Let’s take a look at the relative performance of Akamai (NASDAQ:AKAM) and its peers as we unravel the now-completed second quarter software development earnings season.

As legendary venture capital investor Marc Andreessen says, “Software is eating the world,” and it’s affecting virtually every industry. That’s driving increasing demand for tools that help software developers do their work, whether it’s monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The eleven software development stocks we track reported a mixed second quarter. As a group, revenues exceeded analyst consensus expectations by 1.6%, while revenue expectations for the next quarter were in line.

Inflation has recently risen toward the Fed’s 2% target, prompting the Fed to cut its policy rate by 50 basis points (half a percent or 0.5%) in September 2024. This is the first reduction in four years. While the CPI (inflation) numbers have been supportive lately, the employment measures have turned out to be almost worrisome. Markets will debate whether the timing of this rate cut (and more potential ones in 2024 and 2025) is ideal to support the economy, or whether it is a bit too late for a macro that has already cooled too much.

Fortunately, software development stocks have been resilient, with share prices up an average of 6.9% since the last earnings results.

Akamai (NASDAQ:AKAM)

Founded in 1999 by two MIT engineers, Akamai (NASDAQ:AKAM) provides software that helps organizations efficiently deliver Web content to their customers.

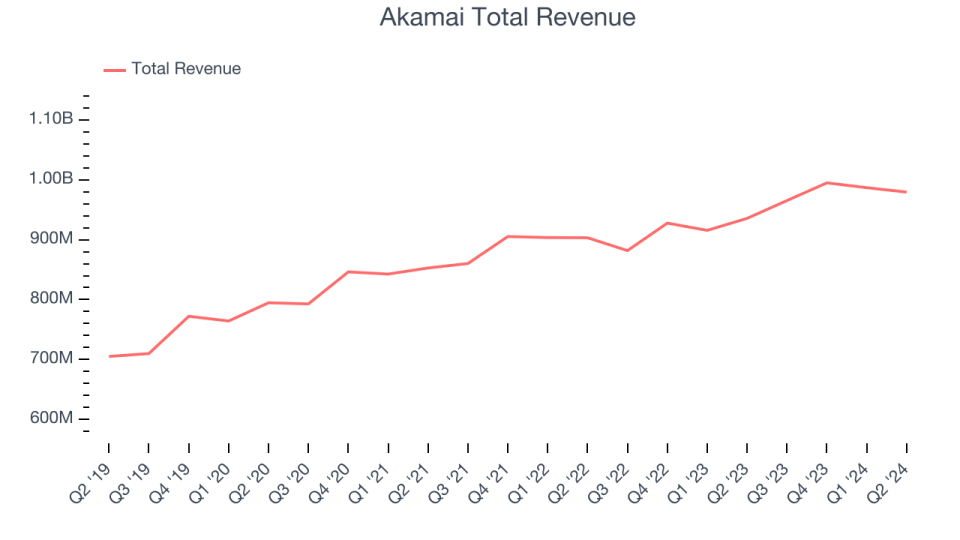

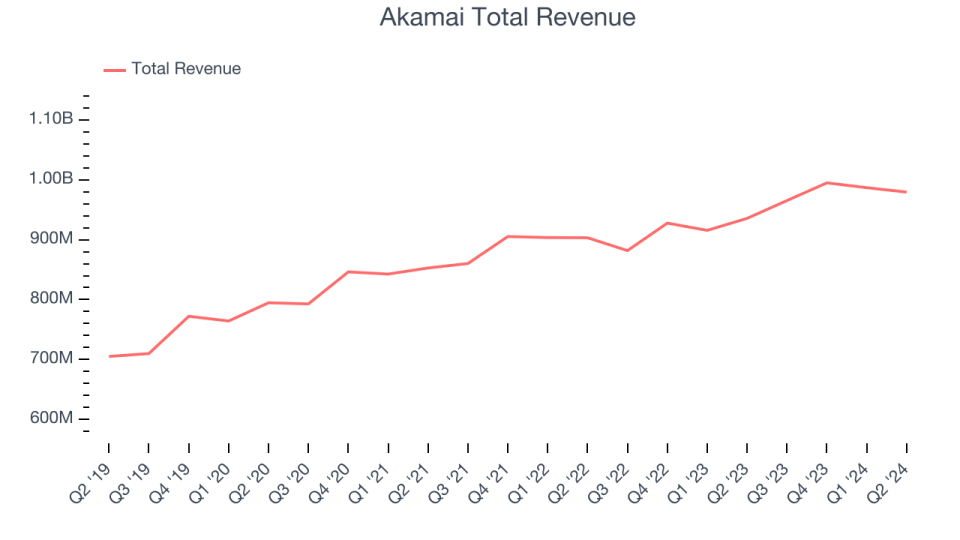

Akamai reported revenue of $979.6 million, up 4.7% year over year. This print was in line with analyst expectations, but overall it was a mixed quarter for the company with in-line revenue expectations for the following quarter.

Interestingly, the stock is up 11.3% since reporting and is currently trading at $101.84.

Read our full report on Akamai here. It’s free.

