Nvidia Corp. CEO Jensen Huang repeatedly stated during the company’s second-quarter 2026 earnings call this week that the top four hyperscalers (Amazon Web Services Inc., Google LLC, Microsoft Corp. and Meta Platforms Inc.) would spend around $600 billion in annual capital expenditures — a figure he said had doubled in just two years and was fueling the current artificial intelligence infrastructure buildout. However, earnings calls and analyst coverage from these hyperscalers show their combined recent capex guidance falls short of $600 billion, though the pace and scale are rapidly climbing thanks to AI demand.

Jensen Huang’s capex claims

- Huang referenced “$600 billion per year” for the top four hyperscalers multiple times in the call, citing Amazon, Microsoft, Google and Meta as examples leading this monumental investment in AI infrastructure.

- This figure was framed as representative of just the hyperscaler leaders and of a doubling in annual spending compared with two years prior. (Note: Nvidia responded to a query on the discrepancy by saying that value represents total industry data center infrastructure spend, not just top cloud service providers.)

Hyperscaler actual capex statements

Here’s what each hyperscaler publicly committed for 2025 (calendar or fiscal year as relevant):

- AWS: CFO stated quarterly capex was running at $31.4 billion, annualizing above $118 billion with most aimed at AI and cloud infrastructure for AWS.

- Google (Alphabet): Announced a major boost in 2025 capex, raising guidance to $85 billion due to cloud and AI infrastructure demand.

- Microsoft: Reaffirmed plans for approximately $80 billion in 2025 capex, with some reports (including Jefferies) later suggesting a number as high as $121 billion for fiscal 2026.

- Meta: CEO and CFO indicated 2025 capex guidance of $64 billion to $72 billion (some estimates center on $70 billion), and expect further growth for fiscal 2026 to ~$30 billion above that.

- Combined: Analyst synthesis (Jefferies, Investing.com) for the “Big 3 + Meta + Oracle” projected $417 billion in cloud capex for 2025, up 64% from the prior year and nearly triple 2023.

Juxtaposition and theories on the delta

Huang’s $600 billion annual capex assertion notably overshoots analysts’ (including ours) and hyperscalers’ own reported figures by close to $200 billion.

Potential reasons for the discrepancy

- Run rate vs. forward guidance: Huang could be annualizing quarterly spikes and extrapolating future run rates, whereas companies report planned or committed spend, which may understate “real” execution if momentum persists.

- Huang knows something we don’t know: He could be sharing internal data based on hyperscaler forecasts, on which he said they have pretty good visibility.

- Global and supplier inclusion: Perhaps Huang interprets U.S. hyperscaler capex as a proxy for global infrastructure spend, potentially adding undisclosed investments or associated supply chain buildouts (such as colocation, power and facility upgrades).

- Competitive narrative: By inflating the combined capex, Nvidia signals the urgency and scale of the AI race — potentially to reinforce its own leadership role and justifications for unprecedented revenue expectations.

- Scope ambiguity: Huang may include broader infrastructure capex, such as networking, logistics, buildings and equipment not strictly limited to “cloud/AI/data center” spend shown in hyperscaler guidance and analyst calculations.

Analytical delta

- Company filings, earnings calls, and analysts put the 2025 capex for the Big 4 (plus Oracle) in the $400 billion to $450 billion range. Huang’s repeated $600 billion figure is likely an optimistic projection, not yet substantiated by hyperscalers’ official statements.

- The delta (~$150 billion to $200 billion) raises questions around how capex forecasts are counted, reported and interpreted for market modeling. If Huang’s broader numbers include associated supplier investments and noncloud projects, it reveals how definitions matter amid AI enthusiasm.

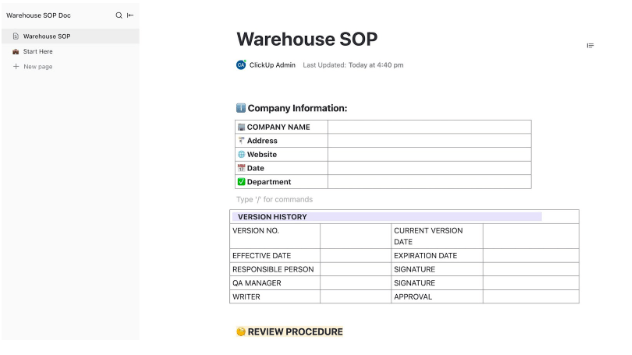

Summary table

| Statement Origin | Capex Estimate 2025 (Billions USD) | Noted Scope |

| Jensen/Nvidia call | $600 | Unclear; “top 4 hyperscalers”; implied broad infra |

| Analyst composite | $417 | Big 4 + Oracle; direct cloud/infrastructure spend |

| Individual calls | ~$65–$120 each | Official earnings guidance per company |

Conclusion

Huang’s surprising $600 billion hyperscaler capex claim at Nvidia’s Q2 2026 earnings call is not validated by the leading hyperscalers’ own 2025 guidance and analyst calculations, which place aggregate spend closer to $400 billion to $450 billion. The gap likely arises from both scope ambiguity (what actually “counts” as hyperscaler capex) and forward-looking narrative intent, as Nvidia seeks to position itself at the center of an industrial-scale AI boom.

Photo: Robert Hof/ News

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About News Media

Founded by tech visionaries John Furrier and Dave Vellante, News Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.