In less than a week, the European giant Yara has announced the paralysis of its ammonia center in Hull, England, a decision that has been taken by the prices of natural gas. And what do they have to do? Gas is an essential component within the manufacture of fertilizers and with the increase in the Price of gas are being affected.

Short. The price of natural gas in Europe has firmed again, reaching values that were not observed since the energy crisis of 2022. The analyst and energy expert Javier Blas has published in his X (formerly Twitter) account that European gas prices , according to the TTF reference index, they have exceeded € 58/MWh. So that it can be understood, if we talk about oil, it would be equivalent to $ 100 per barrel.

This situation has had a special impact on sectors that not only use gas as a source of energy, but also as raw material, such as chemical, metallurgical and fertilizers.

Gas prices in Europe are triggered by their maximum in two years as demand increases. LSEG SOURCE

In data. In the last month, gas prices in Europe have increased by 30%, driven by colder temperatures, a lower renewable energy generation (Dunkelflaute) and low storage levels. This increase has shown that gas stores do not reach half their capacity, while last year they reached 67% at the same time. Analysts have estimated that, if the demand follows this trend, prices could reach € 84/MWh.

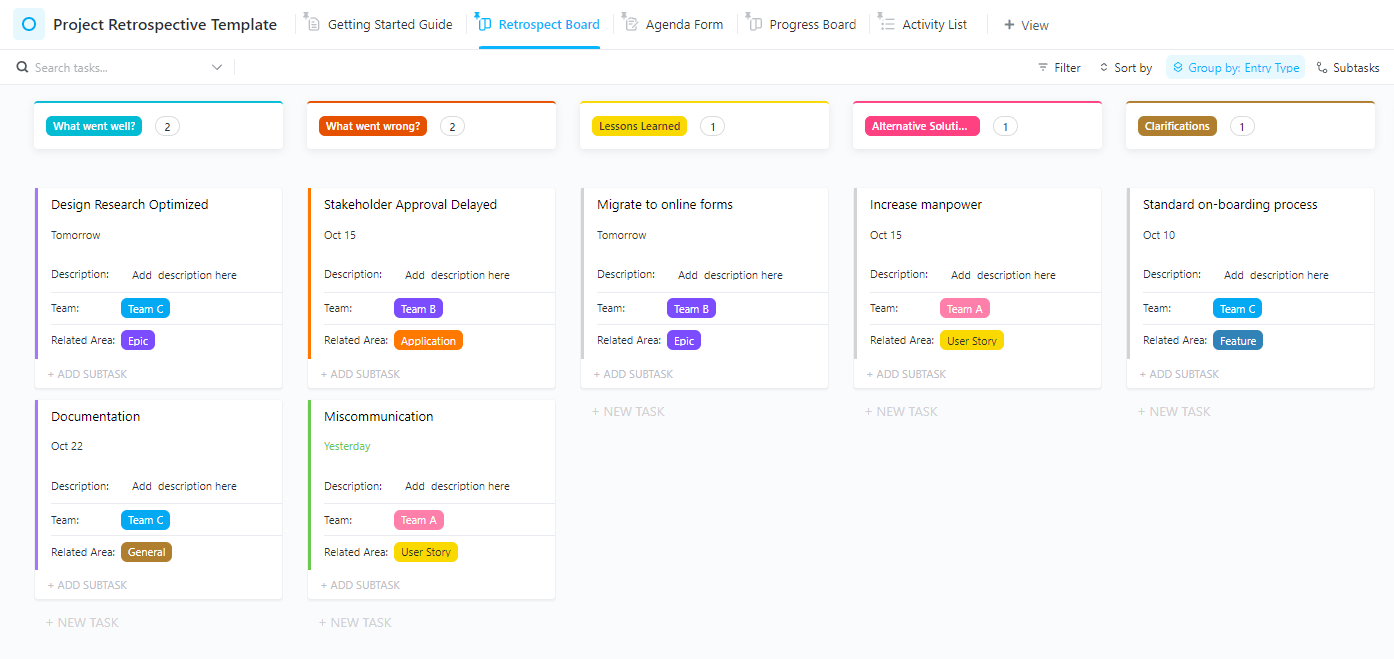

The graph shows the volatility of gas prices since the beginning of 2023. The reasons behind the peaks come from the gradual reduction of Russian gas flows until its total interruption, together with the growing competition with China by the LNG, It has intensified the pressure on prices, which has reduced the availability of gas for the European market.

The critical point for the industry. The profitability threshold for many energy intensive industries is in gas prices between € 50 and 60/MWh. In 2022, when prices exceeded this level, companies like BASF decided to drastically reduce their production in the continent due to high costs. The reason is because the chemical industry is particularly vulnerable, since it uses gas not only as a source of energy, but also as raw material. Other affected sectors include the production of steel, glass and ceramics, where gas represents a significant cost.

As analyzed in FT, if the gas price remains high the industrial impact will be very large for all of Europe. In addition, the products we have mentioned could be more expensive, feeding inflation and reducing the competitiveness of European exports. The situation could also impact economic growth, especially in countries with strong industrial base such as Germany, France and Italy.

Forecasts If winter is still cold, pressure on gas prices could be maintained. Europe will have to resort even more to its strategic reserves and increase LNG imports, although this will depend on the availability of supplies in the global market. At the governmental level, measures such as industry or incentives for consumption reduction could be taken. Price forecasts will depend largely on the climate in the coming weeks and the evolution of demand in Asia.

Image | Pexels

WorldOfSoftware | Forget the industrial revolution: the fastest energy change in human history is happening now