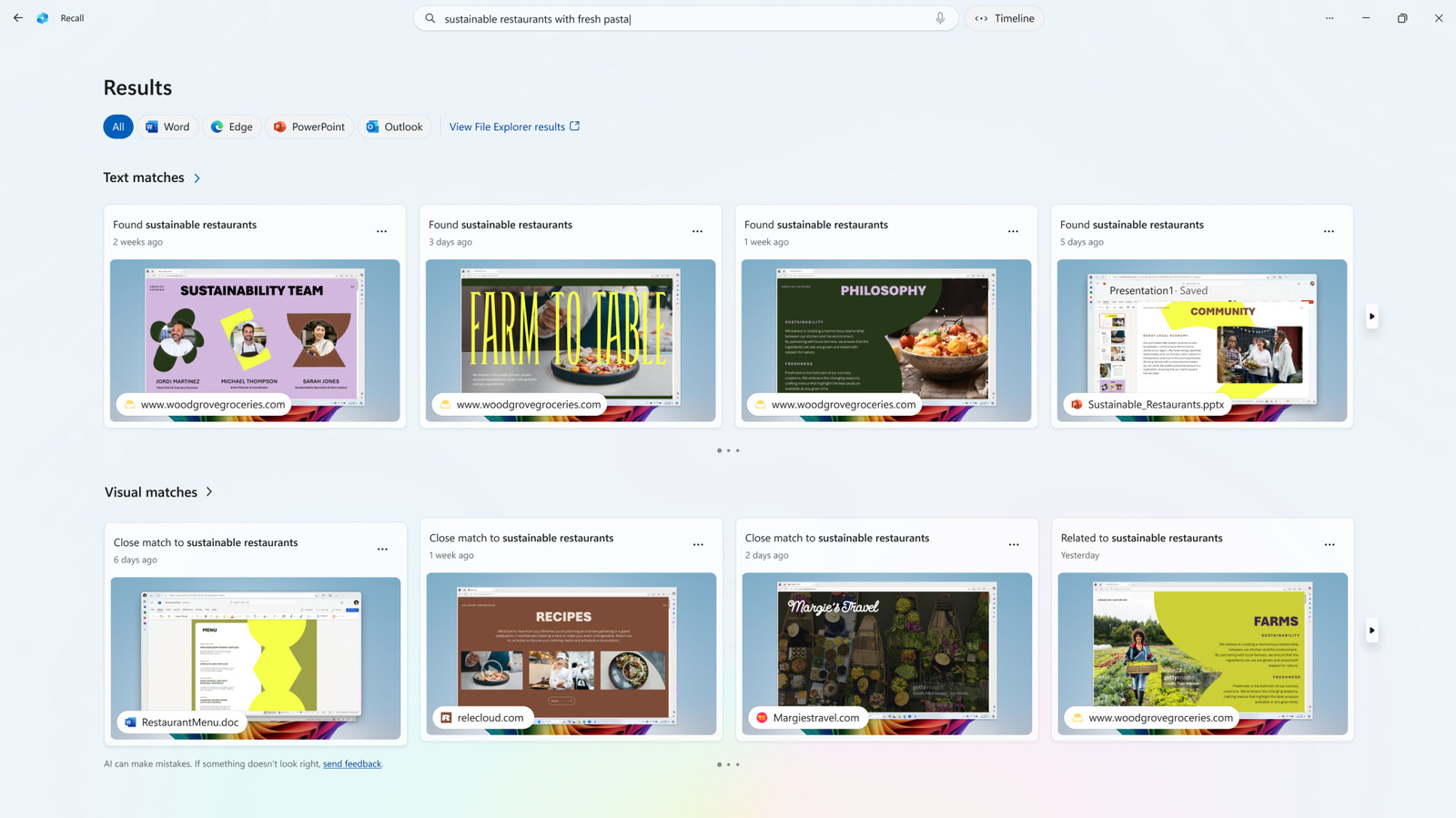

By Seamus McMahon

Reductions in force, or RIFs, are often unavoidable and always painful. I’ve been there. And judging by the latest data from the Crunchbase Tech Layoffs Tracker, RIFs are continuing at a steady pace.

This year, tech firms both large and small have announced layoffs. Even companies in industries with rapid growth, like artificial intelligence, are not immune, as we saw Scale AI announce a 14% RIF in July.

As a leader, you can effectively manage RIFs if you develop a comprehensive strategy and apply the insights gained from the experience and perspectives of other leaders who have been through them.