Best Second Quarter: GitLab (NASDAQ:GTLB)

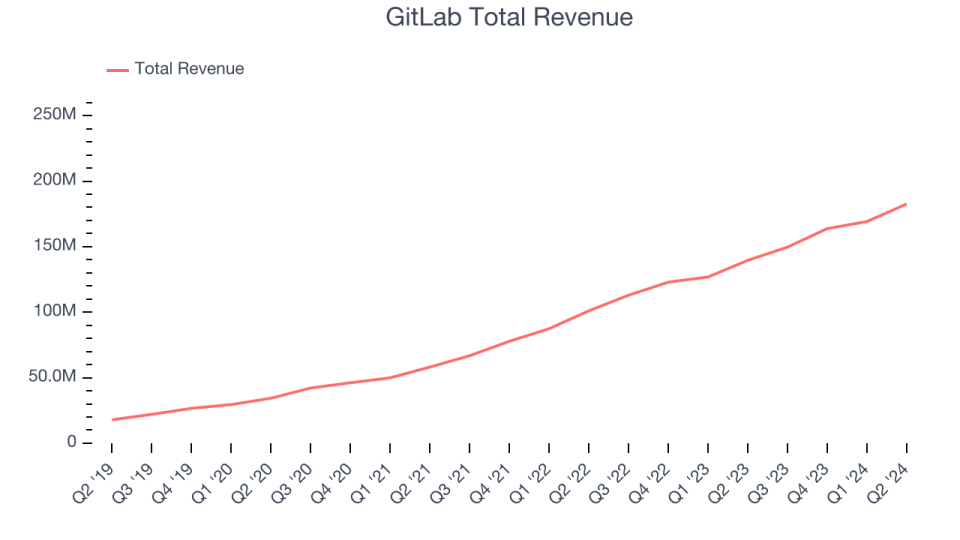

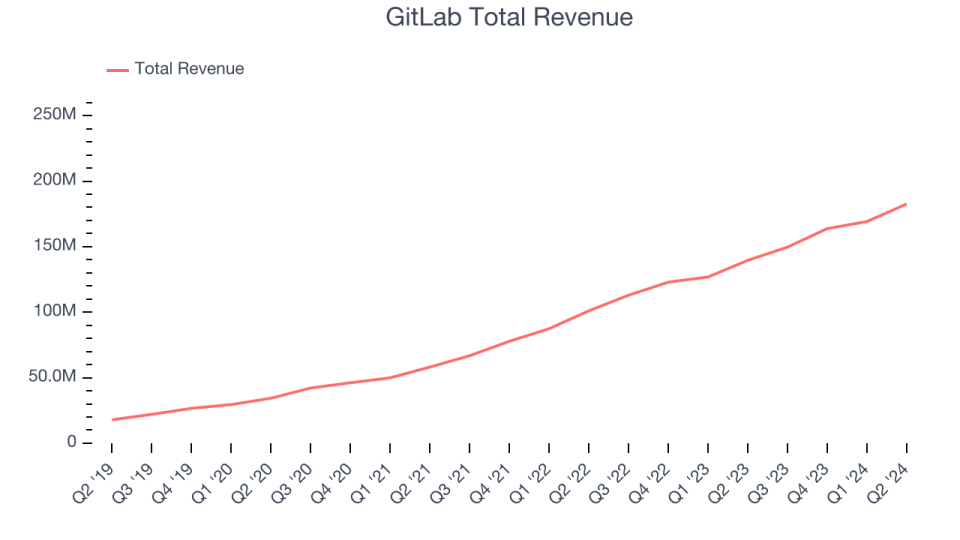

Founded as an open source project in 2011, GitLab (NASDAQ:GTLB) is a leading platform for software development tools.

GitLab reported revenue of $182.6 million, up 30.8% year over year, and beat analyst expectations by 3.1%. The company had a strong quarter with an impressive gain in analyst expectations and a narrow gain in ARR (annual recurring revenue) estimates.

GitLab scored the fastest revenue growth and highest full-year forecast lift among its peers. The market seems pleased with the results, as the stock is up 19.6% since reporting. It is currently trading at $53.46.

Is Now the Time to Buy GitLab? See our full analysis of earnings results here. It’s free.

Founded by three former Amazon engineers, PagerDuty (NYSE:PD) is a software-as-a-service platform that helps companies quickly respond to IT incidents and ensure any downtime is minimized.

PagerDuty reported revenue of $115.9 million, up 7.7% year over year, in line with analyst expectations. It was a weaker quarter as revenue expectations for the next quarter were disappointing and customer growth declined.

PagerDuty provided the weakest full-year outlook update in the group. The company lost 76 customers for a total of 15,044. As expected, the stock is down 4% since the results and is currently trading at $17.54.

Read our full analysis of PagerDuty’s results here.

HashiCorp (NASDAQ:HCP)

HashiCorp (NASDAQ:HCP), originally founded as a research project at the University of Washington, provides software that allows companies to manage their own applications in a multi-cloud environment.

HashiCorp reported revenue of $165.1 million, up 15.3% year over year. This figure exceeded analyst expectations by 5.1%. More broadly, it was a mixed quarter with slowing growth among major customers.

HashiCorp achieved the highest analyst profit forecast among its peers. The company has added 16 business customers paying more than $100,000 annually, bringing the total to 934. The stock is flat since reporting and is currently trading at $33.83.

Read our full, actionable report on HashiCorp here. It’s free.

Cloudflare (NYSE:NET)

Founded by two Harvard Business School students, Cloudflare (NYSE:NET) is a software-as-a-service platform that helps improve the security, reliability, and load times of Internet applications and websites.

Cloudflare reported revenue of $401 million, up 30% year over year. This print exceeded analyst expectations by 1.6%. Zooming out, it was a mixed quarter as analyst expectations were not met.

The stock is up 14.7% since reporting and is currently trading at $85.30.

Read our full, actionable report on Cloudflare here. It’s free.

Participate in paid stock investor research

Help us make StockStory more useful to investors like you. Participate in our paid user research session and receive a $50 Amazon gift card for your opinion. Sign up here.