Welcome to 3 Tech Polls, HackerNoon’s brand-new Weekly Newsletter that curates Results from our Poll of the Week, and related polls around the web. Thanks for voting and helping us shape these important conversations!

We asked a simple question with complicated consequences. Is tech finally coming for Hollywood?

That’s the question we put to readers recently in our front-page poll: What’s More Likely to disrupt Hollywood first?

This Week’s Poll Results (HackerNoon)

What’s more likely to disrupt Hollywood first?

AI has been a major force in seemingly every career field. Now, it seems to have set its eyes somewhere else: Hollywood.

A total of 211 readers weighed in, and the result was less a landslide than a knife-fight in a phone booth.

-

AI-generated scripts barely took the crown at 31% — roughly 65 votes.

-

Deepfake actors were right on its heels at 30% — about 63 votes.

-

Fully AI-produced films came in at 23% — around 49 votes.

-

And “None — unions will block it” landed at 16% — roughly 34 votes.

In other words: readers don’t agree on what hits first. But they overwhelmingly agree on the bigger premise: something is coming.

The AI-script argument is brutally pragmatic. Writing is already a highly iterative, high-volume process. Studios live on drafts, rewrites, punch-ups, and “we need a version by Monday” chaos. So it makes sense that many of you see scripts as the first domino.

But here’s where reality enters the chat: the Writers Guild has already pushed hard for guardrails. The 2023 agreements established that AI can’t be credited as a writer and set rules around how AI can (and can’t) be used in the writing process.

Meanwhile, deepfakes trigger a different kind of anxiety — not about work being automated, but about identity being extracted. When people think “AI actor,” they’re not imagining a new synthetic star. They’re imagining a real performer’s face or voice being used forever, under contract language they didn’t fully anticipate.

This tension is already playing out in public. Recent coverage of AI-created performers and digital actor experiments has sparked backlash and renewed scrutiny of consent, training data, and whether “synthetic stars” are innovation or labor side-stepping.

At 23%, fully AI-produced films feel like the “eventual” answer. Less first impact, more endgame.

But the tech is moving fast. The emergence of high-profile text-to-video systems has already triggered public debate about job displacement and the changing economics of production. If the last decade was defined by cheaper cameras and streaming distribution, the next could be defined by cheaper everything — sets, extras, location shoots, even entire sequences rendered from prompts.

Lastly, a meaningful slice of you believe unions will block this period.

Unions are already building AI protections into agreements, particularly around consent and digital replicas, and the broader labor posture suggests the industry is aiming for managed adoption, not open-season automation.

But “block it” may be too absolute. “Slow it, shape it, and make it expensive to abuse” feels closer to the likely outcome.

In other words, readers don’t see one winner — they see a standoff.

The top spot went to compute, which makes sense considering whoever owns the GPUs owns the pace of progress. Even nations are thinking in teraflops now: the UK’s “AI Research Resource” project and China’s push for sovereign chip supply show that compute isn’t just a business asset anymore — it’s national strategy.

But the thing about power (literal, electrical power) is that it’s expensive. Training models with trillions of parameters costs more energy than small countries use in a year, and that makes compute a choke point — one that may define who even gets to play in AI by 2030.

The close second-place finish — trust and culture — tells us something important: people are catching on that the real question isn’t just how big your model is, but how you built it.

Meanwhile, 26% of voters picked the battle over consumer entry points. If AI becomes a layer between you and everything else — messages, maps, shopping, work — then the gatekeepers aren’t the GPU makers or the model builders. They’re the ones who own your interface. In that world, the “app” as we know it might disappear. The “assistant” becomes the operating system.

And then there’s policy, which scored lowest but matters most once the champagne wears off. The EU AI Act is finally here, with categories, audits, and risk tiers that’ll make compliance officers the new rockstars.

The most interesting part of this poll wasn’t who won. It’s how close the top two were.

