After consecutive steep drops in the amount of venture capital funding made out to startups in both halves of 2023 and 2024, the first half of 2025 has been a collective sigh of relief for stakeholders across Africa’s technology landscape.

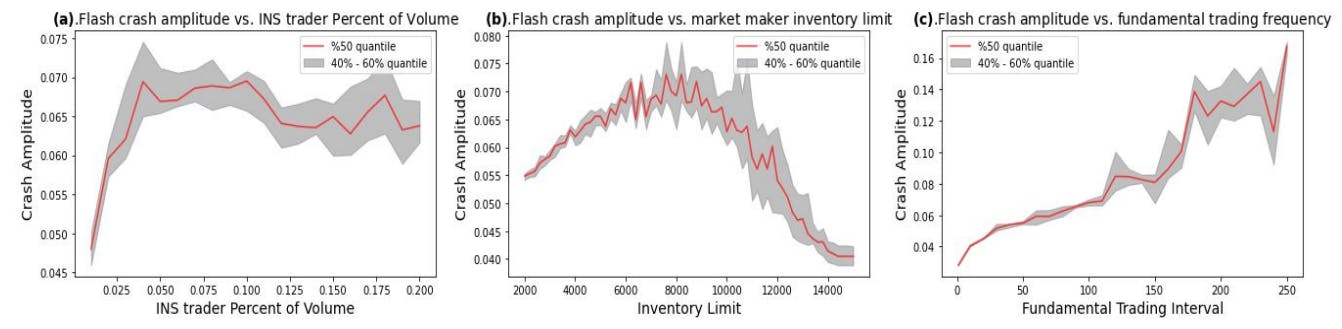

But make no mistake, the uptick in startup fundraising is only part of a larger trend towards revising the case for investing in an African startup. I find that more people—fund managers, founders and other enablers are asking hard questions about what it means to build commercially viable businesses on the continent. And the 166% growth in the concentration of fundraising into fintech reflects an unspoken consensus that investors are clustering around what has been proven to work under the current “Africa opportunity narrative” versus where innovation meets deeper risk.

But, unlike mature technology business ecosystems, where concentrated investor interest in large language artificial intelligence models is the driving force behind the resurgence in startup investing, concentration narratives like the simplistic “fintech for inclusion” story is showing signs that it is near its structural limit. Even fintech-focused firms are modulating this story in their communications. It tells me that:

- Our startup and capital archetypes are evolving.

- The overarching story of startup and tech in Africa is losing its compelling power.

An overarching narrative is a set of stylised facts that explain something. It is the foundational set of generally accepted and simplified realities or idealized patterns that theories are constructed around to advance capital and entrepreneurial utility.

Next Wave continues after this ad.

For us in Africa, the major narratives oscillated between Africa’s demographic expansion and the implied market opportunity it represented. And the opportunity to create, shape and capture market share in some of the fastest-growing economies globally by deploying new technology to leapfrog institutional gaps and market failures.

Sectorally, “financial inclusion,” for example, drove financing flows and policy reform that fueled fintech ventures. That ship has lost steam today. Solar-based micro-grids, for example, drove financing to the models that produced the M-KOPAs of this world. That story has evolved into more complex models today, just as climate adaptation is driving funding to smallholder farm improvement technologies.

While many of the underlying stylised facts remain mostly true, the collision of the grand narrative with market realities and global capital flows has damaged the prevailing story. Unfortunately, most investors and even founders are still caught on the wrong side of a compelling non-moralistic narrative about building and investing in startups. In this sense, the current rebound in startup fundraising is a positive surprise.

Thus, while it’s easy to call the rebound in startup funding a “flight to quality,” it sounds and looks more like a “flight to safety” to me. It tells me that the big story that drove building and investing in startups is due for an upgrade.

Next Wave continues after this ad.

Billions of dollars were raised and deployed based on the existing stories. Unicorns were created, new fund managers joined the VC gravy train, and growth in startup hiring created work opportunities for thousands of brilliant young talent.

But when the private startup capital market broke down from 2023 onwards, it became clear to anyone paying attention that the stories that turned on the capital spigot were not enough to keep the taps flowing. And most importantly, those stories probably worked because of cheap global money, and not always because of their commercial soundness.

We now need stories that are less correlated to the global state of capital, and this applies whether your capital is local or not, because all capital is universal, if not geographically, then in terms of opportunity cost.

Next Wave continues after this ad.

The State of Tech in Africa H1 2025 is a brilliant snapshot of the numbers and context behind a 6-quarter record haul in startup funding, startup layoffs, shutdowns, M&A, and deal count.

It is one thing to read a report about technology startups in Africa and focus on the headline numbers. But a better way for the reader to parse this compilation is to test where the reported numbers improve or disprove your set of stylised facts on building or investing in African startups. And this applies regardless of what your story was, e.g. demographic opportunity, leapfrogging, or even the failings of the VC model.

Next Wave continues after this ad.

Again, this applies whether your focus is on local or global capital because money and business are mobile, and narratives are a powerful vehicle for universal capital mobility.

The point is that despite the rebound in startup funding, the case for updating our commercial and collective narrative for investing in and building African startups has never been more urgent. Don’t believe me? Ask any of the more than two dozen local VC firms that are actively raising capital today.

Abraham Augustine

Ecosystem & Marketing Manager, Norrsken

Thank you for reading this far. Feel free to email abraham[@]norrskenfoundation.org, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.