Every day in Nigeria, over 33 million instant transfers race across our banking rails—from buying fuel and airtime to paying rent. Whether it’s a corporate exec in Victoria Island or an okada rider in Kano, the money moves. But not the context.

Each transaction tells a story: your rent pattern, salary cycle, and debt reliability. But that story is locked in silos. Banks hold it. Wallets replicate it. Fintechs rebuild it from scratch. None of it flows freely until now.

The Central Bank of Nigeria’s Open Banking framework introduces a radical idea: your financial data belongs to you. And if you permit it, any licensed provider should be able to use that data to serve you better.

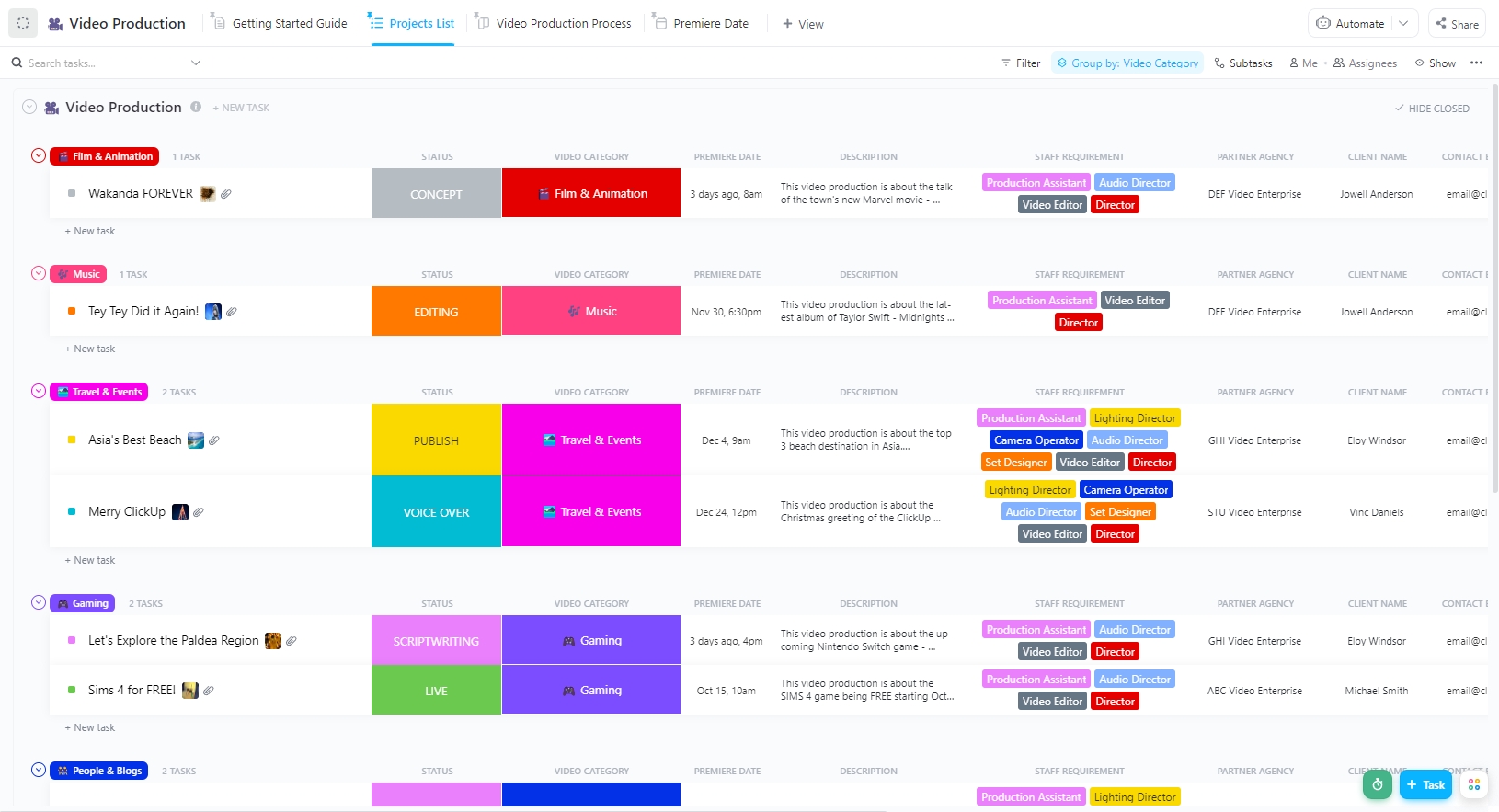

Everyone wins when financial data is no longer siloed

The biggest winners are the people who’ve had the least control until now: everyday customers. They’re no longer stuck with one provider holding their financial history. They can move freely, compare services, and choose what works best.

This shift also opens the door for builders. Many who spent years working around data restrictions can now plug into verified, standardised APIs. Less time spent reverse-engineering statements. More time solving real problems.

Banks stand to gain too, if they act fast. The ones that adapt can move beyond traditional products and become platforms. By exposing APIs, they stay relevant even outside their apps.

At a broader level, the economy wins. Done right, Open Banking doesn’t just modernise the system; it makes it more inclusive, resilient, and responsive.

From hacky, siloed workarounds to real scalable solutions

Guess what happens when financial data moves safely, with customer permission. That data powers better products, faster decisions, and broader access. These are some examples:

- Credit that actually works

Lending in Nigeria is mostly guesswork. That leads to high interest rates, collateral demands, and even public shaming when things go wrong.

With open banking, a small business owner can grant access to a year’s worth of bank transactions. A lender reviews verified income data, decides in minutes, and sets up repayment via direct debit. No land documents. No guarantors. No friction.

This is how we make credit cheaper and smarter.

- A national fraud radar

Every fintech in Nigeria has war stories. Fraudsters exploit weak points, spread funds through mule accounts, and disappear. The damage is local, and the pattern is the same everywhere.

