It’s well known that scaling cutting-edge technologies and battery production requires supply-constrained materials such as lithium, cobalt and nickel, as well as rare earth elements sourced from just a few locations on the planet.

Tech giants, automakers and other industrial players have long been cognizant of the supply chain risks. And recent headlines show concerns increasingly spilling over into geopolitics.

Startups haven’t been sitting this one out either. In the past few quarters, a growing roster of venture-backed companies has secured funding for areas including battery and magnet recycling, rare earth-focused mining technology, and even extracting materials from space.

Collectively, they’ve raised billions to date, including some large recent rounds. To illustrate, we used Crunchbase data to put together a list of a dozen companies, most funded in the past year, with a mission of supplying scarce materials through recycling or at their original source.

Most venture money going to recycling

The largest investment recipients are focused on recycling, looking to extract scarce materials from devices, scrap, batteries and industrial machines no longer in use.

In this arena, the two most heavily funded startups — Massachusetts-based Ascend Elements and Nevada-based Redwood Materials — are both focused on batteries and have been around a while. Together, they’ve pulled in nearly $3 billion in equity funding and over $1 billion in debt financing to date.

Notably, however, both companies secured most of their funding between 2021 and 2023. That coincided with a more bullish period overall for cleantech equity funding. Since then, sustainability-focused investment has trended lower, with U.S. investors in particular seeing impacts from the Trump administration dialing back support for clean energy initiatives.

Outside the U.S., meanwhile, we’ve seen some more recent, sizable rounds around critical materials recycling.

Out of Canada, Cyclic Materials announced in June that it raised $25 million to build a rare earth recycling facility in Kingston, Ontario. It will take magnet-rich scrap and retired industrial products to recycle rare earth elements used in EV motors, wind turbines and consumer devices. Per Cyclic, it’s an undertapped market, as today, less than 1% of rare earth elements are recycled.

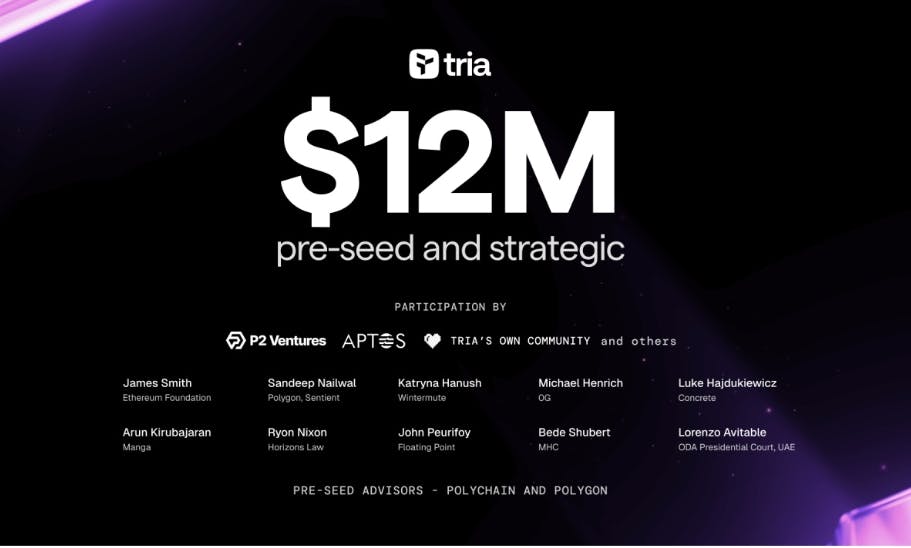

On the earlier-stage side, two German companies also raised good-sized financings. Cylib, which develops technology to draw critical raw materials from end-of-life batteries, picked up a $64 million Series A last spring. And at seed-stage, Munich-based Tozero secured $12 million for a plant to recover raw materials from recycled lithium-ion batteries.

Mining attracts capital too, following MP Material’s footsteps

Startup capital is also flowing to ventures focused on mining critical materials.

Before looking at the latest funding picks, however, it seems worth pointing out that MP Materials — the company generating headlines of late around rare earth mining — is itself a stock market success story with some Silicon Valley roots.

Shares of Las Vegas-based MP shot higher this month following news that the U.S. Defense Department agreed to buy an equity stake in the company, which operates the country’s only rare earth mine in Mountain Pass, California. A few days later, Apple announced a $500 million commitment to buy rare earth magnets developed at an MP Materials’ facility in Fort Worth, Texas.

Notably, MP was one of the earlier companies to ride the SPAC boom, making its public market debut in 2020 through a merger with a blank-check company. The deal included an equity investment from backers including venture capitalist and onetime “SPAC king” Chamath Palihapitiya.

More recently, we’ve seen a few startups nab venture and debt financing around mining efforts and technologies targeting scarce metals.

Montreal-based Torngat Metals secured $120 million in debt financing last month from government sources for a rare earth mining project in Strange Lake, located in Quebec’s northernmost region. It touts the project, which includes “detailed caribou avoidance procedures,” as a strategically important national initiative in a time when Chinese domination of heavy rare earth metals threatens others’ ability to build and source high-performance magnets.

Phoenix Tailings, based in Woburn, Massachusetts, also attracted investors’ interest, pulling in $76.4 million in fresh financing this year, per a May securities filing. The company has developed a process to extract valuable metals and rare earth elements from mining waste.

Exits next?

Major U.S. market indices are trading near all-time highs these days, so it’s looking like a good time for public companies in a lot of industries. But those tied to sourcing of rare metals and battery materials are riding particularly high.

MP Materials, for instance, had a recent market cap around $10 billion — its highest to date. Rare earth stocks more broadly are also sharing in the enthusiasm.

Could IPOs and acquisitions for the most heavily funded companies tied to sourcing scarce materials be next? These aren’t likely to be the fastest-moving spaces for dealmaking, but at least for now some momentum is on their side.

Related Crunchbase query:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.