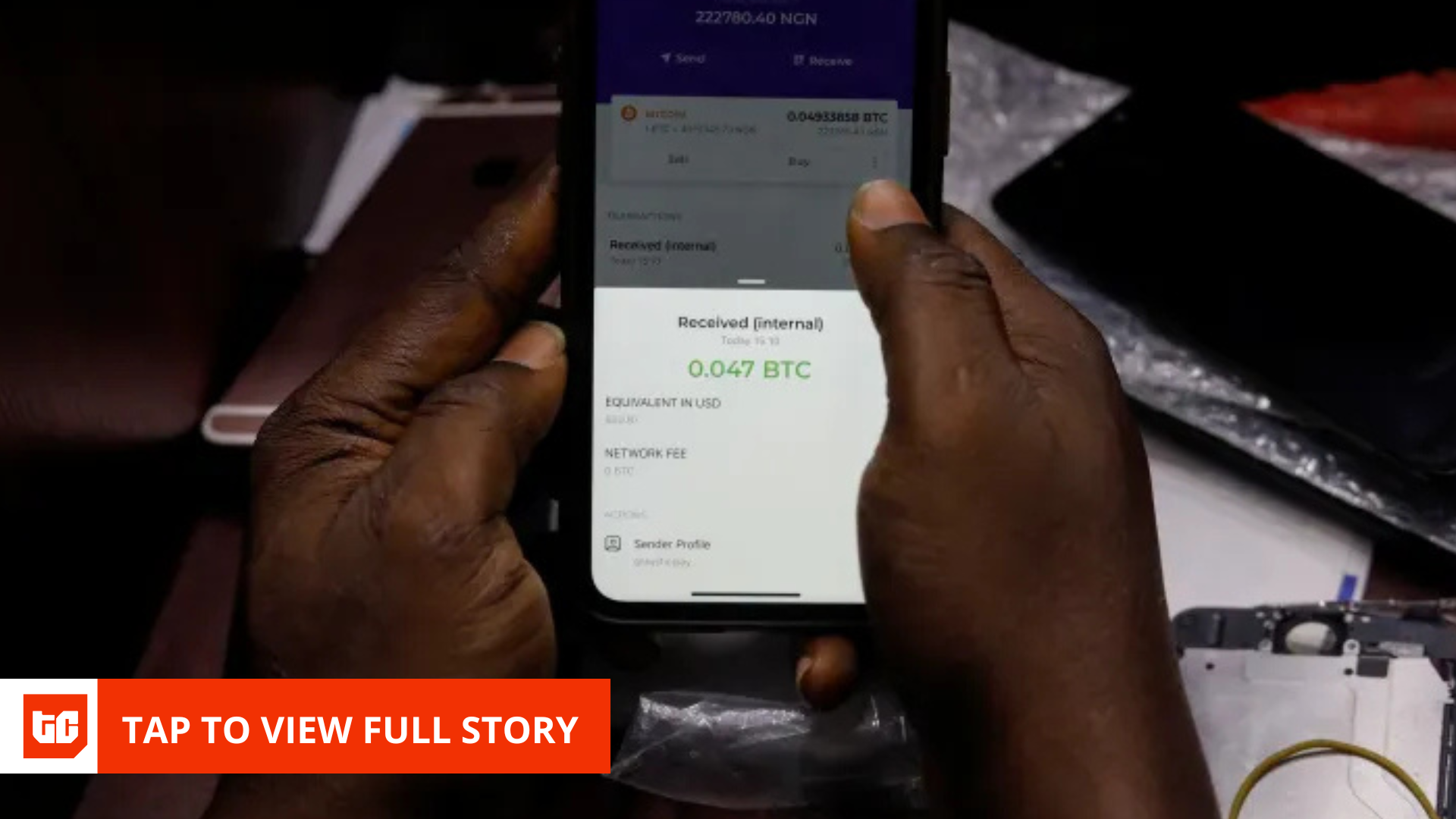

Nigeria is sending mixed signals to the global cryptocurrency industry. On paper, the country has made one of the boldest policy shifts in Africa—recognising digital assets (including cryptocurrencies) in law, establishing a licencing framework, and introducing taxation for crypto businesses. Yet, nearly two years after the sector was legally unblocked, most major crypto companies remain inaccessible through Nigerian telecom networks.

In February 2024, the Nigerian Communications Commission (NCC) directed telecom and internet providers to block access to several major cryptocurrency platforms, including Binance, Coinbase, OKX, Kraken, Luno, and Bybit.

The order, backed by the Central Bank of Nigeria (CBN) and the Presidency, was meant to curb speculation on the naira amid its sharp devaluation. At the time, the government accused peer-to-peer (P2P) trading platforms of facilitating unregulated currency trades that worsened FX instability and devalued the naira.

Access to those platforms was swiftly cut off, and users relying on MTN and Glo networks suddenly found crypto websites unreachable without a virtual private network (VPN). But over a year later, even as Nigeria has formally embraced crypto under new legislation, the telecom restriction remains.

“It’s not even an intentional policy anymore,” said Bernard Parah, CEO of Bitnob, a Nigerian crypto payments startup. “Some sites just remain blocked because everyone forgot and moved on, or the exchanges themselves are restricting Nigerian access.”

The network restriction prevents Nigerian users from accessing the web platforms of crypto service providers, impeding the geo-tagging process for operators. However, a few other foreign crypto companies, like OKX, block Nigerians from using their web platforms, following a de-prioritisation of the market.

