Cet article est aussi disponible en français

<!–

In partnership with

–>

Join us for Battlefield, Moonshot’s startup competition where you can showcase your startup idea to a global audience and an esteemed panel of judges and stand a chance to win up to 2.5 million naira in funding for your business!

Click to register for TC Battlefield

First published on 19 Oct, 2025

The telecom that built a “bank” by accident

Safaricom House. Image:

Kenya’s leading telecoms operator, Safaricom, never planned to become a bank (it is not), yet that is where it has ended up. Its 2025 sustainability report, a document meant to show corporate responsibility, highlights an interesting point; the company now anchors Kenya’s financial system.

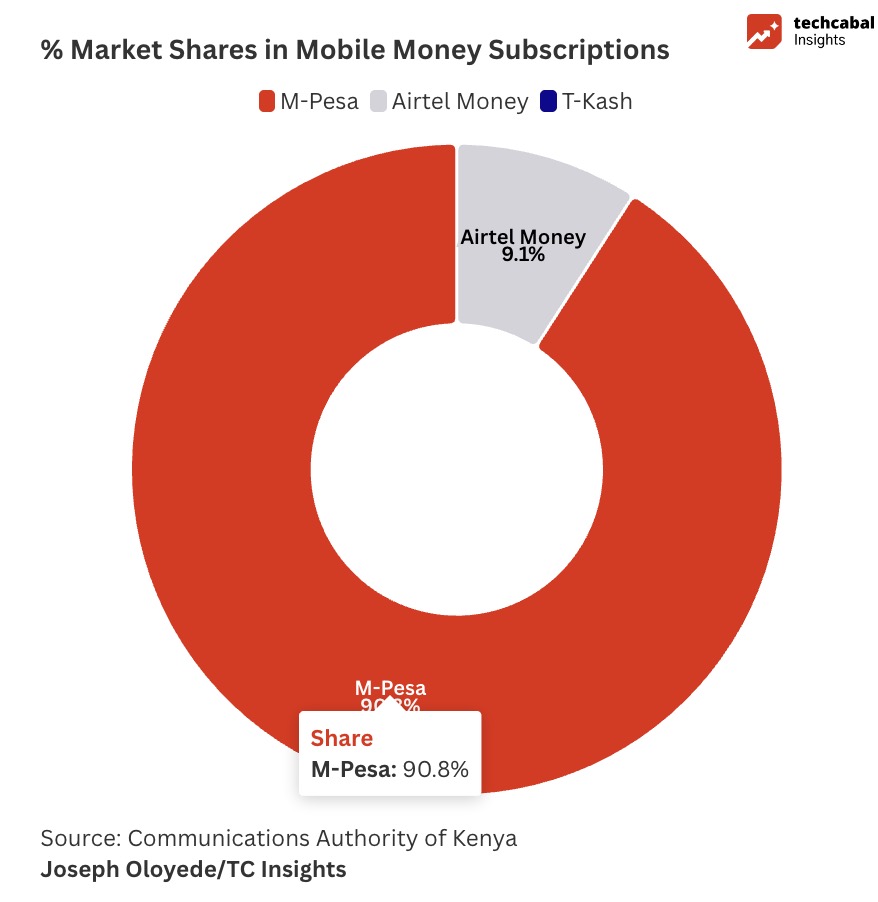

What began in 2007 as a tool for sending money through an SIM toolkit has turned into the main channel through which most Kenyans move, borrow and store their money. Simply put, M-PESA, with a mobile money market share of over 90%, has become the country’s de facto financial network.

However, this kind of scale brings new problems. When a private company becomes essential to how an economy works, it inherits the risks and expectations of a regulator. Safaricom now faces the reality that success attracts scrutiny, and the report makes this clear through two details: 113 employees were dismissed for fraud, and the company has started using artificial intelligence (AI) systems to detect money laundering through betting platforms.

Mobile money market share in Kenya Q1 2025

The number of fraud cases may sound high, but within a workforce of more than 5,500, it is not abnormal. Every financial institution deals with internal breaches, though few are willing to publish the figures. Safaricom’s decision to disclose them shows a company that understands transparency as part of risk management. The company went as far as reporting seven of those cases to the police, a move that most firms would have quietly avoided.

For years, traditional banks treated internal theft as a private matter to be contained, not publicised. KCB and Equity, Kenya’s two largest banks, have dismissed hundreds of employees for similar reasons, but the information rarely reaches the public. Safaricom has chosen to reveal what others hide, and in doing so, it is normalising public accountability in a sector that has long preferred discretion.

The second part of the report—the link between betting wallets and money laundering—is more complex. Safaricom’s systems flagged patterns showing that some betting platforms were being used to launder money. This method is simple but effective: funds of suspicious origin are deposited into a betting account, small wagers are placed to create an activity trail, and the balance is withdrawn as winnings. Once that happens, the money appears legitimate.

It is worth noting that Safaricom does not operate these betting firms, but it processes the payments that make betting possible. That makes it responsible for tracing the money as it moves between customer accounts and licensed operators. The telco has responded by tightening due diligence requirements for high-volume merchants and using data analysis to spot irregular flows in real time. It now checks the beneficial owners of betting companies and screens transactions against global sanctions lists. These steps are standard for international banks, not telecoms, but M-PESA’s size leaves Safaricom with little choice but to act like one.

The real issue is structural. Safaricom built a payments network so extensive that it became a national utility. Nearly half of Kenya’s GDP moves through its systems every year. A company that is central to daily transactions cannot behave like an ordinary business. It must ensure compliance, enforce discipline and protect customer data, even as it keeps the system running without interruption.

Next Wave continues after this ad.

Yet this position invites criticism. Many argue that no single private firm should hold this much power over a country’s financial infrastructure. They are not wrong, but the alternative is unclear. Kenya’s banking sector did not build mobile money at scale, and regulators are still catching up.

Safaricom has become both participant and gatekeeper in an experiment that has no precedent on the continent. It is discovering, in real time, what it means to police a financial system that it has inadvertently created.

The paradox is that the same features that made M-PESA indispensable—its reach, speed and simplicity—also make it vulnerable to misuse. The system’s openness allows both inclusion and exploitation. Safaricom’s task is to manage that tension without slowing the flow of transactions that millions depend on. Fraud will never disappear, but every case caught is a sign that the system is learning and adjusting.

Next Wave continues after this ad.

What the report captures, without saying so directly, is that Safaricom’s journey into finance was never planned. A telecom built a tool for transferring small amounts of cash, and 18 years later, it is managing anti-money laundering compliance and internal fraud like a bank. It did not seek this responsibility, but it cannot avoid it now.

Safaricom is not a villain since it is the custodian of an infrastructure that grew faster than anyone expected, including regulators. The company’s job today is to keep that infrastructure reliable and transparent.

Kenn Abuya

Senior Reporter

Thank you for reading this far. Feel free to email kenn[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.