can vary:

When are KYC checks triggered?

- During registration: Many regulated casinos now request at least basic ID verification upon account creation, especially for users from the EU.

- On first deposit or withdrawal: Some platforms trigger KYC when a player tries to deposit or withdraw for the first time, particularly if the amount exceeds a certain threshold (often €500–€2,000).

- For large or suspicious transactions: Any deposit or withdrawal considered “unusual” (either by size or pattern) will likely prompt additional KYC steps. This includes cumulative deposits or withdrawals over time, not just single transactions.

- Random or periodic checks: Licensed casinos sometimes perform routine checks on existing accounts to comply with ongoing monitoring obligations.

Commonly requested documents include:

- Government-issued ID (passport, national ID card, or driver’s license)

- Proof of address (utility bill, bank statement, or official government correspondence issued within the last 3 months)

- Source of funds (pay slips, bank statements, or a written explanation for larger or repeated deposits/withdrawals)

Some platforms may also require a selfie or video verification for identity confirmation.

The difference in user experience:

- Regulated casinos: Full KYC is a non-negotiable requirement for accessing most features, especially withdrawals. Processing times are getting faster with automated tools like Sumsub, Jumio, Onfido, Veriff, and Trulioo, but delays can occur if manual review is needed.

- Offshore and less regulated platforms: Many still allow players to gamble, deposit, and even withdraw with minimal or no KYC, especially for smaller amounts. However, this approach comes with increased risk (lack of recourse if issues arise, potential for being locked out, etc.) and could become less accessible as regulators crack down on unlicensed operators.

Takeaway:

While KYC procedures are becoming the new normal for EU players, many high-privacy users still seek out platforms with lighter checks. For everyone, it’s important to be prepared for possible document requests – especially if you win big or plan to play regularly.

Licensing: Who’s Playing by the Rules?

Under MiCA, crypto casinos must now meet both the new EU crypto regulations and established gambling authority requirements.

Most crypto casinos continue operating offshore – ~25% hold Curaçao eGaming licenses and ~60% operate without meaningful licensing (“shadow markets”).

However, some are pivoting:

- By July 2025, all platforms serving EU customers must apply for a CASP (Crypto Asset Service Provider) license to remain operational within the EU.

- In Poland alone, roughly 1,600 registered crypto firms are under review post-MiCA, signaling the scale of industry transition across Europe.

Licensing Requirements at a Glance:

- €50,000–€150,000 minimum capital (depending on business model)

- Comprehensive AML/KYC procedures with ongoing monitoring

- Fully audited financials and a vetted executive team

While stronger KYC reduces scams and bonus abuse, some players still prefer faster, low-friction onboarding. Licensed platforms now promote compliance as a trust and security benefit.

Stablecoins: The USDT Shake-Up

MiCA brought changes to how stablecoins work in the gambling sector in 2025. With new EU rules, non-compliant stablecoins like USDT became much harder to use at regulated casinos, it also brings some new updates:

- Tether (USDT) has long been the dominant dollar-pegged token on crypto gambling sites, accounting for 47.3% of turnover on Cloudbet.

- By early 2025, major EU-compliant exchanges (Binance, Kraken, Crypto com etc.) delisted or froze USDT for European users. This forced gamblers to switch to alternatives – primarily USD Coin (USDC), which is issued by Circle with a French e-money license and daily reserve attestations.

- Industry trackers note that USDC is now among the top five currencies for crypto casino deposits and withdrawals (after BTC, ETH, LTC, and, for now, USDT).

| Platform | USDT Status in 2025 |

| Binance, Kraken, Crypto.com | Delisted for EU users |

| Cloudbet | 47.3% of prior turnover was in USDT |

| Casinos Overall | Shifting to USDC and EUR-backed coins |

Those interested in what does this could mean for US market can find a detailed analysis in the latest SBC Americas coverage, which examines how these regulatory shifts in Europe might influence stablecoin adoption and online gambling trends in the United States.

