There are a number of heavily hyped AI software stocks on the market today. Investors looking for alternatives would do well to take a closer look at Snowflake.

Palantir Technologies is among the leaders in the artificial intelligence (AI) software market and has experienced tremendous revenue and profit growth in recent years. As a result, the stock has started flying higher. But the problem is that the shares are now trading at expensive levels. There is a large amount of expected future growth baked into the stock price.

That’s why investors looking for strong returns in that AI niche may be looking for alternative opportunities. Snowflake (SNOW 1.17%) appears to be one that could outperform Palantir in 2026.

Image source: Snowflake.

Snowflake’s data platform is getting an AI-powered boost

Snowflake operates a cloud-based data warehouse platform. Customers can not only store their proprietary data on their systems, but also use that data to build apps, gain insights, and perform analytics. The company also offers a marketplace for third-party data sets, allowing customers to share and exchange data and generate revenue.

Today’s change

(-1.17%)$-2.58

Current price

$217.93

Key data points

Market capitalization

$75 billion

Day range

$215.15 -$222.37

Range of 52 weeks

$120.10 -$280.67

Volume

65

Avg. full

5M

Gross margin

65.96%

The infusion of AI tools into its offerings helps the company attract new customers while generating more revenue from existing customers. Snowflake now offers a wide range of AI services, including serverless graphics processing units (GPUs), which customers can rent to access large language models (LLMs). And the Cortex platform allows customers to build and deploy AI apps using their own data.

The productivity gains these options can bring to customers explains why demand for Snowflake’s AI solutions is increasing. On the last earnings call, management said that in the third quarter of fiscal 2026 (which ended Oct. 31), more than 7,300 customers were using its AI features every week, and 1,200 of them were building AI agents on the platform.

The company ended the quarter with just over 12,600 customers, an increase of 20% compared to the same period last year. So there are still countless customers to whom it can cross-sell its AI offerings.

More importantly, its cross-selling capabilities allow the company to generate more revenue from existing customers, as evidenced by its 125% net revenue retention last quarter. This measure compares the product revenues generated by the customer cohort in the previous year’s period with the revenues recorded from the same cohort in the last period. So a retention rate of more than 100% means that established customers as a group spend more on the offer.

Since Snowflake doesn’t have to incur high marketing costs to pitch its AI tools to its established customers, its revenues are growing at an impressive pace. It reported a 29% increase in product sales to $1.16 billion in the fiscal third quarter, while adjusted earnings rose 75% year over year to $0.35 per share. The operating result increased by 79% in the first nine months of the financial year.

It could repeat such a performance in the current quarter as well, especially given that it has raised its expectations. It now expects to end fiscal 2026 with a 28% increase in product revenues to $4.45 billion, up from its previous guidance of $4.39 billion. Snowflake also reported a residual performance obligation (RPO) of $7.9 billion last quarter, up 37% year over year. The fact that this metric has grown faster than revenue shows that the company is winning contracts faster than it can fill them.

So an acceleration in growth in 2026 could pave the way for more upside potential for the stock, on top of the 44% gain it has made so far this year.

A strong 2026 could be in store for stocks

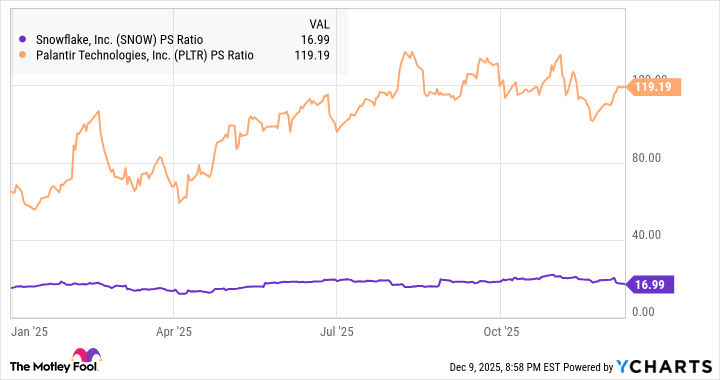

Snowflake’s stock price gain this year is well below Palantir’s 140% jump, but the latter’s high valuation could hinder the stock in 2026. Snowflake is trading at a significantly cheaper sales multiple.

SNOW PS Ratio data by YCharts; PS = price-to-sales.

Comparing the potential growth that both companies are likely to register next year, it’s easy to see why Snowflake has the potential to surpass Palantir. Analysts predict Palantir’s revenue will increase 40% in 2026 to $6.2 billion, compared to this year’s estimated growth of 54%. Snowflake’s revenue, meanwhile, is expected to rise 24% to $5.7 billion next year.

Both companies could beat these consensus estimates thanks to their rapidly improving backlogs. However, Snowflake’s valuation is significantly cheaper and therefore more sustainable.

Assuming Snowflake hits $5.7 billion in revenue next year as expected and trades at 20 times revenue (a premium it could justify by surpassing consensus estimates in 2026), its market cap could rise about 50% from current levels to $114 billion. Palantir’s 12-month average price target of $200, meanwhile, suggests an upside of around 7% from current levels.