That split suggests Hollywood’s first real disruption won’t be a single technology. It’ll be a two-front collision between:

- Automation of craft (scripts)

- Ownership of identity (actors)

And the industry’s next chapter will be written — partly — by how well it can protect humans while adopting machines.

Because if AI in Hollywood becomes a story about consent, credit, and creative dignity, the tech might actually earn its place.

If it becomes a story about replacing people on paper while sampling them in practice, the backlash won’t just be loud. It’ll be justified.

:::tip

Weigh in on the Poll Results here!

:::

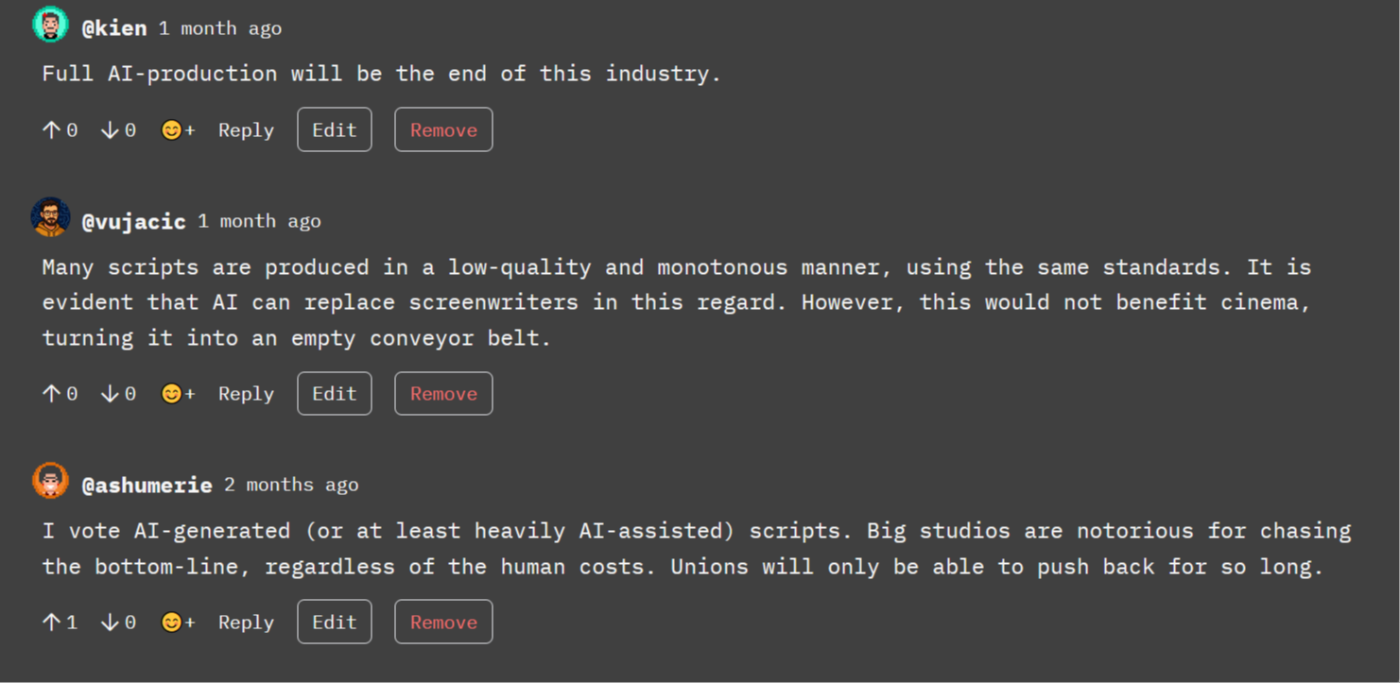

🌐 From Around the Web: Polymarket Pick

Will Netflix close Warner Bros. acquisition by end of 2026?

Current odds: 27% YES

Users on Polymarket aren’t convinced Netflix will be able to acquire Warner Bros. in time, especially considering that Paramount has launched an aggressive bid to acquire the legacy (and by some measures a quintessential) Hollywood media conglomerate.

