Nigeria’s telecommunications sector is experiencing a concerning contradiction: mobile network operators (MNOs) are enjoying unprecedented data revenue growth, but the rising cost of smartphones is stalling internet adoption, threatening to widen the digital divide across the country.

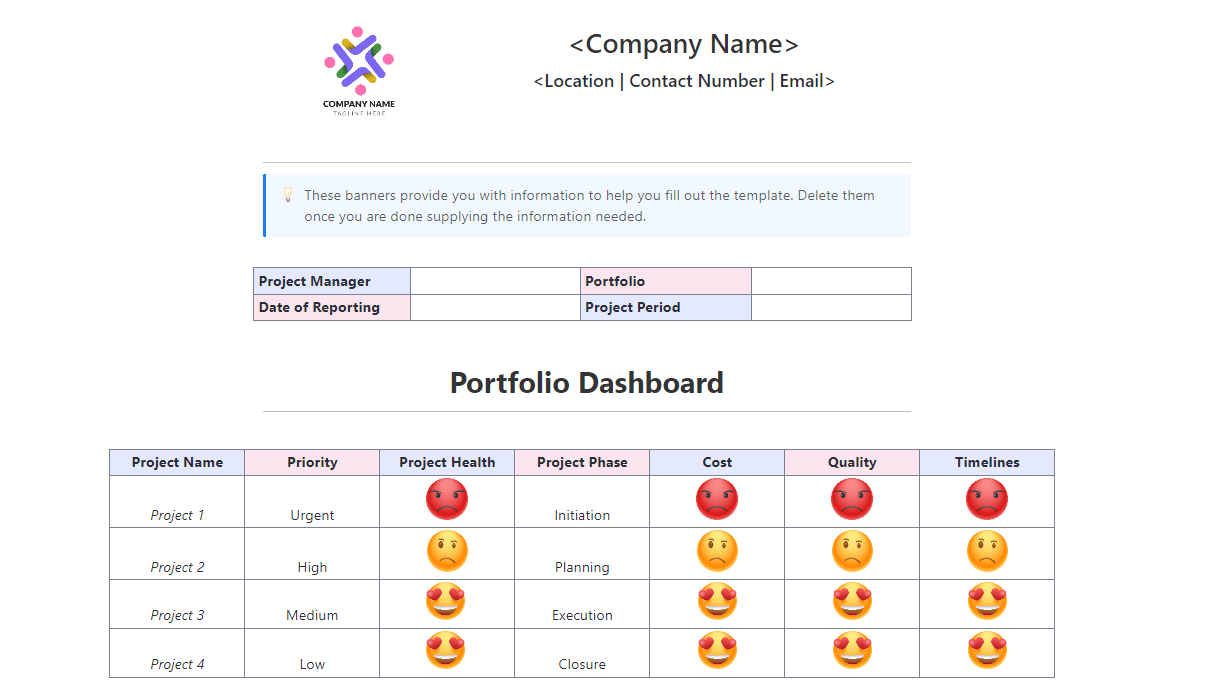

Despite a surge in data consumption by existing users, Nigeria’s overall internet subscriptions declined by over one million in the first half of 2025. Figures from the Nigerian Communications Commission (NCC) show total active internet subscriptions fell from 141.6 million in January to 140.6 million by June.

The drop in internet users reflects telcos’ mounting challenge to sustain subscriber growth amid economic pressures, device affordability issues, and regulatory bottlenecks. MTN Nigeria continues to dominate the sector with 76.5 million internet subscribers as of June 2025, trailed by Airtel (49.4 million), Globacom (13.7 million), and 9mobile (1.08 million).

Yet, even with MTN’s data revenues soaring by 69.2% year-on-year and Airtel’s active data user base climbing to 29.3 million, the nationwide internet user base contracted slightly in a period where digital expansion should be accelerating.

Smartphones are also becoming unaffordable for millions of Nigerians. Entry-level models like the Itel S24, Infinix Hot 50i, and Xiaomi Redmi A5, which retailed between ₦120,000 and ₦180,000 at the start of the year, are now priced between ₦200,000 and ₦220,000. Mid-range devices such as Samsung’s Galaxy A-series breached the ₦400,000 mark, while high-end smartphones like Apple’s iPhone 15 Pro Max 1TB crossed ₦2.3 million.

Naira devaluation, inflationary pressures, and global supply chain disruptions have inflated device prices by 25% within six months. Even the secondhand market has not been spared; older iPhones like iPhone 7 Plus and iPhone 8 (standard), once affordable alternatives, now sell for ₦130,000–₦170,000, pricing out lower-income consumers who once relied on used devices to access digital services.

Smartphone sales volumes declined by 7% between January and June 2025, according to Market intelligence from Canalys.

Data tariffs amplify digital exclusion

When the NCC approved a 50% data tariff hike in January 2025, the cost of 1GB of data jumped from ₦287.50 to ₦431.25, with higher-volume bundles witnessing even steeper increases.

The impact was immediate and pronounced. Internet subscription growth stalled, and by February, the industry recorded a net loss of nearly one million active internet users. While a modest rebound occurred in March, sustained high data prices forced many subscribers to downscale or suspend their internet usage altogether. By June, new activations had slowed to a crawl.

Month-on-month subscription patterns reveal a stark shift in user behavior: data consumption became more cautious and need-driven. Many subscribers began rationing data for essential tasks only, curbing discretionary usage. While existing smartphone owners increased their average data consumption, the higher tariffs created an entry barrier for potential new users, further tightening the addressable market.

Growth despite policy hiccups

In June, the National Identity Management Commission (NIMC) suspended National Identification Number (NIN) verifications to migrate to a new authentication platform. This halted new SIM activations across all networks, effectively freezing the onboarding of new internet subscribers, despite a strong demand for connectivity.

Despite these policy hiccups, telcos are witnessing increased data usage among their existing subscriber base. MTN Nigeria’s smartphone penetration rose to 62.6% in H1 2025 (up from 58.3% in December 2024), equating to approximately 53 million smartphone users. The company added 3.3 million active data subscribers within six months, driving its 69.2% year-on-year data revenue growth.

Airtel Nigeria reflected similar patterns. With a smartphone penetration rate of 51.4%, about 27.5 million of its 53.6 million subscribers are smartphone users. Airtel’s data user base expanded to 29.3 million in Q2 2025, with average monthly data consumption rising from 7.3GB in Q2 2024 to 9.3GB a year later.

Data consumption per user is climbing sharply. However, this masks a more troubling dynamic. The pipeline for onboarding new internet users is thinning. Low-income Nigerians are being priced out of digital inclusion, raising concerns about the long-term sustainability of the sector’s growth trajectory.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com