Ocado shares dropped as much as 16% on Thursday after the company posted a pre-tax loss for the year of £379.3m and admitted job cuts were coming.

In a media conference, Ocado leadership said it was making good progress towards its goal of being cash positive by 2026, but warned cost reductions, including redundancies would be part of its strategy.

In its 2024 results, the grocery e-commerce company posted group revenue was up 14% from the year before, reaching £3.2bn.

Although the retail end of the company remains by far its biggest source of revenue, representing £2.7bn last year, Ocado’s technology solutions business is its fastest growing.

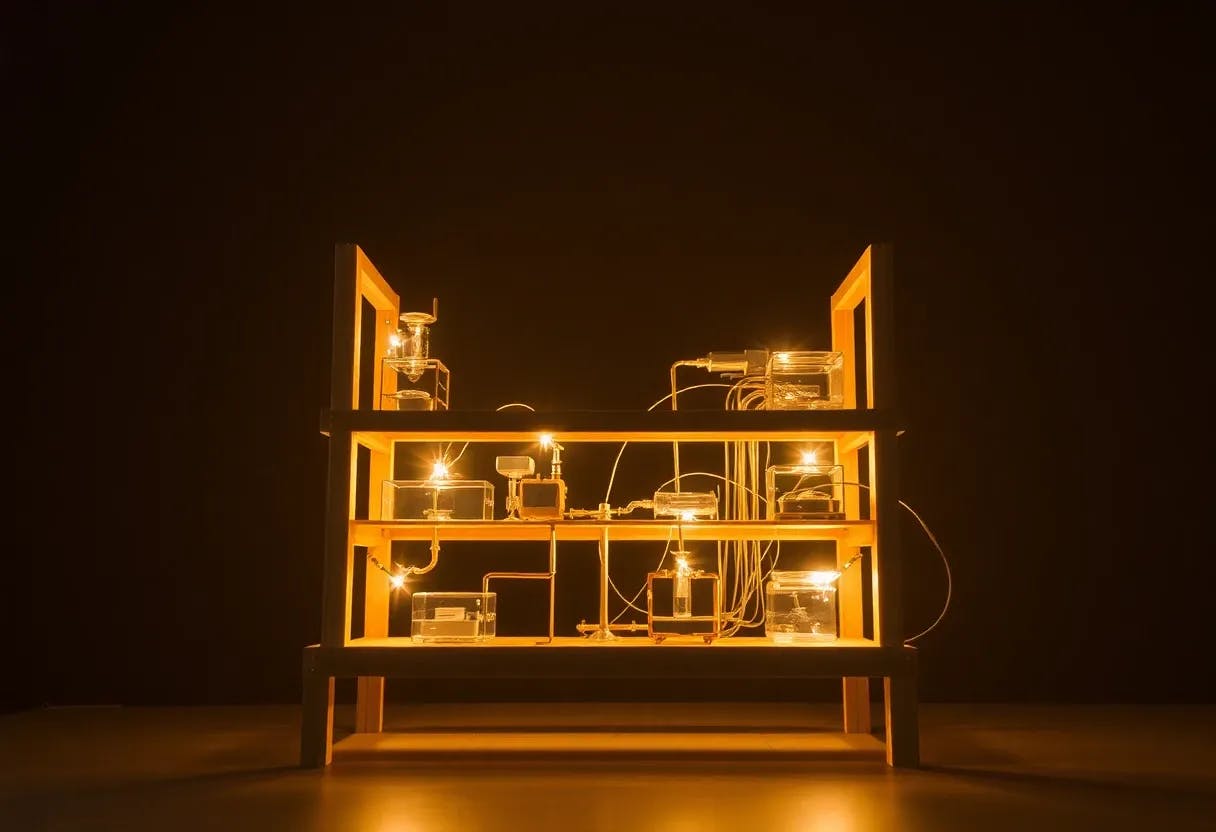

In 2024, Ocado pulled in £496.5m from its technology solutions, which include its automated robotic warehouses, an 18.1% increase, more than any other department.

The grocery firm’s technology solutions have been at the heart of its profitability plans, having spent more than £800m on research and development for services like its automated robotic warehouses.

However, CEO Tim Steiner said the company was at the “tail end” of its tech infrastructure development cycle, meaning members of the R&D team would be let go.

“Whilst we will continue to develop some very significant innovations, they are more software– driven innovations, and they are not as intensive in R&D, and so we will be seeing a reduction of the teams inside the business that develop technologies for us.”

Steiner did not specify how many job cuts at Ocado were expected but said it would likely be “significantly less” than the 1,000 redundancies made last year across all departments.

Ocado shares are trading at 283p, a more than 70% reduction in the last five years.

Register for Free

Get daily updates and enjoy an ad-reduced experience.

Already have an account? Log in