Nigeria continues to dominate Africa’s fintech landscape in 2025, even as funding slows across much of the continent. In the first quarter alone, Nigerian startups raised over $100 million, most of it flowing into fintechs, underscoring the sector’s resilience and central role in the country’s digital economy.

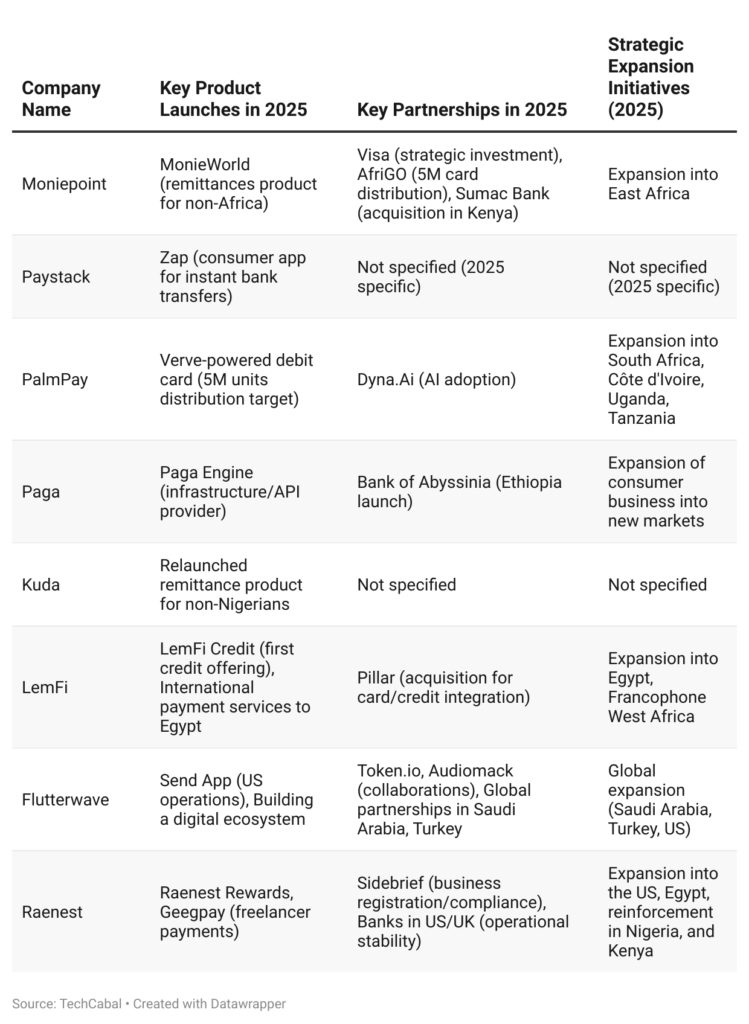

Companies like Moniepoint, Paystack, PalmPay, Paga, Kuda, LemFi, and Flutterwave are driving this momentum. These fintechs are expanding their user bases, securing new rounds of funding, and launching products at a rapid pace.

This article highlights the biggest players in Nigeria’s fintech space in 2025. It covers user growth, funding rounds, product updates, and the broader impact on the continent’s financial future.

The biggest fintech companies in Nigeria (2025): In-depth profiles

Let’s take a closer look at the biggest fintech companies in Nigeria in 2025, leading in funding, users, transactions, and expansion.

Table 1: Key performance metrics of leading Nigerian fintechs (2025)

1. Moniepoint

Moniepoint (formerly TeamApt) is now one of the biggest names in African fintech. It made TIME’s 100 Most Influential Companies and became a unicorn in late 2024, raising over $120 million in Series C funding, including a $10 million investment from Visa.

Moniepoint helps small businesses, particularly informal ones, access digital banking services. It serves over 10 million users, processes over 1 billion transactions monthly, and hit over $100 billion in payments last year alone.

In 2025, it received approval to acquire a majority stake in Kenya’s Sumac Bank, expanding its operations across East Africa. It also launched MonieWorld for international remittances and partnered with AfriGO to distribute 5 million cards in Nigeria.

2. Paystack

Paystack, a prominent payment processing solution, was acquired by Stripe for $200 million in October 2020, having previously raised $11.7 million in funding. It has since expanded its reach to Ghana, Kenya, Côte d’Ivoire, and South Africa.