How MiCA 2025 Transforms Crypto Platforms

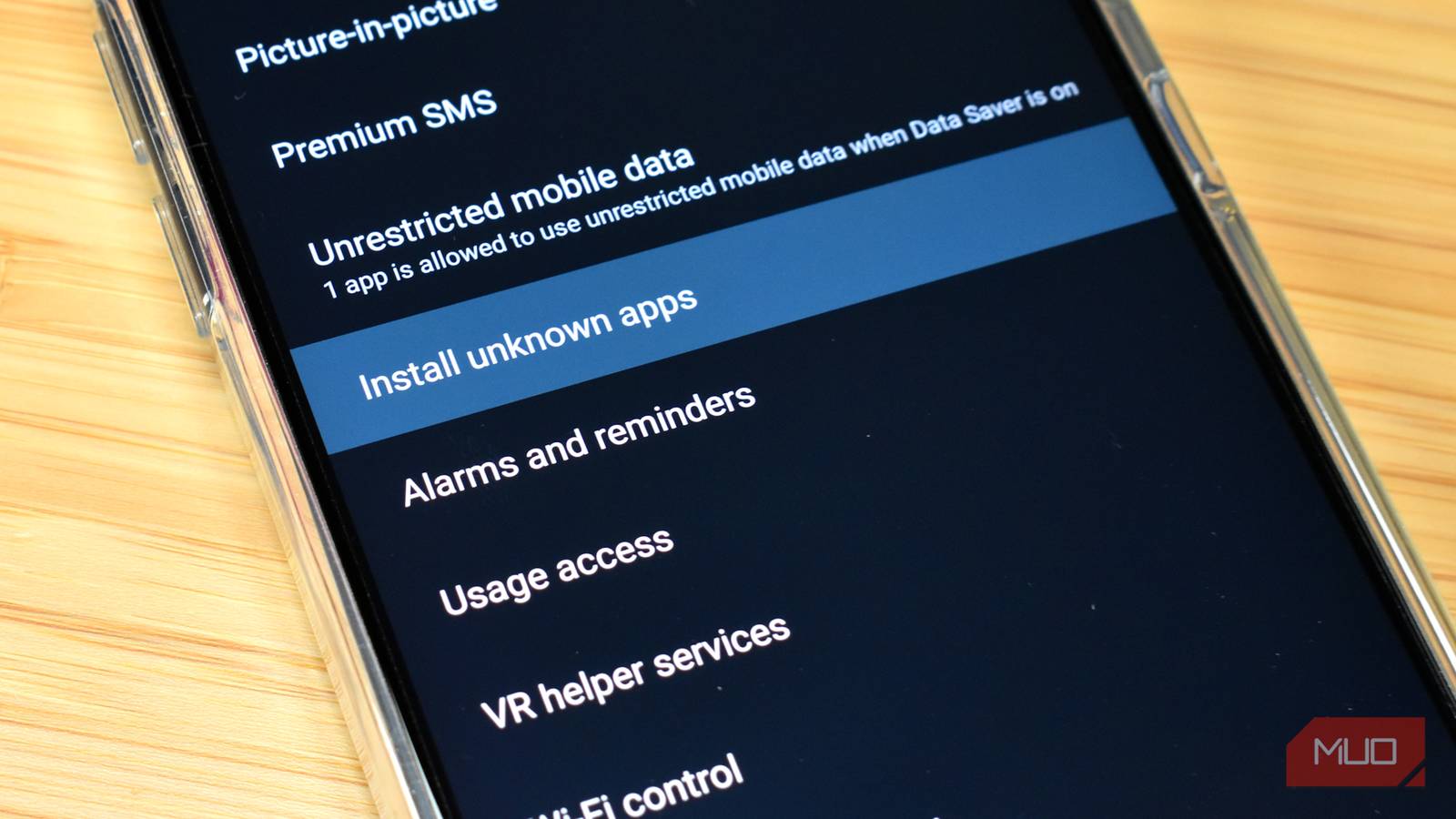

MiCA introduces a range of new legal requirements for crypto exchanges operating in the EU. All exchanges must now register in an EU country, obtain a license, and follow standardized rules for customer verification and anti-money laundering (AML) procedures. These requirements apply to both new platforms and those already serving EU users.

One of the main changes is stricter KYC checks. Exchanges must collect detailed information from all users, such as government-issued ID, proof of address, and sometimes the source of funds for large deposits or withdrawals. MiCA also requires exchanges to continuously monitor transactions, report suspicious activity, and maintain clear records for regulators. Users moving large amounts or making repeated transfers may face additional questions or temporary holds as part of these rules.

Another important legal point is that exchanges offering stablecoins must ensure that the tokens meet MiCA’s new criteria. Non-compliant stablecoins, like USDT, are no longer allowed for EU-facing exchanges. This has led many platforms to adjust their listings, sometimes removing popular coins and focusing on those that meet EU standards.

