Klarna’s costly lesson shows the danger of hype. Here’s how to invest smarter…

Editor’s Note: Our usual Digest Editor Jeff Remsburg is taking a rare break — his first extended vacation in years.

While he’s away, our team has assembled a stellar roster of guest analysts to keep your InvestorPlace Digest filled with sharp insights and actionable ideas.

Today, we turn the Digest over to veteran trader Jonathan Rose, who will dive into how AI is shaping businesses and impacting the workforce – and how traders and investors should approach the fast-paced AI sphere.

Take it away, Jonathan…

Back in 2024, OpenAI CEO Sam Altman sent Wall Street into a frenzy with a single blog post.

He made the boldest claim about AI’s future yet: “We believe that, in 2025, we may see the first AI agents join the workforce and materially change the output of companies.”

He didn’t stop there.

He also told the press that entry-level positions would soon be handled by AI interfaces working behind the scenes – completing tasks that mere humans might take hours to do.

He even fueled another big AI dream: That artificial general intelligence (AGI) – where AI surpasses human ability – was right around the corner.

You can connect the dots from there. Beyond-human intelligence permeating every aspect of business… that’s when humans (seemingly) become obsolete.

Back in 2024, the sky certainly looked to be the limit. Investors were sizing up the AI competition. And they all appeared to agree on one thing…

2025 was supposed to be the year AI finally took over. The year when every small and large task we can think of gets the AI treatment.

Well, it hasn’t quite been the watershed year that transforms everything in AI’s image (more on that below).

But if you’re signed up for and have been following me at Masters in Trading: Live, you know AI’s market momentum is nothing to sneeze at. (Here’s a link to sign up to get those free livestreams delivered to your inbox every day.)

Over the last eight months alone, I’ve put several massive opportunities on your radar – including five of the biggest AI stocks I’m watching right now.

And we haven’t been sitting on the sidelines this year.

I’ve helped Masters in Trading: Live viewers collect double- and triple-digit gains from some of the biggest AI players around.

Just last year, we banked gains of more than 200% and 400% trading C3.ai Inc. (AI) – one of the biggest AI startups in the game.

We’ve also managed massive triple-digit winners on stocks that are fueling AI on the supply side. That includes pure metals plays like The Metals Company (TMC) and MP Materials Corp. (MP) helping us stay right on the pulse of the AI build-out.

So yes, AI is certainly no flash in the pan, but the technology is in the middle of some serious growing pains.

And it’s critical that investors move with caution to avoid getting sucked into a hype trap.

A Lesson for Early Investors

Look, Sam Altman isn’t entirely off the mark. I believe the future truly belongs to AI.

Over the last few weeks, I’ve been putting trends like AI smart glasses on Masters in Trading: Live followers’ radar because the opportunity here is simply too big to ignore.

But if 2025 has proven anything, it’s that AI is a long way from replacing the human touch.

Take fintech startup Klarna Group PLC (KLAR).

Klarna is one of the largest suppliersof “buy now, pay later” microloans – basically tiny cash advances for purchases that don’t need to go through a bank.

Over the last year, Klarna made a risky bet on its future with AI.

The Swedish company was an early adopter of “AI agents” – machine learning software supposedly capable of handling complex tasks on its own.

The problem? Even the best AI agents remain extremely inefficient.

Researchers at Carnegie Mellon University recently found that even the best-performing AI agent, Gemini 2.5 Pro from Alphabet Inc. (GOOGL), failed to complete real-world office tasks 70% of the time. It could only partially handle tasks like responding to colleagues, web browsing, and even coding.

And those competing AI agents? They all did significantly worse when it came to completing similar tasks:

- OpenAI’s GPT-4 had a 91.4% failure rate

- Llama-3.1-405b from Meta Platforms Inc. (META) failed 92.6% of the time

- Amazon.com Inc’s (AMZN) Nova-Pro-v1 earned a near-100% failure rate

Most might be put off by those numbers. But Klarna wasn’t fazed by the data.

So they opted for OpenAI’s model – and, predictably, the results were less than satisfactory.

Rather than introducing tech that could “replace 700 agents,” as Klarna’s CEO had claimed, the AI failed to complete almost any task handed to it.

Customers flooded the lines with complaints about unanswered queries. New products were being added to customers’ subscriptions without their consent.

A laundry list of problems suddenly became the norm – and it was totally unsustainable.

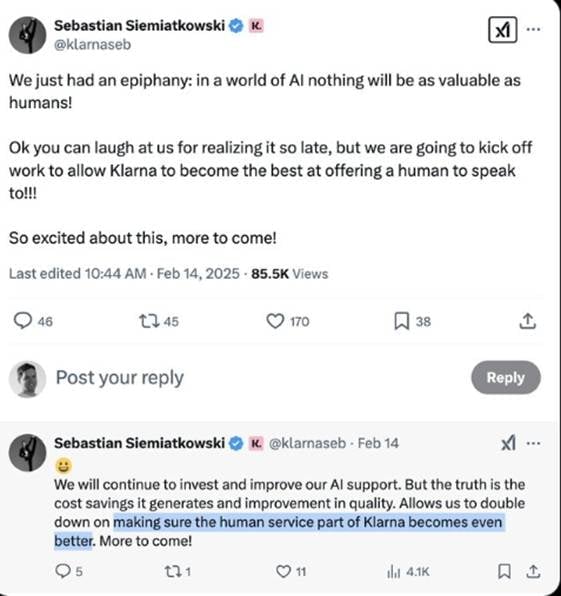

It’s no surprise what happened next. Klarna CEO Sebastian Siemiatkowski did a complete about-face.

