Stitch, a South Africa-based payments infrastructure startup founded in 2021, has raised $55 million in a Series B round, bringing its total funding to $107 million within just four years of operation. The funding is aimed at expanding its in-person payment offerings, improving its online payment suite, and facilitating its entry into card acquiring.

The $55 million funding round was led by QED Investors, with participation from Norrsken22, Flourish Ventures and Glynn Capital, as well as angels including comedian Trevor Noah. Existing backers like Ribbit Capital, PayPal Ventures, Firstminute Capital and The Raba Partnership also contributed.

“This funding round is focused on our next phase of growth to expand our in-person payments launched with acquisition of ExiPay earlier this year, and also (to) bolster our online payments suite to better serve enterprise merchants across all payments needs,” said a company representative.

The funds will also support Stitch’s expansion into accepting card payments from customers, whether in-store or online. The company representative noted that “becoming a direct acquirer allows us to process card transactions directly, without relying on banks. We will be able to offer our clients an end-to-end card product with full control over the whole product lifecycle while reducing the number of intermediaries and lowering costs.”

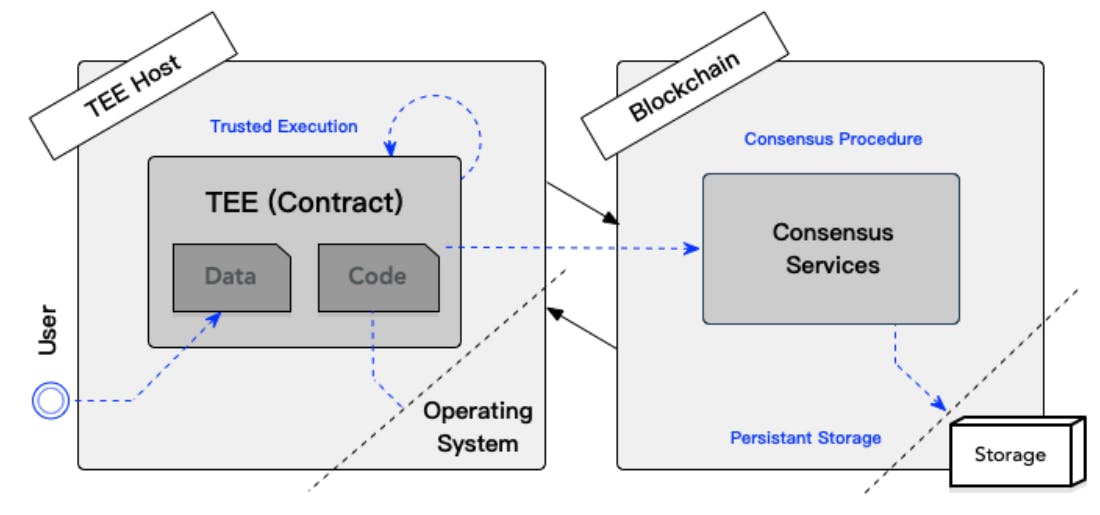

The funding will help Stitch invest in infrastructure that enable the flow of money including payment processing networks, as well as infrastructure to improve payment processing, methods, and service levels.

“The key is seamless switching between these sources. We need to automatically detect failures and switch to backups, ensuring uninterrupted service. This requires maintaining all these alternatives and having the systems and teams to manage the transitions quickly,” said the company representative.

The company noted that its ability to attract such substantial capital in a challenging macroeconomic climate hinges on building a business with demonstrable fundamentals. First, startups must demonstrate a sound business model that addresses a real market need, showing evidence of market share growth, strong client adoption, and positive feedback.

Stitch’s growth is fueled by factors like increasing e-commerce penetration, the rise of digital wallets, and the popularity of buy-now-pay-later (BNPL) solutions. South Africa’s e-commerce penetration is experiencing significant growth, with estimates suggesting a rise from 49% in 2023 to 60% by 2028.

“Investors primarily focus on the fundamentals of building something people genuinely want and demonstrating strong financial performance. You need to clearly illustrate your growth trajectory and sound financial fundamentals. Then, the ‘nice-to-haves’ like investor networks and brand storytelling become relevant,” the company representative said.

Stitch serves some of the leading enterprise businesses in South Africa including Takealot, Mr. D, MTN, Vodacom, Standard Bank’s Shyft, TFG’s Bash, Hollywoodbets, Luno, The Courier Guy and many more. This funding will help them serve their clients better.

“Businesses like Takealot operate 24/7/365. We need to provide consistent, uninterrupted service. However, South Africa’s financial infrastructure is not designed for round-the-clock operation,” the company representative said.

Stitch bridges this gap by providing a comprehensive suite of payment solutions for enterprise businesses. It also launched Express, a simple checkout solution designed for online businesses of all sizes that use e-commerce platforms such as Shopify and Woo, in early 2025.

Beyond access to all local online payment methods and in-person payments, Stitch is also known for its fraud prevention capabilities with its Shield product which uses AI to detect fraud across all transactions, providing merchants with tools to manage fraud incidents, and handling both prevention and response.

The startup notes that South Africa’s payment infrastructure market is constantly innovating. Merchants are demanding higher service levels, faster product delivery, and new payment methods to cater to diverse customer segments. They are also seeking seamless omnichannel experiences, merging online and in-person payments.

“Value-added services are becoming crucial. They want detailed payment insights, AI-driven fraud prevention, and streamlined reconciliation and reporting. Enterprises are looking for comprehensive solutions, not just basic payment processing,” the company representative said.