- Report claims Snapdragon X laptops only capture 0.008% of the global PC market

- Microsoft Surface leads Snapdragon X adoption in niche segment

- Qualcomm faces stiff competition from AMD, Intel, and Apple

The PC market is continuing to be a challenge for Snapdragon X laptops, with recent reports showing limited market penetration in its first full quarter since launch, as total sales reached under 720,000 units.

This figure represents less than 0.008% of the total PCs shipped globally over the same period, equivalent to fewer than one out of every 125 devices.

Despite a notable sequential growth of 180% in Q3 2024 compared to Q2, the Snapdragon X Series remains a small segment of the broader Windows market, capturing less than 1.5% of the ecosystem.

AI-capable PCs are gaining momentum

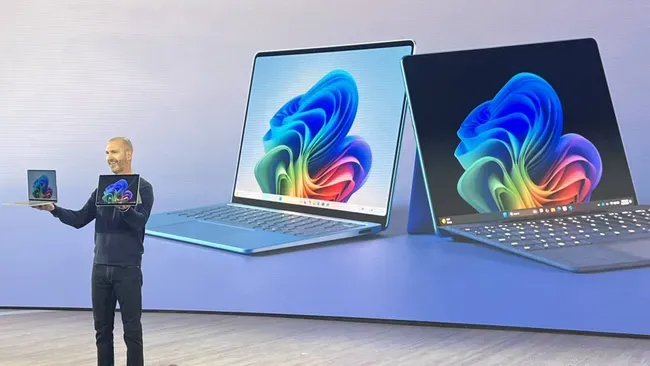

Microsoft and other popular brands have already transitioned some devices to the Snapdragon X platform, however, the market for these devices remains niche, even as Qualcomm pushes forward with integration into more consumer and business devices.

Canalys told TechRadar Pro, “As this was the first full quarter of shipments for Snapdragon X Series PCs, we saw sequential growth of around 180% compared to Q2 2024. However, as a proportion of the total Windows market, the products remain very niche, at less than 1.5% share. The top shipping vendor was Microsoft, which has transitioned most of their Surface line to the platform. Behind them was Dell who has embraced the new platform quite strongly in terms of SKU count, followed by HP, Lenovo, Acer and Asus (all four with similar volumes).”

While Snapdragon X laptops struggle to gain traction, the broader category of AI-capable PCs is rapidly expanding. In Q3 2024, shipments of these devices reached 13.3 million units, accounting for 20% of all PC shipments. This category includes desktops and notebooks equipped with chipsets dedicated to AI workloads, such as AMD’s XDNA, Intel’s AI Boost, and Qualcomm’s Hexagon.

Windows devices led the AI-capable PC market for the first time, capturing 53% of the segment. The surge in demand was supported by the Windows 11 refresh cycle and processor advancements. Sequential growth for AI-capable PCs stood at 49%, underscoring the market’s increasing appetite for AI-driven computing capabilities.

Nevertheless, AI-capable PCs face significant hurdles. Canalys’ data suggests that consumers and channel partners remain cautious about adopting these premium offerings. For instance, Microsoft’s Copilot+ PCs, requiring at least 40 NPU TOPS and other high-performance specifications, have yet to fully convince buyers of their value.

A November 2024 poll of channel partners revealed that 31% do not plan to sell Copilot+ PCs in 2025, while 34% expect these devices to account for less than 10% of their sales. With Windows 10’s end-of-support deadline approaching, PC vendors are under pressure to drive upgrades among users still relying on ageing devices.

To stand out in the competitive AI-capable PC market, vendors are exploring unique strategies. HP has emphasized collaborations with independent software vendors (ISVs) to enhance on-device AI experiences. Lenovo has invested in proprietary AI tools embedded within its PCs, such as Creator Zone and Lenovo AI Now.

Dell and Lenovo are leveraging on-device AI to complement their broader AI service ecosystems. Meanwhile, Apple has taken a distinct approach, focusing on its vertically integrated ecosystem.