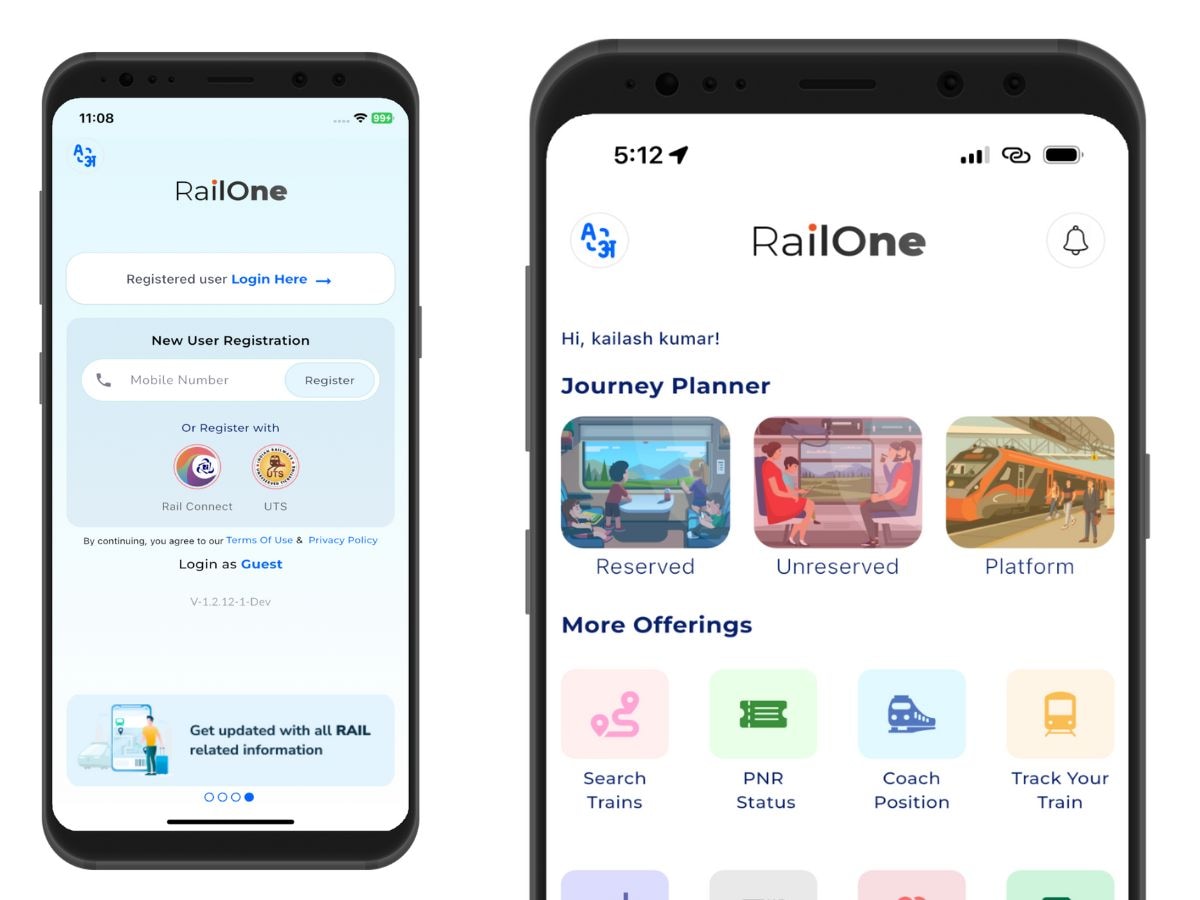

Press note. Sage has presented within the framework of the South Summit in Madrid, its study Scaling for Growth: Unlocking the Potential of Europe’s Startups and Scaleups. An investigation carried out among more than 7,500 SCALE-UPS and SCALE-UPS of New Generation in 15 countries of the European Union, in addition to the United States, Canada and the United Kingdom.