During my stints as a senior executive and CEO in various banks, I had to shutter more than one business that wasn’t making strategic sense. As a founder, I had to lay off the majority of the team in a business that didn’t find its product-market fit.

In both cases, many of the team members were long-time colleagues and friends. It sucked.

If you are not currently facing a RIF, this is the perfect time to create a strategy for one and hope you will never need it. Regardless, it is still crucial to assess the factors and events that could necessitate such a response.

Let’s explore what those look like.

Factors influencing RIFs

RIFs can be caused by macro and micro factors, the fault of the leadership team, or truly be necessitated with no one to blame.

At the macro level, if you look at venture capital and private equity, limited partners have been vocal about reducing their funding commitments until they see some capital returned. Secondary stock sales are not giving them much comfort that their GPs’ valuations of their portfolio companies are realistic.

The upshot for founders: You may be unable to count on that next raise being as large or coming as quickly as you had planned.

At the individual company level, a RIF may be the best or only way to deal with a change in strategy and market positioning. It may also be the most sensible option to revamp an organization that is no longer streamlined for success. The unexpected loss of a key customer could leave leadership with no choice but to reduce headcount.

One positive aspect that we can draw from the most recent economic data is that the U.S. economy has held up better than many expected, despite or perhaps because of changes in trade policy, tax rules and beyond.

However, uncertainty still looms for the second half of 2025 and into 2026. Including a downsizing scenario in your planning makes strategic sense, no matter how optimistic the outlook generally.

Conducting RIFs with compassion and clear strategic objectives

Your main priority in conducting a RIF should be treating employees with compassion. While this might seem obvious, there have been many instances in recent years where this hasn’t been the case.

I see too many RIF announcements that provide only vague rationales. This may be what your lawyers advise, but it clouds the perception of “Are you really on top of the business?”

Be as clear as you can about why this RIF had to happen and why now. To the extent you can afford severance and placement assistance, the positive impact on the remaining team may be as powerful as retention bonuses for key people. It will pay off in the recruiting marketplace.

Similarly, I have seen RIF plans that cut evenly across the company, without a strategic plan to reallocate resources to the best-performing teams, products and markets. Very often, this leads to a second, or even third, RIF within a year.

Let’s turn to the CEO and top team. Anyone with a shred of empathy will hate announcing and leading a RIF, no matter how justified. However, the remaining team needs leadership that is focused and sympathetic, yet calm and energized about the post-RIF opportunities.

By all means, turn to your peers who have been through this. Mentors and coaches can play a brief but pivotal role in providing guidance and serving as a neutral party to confide in.

Perhaps surprisingly, there is potential upside in downsizing. After a couple of personal repetitions and counseling of other CEOs, I came to realize that a RIF can create opportunities to promote and hire superior talent into new positions. In particular, if you are shrinking one product line or geography, you may be looking to reassign talent to existing teams that you’re able to keep.

Striking the right balance of empathy for those leaving and optimism toward those staying and joining is possible. Focus, conviction and empathy will get you there.

Mistakes to avoid along the way

I’ve been in the business for decades and I’ve learned some lessons. The first is that I wish I had developed both pessimistic contingency plans and optimistic business projections. Even a skeleton plan of how you will reduce burn rates, who stays and who goes, allows leadership to focus on execution and communication when they are most critical.

The next step is to keep your investors informed about this planning. This not only ensures that you look professional, but it also gives you the best chance to get their support when it’s no fun for them either.

On the topic of communication, I learned to keep the story short, candid and in your own voice. If it sounds like a committee or outside counsel wrote your message, you will lose authenticity when it really matters. Reiterate your right to win and your confidence that the RIF sets you up for success.

From a tactical perspective, conduct the RIF mid-week and hold a follow-up town hall on Friday. Letting people know they are being let go on a Wednesday gives them and HR some time to process before the weekend. Similarly, a town hall on Friday gives you the best shot at sending the remaining team into the weekend with the story you want to tell.

Anticipation, planning and clear communication. Done correctly, a RIF can galvanize and focus an organization.

Seamus McMahon is an organizational and strategy consultant who helps individual and corporate clients with executive coaching, team development, succession planning and strategy development. He has had leadership roles in large and small organizations: he ran the global financial services group at Booz Allen, was the CEO of TD Bank USA, led HSBC’s U.S. expansion program, and co-founded Novantas, a data analytics company. During the 2008-2009 economic crisis, McMahon was an adviser to the U.S. Congress on the Troubled Asset Relief Program, and he has served on several nonprofit boards, including the National Council for Economic Education, American Lung Association of New York, and the National Ability Center.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.