Open banking makes it possible to share live fraud signals. If a bad actor gets flagged at one provider, others can detect and block them in real-time. Shared infrastructure, device hashes, IP patterns, account links, etc., make fraud detection collaborative.

Each fintech player stops playing defense alone.

- Direct debits that travel with you

Cards are great until they aren’t. Direct debit mandates don’t follow you when you switch banks or change devices. That’s why recurring billing with a bank is clunky and adoption is low.

With open banking, you set up a reusable direct debit mandate tied to your identity. One dashboard shows every recurring instruction from Netflix to PHCN bills. You can cap, pause, or revoke them anytime.

Need more control? Enable two-factor approval. Spot a suspicious charge? You can block it before it hits.

Getting regulation right is key

Compared to other countries, Nigeria is off to a solid start. The UK’s rollout faced governance issues and weak enforcement. Some banks dragged their feet, and adoption slowed because customers didn’t see enough value or protection.

In Brazil, security concerns and uneven API quality made early adoption tricky. Many people still don’t know how Open Finance works or why they should care.

Nigeria now has a chance to avoid those mistakes. Its rules, laid out in Section 11, outline how consent, security, and reliability should work in every real-world API call, are clear. Its structure is strong. But the real test is in how well providers follow through—and how quickly regulators respond when they don’t.

The real risk: We waste the opportunity

Open banking gives us a rare chance to redesign Nigeria’s financial rails with trust and interoperability at the core. But the system is only as strong as what we build on top of it. We’ve seen what can go wrong. The eNaira launched with big goals but didn’t take off, partly because people didn’t understand its value.

If APIs are unreliable, if customers don’t understand what they’re consenting to, or if data hoarding continues under new labels, this momentum will stall.

But if we build carefully and fast, we can enable a generation of financial products that are smarter, safer, and truly inclusive.

The APIs are coming. The opportunity is open. The next move is ours.

___________

Lukman Bello is a payments infrastructure expert and Technical Solutions Lead at Paystack, where he has spent more than six years guiding businesses through the intricate world of African fintech. He has overseen integrations for hundreds of notable local and global brands, turning regulatory complexity into clear product strategies and robust code.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com