Generis, a Web3 marketing agency with hands-on experience across crypto platforms, has seen firsthand that the main challenge for exchanges is balancing regulatory requirements with a smooth user experience.

According to Generis, exchanges face higher costs due to extra compliance steps, more advanced onboarding systems, and the need to update their legal documentation to reflect MiCA’s standards. At the same time, exchanges must help users understand what information is needed and why certain coins or services are no longer available.

In summary, crypto exchanges now require more thorough user verification, closer monitoring of activity, and stricter coin listings to comply with MiCA. These changes make the environment safer and more transparent, but they also bring new steps and some challenges for both platforms and users.

How Player Behavior Is Changing

The rollout of MiCA in 2025 brought significant changes to how players interact with crypto gambling sites. Not only are users seeking speed and privacy, but the types of games and payment methods they use are evolving:

- Provably fair games are increasingly in demand – about 28% of players filter for casinos offering them, seeking transparency in game mechanics

- Cutting-edge formats like crash games and esports betting are gaining traction, with crypto esports betting rising ~25% year-over-year

With more platforms tightening compliance and payment restrictions, users are actively seeking casinos that still offer speed, privacy, and flexibility.

Data from 2025 shows that player expectations are evolving, with many now filtering casinos by payout speed, accepted cryptocurrencies, and whether full KYC is required.

| User Preference | % of Users Filtering for It |

| Fast payouts (<10 min) | 43% |

| Platforms supporting BTC & ETH | 56% |

| No KYC | 34% |

| Provably fair games | 28% |

Crypto Gamblers: Navigating the New Reality

For crypto gamblers, MiCA has introduced significant changes to how people play and interact with online casinos in the EU. Many licensed platforms now require players to complete a KYC process before they can start betting. This typically means submitting a passport or government ID, a recent proof of address, and sometimes information about the source of larger deposits or withdrawals.

Most casinos use automated verification systems to check documents, which helps speed up the process for players.

Popular solutions include Sumsub, Jumio, Onfido, Veriff, and Trulioo. These platforms scan IDs, compare photos, verify addresses, and can even run checks against sanctions or watchlists. Even with automation, there may be delays during peak times or if a manual review is needed.

Smaller withdrawals are usually processed automatically, while bigger wins can take longer for compliance checks.

Some players appreciate these rules, since stronger KYC and AML procedures help reduce scams, fake accounts, and bonus abuse.

Many casinos now highlight their MiCA compliance as a sign of trust and security. Others still prefer the old approach, where it was possible to play and cash out quickly without sharing personal information. Players should also be cautious of scams – especially fake KYC or phishing attempts – and always choose reputable, licensed platforms for the safest experience.

What Players Face Now

For EU-based casino players, the changes brought by MiCA are immediately noticeable in their day-to-day gambling experience:

- Difficulty accessing USDT via regulated platforms

- Greater reliance on USDC, which offers:

- Fast SEPA withdrawals

- MiCA-compliant reserves and audits

- Less anonymity (blacklisting risk from issuer)

Some users bypass restrictions using VPNs or offshore sites that still support USDT.

Looking Ahead: The Future of Crypto and Gambling in the EU

MiCA’s 2025 rollout marks only the beginning of a broader regulatory wave. EU lawmakers continue to explore how decentralized finance (DeFi), NFTs, and emerging Web3 services fit into this new landscape. The gambling sector expects more granular rules targeting decentralized casinos and prediction markets in the next few years, especially as regulators gain experience from the current compliance push.

Players and users should watch for updates, as EU rules evolve to keep pace with the fast-changing world of digital assets. The best defense remains education – staying informed and choosing platforms that prioritize both security and user experience.

Final Thoughts

The MiCA regulations that swept across the EU in 2025 reshaped the crypto and gambling landscape. Both crypto gamblers and general users now navigate a more structured, transparent, and secure digital environment. Enhanced KYC and AML checks bring new responsibilities but also new protections. The shift away from USDT and toward compliant stablecoins changes the payments game for all.

For anyone involved in crypto or gambling in Europe, the lesson is clear: adaptation and vigilance open the door to continued opportunity and safer play. With trusted brands leading the way and regulators clarifying the rules, the future for crypto in the EU looks challenging but ultimately brighter.