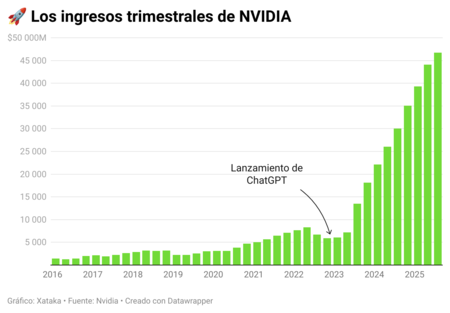

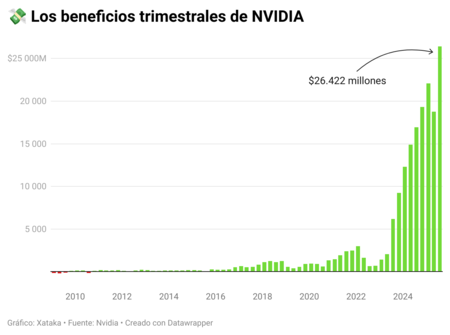

Nvidia has presented its results from the second fiscal quarter. Technically beat all forecasts:

- Adjusted benefits of $ 1.05 per share compared to the 1.01 expected.

- Revenues of 46,740 million dollars against the projected 46,230 million.

The company has also projected income of 54,000 million for the current quarter, slightly above the consensus of 53.4 billion.

Why is it important. These seemingly solid numbers have not been enough for a market that has made Nvidia the definitive fire test of the boom from Ia.

The action has fallen 3% in the operations after closing, a reaction that reveals to what extent the expectations about the most valuable company in the world – with 4.4 billion capitalization – have reached almost impossible levels of satisfying.

China’s problem. The great shadow on the results has been the total absence of sales of the H20 chip to China during the quarter. Nvidia has not included any sales forecast to China in its guide for the third quarter, despite the fact that the financial director, Colette Kress, has mentioned that they have between 2,000 and 5,000 million dollars in ready -to -send orders to send if geopolitical issues are resolved.

The company is waiting for the Trump administration to clarify the regulations on the 15% cut that wants to impose Chips sales to Chips.

Jensen Huang has been unusually direct during the call with analysts: “The Chinese market esteem that represents about 50,000 million dollars of opportunity for us this year.”

- He added that half of the world’s researchers are in China …

- And that it is “quite important” that American technology companies can access that market.

Between the lines. Huang’s frustration with the geopolitical situation is palpable. His comment that “we just have to continue advocating” before the Trump administration makes us glimpse a more tense negotiation than the official statements say.

The CEO has suggested that they are working in a modified version of their Blackwell chips for China, with reduced performance, indicating that Nvidia is willing to make weight concessions so as not to lose that market. Striking in a company today as powerful as Nvidia.

Data centers disappoint. The data centers segment, which represents 88% of total income, has generated 41,1 billion dollars, slightly below the expected 41,290 million.

It is the second consecutive trimester that this important segment does not reach expectations, a worrying signal when large technological ones such as goal, Google and Microsoft are investing tens of billions each quarter in AI infrastructure.

“Everyone is sold”. Huang has said during the call that “everything is sold”, referring to both current Hopper chips and the new Blackwell. He added that Blackwell Ultra’s production is “moving forward” and that demand is “extraordinary.”

However, these statements contrast with the fact that the income growth of 56% year -on -year is the slowest in nine consecutive quarters of growth greater than 50%.

Growing pressure. The market reaction tells an uncomfortable truth: Nvidia has become hostage of its own success. With a weight of 7.5% in the S&P 500 – 3% in December – any stumbling block has the potential to drag the entire market.

An important Nvidia failure would be a detonation for half -world bags.

The contrast. Huang has promised that AI infrastructure spending will reach between 3 and 4 billion dollars for the end of the decade, but the immediate reality is that NVIDIA cannot freely access the second largest computer market in the world.

The repurchase of 60,000 million dollars in shares approved by the Council – one of the largest in American business history – seems more an attempt to sustain the Price of the action than a real confidence signal in the future without regulatory mosquadillas.

In WorldOfSoftware | Deepseek has suggested that Nvidia chips no longer needs. We believe to know who is buying them

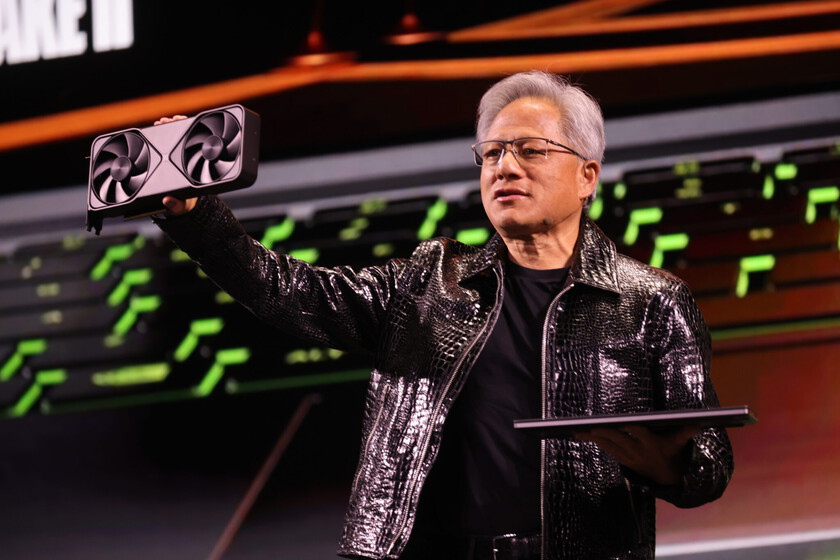

Outstanding image | Nvidia