This AI stock is up almost 300% in 2025 and still has more upside to offer.

Palantir Technologies (PLTR +0.36%) delivered another great return in 2025, driven by an acceleration in growth. Growing demand for Palantir’s artificial intelligence (AI) software solutions, which are used by both governments and businesses, sent its shares up as much as 135% last year.

However, investors are wondering if it’s a good idea to buy Palantir stock after the stellar rise. After all, the company trades at an expensive 417 times earnings and 117 times sales. Even analysts don’t expect much upside from Palantir in the coming year. The average 12-month price target of $200 is only 11% higher than the current share price. Furthermore, only a quarter of the 26 analysts covering Palantir suggest buying it now.

However, there’s another AI stock that significantly outperformed Palantir last year and is currently trading at an incredibly cheap valuation: West Digital (WDC +6.55%). Shares of the data storage solutions specialist are up 282% in 2025. Let’s see why that was the case.

Image source: Getty Images.

Western Digital is growing at a rapid pace

Western Digital is known for manufacturing and selling data storage solutions such as hard disk drives (HDDs) and solid-state drives (SSDs). It sells these products to consumers, enterprises and cloud service providers. The company now generates almost 90% of its revenue from the cloud segment. This is not surprising, as there is a huge demand for storage solutions in AI data centers.

Today’s change

(6.55%)$12.29

Current price

$199.97

Key data points

Market capitalization

$64 billion

Day range

$186.04 -$200.65

Range of 52 weeks

$28.83 -$221.23

Volume

383K

Avg. full

8.9 million

Gross margin

39:30%

Dividend yield

0.17%

Western Digital management stated this during the October 2025 earnings call, with CEO Irving Tan stating:

The rapid adoption of AI and data-driven workloads at hyperscalers is driving robust demand for our products and solutions.

It’s easy to see why that is the case. AI model training and inference applications create the need to store massive amounts of data, which can then be acted upon by graphics processing units (GPUs) or other types of processors. According to Tom’s Hardware, each GPU can take up several terabytes of storage space.

As a result, the amount of data generated globally is expected to triple between 2023 and 2028, according to IDC. Given that 2% of the data created is stored, Western Digital’s addressable market will expand at a tremendous pace. Western Digital specifically points out that AI will lead to a 131% increase in HDD shipments between 2024 and 2028.

However, the demand for data center storage is growing faster than the supply. There is reportedly a wait of more than a year for HDDs. This has led to a rise in the price of HDDs and enterprise flash storage chips. Not surprisingly, Western Digital reported a whopping 137% year-over-year increase in its non-GAAP earnings to $1.78 per share in the first quarter of fiscal 2026 (which ended October 3, 2025).

Sales rose 27% to $2.8 billion during this period. Analysts expect a 58% increase in Western Digital’s profits for the current fiscal year (ending July 2026). However, the company could ultimately do better. Western Digital said in its previous earnings call that it has no plans to add any more production capacity for the time being. Since it is one of the largest sellers of storage devices, this decision will likely drive prices up even further.

So there’s a good chance that Western Digital’s earnings growth will exceed analyst expectations both this year and next fiscal.

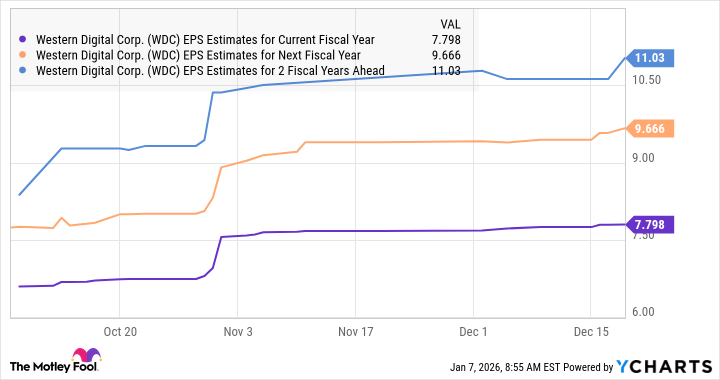

Data per YCharts.

Why stocks are a no-brainer purchase right now

The chart above shows that Western Digital is on track to deliver healthy double-digit earnings growth over the next three financial years. It could outperform thanks to favorable storage market dynamics, but even if earnings rise in line with Wall Street expectations, the stock could continue to rise.

Shares of Western Digital trade at just 23 times forward earnings. That’s lower than the Nasdaq-100 the index’s average earnings multiple of 33 (using the index as a benchmark for technology stocks). If Western Digital’s stock trades in line with the index average and delivers earnings of $9.67 per share in the next fiscal year (as seen in the chart above), the stock price could reach $319 over the next year and a half.

That’s 45% higher than the current share price. The stock’s attractive valuation suggests that investors are getting a good deal on Western Digital, and they should consider buying the stock outright before it rises further.