Paystack processes over $250 million in monthly transaction volume. In Q4 2024, the company handled three billion API requests. Bank transfers have become a dominant payment channel on its network, accounting for 58% of its transactions in 2023, a notable increase from 28% in 2022.

In March 2025, Paystack launched Zap, its first consumer-centric product in nine years. Zap is designed to facilitate instant money transfers to any Nigerian bank account in under 10 seconds. Users can link their existing commercial bank accounts via Paystack’s direct debit system or deposit funds into a Paystack-Titan Trust Bank account. While Zap allows linking debit and credit cards from any country, Paystack has clarified that it is not currently targeting the remittance market; rather, it aims to serve visitors making transactions within Nigeria.

3. PalmPay

PalmPay is another fast-growing fintech brand. It ranked second on the Financial Times’ list of Africa’s fastest-growing companies. As of Q1 2025, PalmPay has over 35 million users and processes more than 15 million transactions daily.

Between January and December 2024, it processed ₦71.5 trillion in transactions, with 80% of users remaining active monthly. The company has over 1 million agents and merchants across the nation. PalmPay plans to expand into South Africa, Côte d’Ivoire, Uganda, and Tanzania this year.

4. Paga

Paga has been around since 2009, making it one of Nigeria’s oldest fintech companies. It’s profitable, privately owned, and has processed over ₦23 trillion in transactions since its launch.

Paga serves over 21 million users and collaborates with an extensive network of agents. In 2024, it processed ₦8.7 trillion, with monthly volumes now crossing ₦1 trillion in 2025.

The business has grown beyond payments and now operates three key services: Paga for consumer payments, Doroki for SME support, and Paga Engine, which offers APIs for other fintech companies in Nigeria.

Paga is expanding into Ethiopia, thanks to a new partnership with the Bank of Abyssinia, and with further expansion plans.

5. Kuda

Kuda is one of Nigeria’s most active digital banks. In Q1 2025, it processed over 300 million transactions worth ₦14.3 trillion. Of this, ₦8.5 trillion came from regular users, and ₦5.8 trillion from business accounts, despite the business product only launching in 2022.

Kuda also issued ₦16.4 billion in overdrafts in Q1 alone, and did it profitably. It employs a risk-based model to determine interest rates, enabling more people and businesses to access credit without overextending themselves.

Kuda expects to hit ₦57 trillion in transaction volume by the end of 2025. It also relaunched its remittance service, now targeting users outside Nigeria who wish to send money back home.

6. LemFi

LemFi, a global remittance app, raised $53 million in Series B funding in January 2025, bringing its total to over $86 million. It now serves over 2 million users across the US, UK, Canada, and Europe, processing $1 billion in monthly transactions.

In June 2025, LemFi acquired Pillar, a UK-based credit card company, giving it more control over card services, multicurrency wallets, and credit features, which it’s rolling out in countries like Egypt, Morocco, and Tunisia.

It also launched LemFi Credit, its first lending product, which is already being used by over 8,000 people. LemFi’s goal is to become the go-to financial app for immigrants by offering a comprehensive range of services, from money transfers to credit..

7. Flutterwave

Flutterwave remains Africa’s most valuable fintech company with a $3 billion valuation. Since its inception, Flutterwave has processed over 890 million transactions in excess of $34 billion. The company has an infrastructure reach in 34 African countries. It recently secured a payment institution licence from the Central Bank of West African States (BCEAO), granting it the ability to operate fully in Senegal.

8. Raenest

Raenest helps African freelancers, remote workers, and businesses manage money across borders. In February 2025, it raised $11 million in a Series A extension, bringing its total to $14.3 million.

Since launching, Raenest has processed over $1 billion in payments and supports more than 700,000 individuals and 500 businesses. Its services include multi-currency wallets (USD, GBP, EUR), international transfers to over 50 countries, virtual dollar cards, and local withdrawals with low fees.

Raenest’s Geegpay product is built specifically for freelancers and creators. In 2025, it introduced Raenest Rewards to reward loyal users. It also partnered with Sidebrief to help African entrepreneurs establish and manage their businesses across Africa, the US, and the UK.

Table 2: Notable product launches & partnerships (2025)

Final thoughts

What’s clear is that the playbook has changed: it’s no longer just about payments. Fintech companies in Nigeria are building ecosystems that combine banking, lending, compliance, remittances, and tech infrastructure into all-in-one platforms.

As regulations tighten and competition grows, the biggest players will be those who not only scale but also solve real problems with clarity and speed.