Crypto reforms without connectivity

Between 2023 and 2025, Nigeria took significant steps toward mainstreaming digital assets. The signing of the Investment and Securities Act (ISA) 2025 in March by President Bola Tinubu was a watershed moment: for the first time, cryptocurrencies were formally recognised as securities under Nigerian law. The Act placed Virtual Asset Service Providers (VASPs), including exchanges, custodians, and wallet providers, under the direct oversight of the Securities and Exchange Commission (SEC).

The SEC followed up with its Digital Assets Rules and VASP Licencing Framework, which came into force on June 30, 2025. It requires all crypto platforms serving Nigerian users, local or foreign, to obtain a VASP licence and comply with disclosure, consumer protection, and anti-money laundering (AML) standards.

The CBN, previously hostile to crypto, also softened its stance. Through a joint committee with the SEC, it developed a framework to allow licenced exchanges to access the banking system, reversing its 2021 ban that had prohibited banks from servicing crypto companies. Banks remain wary of working with crypto firms.

The government went a step further. The Tax Administration Acts 2025 introduced taxation on digital assets, 25% on individual capital gains. The inclusion of crypto in the tax net signalled that Nigeria now saw it as a legitimate, taxable economic activity, not a threat to monetary stability.

“One step forward, two steps back”

Industry players say Nigeria’s Jekyll-and-Hyde approach to crypto regulation points to a bigger problem of chaotic enforcement.

“The telecom block is just a symptom of a larger issue,” said an executive at one of the crypto exchanges who pleaded anonymity to speak freely. “We have laws, but no enforcement consistency. You can’t say you’ve legalised crypto and still block access to exchanges.”

Local operators, too, are feeling the pressure. Exchanges such as Quidax and Busha, which received provisional crypto licences as part of the SEC’s Accelerated Regulatory Incubation Programme (ARIP) sandbox, have faced their own hurdles, including having to change their domain names after their original websites were blocked.

Both Quidax and Busha declined to comment on the matter.

“ARIP isn’t a licence; it’s just a sandbox,” another industry executive, who also spoke on the condition of anonymity, explained. “We’ve been in there for over a year, submitted all documents, and gotten confirmation that everything is in order—yet no one’s been fully licenced. The SEC keeps saying progress is being made, but nothing has moved.”

Others, like Bybit and Bitget, operate quietly via mobile apps, even though they lack licences or ARIP participation. Most of the larger international platforms, including Binance and OKX, have remained inaccessible unless users turn to VPNs or alternate networks.

Yet for newer Nigerian crypto startups, such as Coinveto, Mular, and Mobarter, launching after the blanket telecom restriction, the situation is less dire. Their web platforms are not affected by the telecom block. They have launched without facing restrictions, possibly because they are “too small to attract regulatory scrutiny,” according to an early-stage crypto startup founder.

The P2P problem and policy paralysis

While Nigeria’s blanket telecom restriction was aimed at curbing P2P transactions, it did little to stop it. P2P activity simply moved to mobile apps and private groups, where oversight is even weaker.

“The attempt to shut down P2P didn’t solve the problem,” said another executive of an exchange. “It only made the market more opaque.”

For many industry observers, the persistence of the telecom block reveals Nigeria’s deeper coordination problem. The NCC said it had no mandate to lift the restriction without a counter-directive from higher authorities.

“You can’t just undo a directive without an official reversal,” a senior NCC official told . “We were asked to block access, but no one has issued a new instruction to unblock it. It’s a sensitive issue, especially since security agencies still view crypto with suspicion.”

The NCC believes the directive to unblock the crypto exchanges needs to come from either the Office of the National Security Adviser (ONSA) or the SEC, the regulator of the industry.

That bureaucratic deadlock leaves Nigeria in an awkward position: officially regulating crypto under the SEC’s authority, while still informally restricting its online ecosystem through telecom providers.

The SEC did not respond to a request for comments.

“It’s quite embarrassing that we’re hailing ourselves [as a crypto-friendly country], but several things are not in order; it sends the wrong signals,” said Rume Ophi, a crypto analyst. “The SEC is not talking about the telecom block, so it’s enough to say that the onus lies on the ONSA.”

Ophi says, considering Nigeria’s security challenges, stakeholders must be cautious in how they confront the ONSA to avoid appearing to regulators as though they’re moving illicit funds. Since there’s no clear evidence that the ONSA is behind the telecom restrictions—though Ophi believes the security agency is—he argues that the SEC should bear the brunt, as stakeholders cannot directly challenge the ONSA.

A patchwork of progress

According to Obinna Iwuno, President of the Stakeholders in Blockchain Technology Association of Nigeria (SiBAN), an industry lobby group, the partial block continues to harm local crypto businesses.

“It’s affecting operators who are trying to comply,” he said. “Some platforms are available on Airtel but not MTN, others on Glo but not 9mobile. It’s inconsistent and hurts legitimate exchanges.”

SiBAN has raised the issue with regulators, urging the SEC and the NCC to coordinate a clear resolution.

“We don’t even know who is responsible for reopening access; is it the NCC or another agency? That confusion shows how uncoordinated the space still is,” Iwuno added.

Meanwhile, the Nigerian government continues to promote blockchain innovation and financial inclusion through policies like the Payments System Vision 2025, which envisions integrating stablecoins and digital assets into the formal economy.

With over 26 million crypto users, Nigeria remains one of the world’s largest digital asset markets. Yet, without consistent enforcement, licencing, and infrastructure clarity, much of that potential remains untapped.

“The truth is, we’re regulating crypto in name only,” said one industry executive. “Until the telecom ban is reversed and banks can fully service exchanges, we’re still stuck halfway between prohibition and progress.”