Source: The Verge

Back in May, Klarna started scrambling to rehire the full-time workers and contractors they’d axed.

But rehiring a whole department is a lot harder than firing them.

Klarna’s recruitment drive is ongoing as I write to you.

It’s safe to say they’ve learned a painful – and financially unpleasant – lesson. And now other companies are starting to dial back their AI-everything plans.

A recent Gartner survey found that out of 163 business executives, half said their plans to “significantly reduce their customer service workforce” would be abandoned by 2027.

If we take a deeper look at AI in 2025, it becomes even clearer just why these implementations keep failing…

Look at the Gartner’s “Hype Cycle” chart below. The model shows us how new technologies typically progress from early excitement to realistic adoption. It’s used to visualize where a given technology stands in terms of maturity, visibility, and real-world usefulness.

Source: Gartner

AI Agents – the exact tech Klarna bet on – are sitting at the “Peak of Inflated Expectations.” That’s the danger zone where reality hasn’t caught up to the promises yet.

Meanwhile, technologies like Foundation Models and Cloud AI Services are already moving through the “Trough of Disillusionment” toward the “Slope of Enlightenment.” That’s where real, practical value starts emerging.

This chart tells us everything we need to know about where we are. We are still very early in this game.

Some technologies won’t reach their productivity plateau for years to come. Others are obsolete before they get there…

So as investors and traders, it’s our job to identify which players will survive the trough and climb to the plateau.

The Real Future of AI

None of this means that AI isn’t working. Far from it.

But we need to align our expectations for where we are in the cycle.

In the immediate future, the best use cases for AI look a lot like what we’re already doing with it – but better.

AI is revolutionizing diagnostics by detecting cancers, analyzing X-rays, and identifying patterns human doctors might miss. Companies building AI-powered diagnostic tools are saving lives and improving efficiency in healthcare systems worldwide.

And all that AI-powered insight is trickling down to smartwatches, smart glasses, and other “wearables” as well. From real-time translation to augmented reality navigation, AI-powered wearables are enhancing how we interact with the world…

This isn’t about replacing human interaction — this is about amplifying it.

Just consider how AI can overhaul the way we learn.

AI tutoring systems are personalizing learning at scale. They’re helping to address individual student needs in ways traditional classrooms can’t. This isn’t replacing teachers – it’s giving them superpowers.

It’s the same in the creative space. AI is helping artists, writers, and designers work faster and explore ideas they couldn’t reach alone. It’s collaboration, not replacement.

These aren’t pie-in-the-sky promises. These are real applications delivering measurable value today.

That brings me back to OpenAI. Many of you probably know the firm is essentially headquartered within Microsoft Corp. (MSFT).

And even as Sam Altman has been outspoken about AI’s future use cases, the fact is that their biggest product, ChatGPT, isn’t replacing “all human work as we know it” yet.

It’s enhancing what we can already do.

For some time now, AI has been an integral part of the various tools I’ve built out for members of Masters in Trading: Live and all my trading services.

Back in July, I built out a tool that lets me see in real time how much Ethereum (ETH-USD) a whole range of publicly traded companies are adding to their corporate treasuries. If you’re interested in learning more about how I put that tool together – and my whole ETH trading approach – you can check it out right here.

I did a lot of the legwork. But getting it all working and finished for my viewers? That was sped up by AI.

There’s also my Unusual Options Activity Scanner (more on that here). I developed the basic concept years ago and built a lot of it from scratch.

But recently, AI has been there to help me map out tweaks to the UOA Scanner so that it works more efficiently to uncover spikes in options trading volume.

Simply put, AI is an invaluable helper — an assistant that can help me speed up tasks, transforming projects that once took weeks and days into just a few hours.

And when it comes to investing in AI technology, its abilities, inabilities, and future potential are important factors to consider. In fact, I believe investors should be picky about the AI space…

Don’t Get Caught in the Hype

The most reliable names are still the best. The ones that are regulatory-compliant, already have massive consumer bases, and have cash and other resources to keep going without worrying about funding – those are the companies that will succeed long-term.

There are a handful of AI stocks I’m watching that could make serious strides and become the next Microsoft – or at least get acquired by the incumbents.

But just like I’ve told Masters in Trading: Live watchers in the past, the big names aren’t where the opportunity truly lies. It all comes down to the key suppliers driving the boom in chips, data centers, and more.

Today, I want to make it clear: The efficiencies and gains AI will drive are not to be underestimated.

We’re just at the earliest stages. That means it’s far too early to consider automating entire positions out of existence.

For traders? It’s even better. We’re on the ground floor watching AI take off.

Now is the time to strike.

You can find the top AI stocks I’m watching and recommending daily during my livestreams at Masters in Trading: Live.

If you’re not already a member, click here to sign up – for free – and get more details on my favorite trading strategies every day the market is open at 11 a.m. Eastern.

Remember, the creative trader wins.

Jonathan Rose

Founder, Masters in Trading