Apple has been in the smartphones market for almost two decades, but I had never managed to lead global sales in a first quarter. That has just changed. Between January and March 2025, the Cupertino company has been at the top of the world ranking, ahead of Samsung and with Xiaomi completing the podium.

Counterpoint Research has been in charge of putting figures and context to the new Apple milestone. The keys? An unusual launch calendar for the company, a solid growth in emerging markets and a good global behavior just before the earthquake of the tariff war driven by the United States.

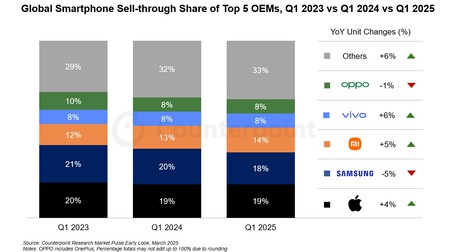

At the top of the podium. Apple led global smartphones sales in the first quarter of 2025 with a 19% market share. In addition, it achieved a 4% increase in units sold compared to the same period of the previous year. In second position Samsung appears, which obtained 18% and experienced a 5% drop in units sold.

Xiaomi, meanwhile, maintains third place with sustained growth. Its evolution has been progressive: in the first quarter of 2023 it had 12% of the market, in 2024 it rose to 13% and in this start of 2025 it has reached 14%. Although its position has not changed, the constant improvement in quota reflects a difficult to ignore rise.

An unusual launch. A key part to understand Apple’s leadership This quarter is at the launch of the iPhone 16E. The device was announced on February 19 and reached stores just a week later. Although it is not usual to see new iPhone in this section of the year, there are precedents: the original iPhone was launched in March 2016, and the third generation also did it in March, but of 2022.

An iPhone discussed, but sold without brake. Although the iPhone 16E has not fully convinced whom they expected a more competitive proposal in quality, the truth is that its market performance has been remarkable. It is a model with a more accessible approach, but with a hardware reinforced to be compatible with Apple Intelligence. Despite doubts, its launch has had a strong reception.

A trimester of contrasts. The global market grew by 3% year -on -year in this first quarter, promoted by China, where “public subsidies reactivated demand, and for recovery in emerging markets such as India, Southeast Asia or Latin America. On the other hand, markets such as Europe, the United States or even China showed signs of exhaustion, according to the analysis firm.

A market that does not stop. Samsung started the year with a slower pace due to the delay of the Galaxy S25, but the sales rebounded after its launch and that of the new A. Xiaomi series, meanwhile, reinforced its presence in both new markets and in its country of origin. Vivo became the brand that grew most among the top five, while Oppo maintained fifth place thanks to good results in India, Latin America and Europe.

Amazon sellers in the US. The problem is that it is illegal” width=”375″ height=”142″ src=”https://i.blogs.es/bb39ab/52845857650_27d5da0460_k/375_142.jpeg”/>

Other manufacturers also gained ground, although they were out of the top five. Huawei was the largest seller in China during the quarter. Honor and Motorola also grew strongly in several international markets, intensifying competition in segments where great global brands predominated.

Tension on the horizon. Although the quarter leaves positive figures, the immediate future is not clear. The threat of new tariffs, driven from the United States, has forced brands such as Apple to move file quickly. The company charted flights from India to mitigate possible problems. At the moment, exemptions have appeared on stage, but uncertainty persists.

Images | Thai nguyen | Medhat Dawoud | Ricardo Aguilar (WorldOfSoftware)

In WorldOfSoftware | If the question is “who will win if prices for tariffs up” the answer is: “Second -hand mobiles”