If you haven’t been following along the acquisition saga, we don’t blame you. Netflix’s push for Warner Bros. has turned into one of the messiest, most consequential media battles in years.

Netflix and WBD announced an agreement in December for Netflix to acquire the company’s Streaming & Studios business for about $72 billion in equity value, with closing expected after a corporate separation, but the deal immediately ran into political and industry resistance.

Then Paramount Skydance escalated the drama by launching a hostile roughly $108.4 billion bid for the entire WBD on December 8, arguing its offer is more shareholder-friendly and easier to clear regulators.

WBD’s board has so far maintained its backing of the Netflix path while reviewing the new proposal, though we never know what happens next.

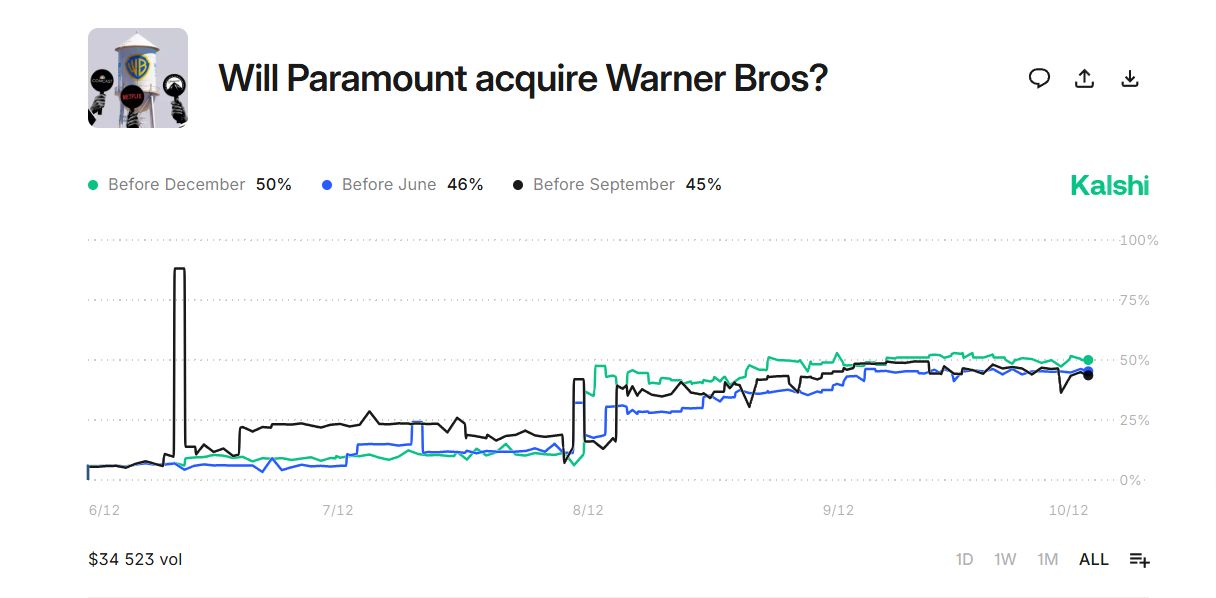

🌐 From Around the Web: Kalshi Pick

Will Paramount acquire Warner Bros?

Current odds: Before March: 36% | Before June: 46% | Before September: 48% | Before December: 50%

At the opposite end of the spectrum, we have bettors on Kalshi determining whether Paramount will acquire Warner bros. Based on the odds, the question isn’t whether Paramount will acquire WB, but rather when.

If Paramount Skydance Corporation announces an agreement to acquire Warner Bros. Discovery before Dec 1, 2026, then the market resolves to Yes.

We want to hear from you!

:::tip

Vote on this week’s poll: What would make you trust AI more in high-stakes uses?

:::

That’s it, folks! We’ll be back next week with more data, more debates, and more donut charts!