According to the criteria established by the OECD, a Scale-Up is defined as that company that has achieved an average annual growth of employees or business volume greater than 20% for a period of three years, starting from a minimum of 10 employees at the beginning of the observation period. For its part, a new generation Scale-Up is a high-growth company that has grown at least 20% in one of the last three years, demonstrating a strong expansion potential, but still does not meet all the OECD Scale-Up criteria.

High growth companies maintain high levels of billing

On average, in Europe, these types of companies invoice 13 million euros per year and, among the Spanish, 20% of the surveyed invoice more than 50 million, while 41% invoice between 5 and 20 million a year.

With the aim of supporting the European Commission’s initiative to improve the competitive and innovation capacity of the EU, through the creation of an optimal scenario for the development of SCALE-UPS, the Sage report seeks to provide information based on data to guide the formulation of European policies on emerging companies and put the focus on digital adoption as a key point for its growth.

Spanish scale-ups exceed the European average for adoption of AI

The results of the SAGE report show that European Scale-Ups grow well above that rate, to a 38% annual, while the Spanish are very close with a growth of 36%. Technology adoption is an engine for the development of emerging companies. This is stated by 91% of European Scale-Ups, which considers that technology is important for its growth. Spanish emerging companies have a greater awareness of digitalization for the success of their businesses.

In fact, they are the most risky in the use of new digital tools such as AI. 45% of them are climbing it to multiple areas of the business or already have it completely integrated, a rate higher than the European average (42%). In addition, the investment in IT is considered very important or critical to boost the business growth of Spanish Scale-ups, since 49% recognize that it would be a priority to invest in digital technologies if they receive new financing, 10 points more than their European counterparts (39%).

A single market weighed by regulatory, fiscal barriers and payment delays

Simple access without obstacles to the single European market is revealed as a habilitator for the growth of SCALE-UPS, since trade is essential. 57% of emerging companies surveyed operating in other markets other than their country of origin are capable of generating more than 70% of its benefits within the EU, evidencing the importance of trade and international expansion for EU business enrichment.

Although 98% of European SCALE-UPS has expanded internationally or plans to do so, the truth is that more than 55% claim more support for their commercial activities to the European Union, such as a simplification of the regulation and elimination of its fragmentation. In addition, for 47% of Spanish emerging companies, the fiscal environment is a barrier to their growth, a rate well above the European average (42%). On the other hand, Spanish Scale-ups are the most likely to indicate late payments as a critical barrier: 47% say that it significantly affects growth, 10 points above the EU average.

Spain leads in the use of public financing against Europe

To facilitate the growth and development of European SCALE-UPS, it is important to access sources of financing in a simple way, since 67% of new emerging companies have difficulties in accessing capital financing. Since only 5% of the global risk capital goes to the EU, it is essential to release private capital through tax incentives for better access.

On the other hand, Spanish Scale-ups lead the use of public financing, with one in four (25%) that access public subsidies, compared to 18% of the European average. Despite the public support that Spanish emerging companies receive, more than half (52%) continue to require better access from the EU to affordable financing to facilitate the growth of their businesses.

Spanish emerging companies are the ones that perceive the most obstacles to access qualified talent

The talent scarcity, especially in digital skills, is a brake on the growth of Spanish Scale-ups and an important concern. More than half of expanding companies acknowledges that they have difficulty hiring digital talent and prepared for AI. In addition, Spain faces a greater challenge when accessing talent. Only 36% of Spanish Scale-ups are satisfied with access to qualified talent, 13 points below the European average.

In general, the emerging companies ecosystem demonstrates solid foundational elements and leading public financing. However, it faces structural barriers around access to talent and capital of the private sector. Addressing these problems could release Spain’s potential as a European Scale-UPS leader.

Before this European scenario and the demands of Spanish emerging companies, from SAGE a series of recommendations are offered to boost growth opportunities, address the needs of SCALE-UPS in Europe, and position Spain as a European model:

- Take advantage of the success of public financing to attract private capital, through the creation of public-private investment vehicles and tax incentives.

- Develop talent wallets, with digital skills programs, and the creation of ‘talent visas’ to attract European and international workers aligned with the Spanish technological ecosystem.

- Lead the fight against delinquency, promoting the directive on delinquency and implementing electronic billing.